The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

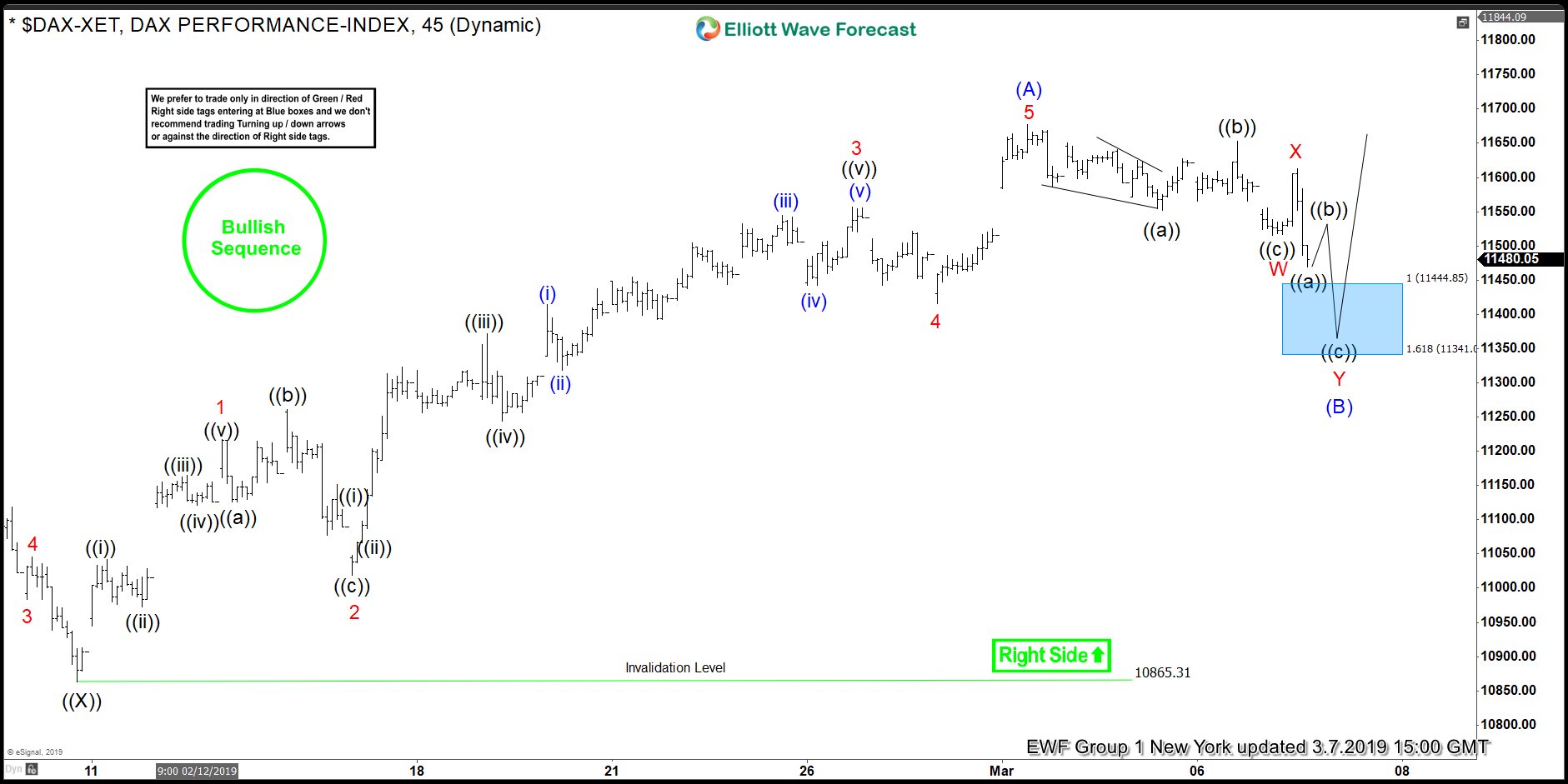

Elliott Wave View: DAX Structure Remains Bullish As Pullback In Progress

Read MoreThis article and video explains the short term Elliott Wave path for DAX. The Index remains bullish and dips should find buyers in 3, 7, or 11 swing.

-

Elliott Wave View: S&P 500 (SPX) Correction Should Find Buyers Again

Read MoreThis article and video explain the short term Elliottwave path for S&P 500 (SPX). The Index is in wave ((4)) correction but should find buyers again for more upside.

-

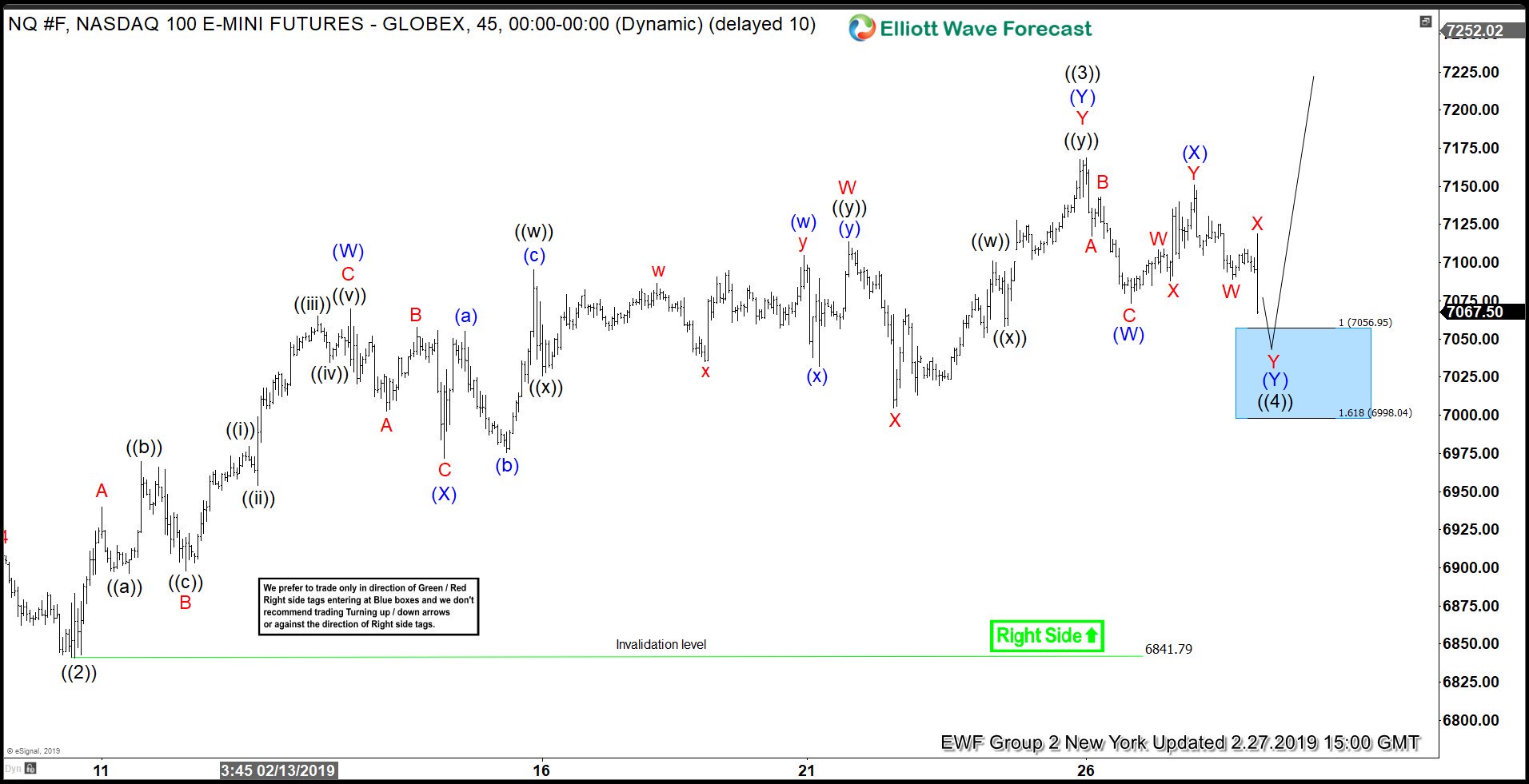

NASDAQ Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NASDAQ. As our members know recently we got pull back that was unfolding as Elliott Wave Double Three Pattern. We expected NASDAQ to find buyers again and trade higher due to incomplete bullish seqeuences in […]

-

Zendesk (NYSE: ZEN) – Elliott Wave Bulls remain in Control

Read MoreZendesk (NYSE: ZEN) is a customer service software company based in United States. Its cloud-based help desk solution is used by more than 200000 organizations worldwide. the company’s earnings over the next few years are expected to increase by 34%, indicating a highly optimistic future ahead which would attract more investors. In this article, we’ll be taking a […]

-

Elliott Wave View: Short Term Bullish in Alibaba

Read MoreThis article & video explains the short term Elliott Wave path of Alibaba. The Stock is still missing 100% extension from Jan 2019 low favoring more upside.

-

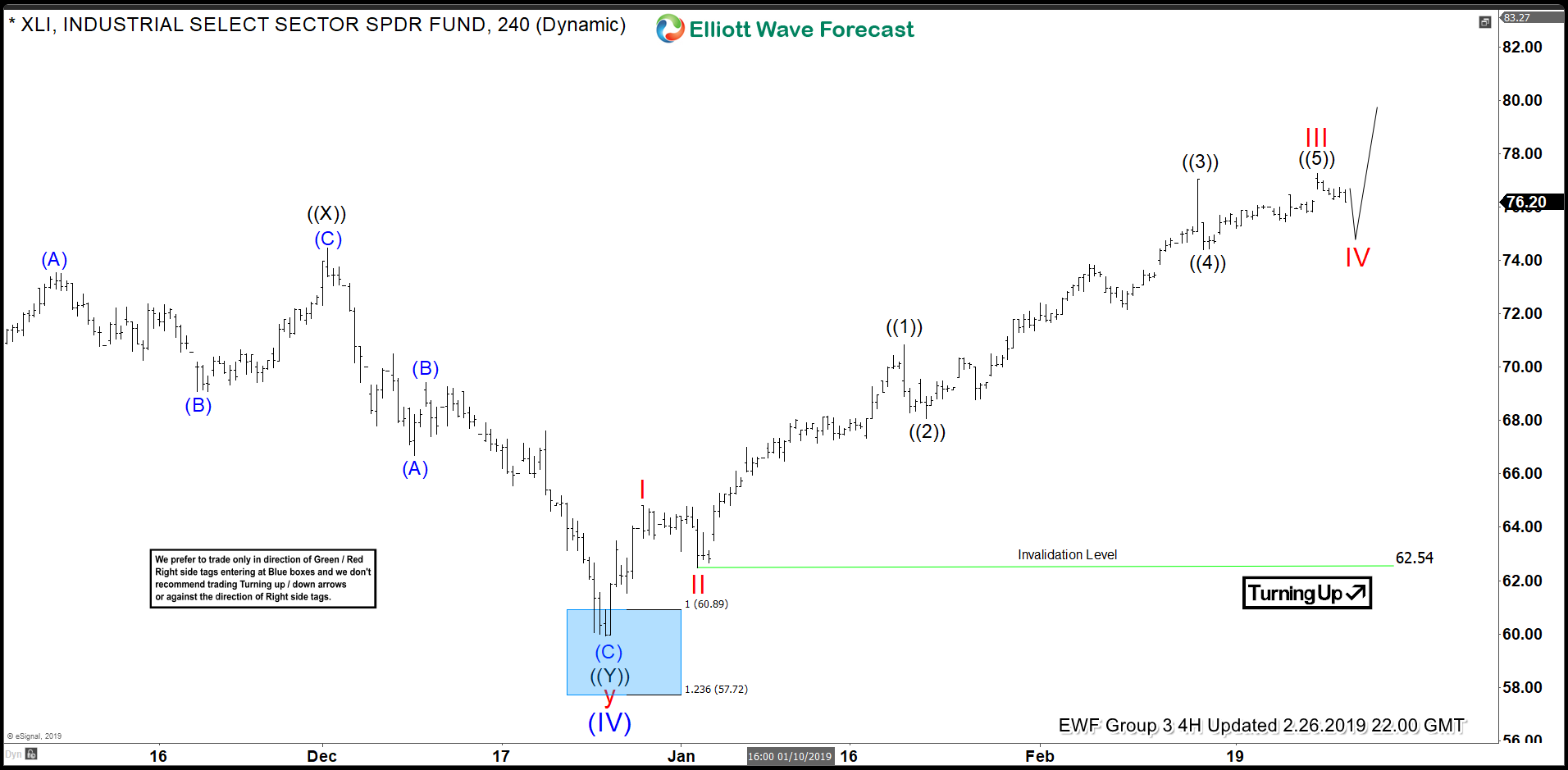

Industrial ETF XLI Set to Make New All-Time Highs

Read MoreXLI Set to Make New Highs The Industrial Sector ETF, XLI, is set to make new all-time highs above the January 2018 high at 80.96. From 80.96 Elliott wave analysis suggests XLI corrected lower on the daily chart in 7 swings to the 12/26/2018 low of 59.92. Within the final 3 waves of y (red […]