The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

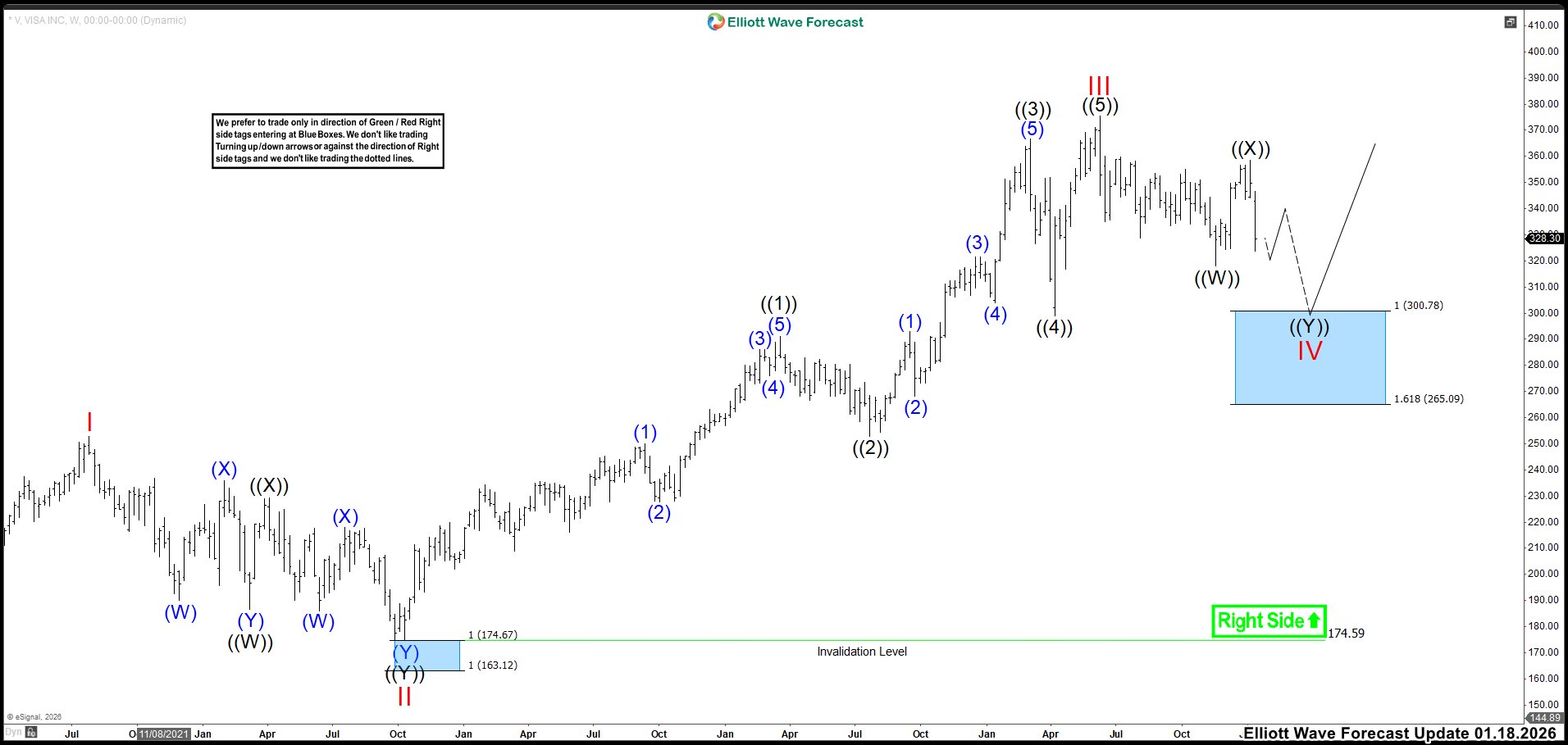

Visa (V): Can the 2026 Bullish Trend Overcome Recent Price Lag?

Read MoreMarket analysts expected Visa (V) to post strong results in early 2026. They pointed to rapid AI adoption and rising global travel. Visa planned to report earnings on January 29, 2026. Estimates projected an EPS near $3.14, showing a clear double‑digit gain from last year. Visa also used its value‑added services and new flow initiatives […]

-

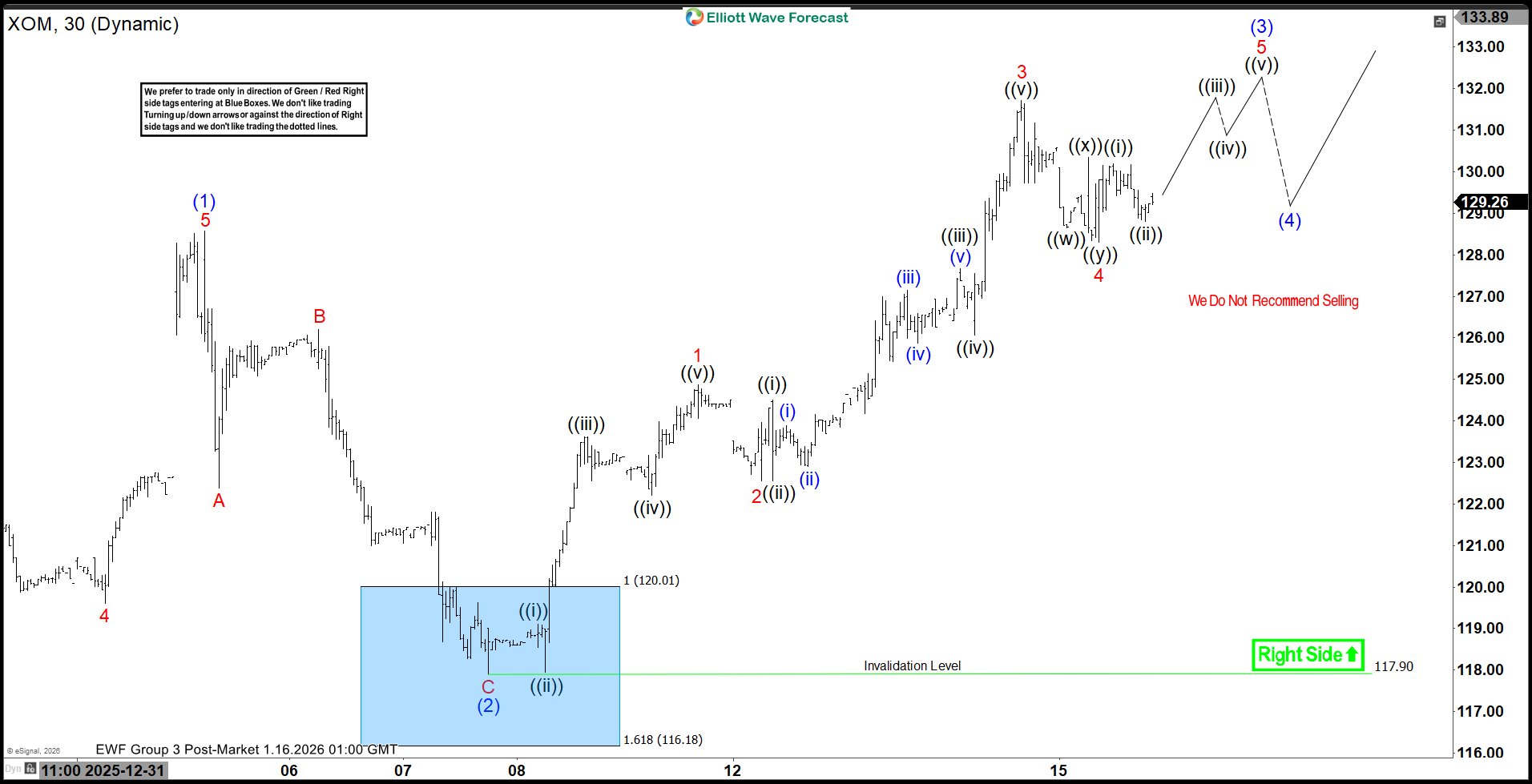

Exxon Mobil (XOM) Elliott Wave Outlook: Impulsive Rally Signals Trend Continuation

Read MoreExxon Mobil (XOM) breaks to new all-time high in impulsive structure. This article and video discuss the Elliott Wave path for the stock.

-

Elliott Wave Outlook: Gold Miners ETF (GDX) Advances in Impulsive Formation

Read MoreGold Miners ETF (GDX) is advancing higher within impulsive structure. This article and video look at the Elliott Wave path of the Index.

-

PNC Financial Services Nears ATH with $250 Target in Sight

Read MorePNC Financial Services stock recovered its entire 33% 2025 decline. It also broke decisively above its 2024 peak. Today, we analyze the Elliott Wave structure behind this powerful breakout. This examination maps a precise path to higher targets. Our technical blueprint reveals a compelling setup driven by strong momentum. Elliott Wave Analysis From its 2025 […]

-

Liquidia (LQDA): Buy The Breakout Or Wait For Pullback?

Read MoreLiquidia Corporation, (LQDA) is a biopharmaceutical company. It develops, manufactures & commercializes various products for unmet patient needs in the United States. It comes under Healthcare sector in Biotechnology Industry & trades as “LQDA” ticker at Nasdaq. As discussed in last article, it extends rally in impulse I from June-2025 low. It should extend into […]

-

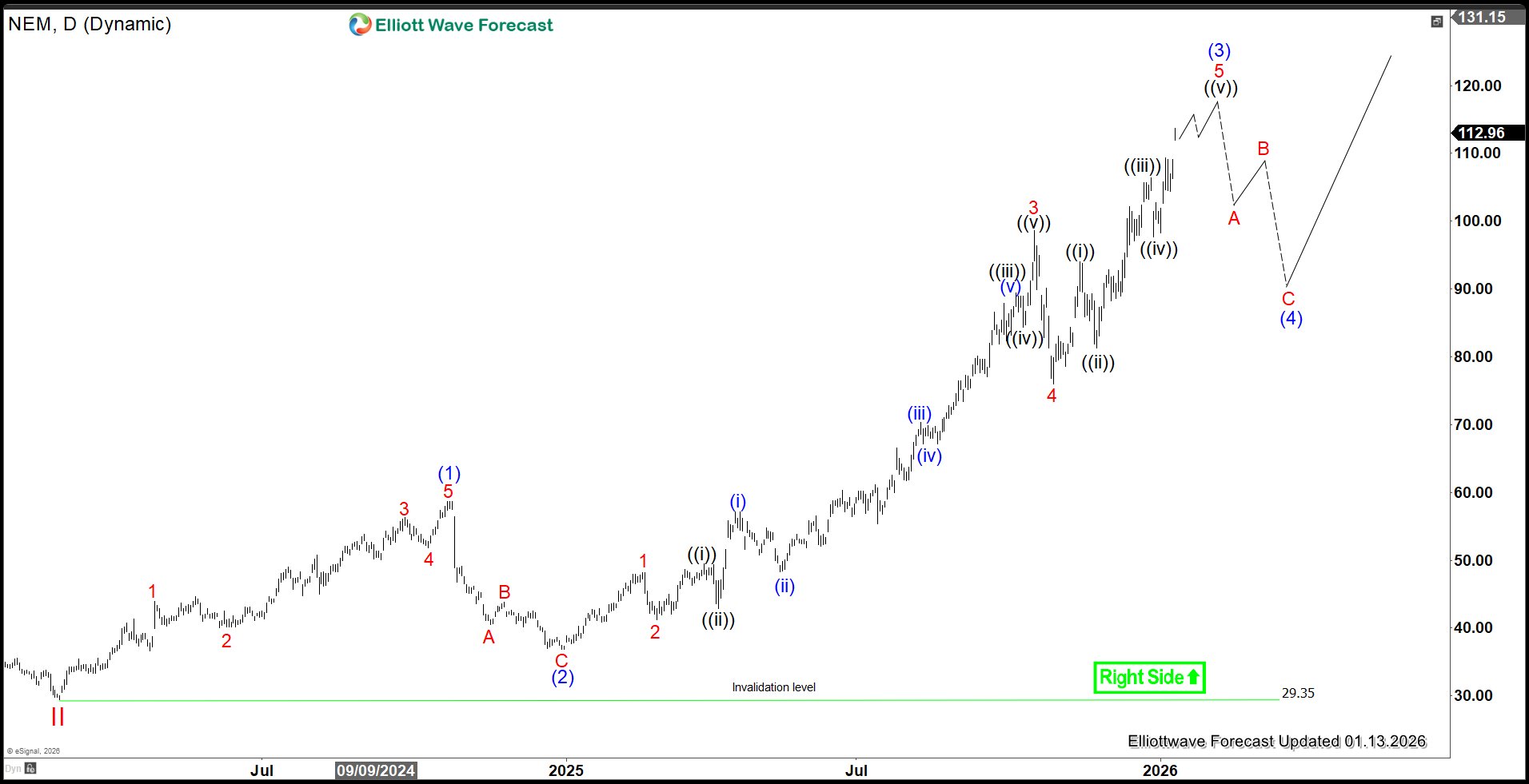

Newmont Mining (NEM) Elliott Wave Outlook: Impulsive Rally Building Momentum

Read MoreNewmont (NEM) resumes the powerful nesting impulse and should continue to stay supported. This article looks at the Elliott Wave path.