The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nvidia (NVDA) Breaks to New All-time High, What’s Next?

Read MoreNvidia (NVDA) has broken to new all-time high and the structure looks incomplete. This article and video look at the Elliott Wave path.

-

META Looking to End Impulsive Rally Wave (5)

Read MoreMETA is looking to extend higher to complete impulsive rally from 1.2.2024 low before a pullback. This article and video look at the Elliott Wave path.

-

Dow Futures (YM) Doing Elliott Wave Corrective Pullback

Read MoreDow Futures (YM) has ended the cycle from 10.27.2023 low & now doing a corrective pullback. This article and video look at the Elliott Wave path.

-

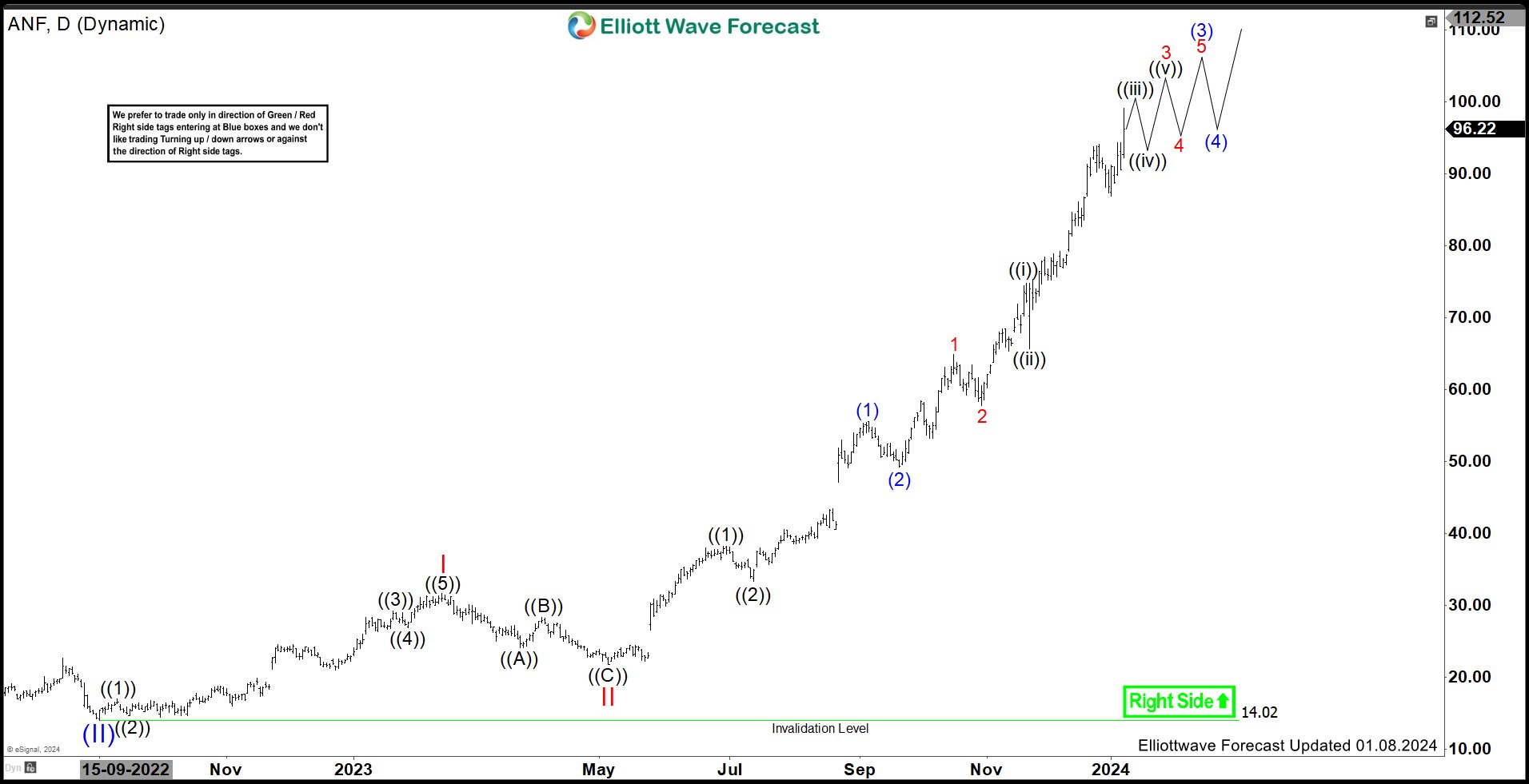

Will ANF Provide Any Buying Opportunity?

Read MoreAbercrombie & Fitch Co., (ANF) operates as a specialty retailer in the United States, Europe, Middle East, Asia & Asia-Pacific & Internationally. The company operates though two segments, Hollister & Abercrombie, which operates through its stores, various wholesale, franchise, licensing arrangements & e-commerce platforms. It comes under “Consumer Cyclical” sector under Apparel Retail & trades […]

-

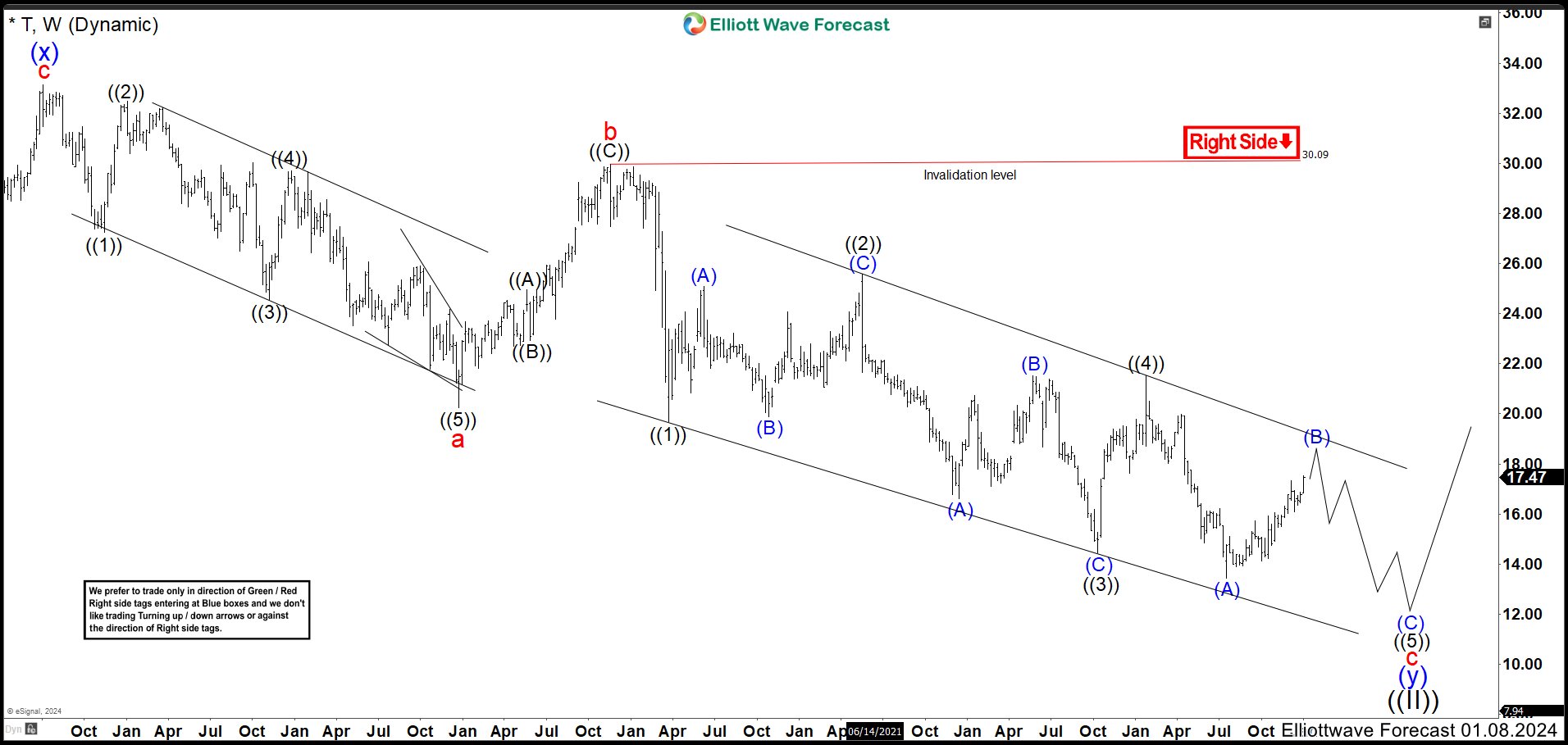

AT&T (T) One More Low Is Expected to Complete a Bearish Sequence

Read MoreAT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. T Weekly Chart Septembre 2023 On the weekly chart of T, we saw in more details the structure of the wave […]

-

Dow Futures (YM_F) Elliott Wave Forecasting The Path

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Dow Futures ($YM_F ) published in members area of the website. As our members know YM_F we see cycle from the 32406 low completed at the 38115 peak. While below that level, we could be […]