The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Everbridge (NASDAQ: EVBG) Bullish Sequence Driving Cycle Higher

Read MoreEverbridge (NASDAQ: EVBG) is a company that sells communications services for notifications of emergencies. It helps businesses and governments respond to crises and threats like network outages, terrorism, active shooters, and severe weather. During the current pandemic, Everbridge’s service demand rose significantly which supported its stock price to rally to new all timer highs breaking above 2019 peak. […]

-

Elliott Wave View: Apple in Zigzag Correction

Read MoreShort Term Elliott Wave view in Apple (AAPL) suggests that cycle from February 13, 2020 high has ended at 212.6 low as wave w. Internal of wave a unfolded as a double three Elliott Wave structure Down from February 13 high, wave (W)) ended at 256.37 and wave ((X)) bounce ended at 304.15. The Index then […]

-

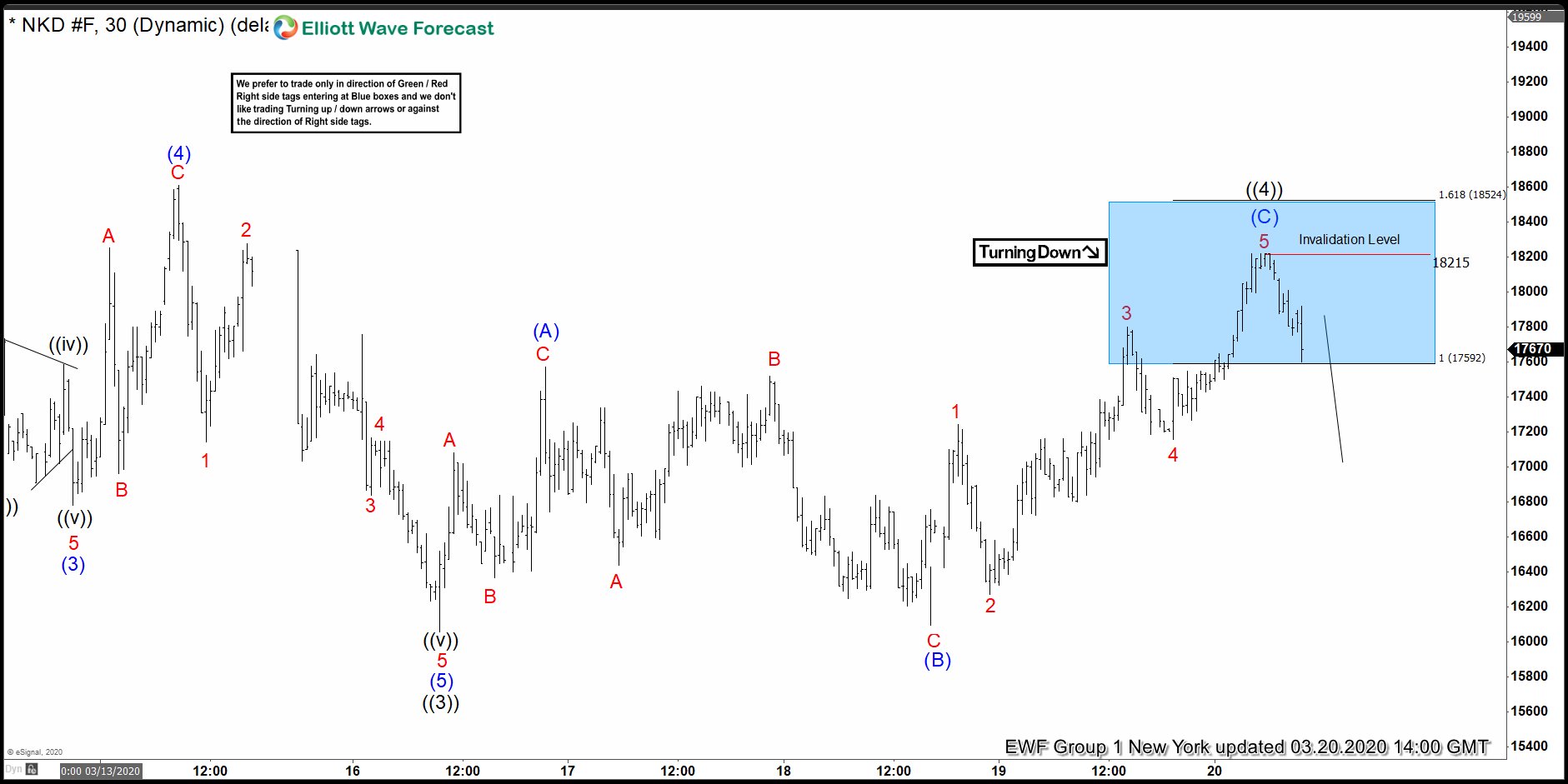

Elliott Wave Hedging Called For Reaction Lower In Nikkei

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Nikkei In which our members took advantage of the blue box areas.

-

Elliott Wave View: S&P 500 (SPX) Recovery in Progress

Read MoreS&P 500 (SPX) ended the cycle from Feb 20 high as 5 waves and now in recovery in 3, 7 ,11 swing. This article looks at the Ellilott Wave path.

-

Elliott Wave View: Chevron ($CVX) A Bottom Is Close

Read MoreThe Energy Industry has had a some rough waters for the past few years with Chevron also participating in the rout. However, the current technicals on the chart suggest a major low is possible in 2020. Recently, a lot has happened in the oil industry, OPEC+ (which included Russia) has been all but abandoned. A […]

-

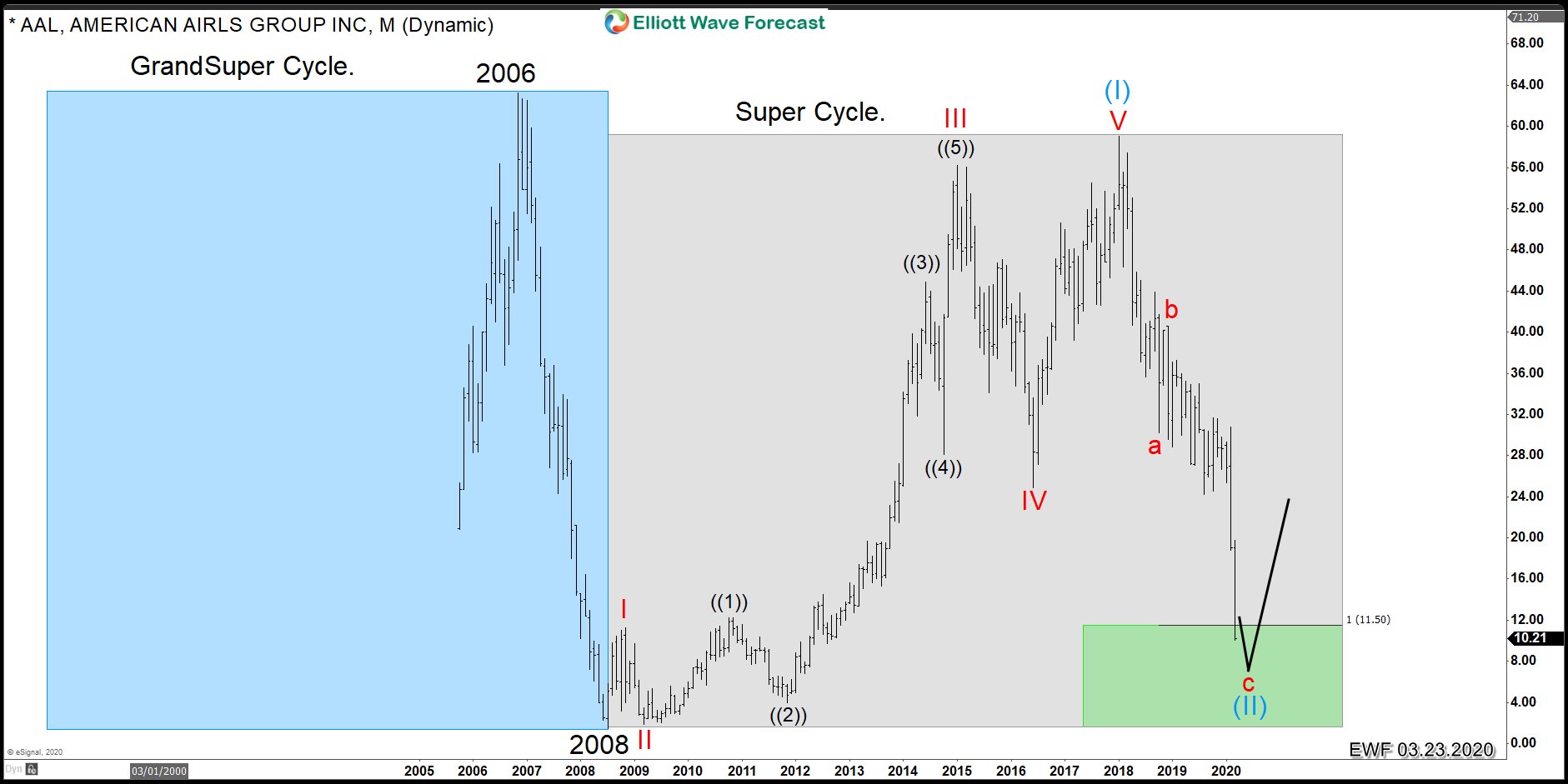

American Airlines (AAL): Another Buying Opportunity

Read MoreIn this article, we will look at the American Airlines (AAL) to make sense of the recent huge volatility in the stock market. The world faces a tremendous crisis due to the pandemic created by the Corona virus. The financial markets consequently have entered a tremendous selling pressure. As it always happens, some sectors always […]