The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

JNJ Bullish Sequence Calling for New All Time Highs

Read MoreJohnson & Johnson (NYSE: JNJ) is one of the oldest companies around the market as it was founded in 1886. It manufactures medical devices, pharmaceutical and consumer packaged goods and its stock JNJ represent 10.8% of the Health Care ETF “XLV” weight. J&J beats Earnings & Sales Estimates in Q3 and since the release in mid […]

-

Recession in 2020? Technical or Fundamental

Read MoreIf you have been reading the headlines lately, something would have come to your attention, several prominent economists and investors are calling for a recession in the year 2020. Market is a product of many participants, some trade on Fundamental grounds and some trade on Technical or a combination of both. Many keep calling and […]

-

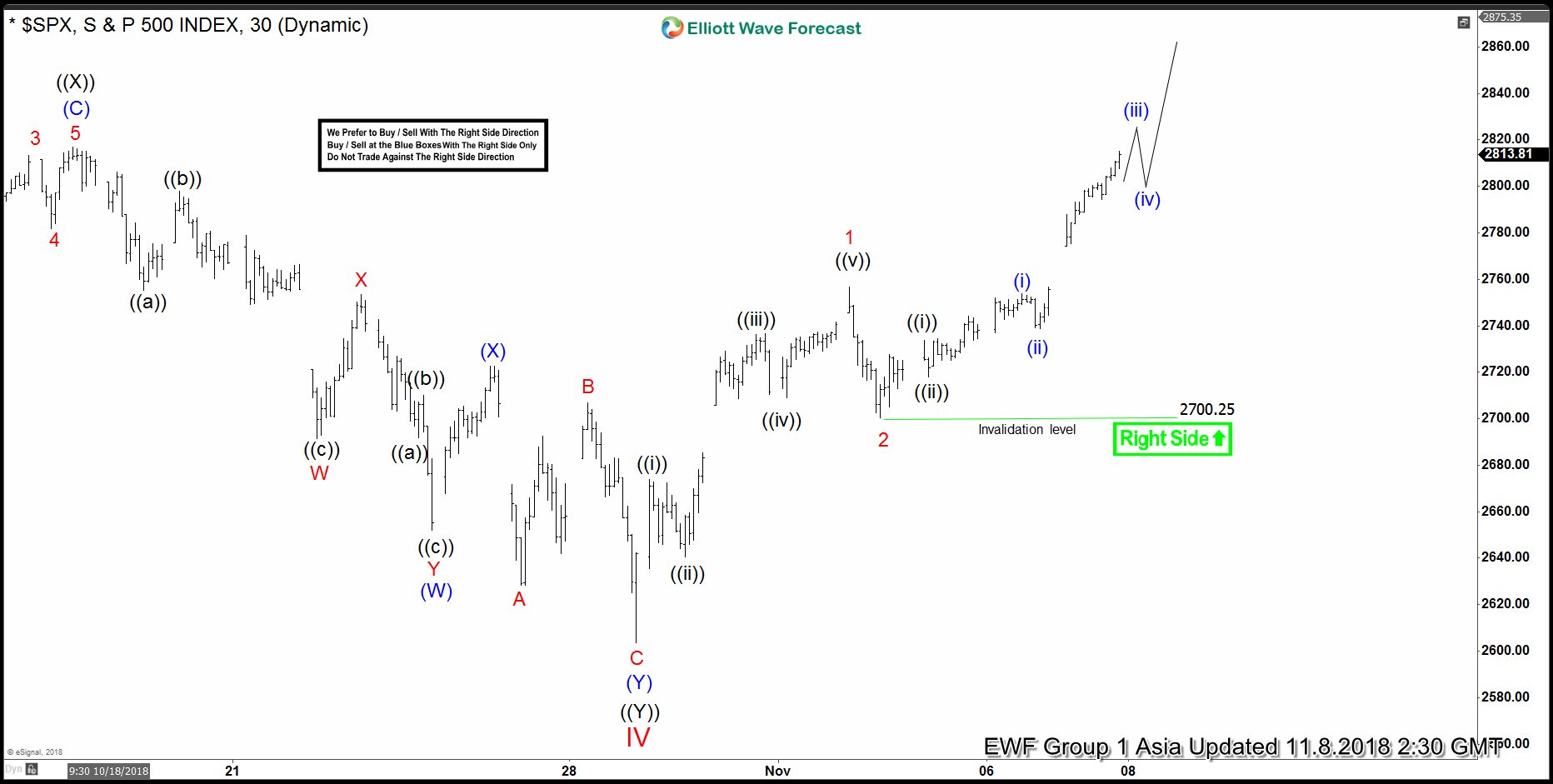

Elliott Wave View: SPX Starts a New Impulsive Rally

Read MoreShort term S&P 500 (SPX) Elliott wave view suggests that the selloff starting from Sept 21 high (2940.9) has ended at Oct 29 low (2603.54). We take the most aggressive view and call the low at 2603.54 as wave IV in Cycle degree. This suggests that SPX is ready to rally in a new bullish […]

-

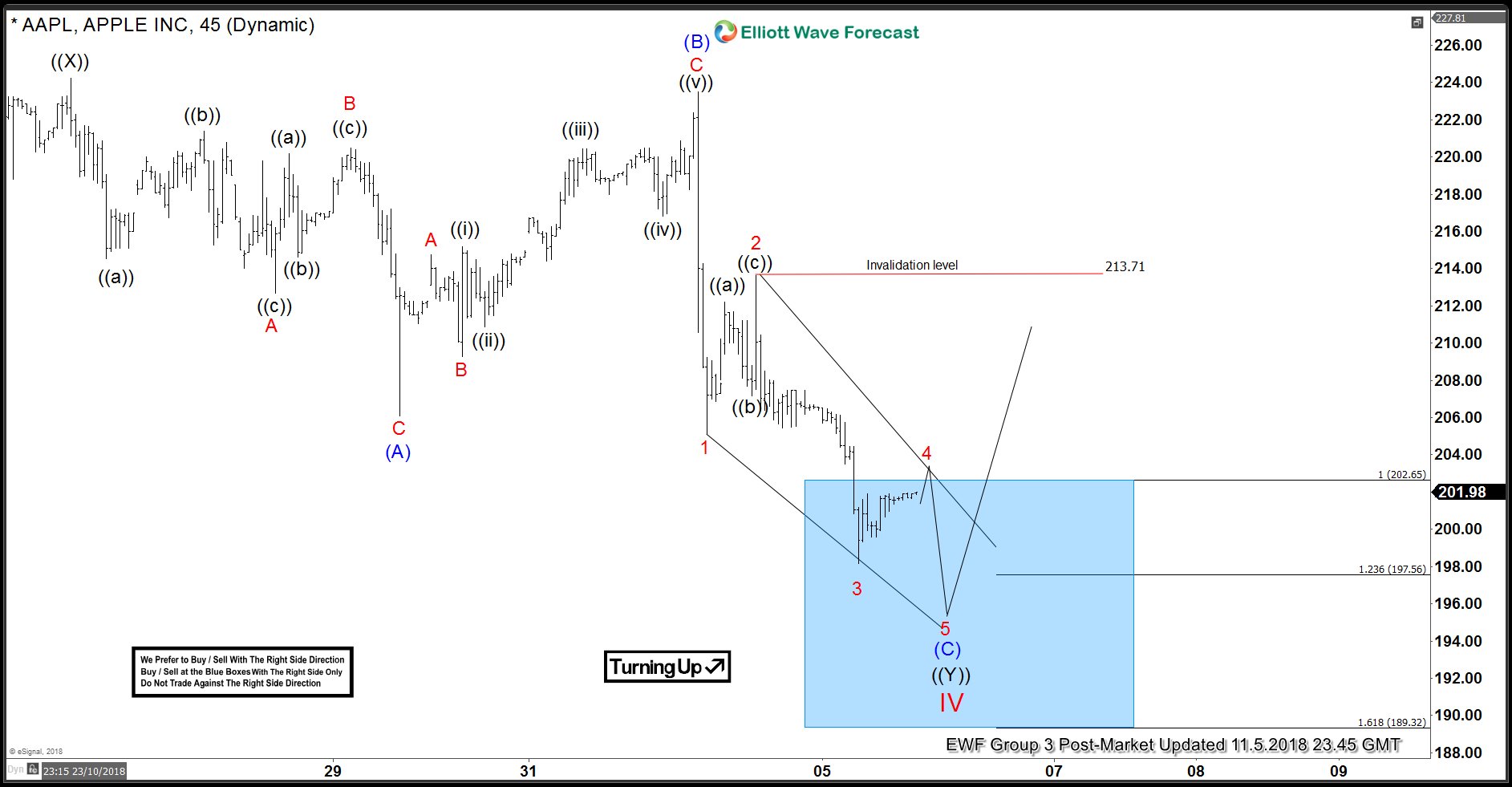

AAPL Elliott Wave Analysis Suggests Selloff Close to Ending

Read MoreApple (AAPL) short-term Elliott wave analysis suggests that the decline from $224.23 high, i.e. Primary wave ((X)), is unfolding as a Flat Elliot Wave structure. Down from $224.23, Intermediate wave (A) ended at $206.09 and bounce to $223.49 ended Intermediate wave (B). Intermediate wave (C) is currently in progress. Internal of Intermediate wave (C) is unfolding […]

-

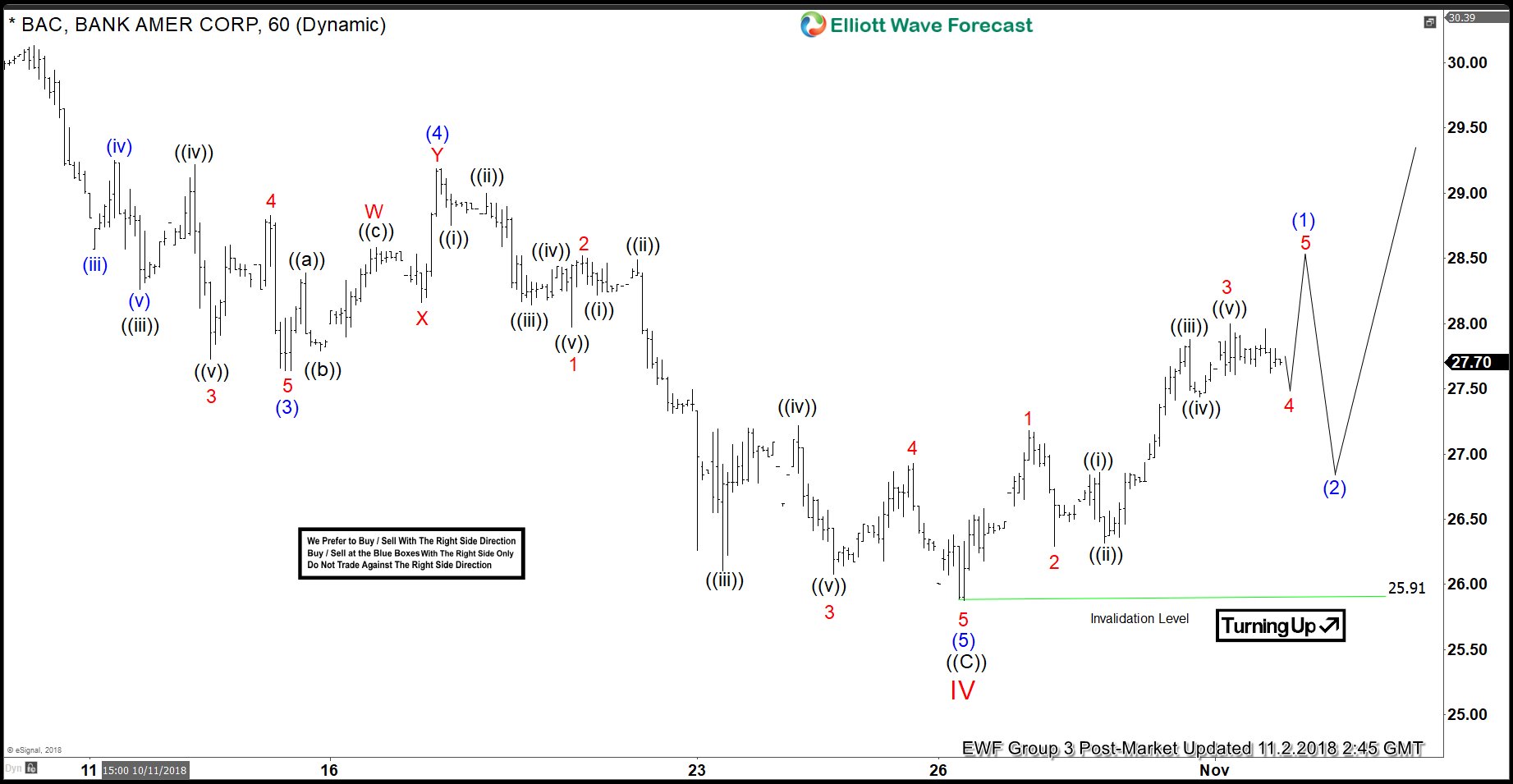

BAC Elliott Wave Analysis: Correction Ended

Read MoreBank of America corporation ticker symbol: BAC short-term Elliott wave analysis suggests that a decline to $27.26 low ended intermediate wave (3). The internals of that decline unfolded in 5 waves impulse structure in lesser degree cycles. Up from there a 3 wave bounce to $29.19 high ended intermediate wave (4) as double three structure. […]

-

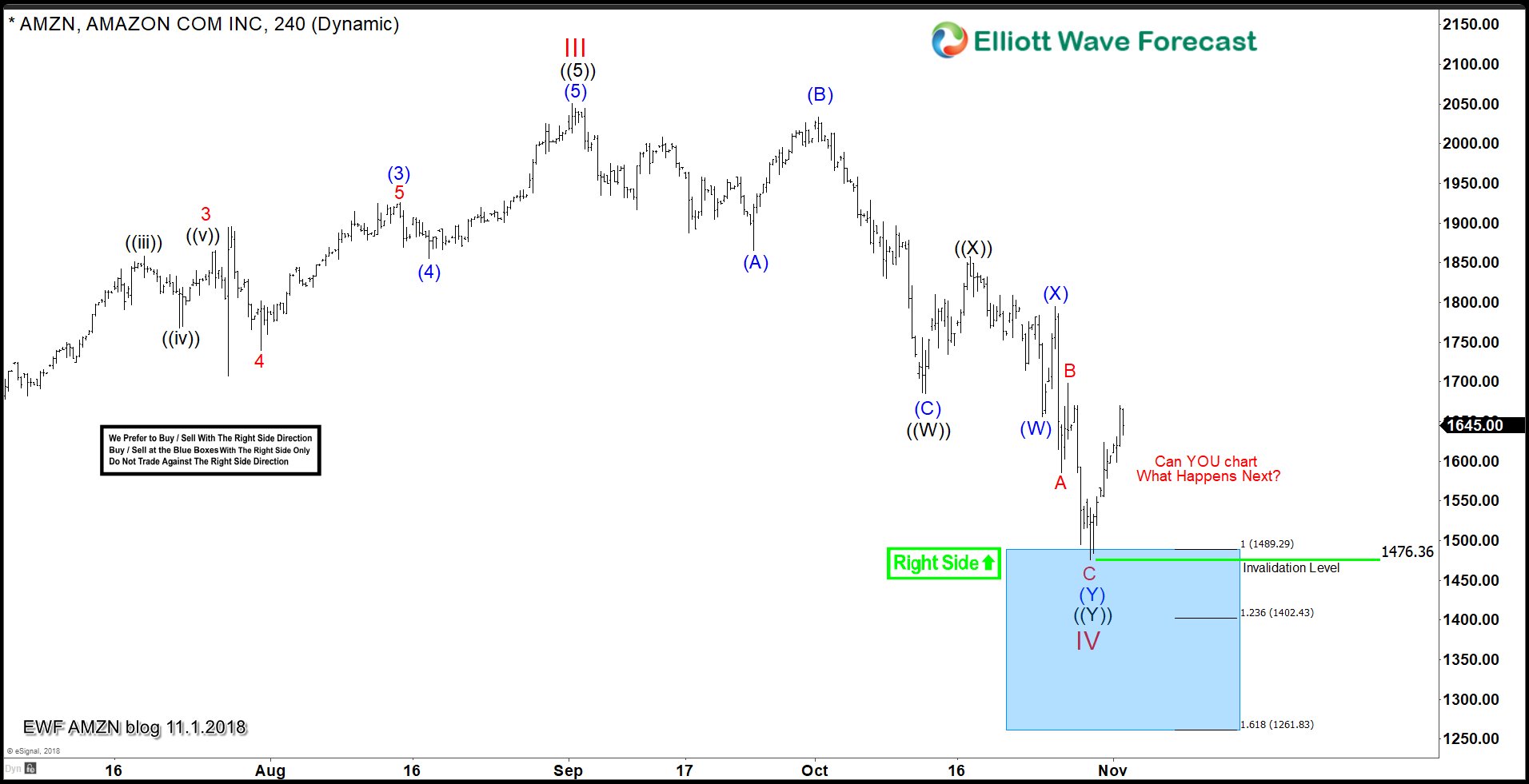

Being Down $45 Billion in AMZN Stock No Big Deal

Read More“What goes up must come down.” – Sir Isaac Newton It was widely reported this week that Amazon (AMZN) founder, Jeff Bezos, lost roughly $45 Billion dollars in net worth during the October stock market selloff as shares of AMZN cratered from all-time highs set on 9/4/2018 at $2,050.50/share to the most recent low of […]