The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

G20 Meeting May Dictate Path of Stock Market for Rest of the Year

Read MoreGlobal Indices continue to retreat in the fourth quarter of this year as the combination of Fed’s quantitative tightening and escalating trade wars threatens to derail the 10 year bullish market. Below is the Year-to-Date return of the Global Indices as of Friday Nov 24: Next week, global Indices will have a chance to find […]

-

Tesla Maturing Sideways Price Action?

Read MoreTesla ticker symbol: $TSLA short-term Elliott wave view suggests that Minor wave 3 ended at $349.20 high. Down from there, a pullback to $328.50 low ended Minor wave 4. The internals of that pullback unfolded as a Flat correction. Minute wave ((a)) of 4 ended at $330.14 low in lesser degree Flat correction. Above from […]

-

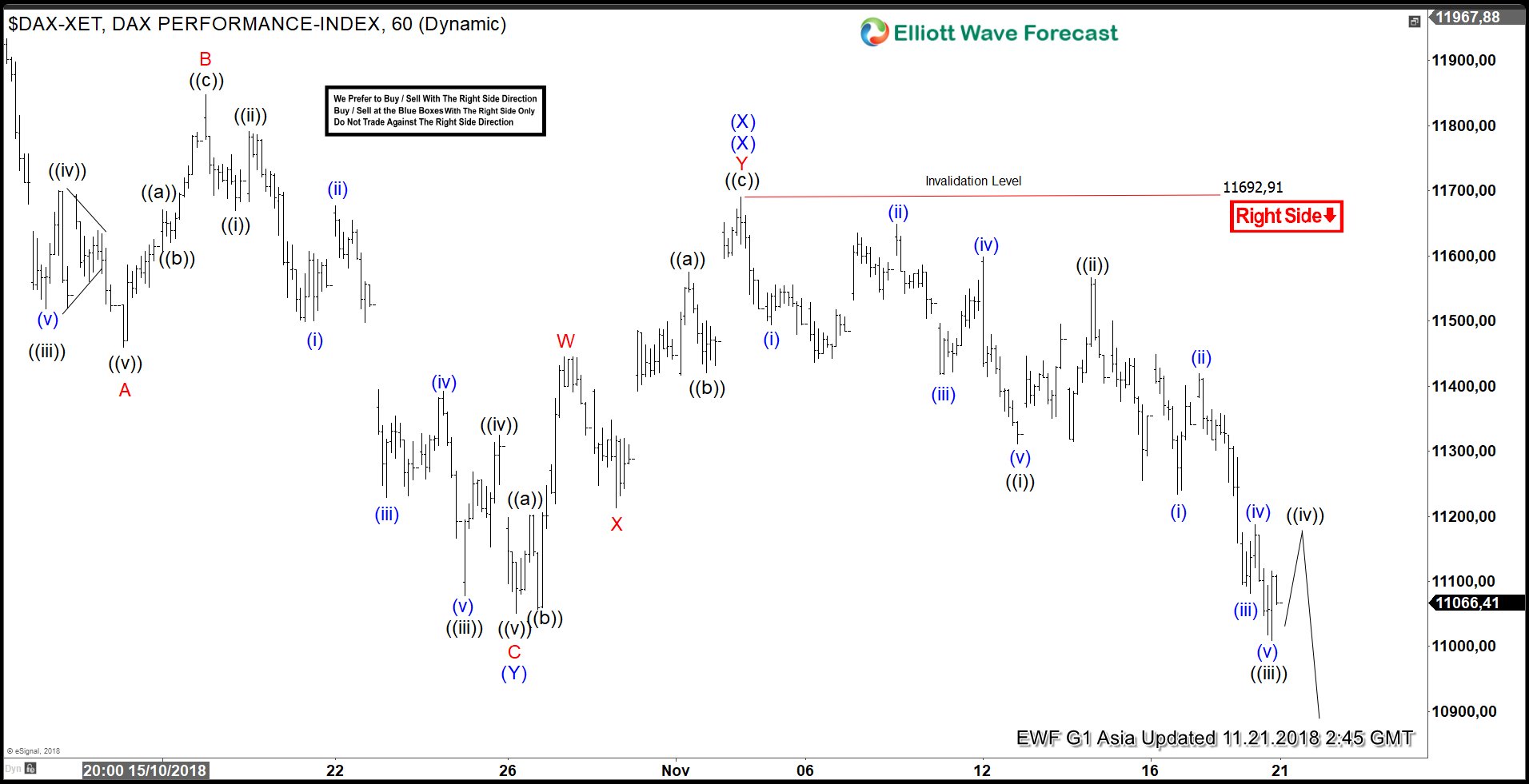

DAX Elliott Wave Analysis Calling Rally to Fail for Extension Lower

Read MoreDAX has broken below Oct 26 low (11051) and suggests that the Index has resumed the decline lower. We are calling the decline from July 27 high (12886.83) as a triple three Elliott Wave Structure. Decline to 11051.04 low on Oct 26 ended Intermediate wave (Y). From there, rally to 11692.91 high on Nov 2 ended […]

-

XLY – Don’t Count the American Consumer Out Yet

Read MoreThe U.S. Consumer Measured Via the XLY “The U.S. economy is the global economic driver. And within the U.S. economy, the U.S. consumer is the global driver.” James P. Gorman We’re Entering In Negative Territory for 2018 The stock market (measured via the S&P 500 and Dow Jones Industrial Average) has officially erased all of […]

-

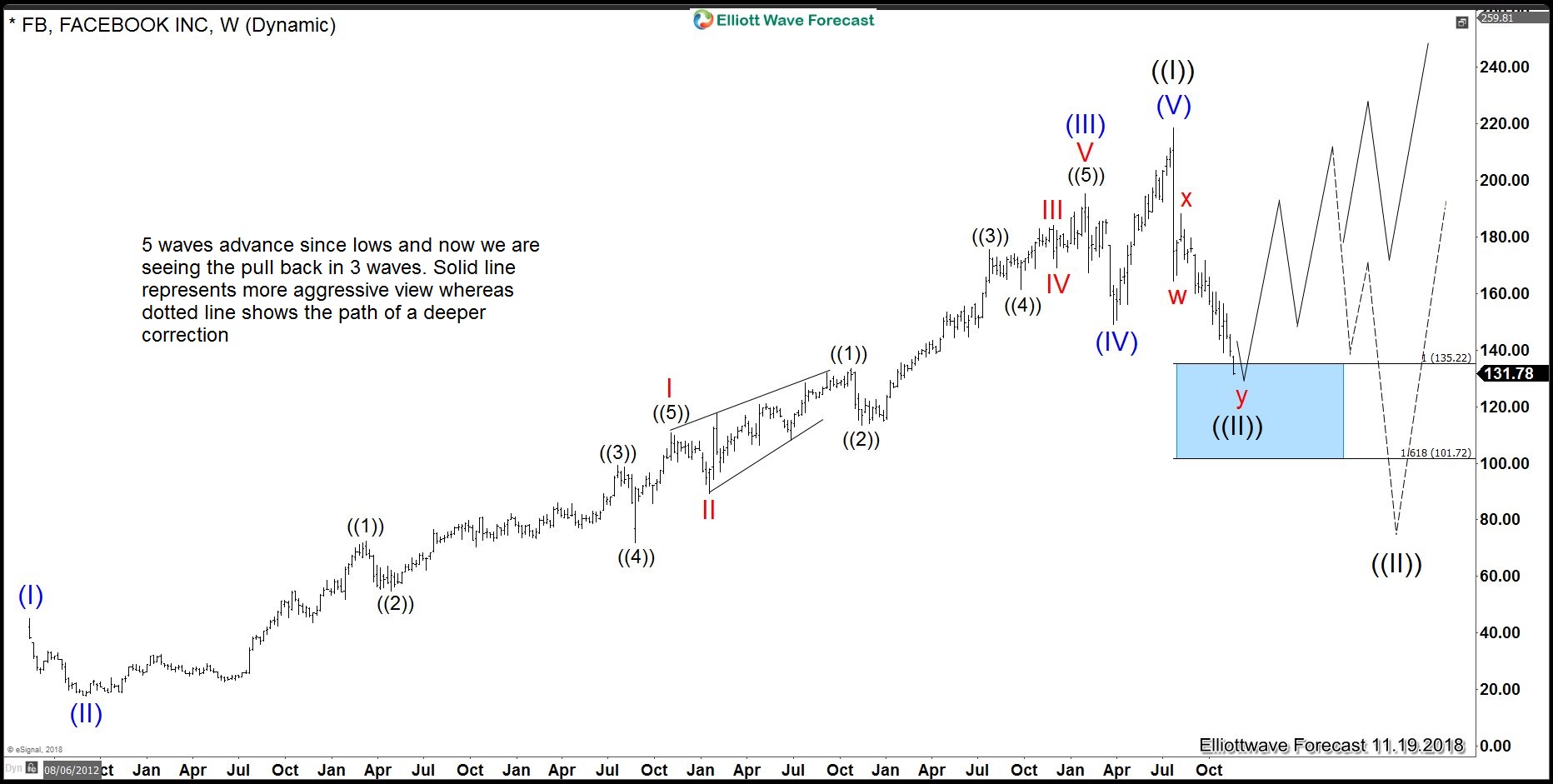

Facebook Ends Cycle from IPO. What’s Next For The Social Networking Giant

Read MoreEven today with the explosion of advancements in quantitative analysis utilizing the most sophisticated algorithms and artificial intelligence available the debate rages on between whether a technical-based trading methodology is superior to a fundamental-based trading methodology and vice versa. That debate is examined below via analysis of individual financial instruments such as Facebook (FB). The […]

-

Amazon (AMZN) – Highlighting Next Area For Buyers

Read MoreWe recently wrote an article explaining why Mr Jeff Bezos had nothing to worry about after being down $45B in October’s market sell off and also stated the obvious fact that trend in Amazon (AMZN) is up and pull backs are a buying opportunity. AMZN reached our blue box area starting from $1477 at the […]