The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPY Confirms Elliott Wave Mastery with Blue Box Rally

Read MoreIn this technical blog, SPY manages to reach the blue box & confirms the Elliott wave mastery with blue box rally higher.

-

RY (Royal Bank of Canada) Favors Rally To 187.25 or Higher

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY extends rally from April-2025 low as nesting as it managed to erase the momentum divergence. It favors […]

-

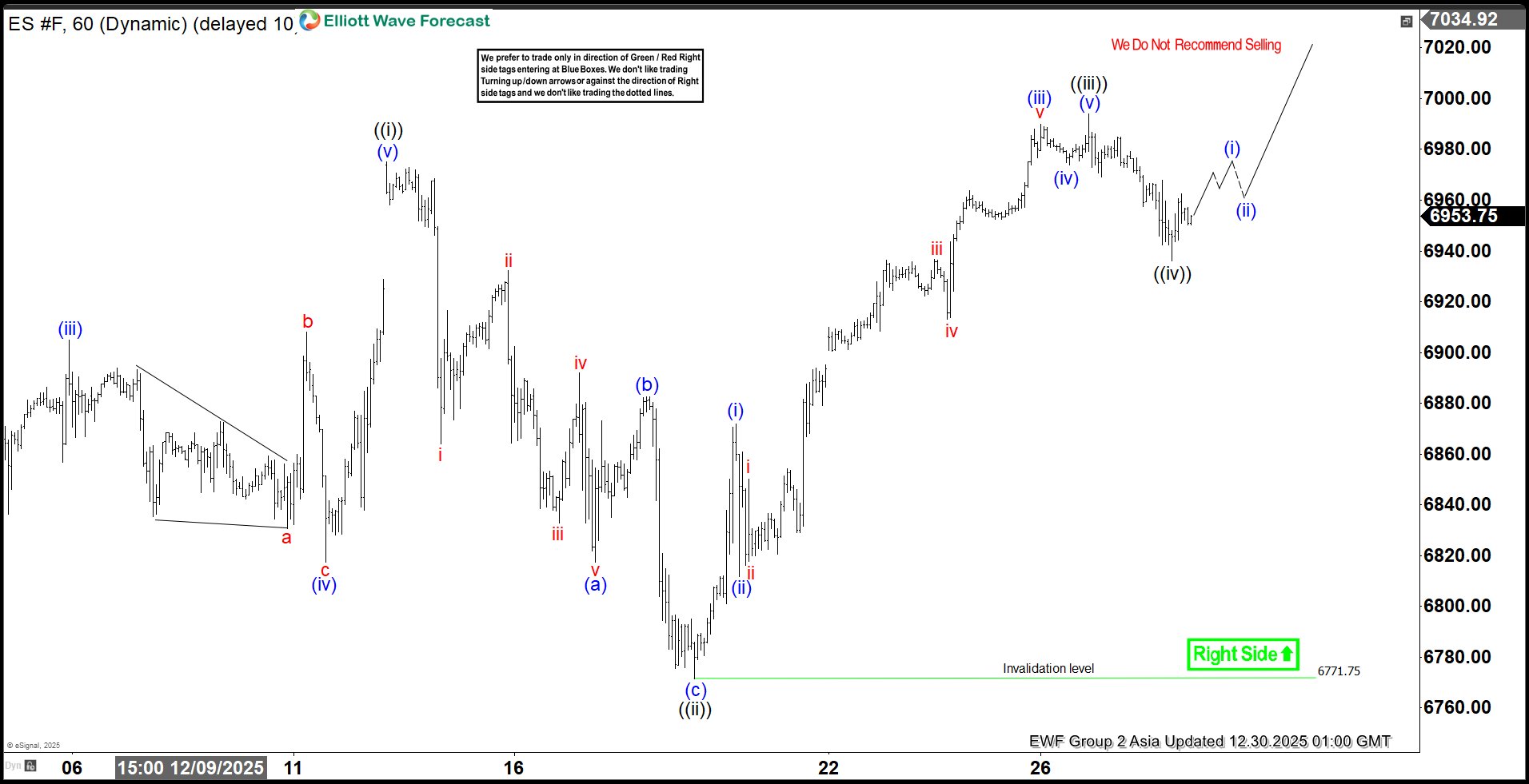

S&P 500 E‑Mini (ES) Maintains Bullish Structure, Eyeing Further Upside

Read MoreS&P 500 E-Mini Futures (ES) continues to rally to new all-time high with incomplete bullish structure. This article and video look at the Elliott Wave path.

-

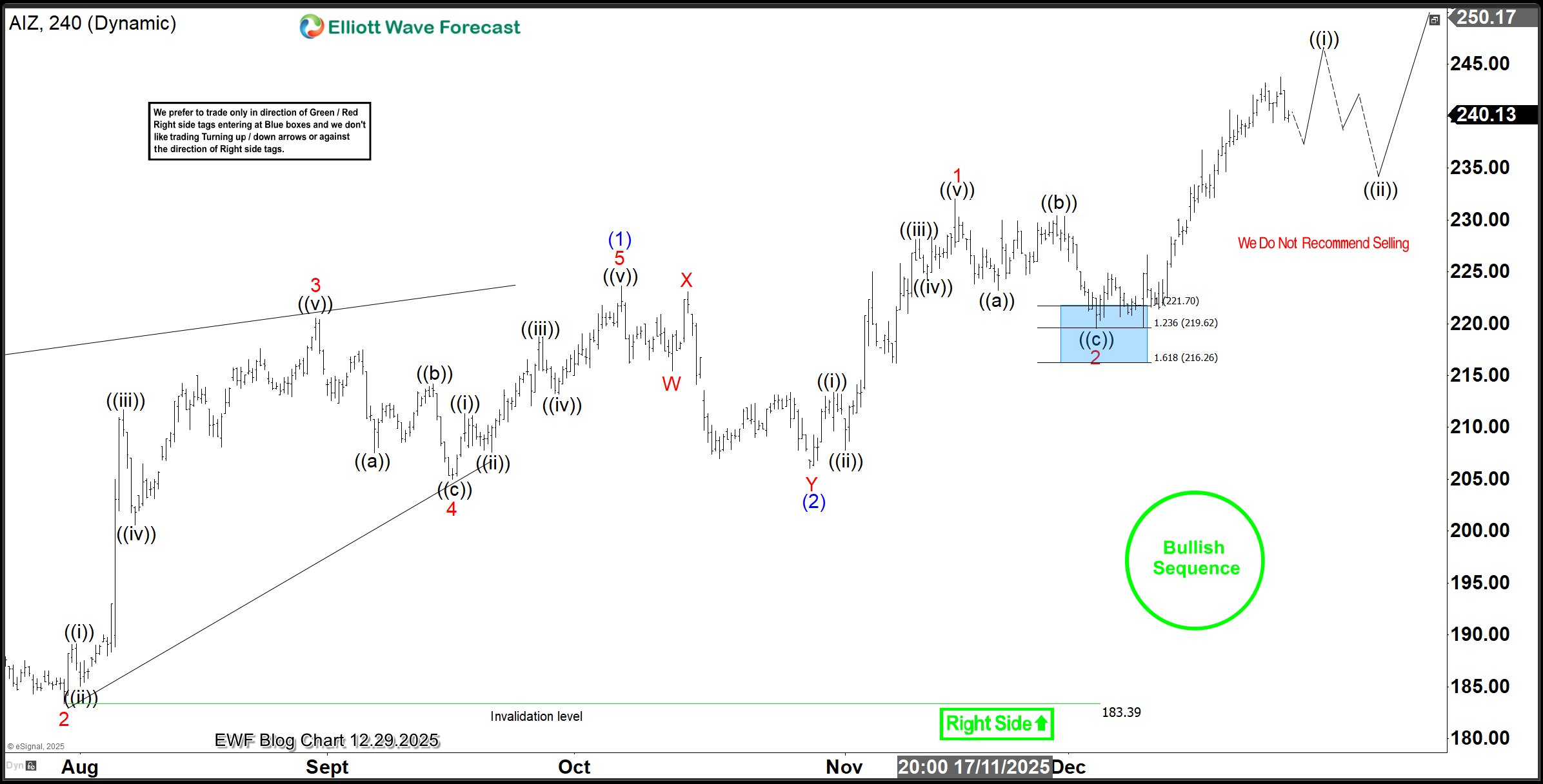

AIZ Analysis: 10% Rally From Blue Box—What’s Next?

Read MoreAIZ broke a new record high to continue the all-time bullish cycle. This recent break makes one of the most profitable in its sector. Traders should continue to buy the dip just as we did from the blue box in the last update. About AIZ Assurant Inc. (NYSE: AIZ) is a leading global provider of […]

-

PM Price Analysis: Risk-Free Target Met, $215 Ahead?

Read MorePhilip Morris International Inc. (PM) may have ended the over 4 months bearish cycle from June 2025. The current rebound happened at the blue box where the October 29 blog post alerted traders to go long. After reaching the first target, why do I think it could reach $215 in the coming days or weeks. […]

-

Robinhood (HOOD): Can It Dip Below $100 Before New Highs?

Read MoreOur earlier review highlighted Robinhood‘s (NASDAQ: HOOD) bullish five-swing structure. Currently, we are analyzing the weekly Elliott Wave pattern. This study clarifies the ongoing correction and prepares us for the next strategic phase ahead of a new bullish cycle. Elliott Wave Analysis HOOD completed a five-wave advance from its 2022 low of $6.81. This rally […]