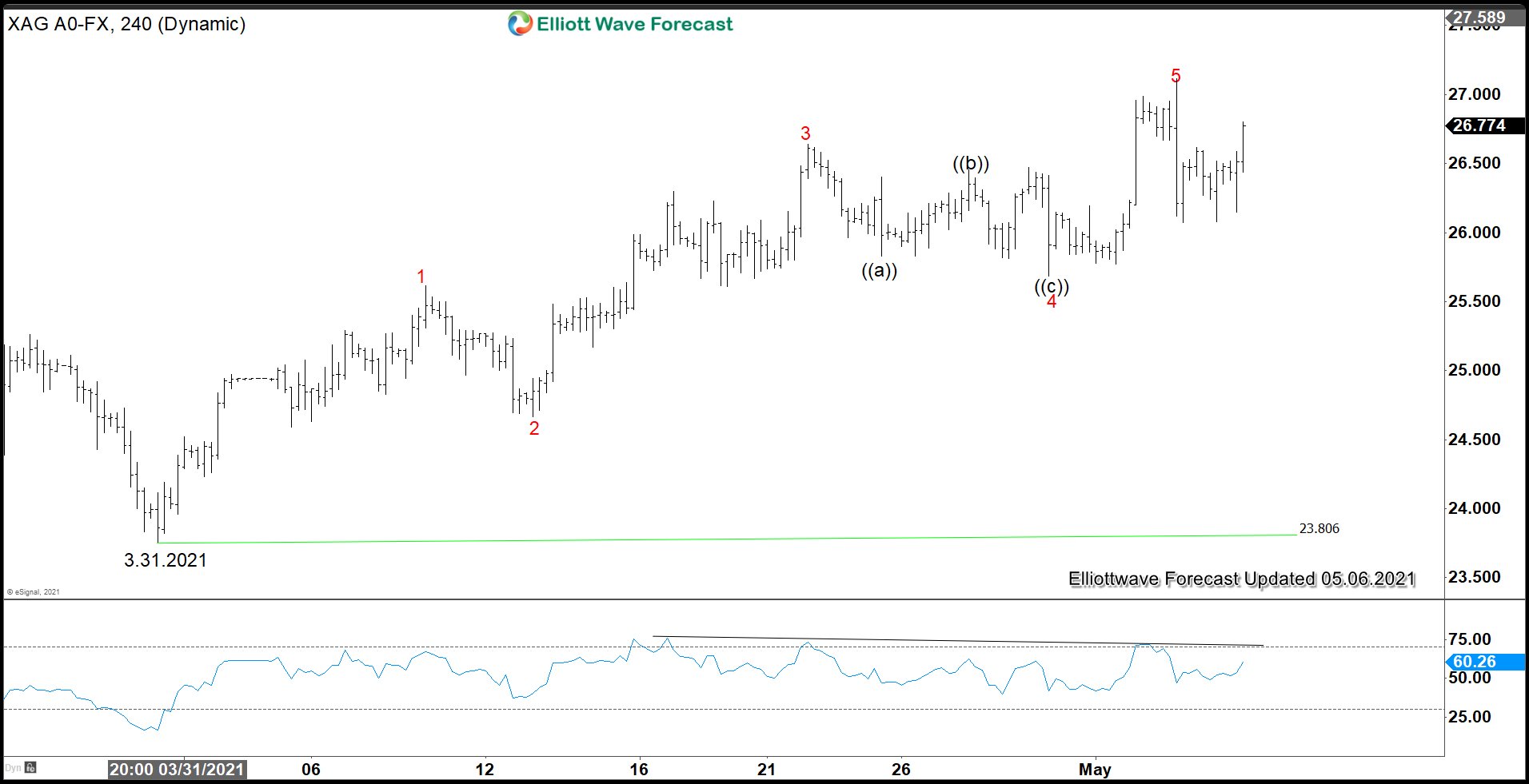

Elliott Wave view in Gold (XAUUSD) suggests the rally from March 31, 2021 low ended wave (1) at 1916.53. Pullback in wave (2) ended at 1855.10 as a zigzag Elliott Wave structure. Down from wave (1), wave A ended at 1891.70 and bounce in wave B ended at 1909.69. Final leg wave C of (2) ended at 1855.10 as a 5 waves impulse. The metal has turned higher in wave (3) as an impulse structure.

Up from wave (2) low, wave (i) ended at 1870.91, and pullback in wave (ii) ended at 1864.30. The metal resumes higher in wave (iii) towards 1903.34 and pullback in wave (iv) ended at 1888.60. Final leg higher in wave (v) ended at 1903.76 and this completed wave ((i)) in higher degree. Pullback in wave ((ii)) is proposed complete at 1869.60 as a zigzag. Down from wave ((i)), wave (a) ended at 1882.80, wave (b) ended at 1898.92, and wave (c) ended at 1869.60. Gold has started to turn higher in wave ((iii)). Near term, as far as pivot at 1855.10 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.

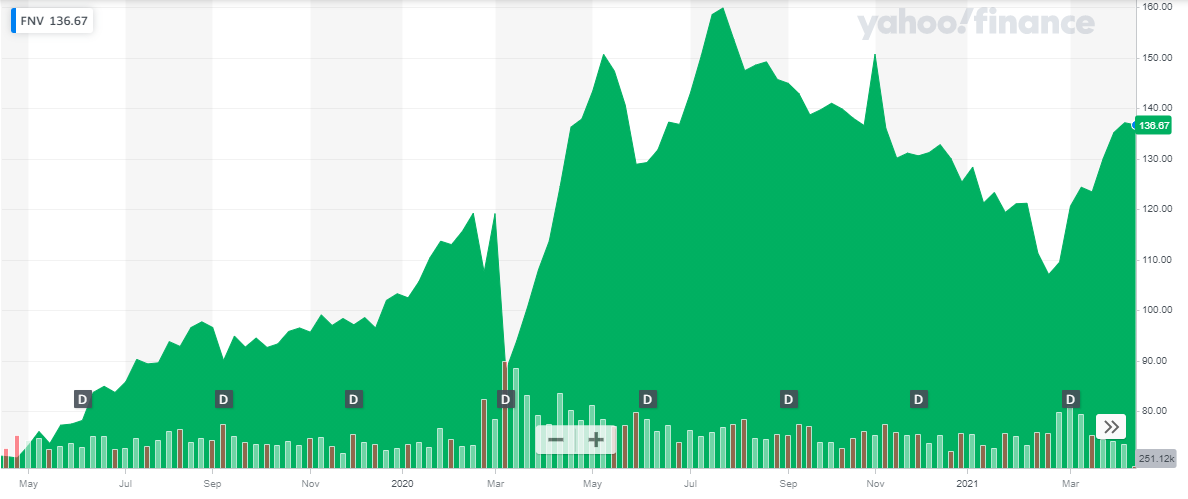

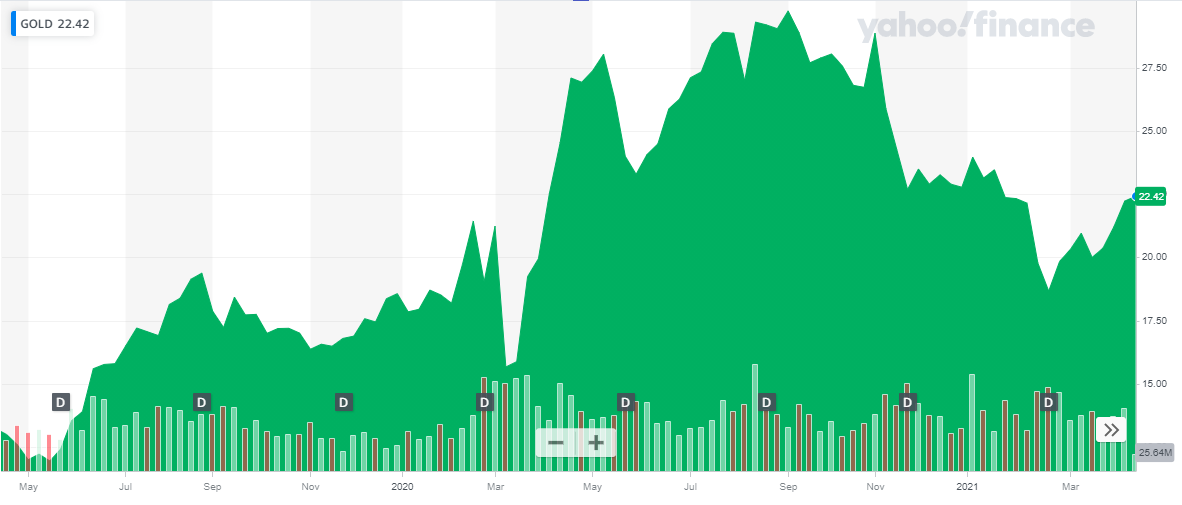

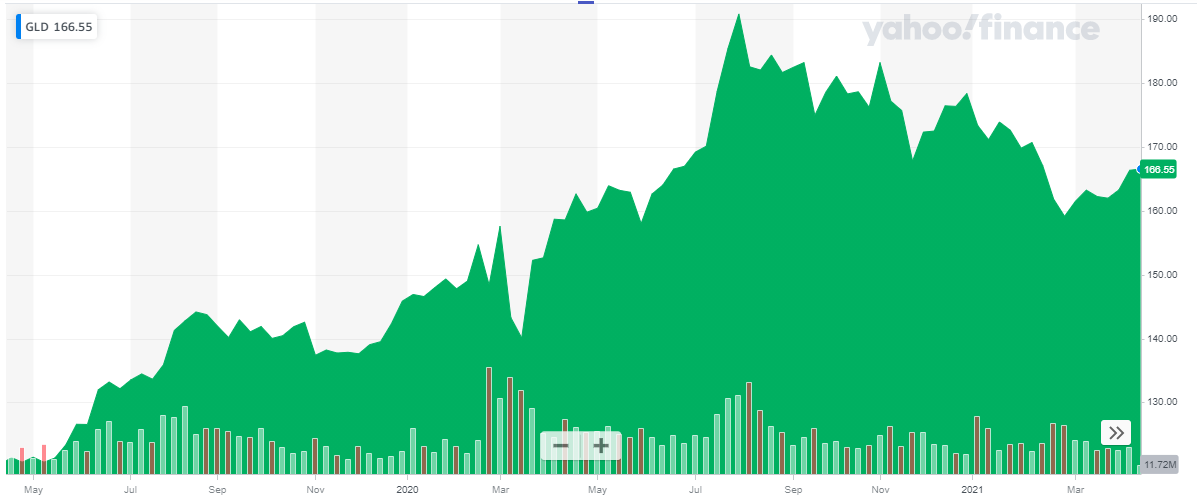

The stock performance of Franco Nevada for the last two years is shown in the chart below:

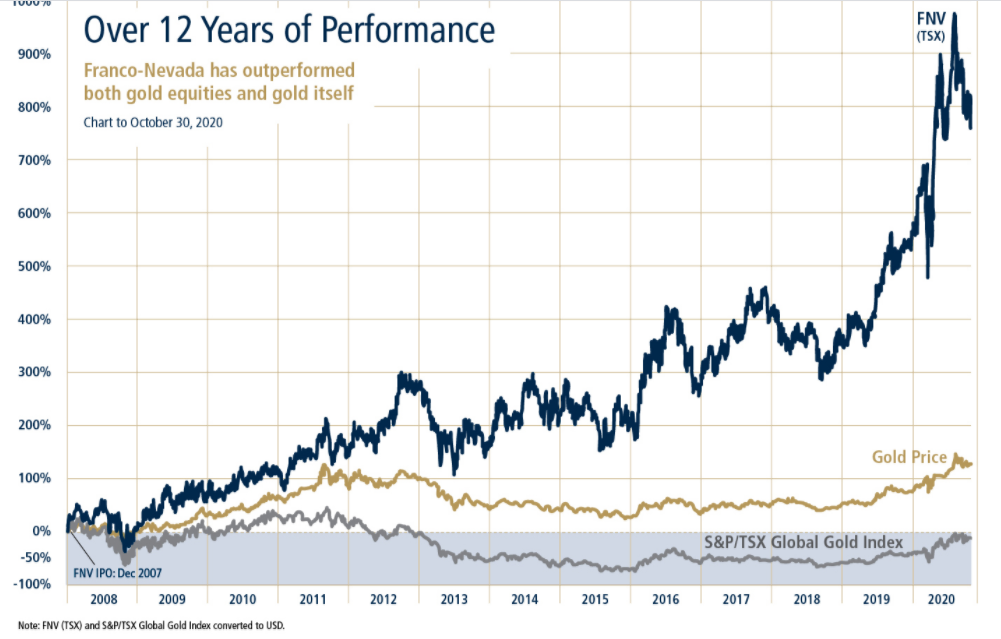

The stock performance of Franco Nevada for the last two years is shown in the chart below: Based on its performance Franco Nevada is one of the best gold mining stocks to buy.

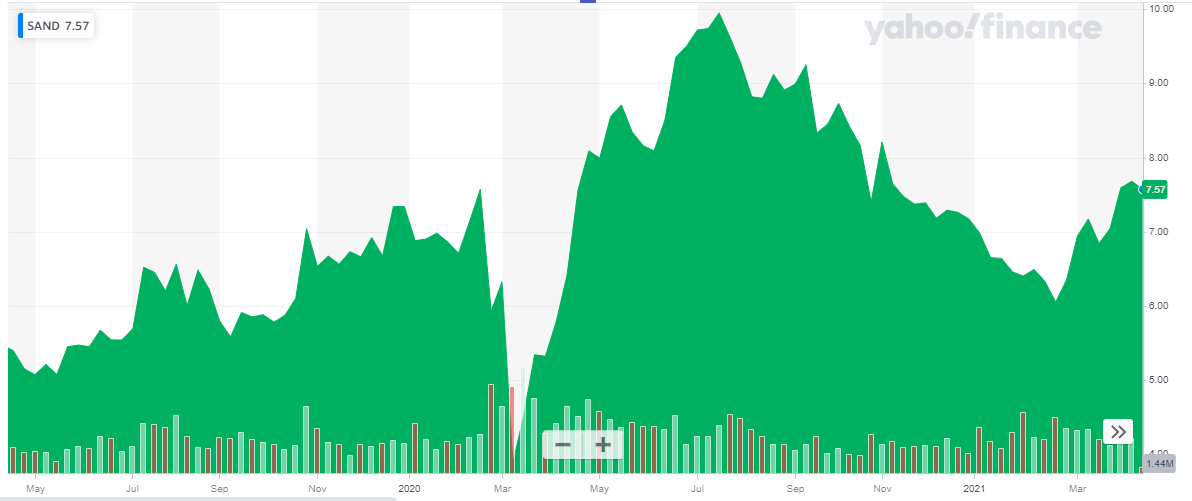

Based on its performance Franco Nevada is one of the best gold mining stocks to buy. The company is debt-free and has a growing cash position. This makes Sandstorm one of the best cheap gold stocks to buy.

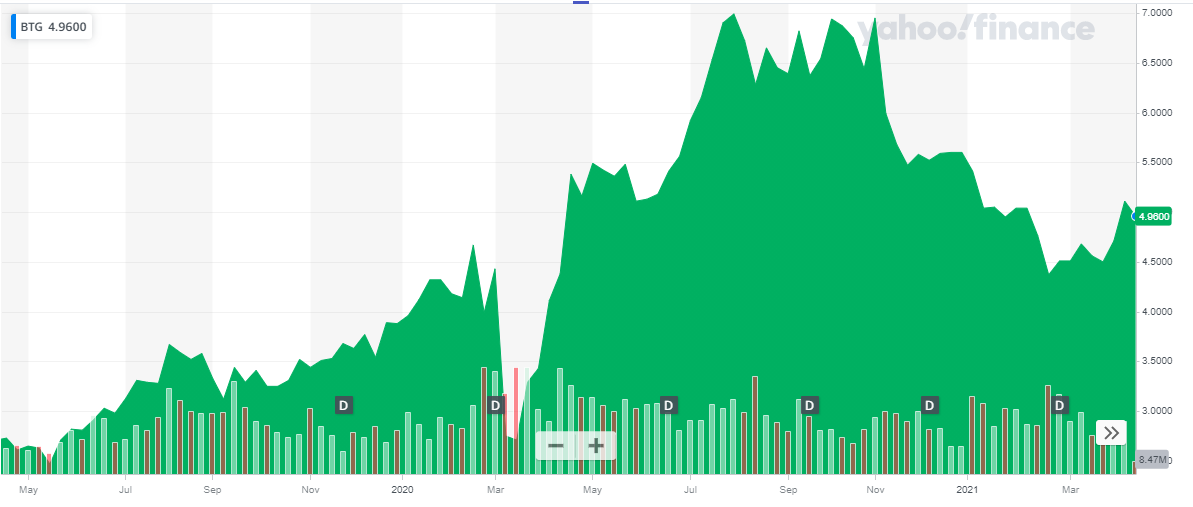

The company is debt-free and has a growing cash position. This makes Sandstorm one of the best cheap gold stocks to buy. B2Gold is an excellent long-term investment. Its performance in 2020 and the positive outlook for 2024, make it one of the

B2Gold is an excellent long-term investment. Its performance in 2020 and the positive outlook for 2024, make it one of the

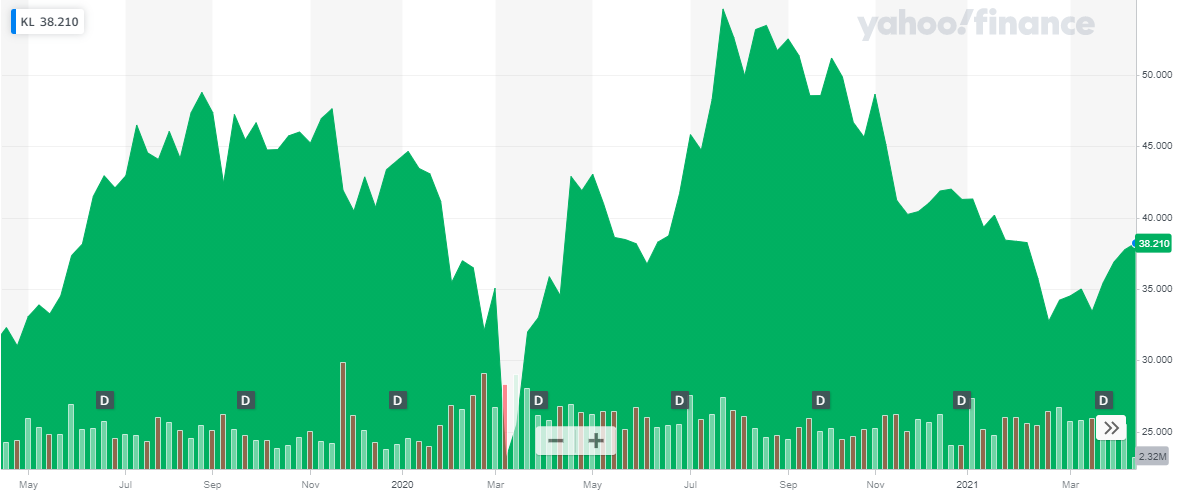

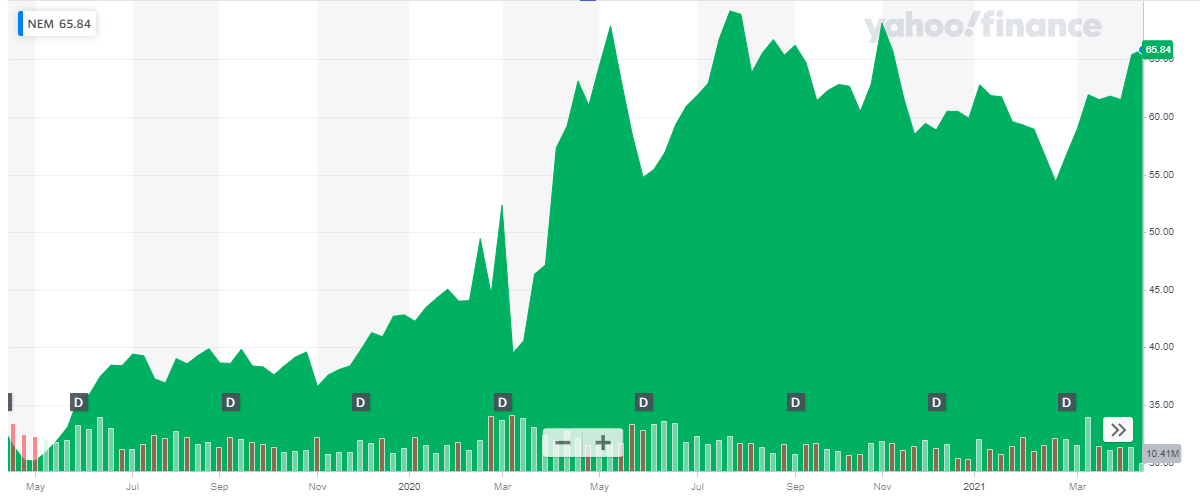

Newmont Corporation has better performance than its competitors. It offers a better yield and Price Earnings Ratio to investors. Newmont is one of the best gold stocks to buy in 2023.

Newmont Corporation has better performance than its competitors. It offers a better yield and Price Earnings Ratio to investors. Newmont is one of the best gold stocks to buy in 2023.