The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best Hydrogen Stocks to Watch in 2024

Read MoreWhat are Hydrogen Stocks? Hydrogen stocks are companies focusing on the production of hydrogen fuel cells. These companies primarily include those that produce hydrogen fuel cells, although many also sell hydrogen gas and alternative energy production equipment. Hydrogen is the most abundant element on earth. But it does not exist as a gas. Therefore, it […]

-

NTR : Favors Short Term Weakness Before Turning Higher

Read MoreNutrien Ltd., (NTR) provides crop inputs & services. It offers potash, nitrogen, phosphate & sulphate products, & financial solutions. The company also distribute through approximately 2000 retails locations in US, Canada, South America & Australia. It is based in Canada, comes under Basic Materials sector & trades as “NTR” ticker at NYSE. NTR started impulse […]

-

EMN – Favors Flat Correction Before Turning Higher

Read MoreEastman Chemical Company (EMN) operates as specialty materials company globally. It serves transportation, personal care, wellness, food, feed, agriculture, building & construction, water treatment, energy, consumables, durables & electronic markets. It is based in Kingsport, Tennessee, US, comes under Basic Materials sector & trades as “EMN” ticker at NYSE. EMN favors a flat correction since […]

-

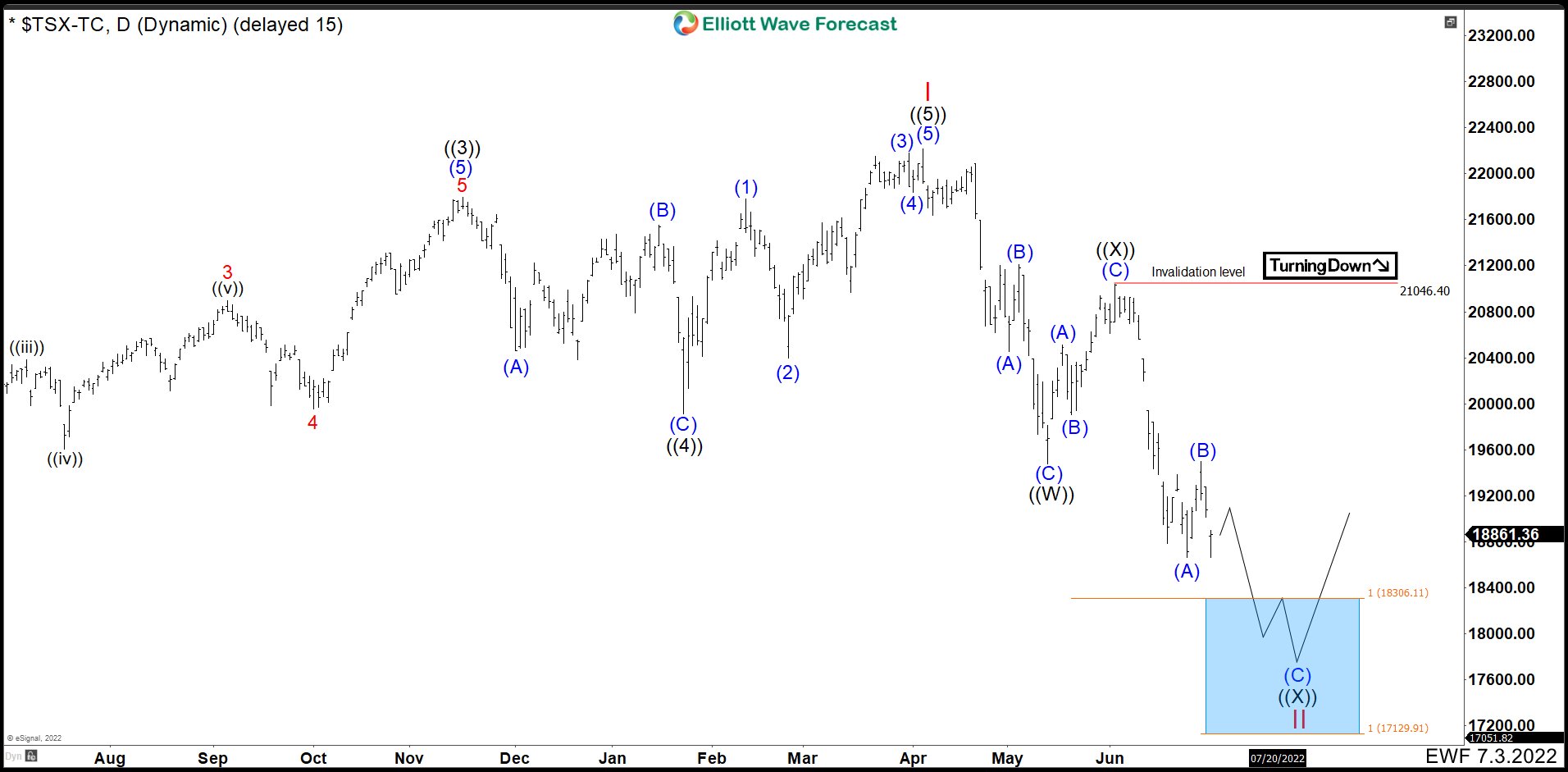

Canada Index (TSX) Needs One Wave Down To End A Double Correction

Read MoreThe S&P/TSX is a major stock market index which tracks the performance of largest companies by market capitalization on the Toronto Stock Exchange in Canada. It is a free float market capitalization weighted index. The index covers approximately 95 percent of the Canadian equities market. The S&P/Toronto Stock Exchange Composite Index has a base value […]

-

Elliott Wave View: Further Downside in AMD Expected

Read MoreAMD shows incomplete bearish sequence and looking for further downside. This article and video look at the Elliott Wave path.

-

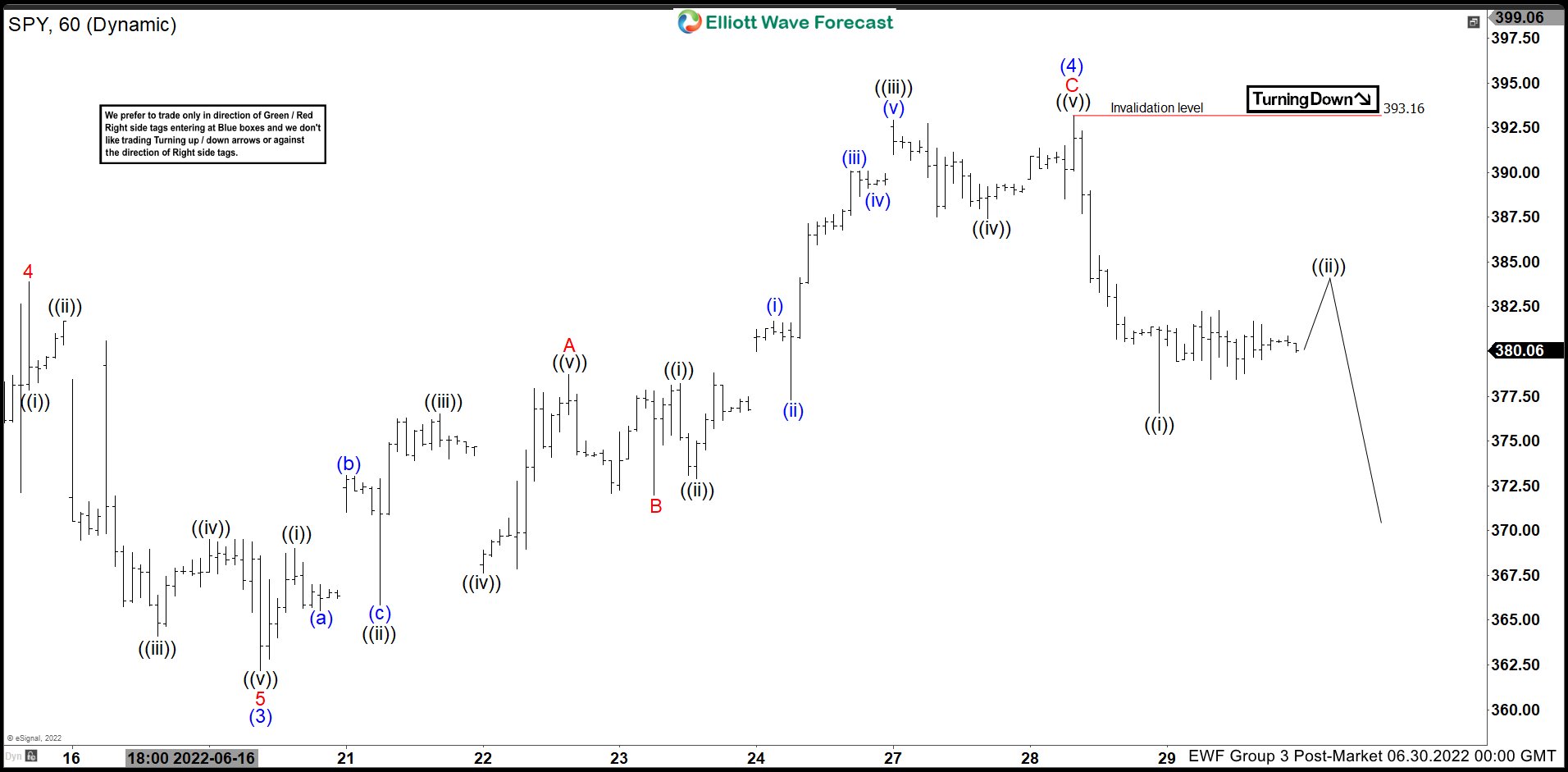

Elliott Wave View: SPY Starts A New Leg Lower

Read MoreShort term Elliott Wave view in SPY suggests the decline from 3/30/2022 high is unfolding as a 5 waves. Down from wave ((B)), wave (1) ended at 385.15, and rally in wave (2) ended at 417.44. The ETF then extends lower in wave (3) towards 362.17. Rally in wave (4) completed at 393.16 with subdivision […]