The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Disney (NYSE: DIS) Impulsive Structure is Supporting Further Rally

Read MoreDisney (NYSE: DIS) surged to new all time highs in April 2019 confirming the breakout of the consolidation range that lasted for 3 years. The rally from December 2018 low unfolded as an impulsive 5 waves structure which is part of the weekly cycle from 2016 low. The cycle ended on July peak from where […]

-

Boeing Elliott Wave Analysis: Stock Will Dictate Path For World Indices

Read MoreHello Traders. In this previous Boeing blog, we discussed the path for the Boeing stock. Now, let have a look at the latest 4 Hour chart. We can see that soon the stock will be reaching the $267.00 area. That area in the following chart is the 100% extension from 3.1.2019 peak. The Instrument has […]

-

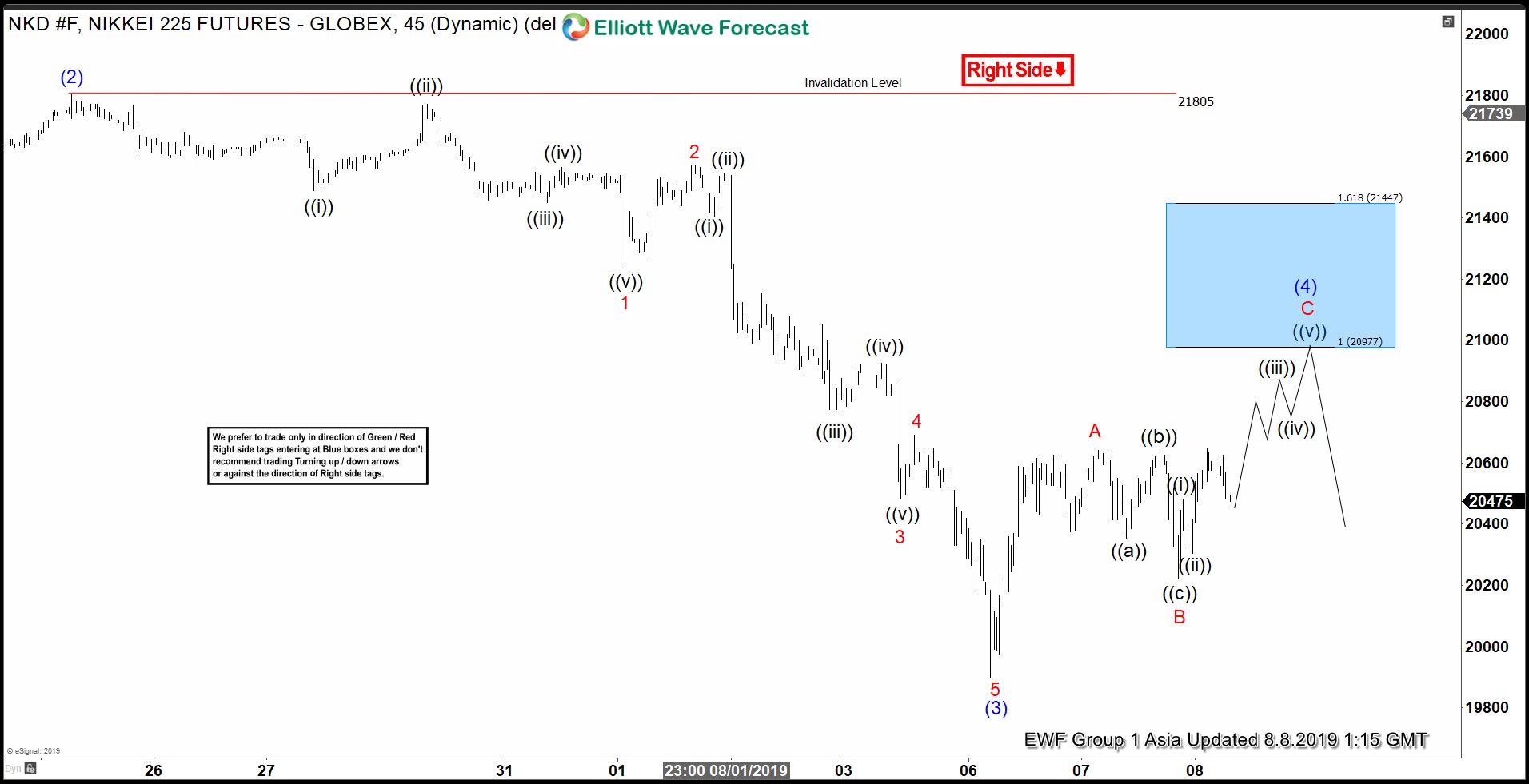

Elliott Wave View: Rally in Nikkei Should Fail and See Sellers

Read MoreNikkei is correcting the cycle from July 25 high as a zigzag and can see sellers for more downside while rally fails in 3, 7, or 11 swing.

-

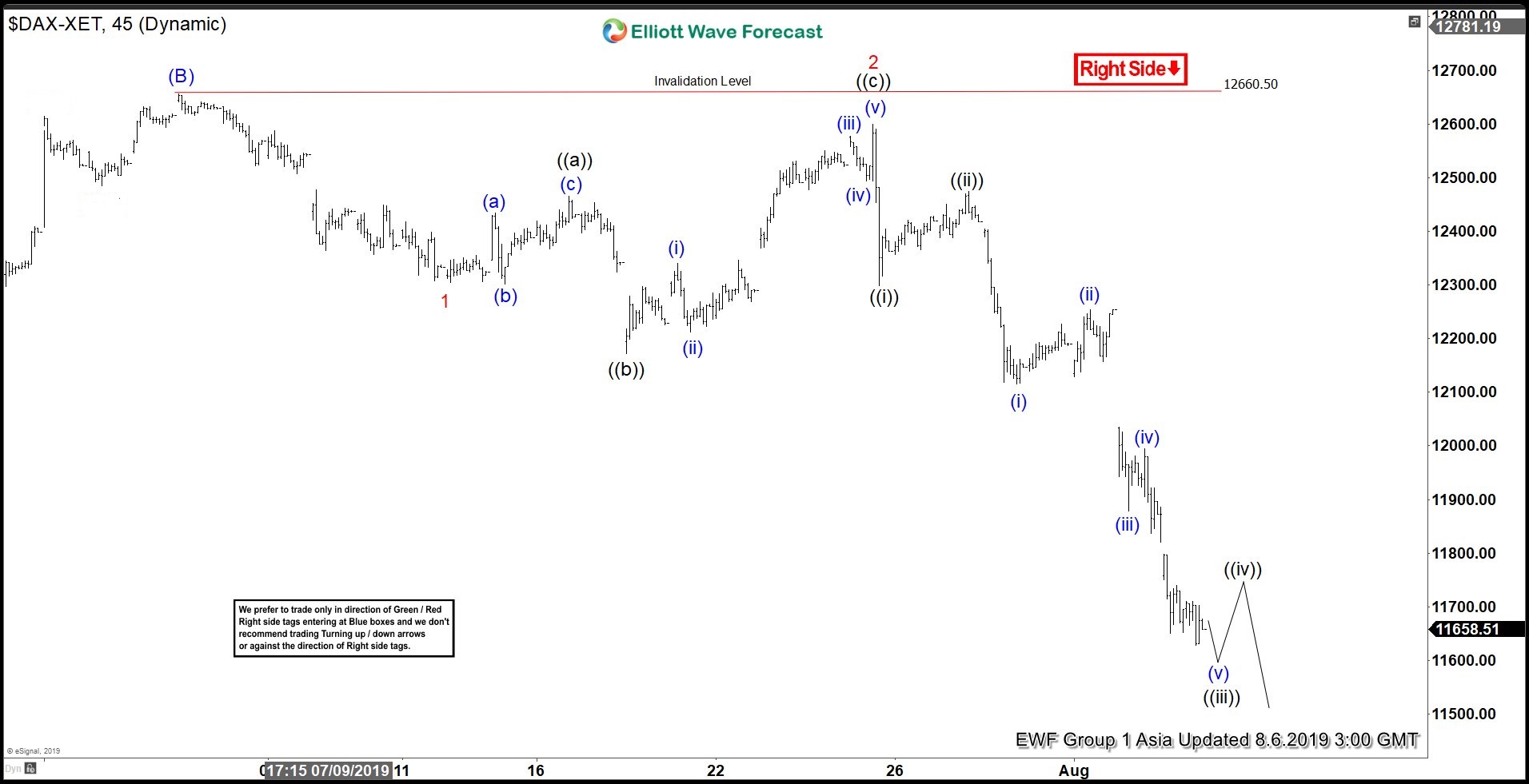

Elliottwave View: Decline in DAX a correction or a new bearish market?

Read MoreDecline in DAX from July 4 high (12660.5) is impulsive. Index should see further downside in the near term. This article talks about Elliott Wave path.

-

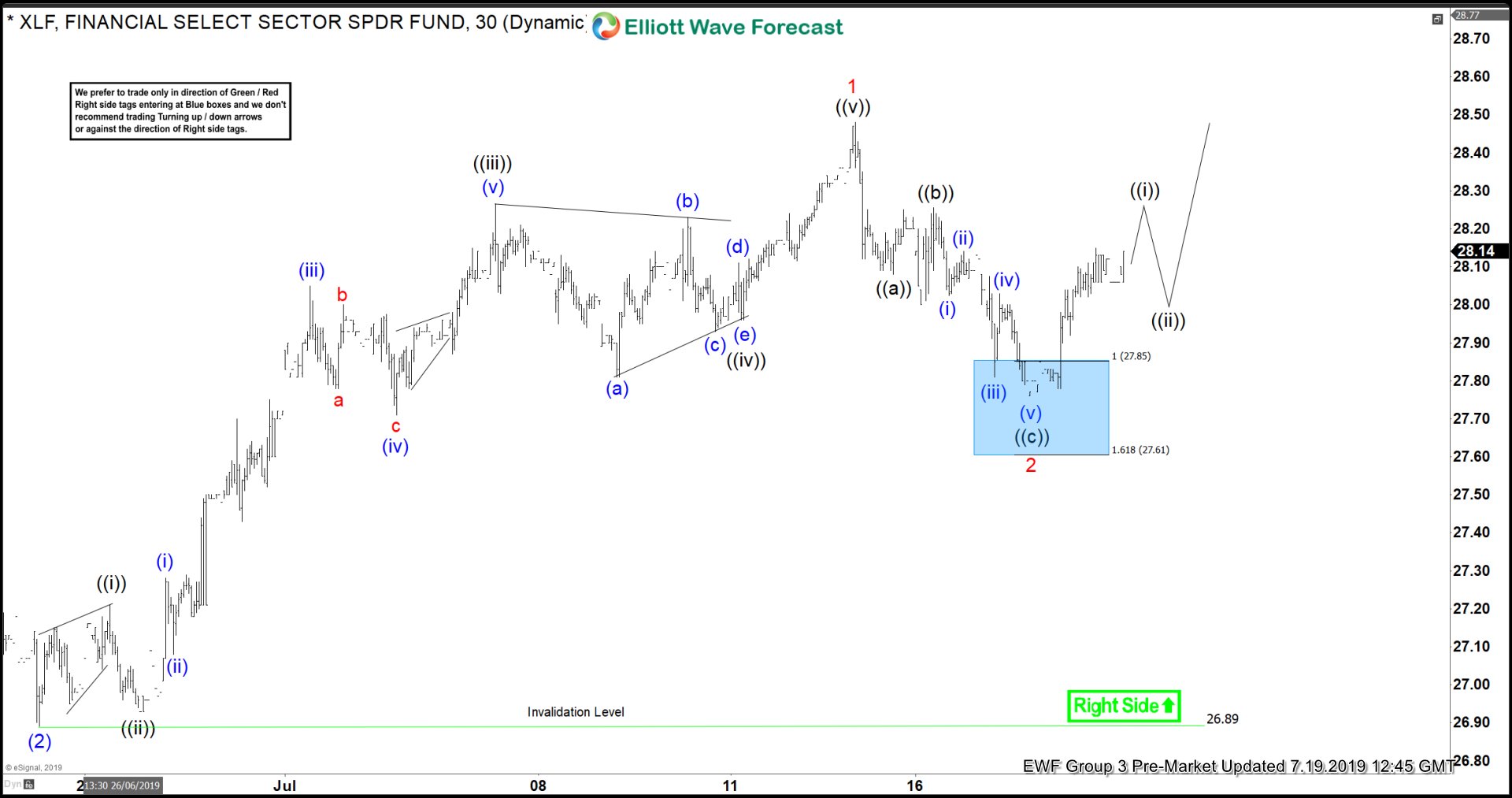

XLF Buying The Dips At The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLF ( Financial Select Sector), published in members area of the website. Break of April 26th peak made December 2018 Cycle incomplete to the upside .Consequently XLF is bullish against the 25.72 low. We advised […]

-

Lockheed Martin (NYSE: LMT) Bulls Facing CrossRoad

Read MoreLockheed Martin (NYSE: LMT) has a current market cap of $104.3B and $56.46B in revenue, outperforming the defense sector companies in the recent years. The second quarter earnings report provided a clear indication that the bull case for the stock is intact with revenue up across the board. The technical picture for the stock is showing […]