The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Citigroup (NYSE: C) Impulsive Rally Extending for Year-End

Read MoreCitigroup (NYSE: C) is currently up $34 year-to-date and the stock is still aiming for further gains before year-end as the financial sector continues the recovery from last year correction. The recent impulsive rally from 10.03.2019 low allowed the stock to break above September 2019 peak which opened a bullish sequence from August low and […]

-

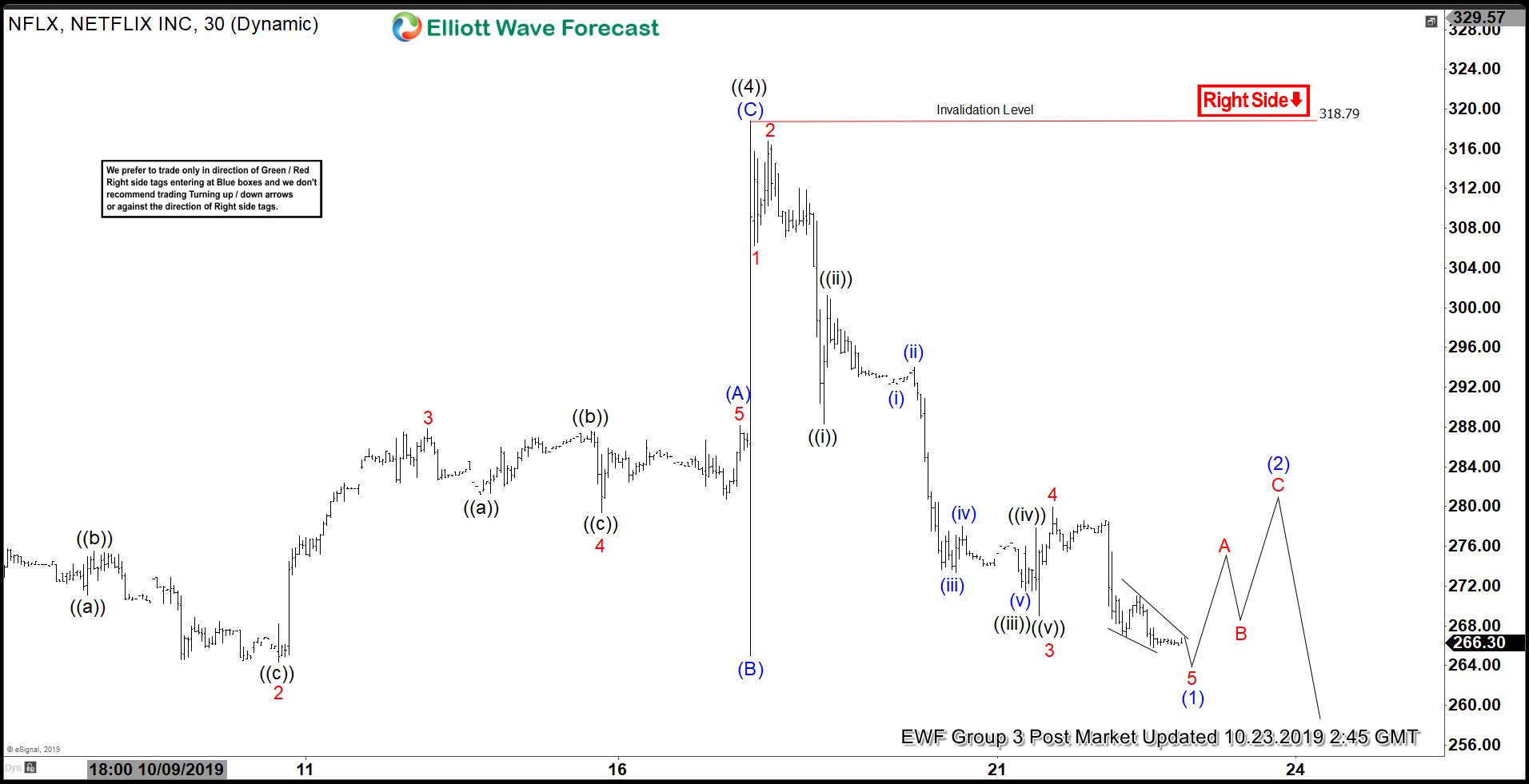

Elliott Wave View: Netflix Looking to Resume Lower

Read MoreShort Term Elliott Wave view on Netflix (Ticker: NFLX) suggests that the spike to $318.79 on October 17, 2019 ended wave ((4)). Internal subdivision of wave ((4)) unfolded as a zigzag Elliott Wave structure where wave (A) ended at 288.17, wave (B) ended at 265, and wave (C) ended at 318.79. Since then, the stock […]

-

Elliott Wave View: Nasdaq Pullback Should Continue To Find Support

Read MoreNasdaq shows a bullish sequence from August 6, 2019 low favoring more upside. Near term, while pullback stays above 7480, expect Index to extend higher.

-

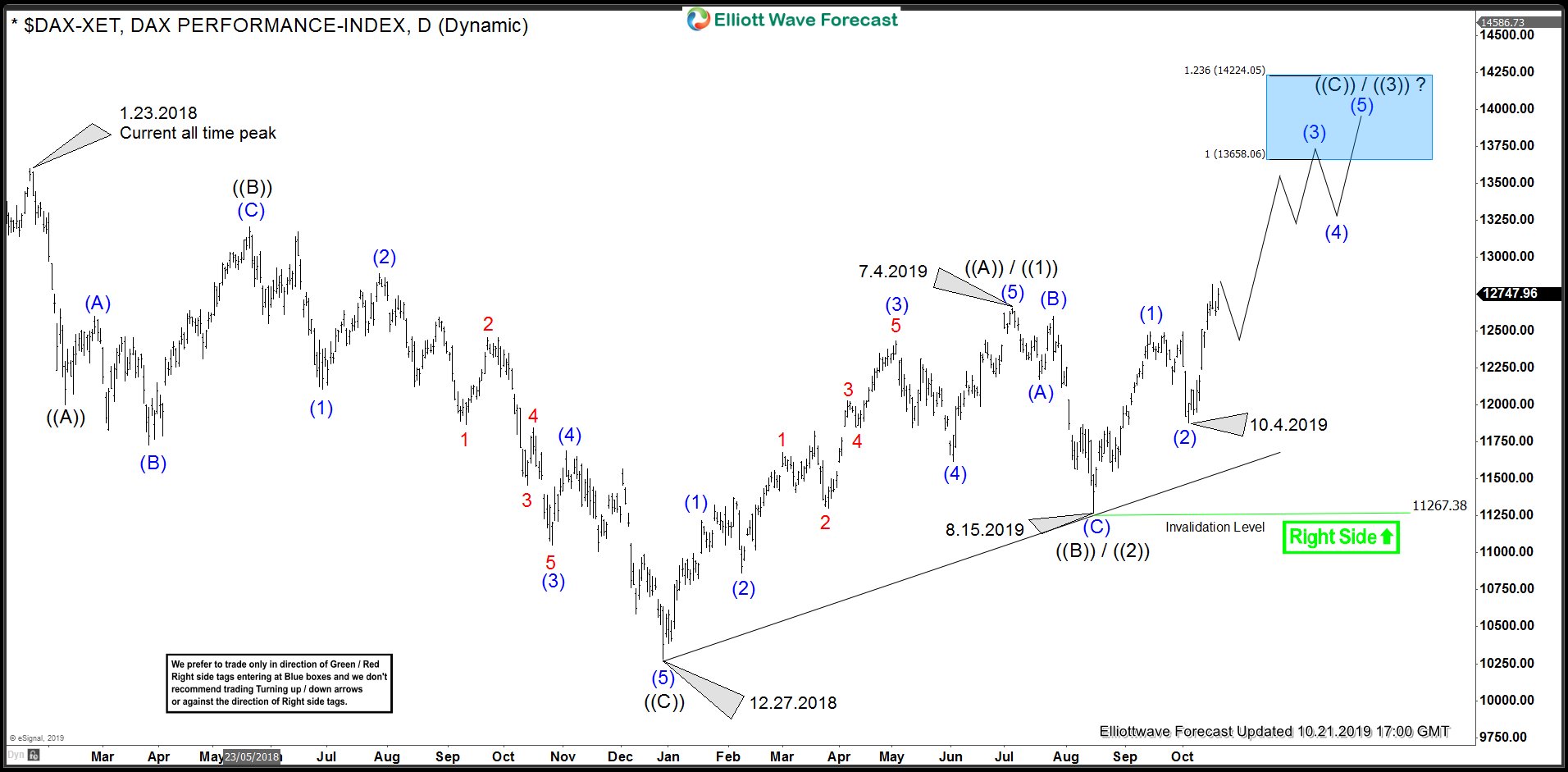

DAX Bullish Sequence Aims for New All Time High

Read MoreThis month, DAX broke above 7/4/2019 peak (12656.05) and even though it’s still below it’s peak seen back on 1/23/2018 (13596.89), series of higher highs from 12/27/2018 (10279.20) calls for more upside. In this blog, we will take a look at two different degrees of bullish sequences in $DAX and explain why we believe the […]

-

Rallies In Lufthansa Stock Should Fail For More Downside

Read MoreHello fellow traders. In today’s blog, we will recap a blog I did last month about Lufthansa. In that blog, I talked about the reasons why the stock should remain weak in the coming weeks and months. Of course, we need to understand that the market never moves in one straight line. There will be […]

-

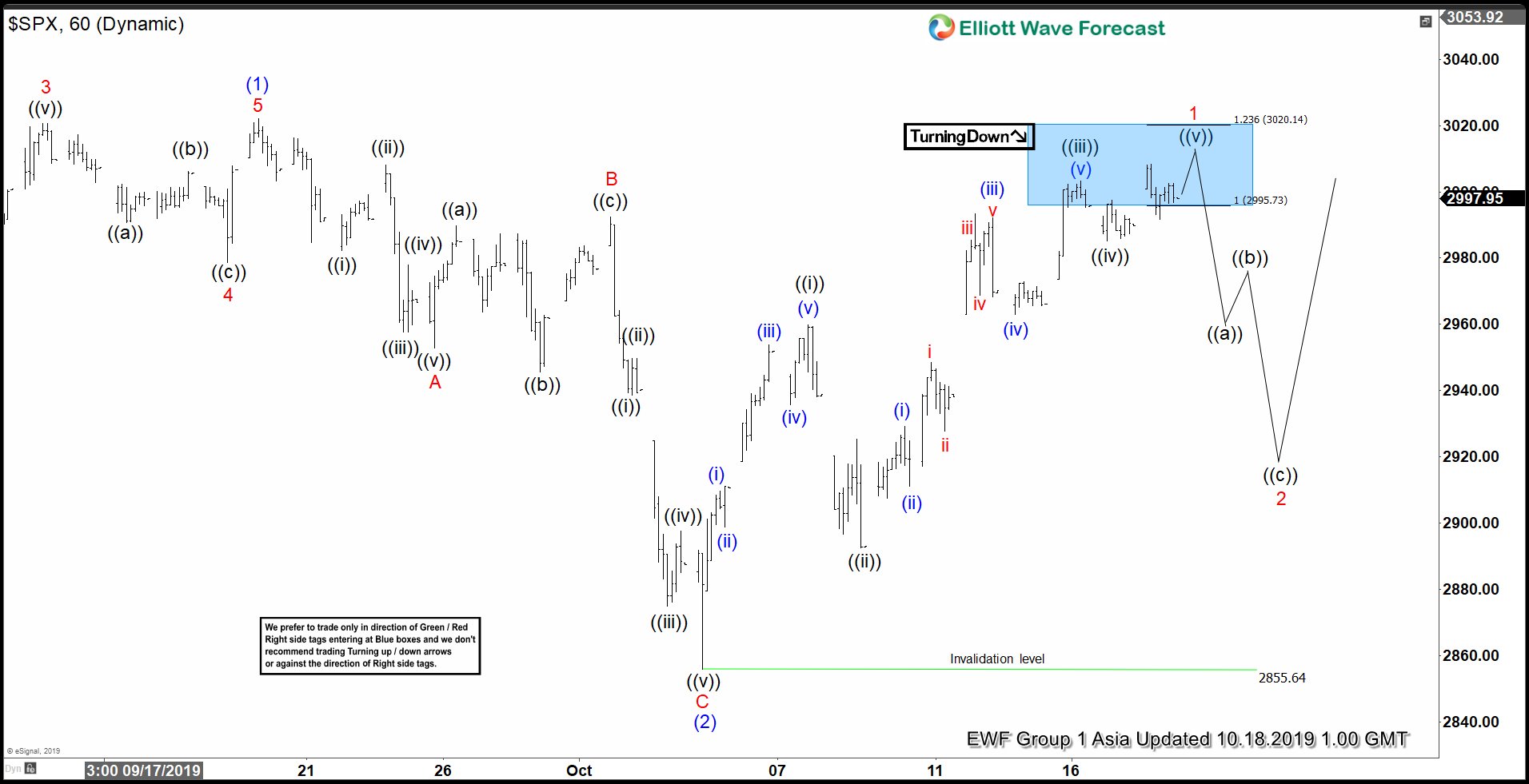

Elliott Wave View: S&P 500 (SPX) Looking to Break to All Time High

Read MoreS&P 500 (SPX) has been sideways since January 2018 and it’s also sideways more recently since July 26 high. After forming peak at January 22, 2018 at 2872, the Index managed to make two more marginal highs. However, each time, the new marginal high lose the momentum and pullback again. Current short term outlook suggests […]