The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Amazon (AMZN) Rallying in a Double Zigzag

Read MoreAmazon (AMZN) is looking to do a double correction from 9.1.2022 low & should see more upside. This article & video look at the Elliott Wave path.

-

Cameco (CCJ) Looking to Extend Higher

Read MoreThe fundamental of Uranium continues to get better. Various countries like Japan and South Korea have now turned to nuclear power as a solution to the energy crisis. The U.S. and Europe recently proposed to put a cap on Oil supplied by Russia. Russia in turns turned off the gas pipe in Nordstream 1. The […]

-

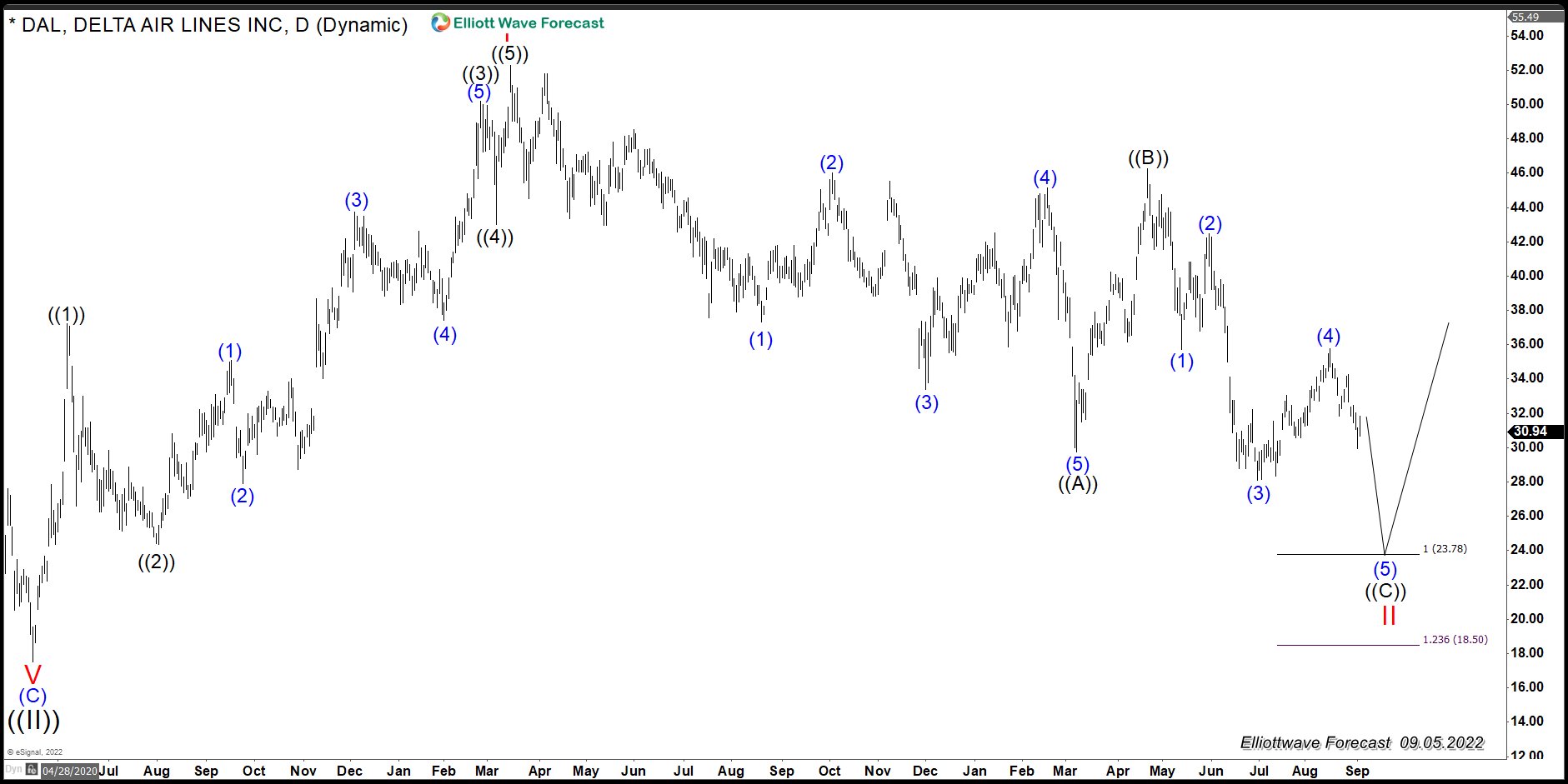

$DAL (Delta Air Lines INC): Another Buying opportunity In the Horizon

Read MoreDelta Airlines (DAL) shows an impulse from all-time low and 2020 low & should give a buying opportunity soon. This article looks at the Elliott Wave chart.

-

GMAB : Should Expect Sideways To Lower Before Upside Resumes

Read MoreGenmab A/S (GMAB) develops antibody therapeutics for the treatment of the cancer and other diseases. The company is based in Copenhagen, Denmark, comes under Healthcare – Biotechnology sector & trades as “GMAB” ticker at Nasdaq. GMAB made an all time high at $49.07 & currently favors correcting lower the sequence up since 2013 low. It […]

-

TSX Bounced From The Blue Box. What Is Next?

Read MoreS&P/TSX is a major stock market index which tracks the performance of largest companies by market capitalization on the Toronto Stock Exchange in Canada. It is a free float market capitalization weighted index. The index covers approximately 95 percent of the Canadian equities market. The S&P/Toronto Stock Exchange Composite Index has a base value of […]

-

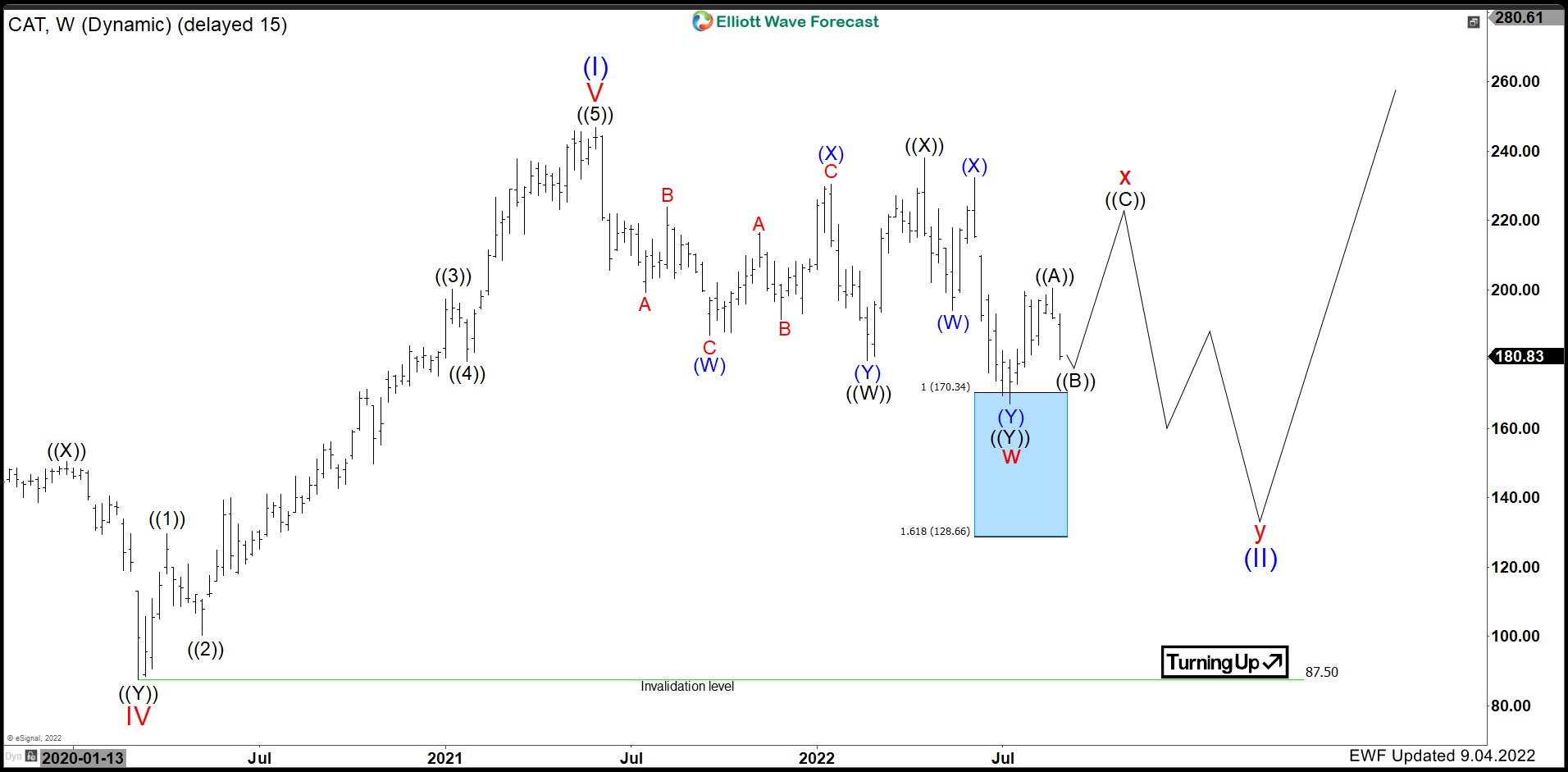

Caterpillar Inc. ($CAT) has reached inflection area. What’s next?

Read MoreCaterpillar Inc. ($CAT) is an American Fortune 100 corporation that designs, develops, engineers, manufactures, markets, and sells machinery, engines, financial products, and insurance to customers via a worldwide dealer network. It is the world’s largest construction-equipment manufacturer. Caterpillar stock is a component of the Dow Jones Industrial Average. Caterpillar ElliottWave September 2022 View (Weekly): The Weekly Chart above shows the cycle from March 2020 low unfold in […]