The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

U.S. Stock Market Surged as November Payroll Smashed Expectation

Read MoreU.S. stock market surged as November Nonfarm Payroll came out strong at 266,000. Unemployment rate also fell to 3.5%, which is at 50-year low since 1969. The result smashed the consensus expectation of 185,000. Stocks leaped higher after the blockbuster number as the US economy is firing on all cylinder. There was initially some concern […]

-

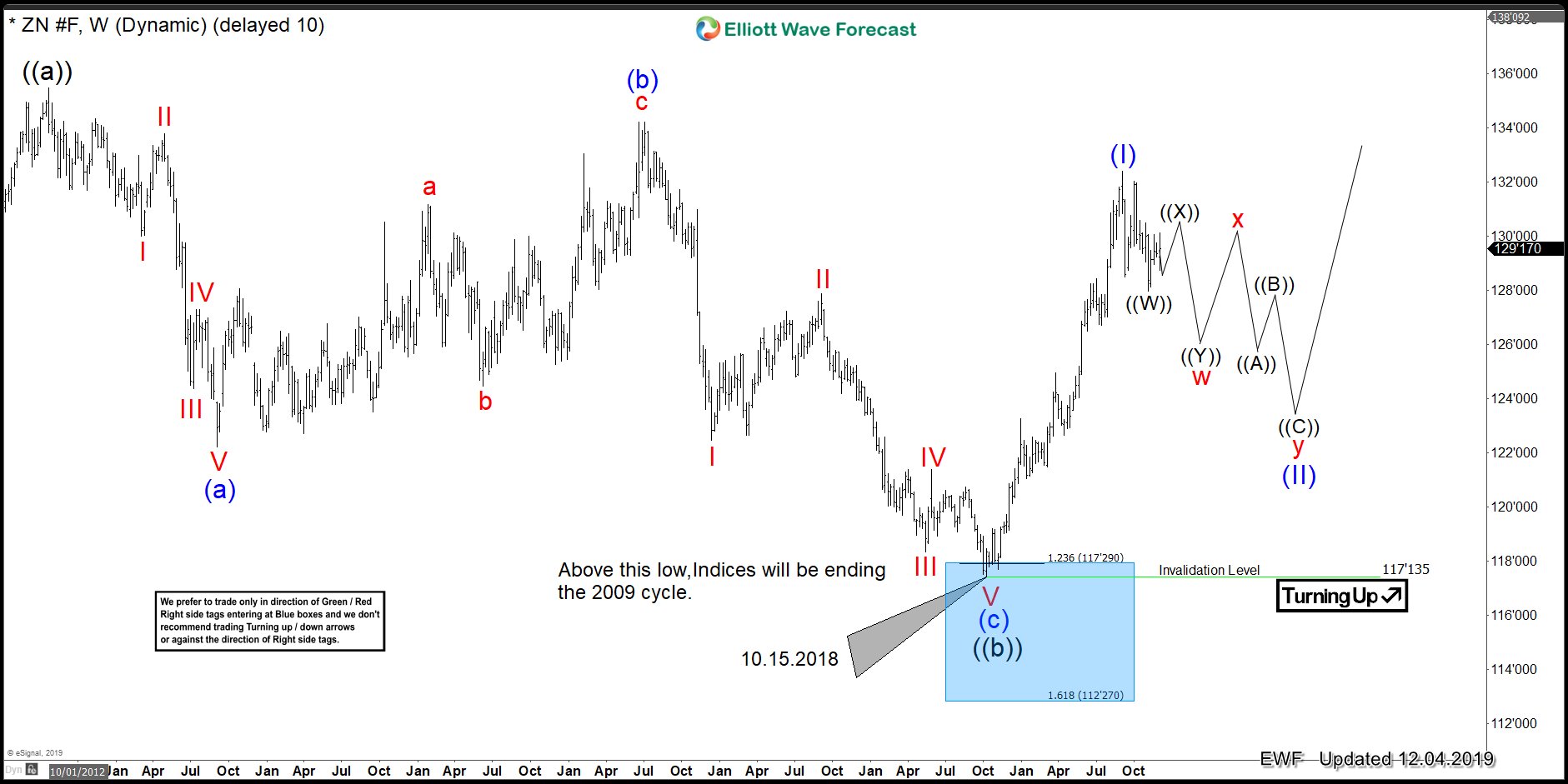

Ten Year Notes ($ZN_F) low on 10.08.2018 Will Decide The Extension In $SPY

Read MoreTen Year Notes ($ZN_F) low 10.08.2018 will decide the Extension in $SPY Many Traders use to trade only one instrument and fall into the trap of isolation resulting in seeing only just a little piece of the whole Market. We at sifaha.com pay attention to the entire Market because we believe each instrument plays a part in the whole market. […]

-

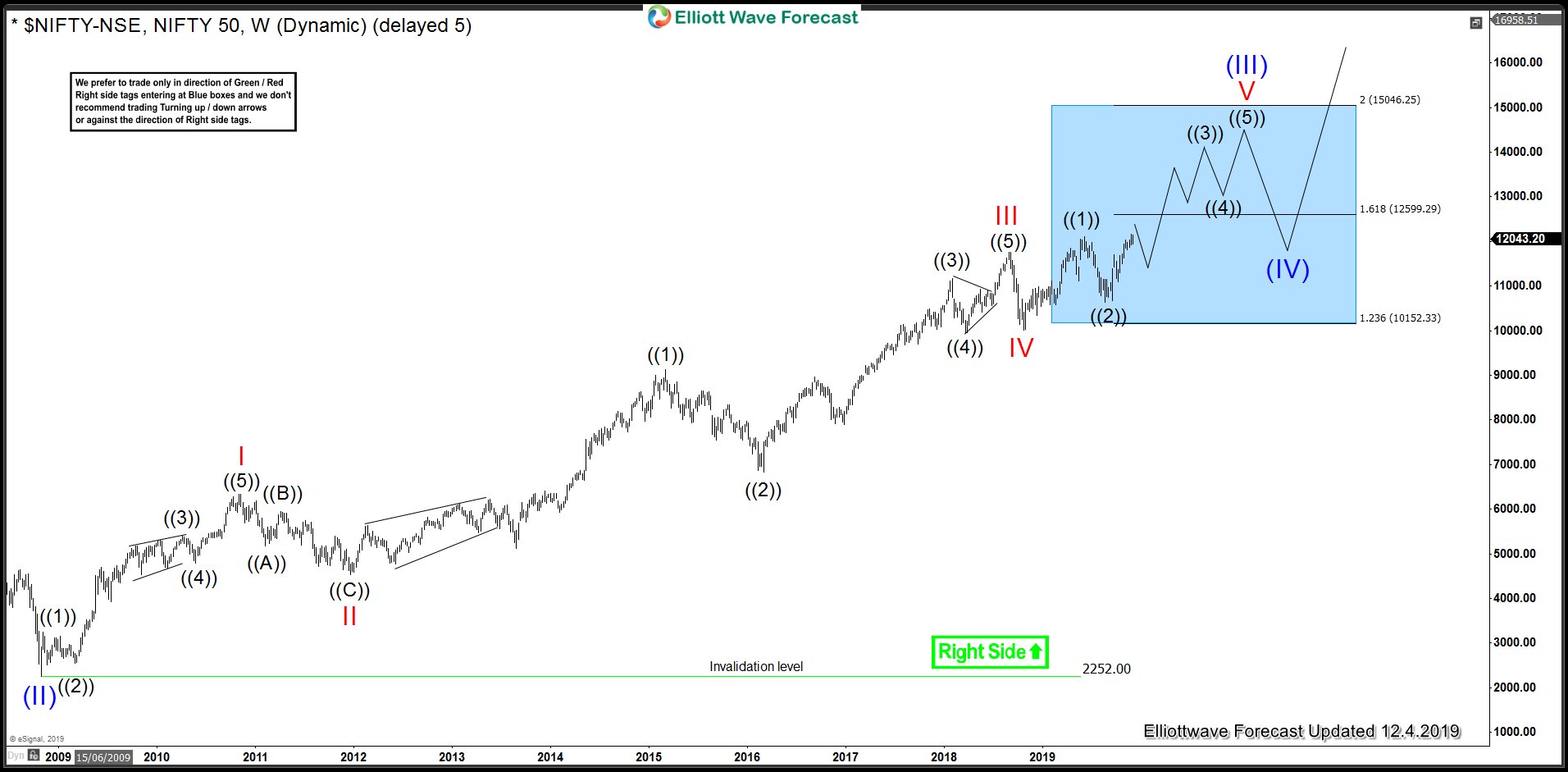

Nifty Long-term Elliott Wave View: Super Cycle wave (III) In Progress

Read MoreWe provide round the clock coverage of many World Indices including US, European, UK, Australian and Asian Indices. Today, we will be taking a look at the long-term view of Nifty-NSE Index from India. The NIFTY 50 index National Stock Exchange of India’s benchmark broad based stock market index for the Indian equity market. Full […]

-

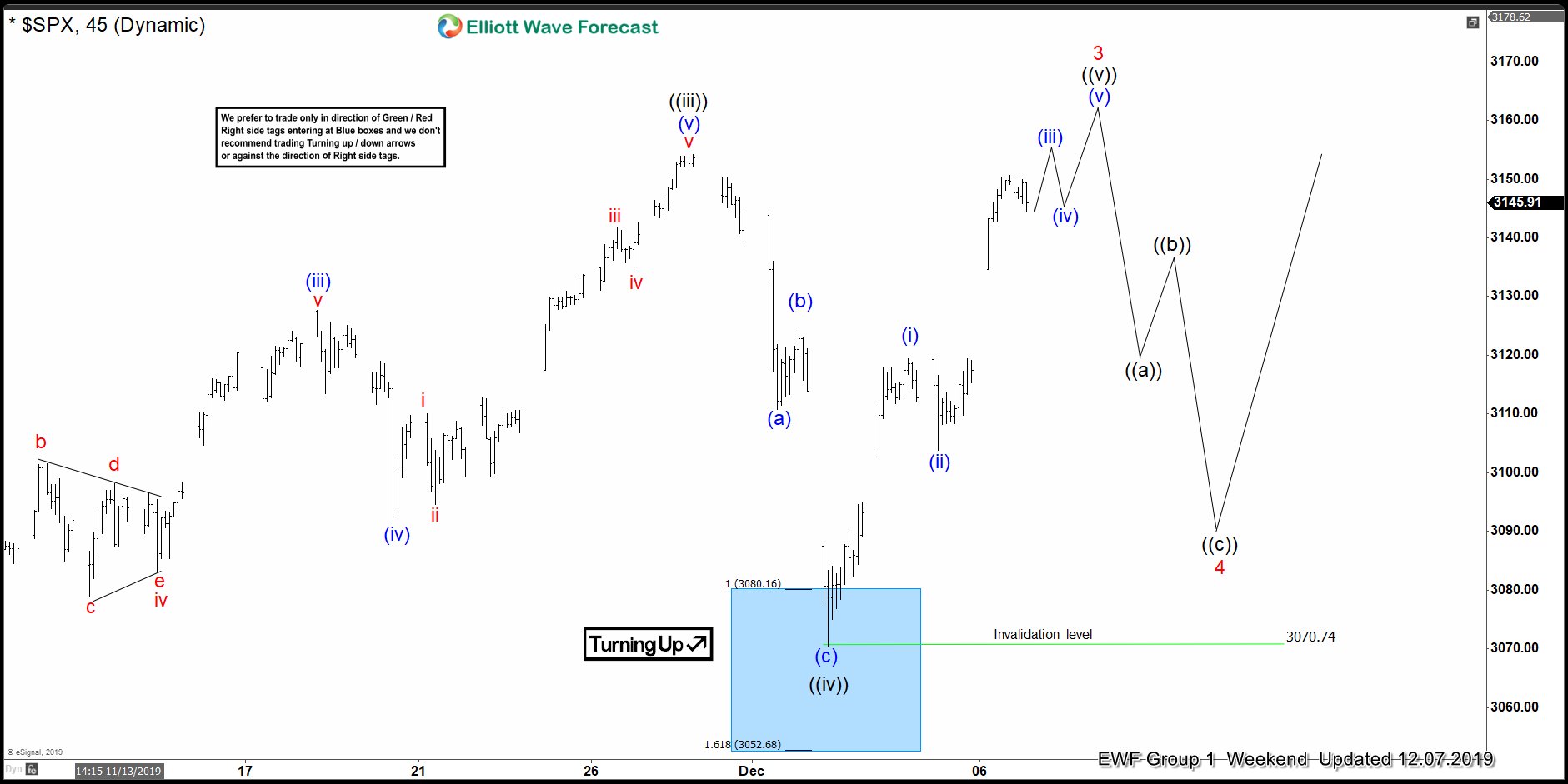

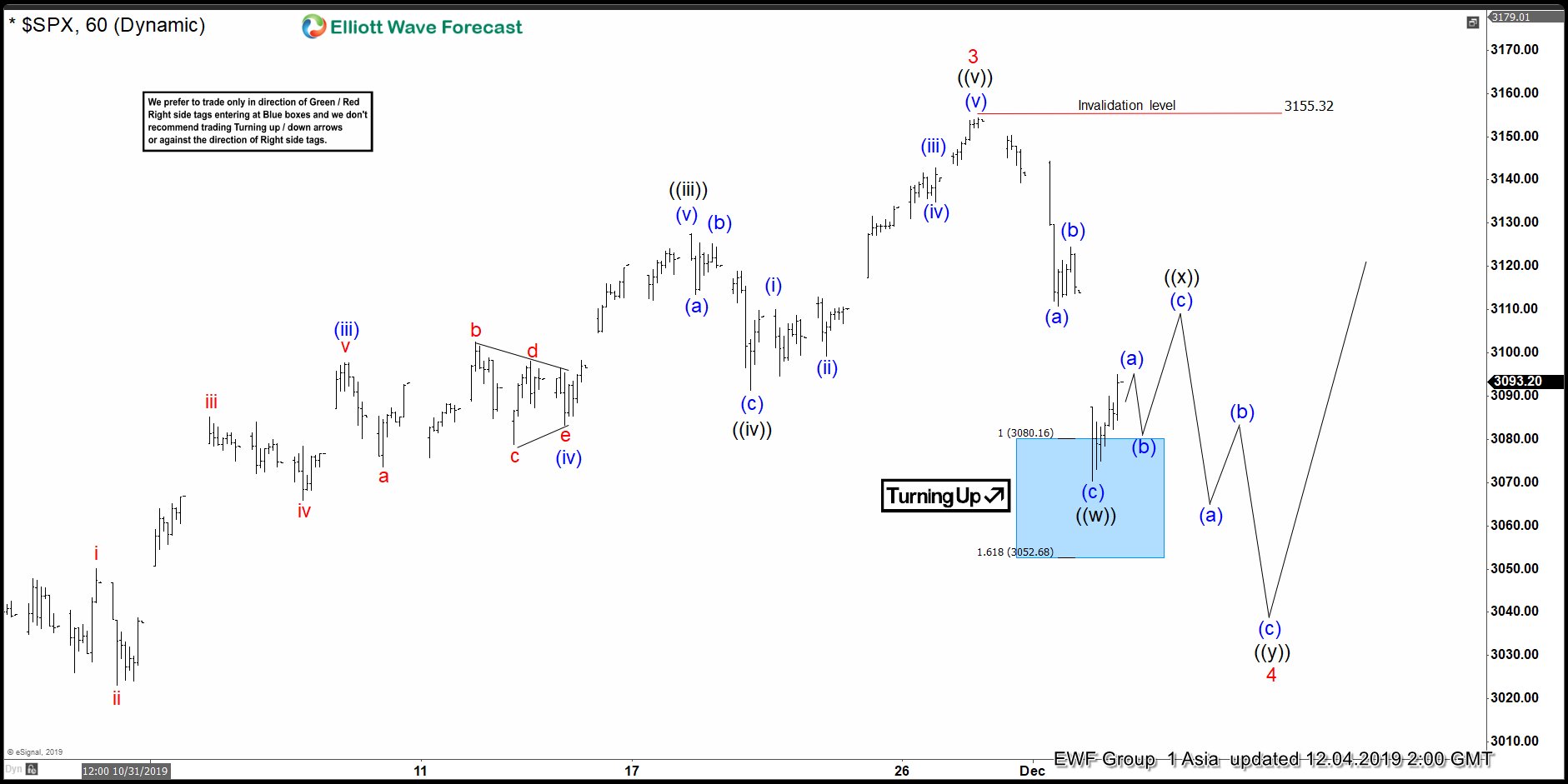

Elliott Wave View: SPX Correction in Progress

Read MoreSPX has started a wave 4 correction & could see further downside to end a double zigzag Elliott Wave structure. This article look at the Elliottwave path..

-

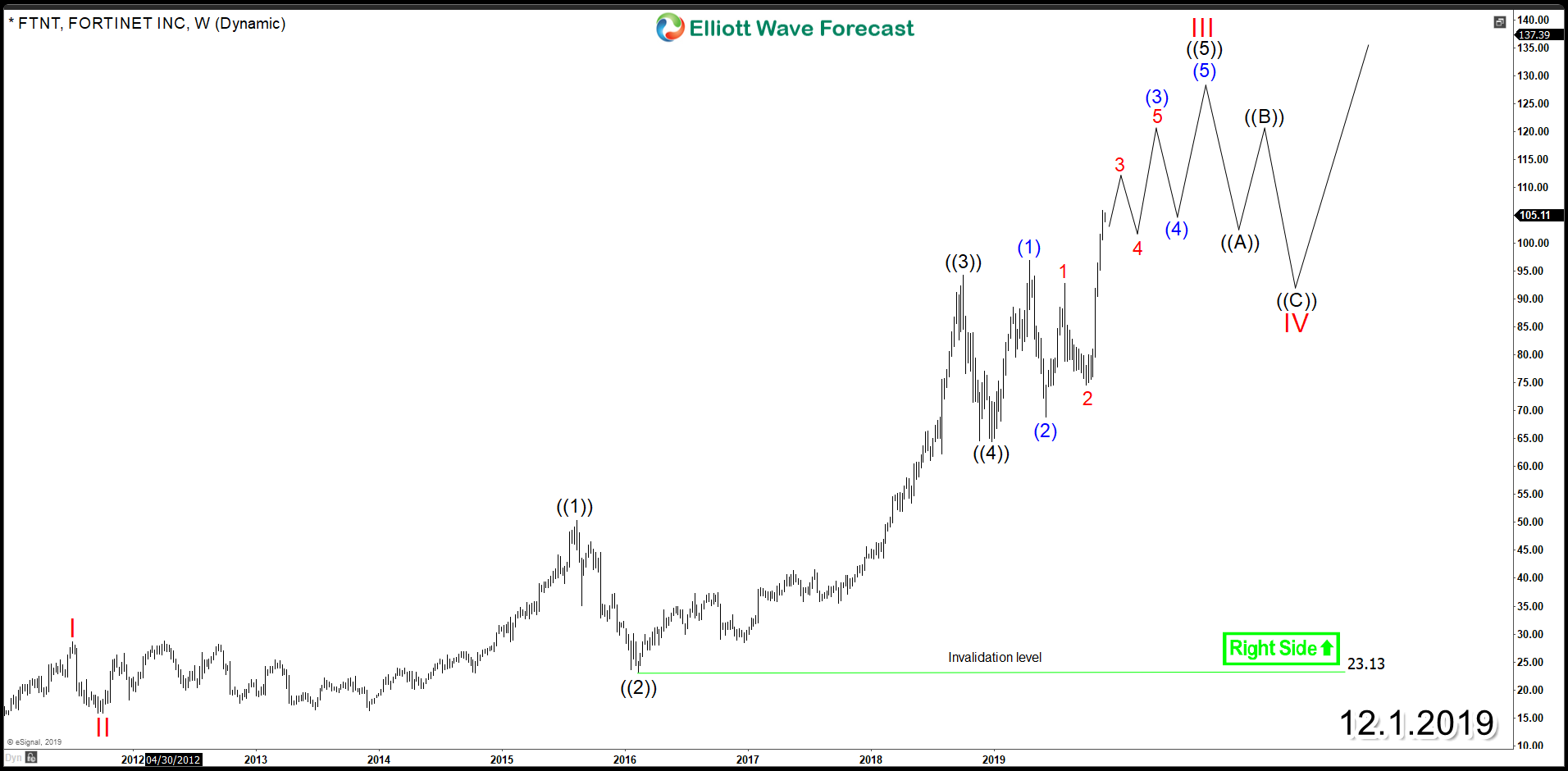

Fortinet Inc (NASDAQ: FTNT) Making Record Highs

Read MoreFortinet Inc (NASDAQ: FTNT) is an American multinational corporation providing network security solutions such as firewalls, anti-virus, intrusion prevention and endpoint security. Since IPO, the stock started a bullish cycle within an impulsive Elliott Wave structure which is currently still in progress. It’s expected to continue making new all time highs as the more aggressive view is suggestion further extension […]

-

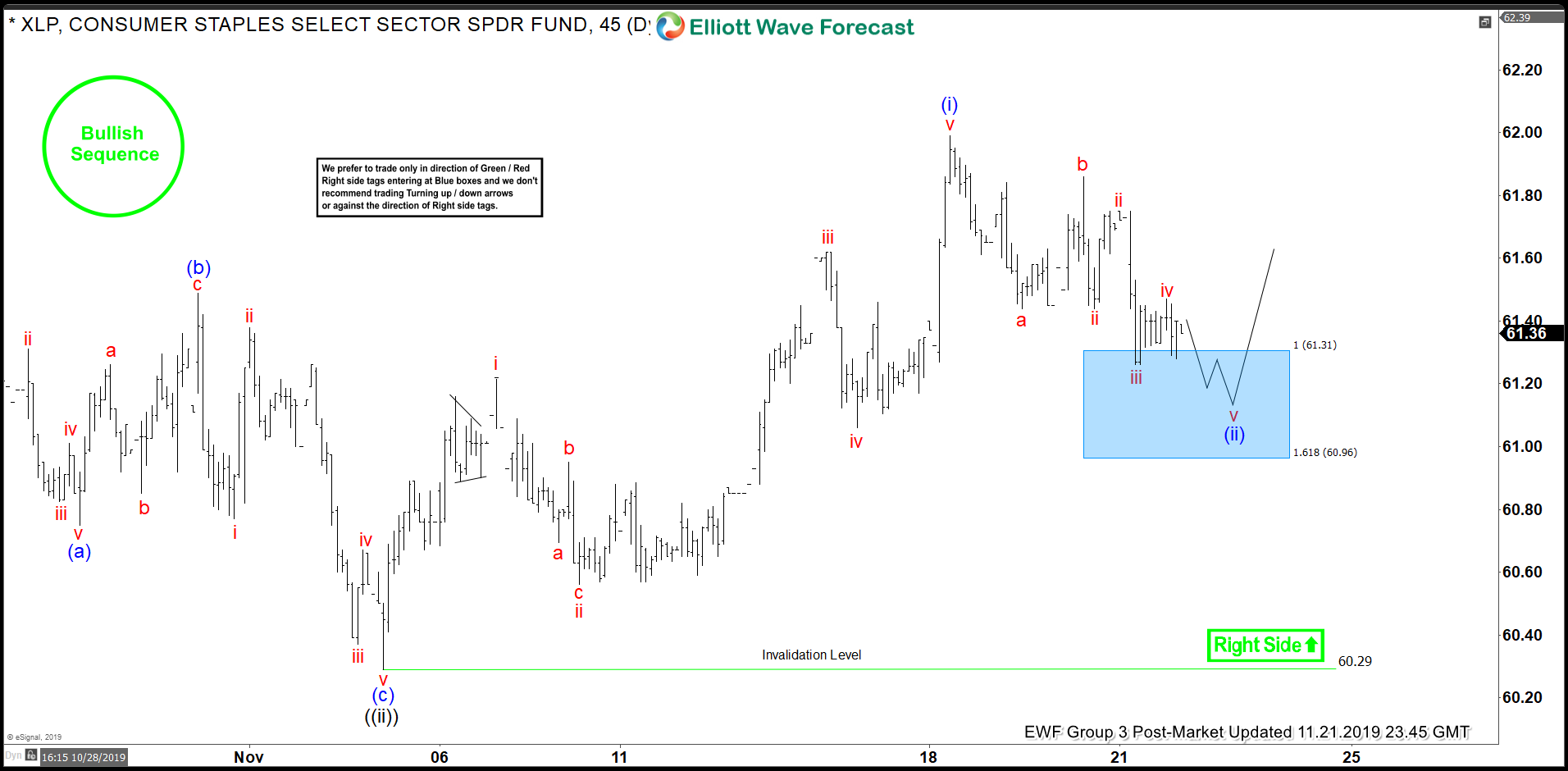

XLP Elliott Wave View: Buying The Dips At Blue Box Areas

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XLP. In which our members took advantage of the blue box areas.