-

Elliott Wave View: Dollar Index (DXY) Has Resumed Higher

Read MoreDollar Index (DXY) ended cycle from 9.28.2022 high and resumes higher. This article and video look at the Elliott Wave path.

-

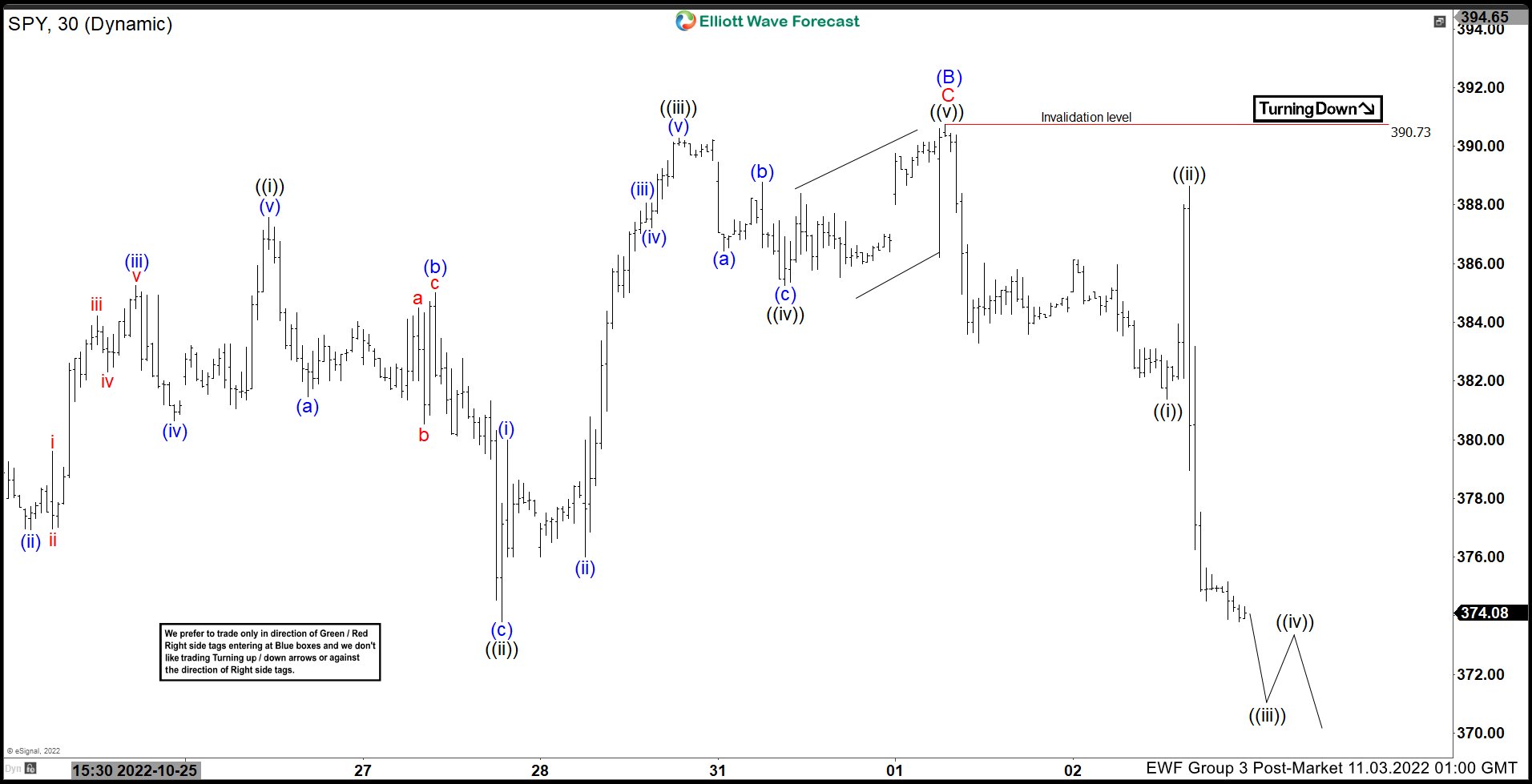

Elliott Wave View: SPY Looking to Resume Lower

Read MoreSPY shows incomplete sequence from 1.4.2022 high favoring more downside. This article and video look at the Elliott Wave path.

-

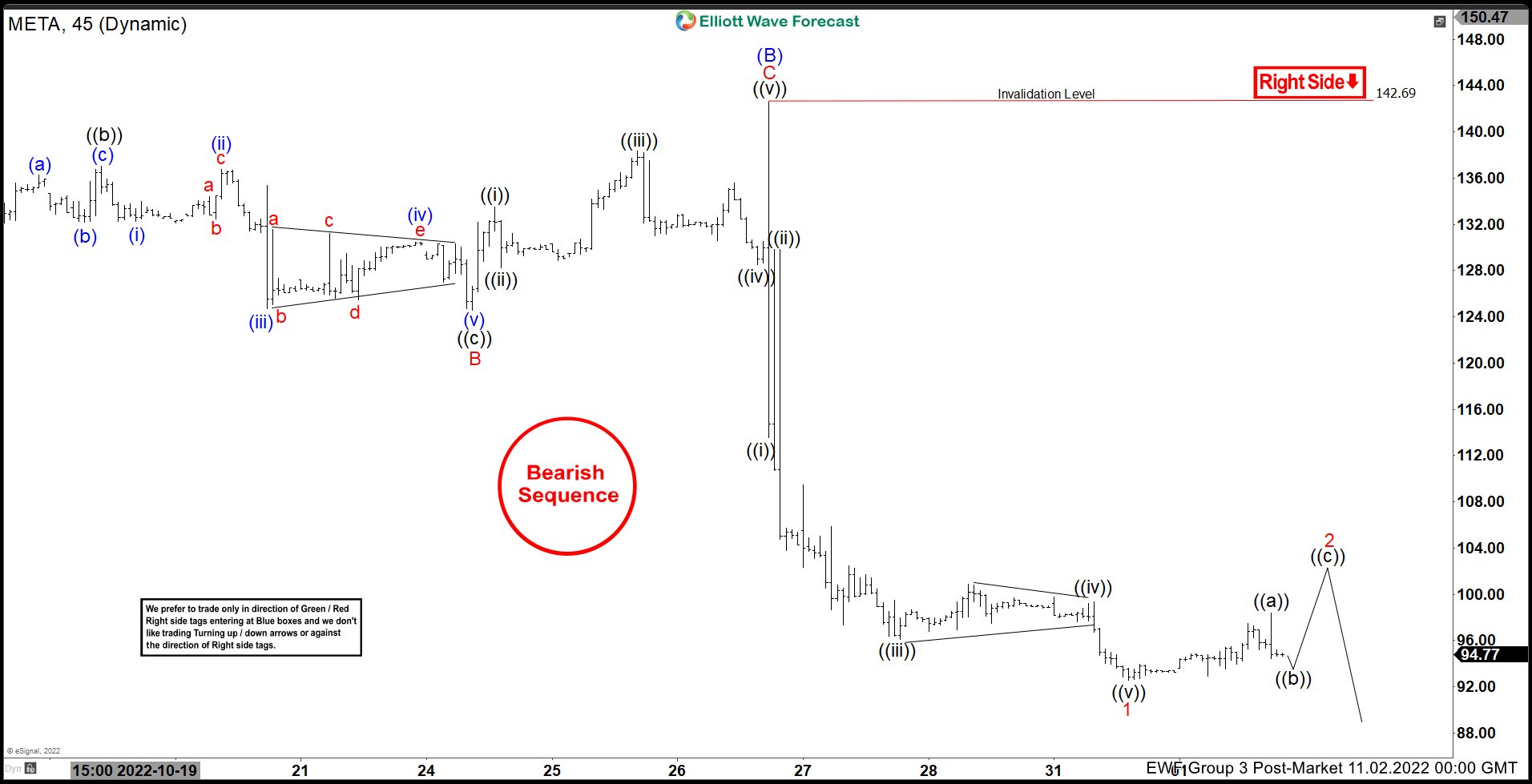

Elliott Wave View: META Should Continue Further Downside

Read MoreMETA shows a bearish sequence from 7.21.2022 high favoring more downside. This article adn video look at the Elliott Wave path.

-

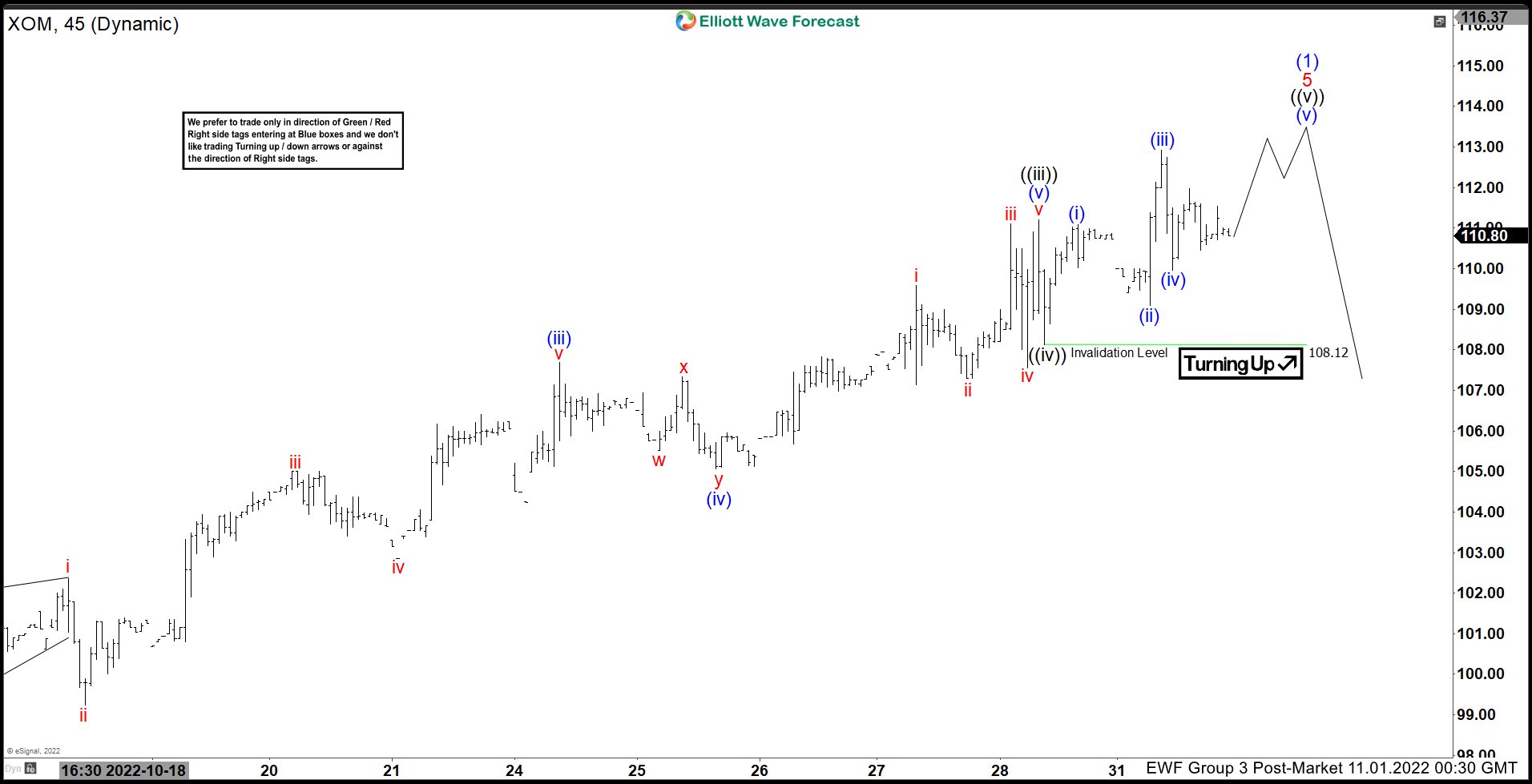

Elliott Wave View: Exxon Mobil (XOM) Looking to End 5 Waves Rally

Read MoreExxon Mobil (XOM) looks to end cycle from 9.26.2022 low as an impulse soon. This article and video look at the Elliott Wave path.

-

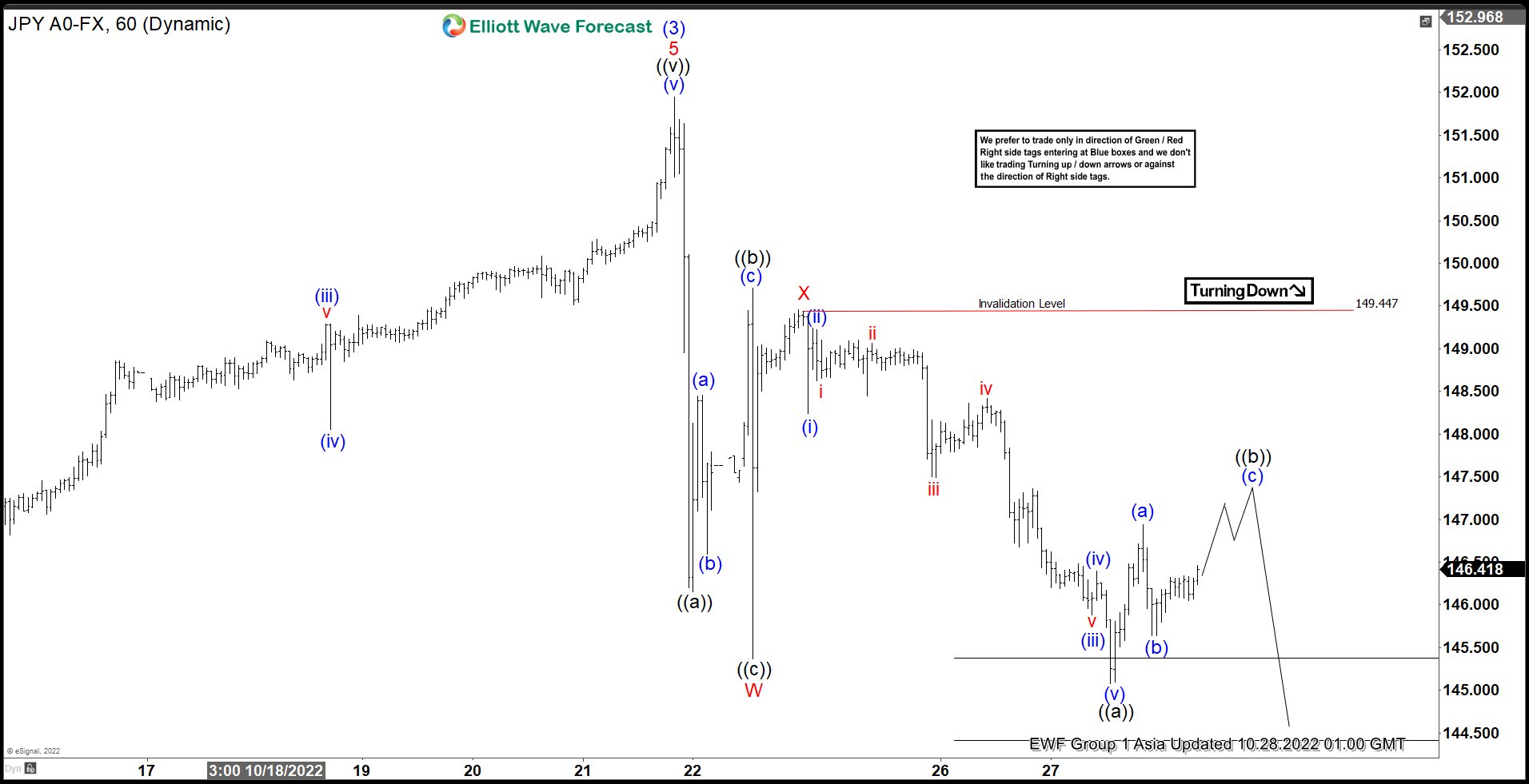

Elliott Wave View: USDJPY Looking for Double Correction

Read MoreUSDJPY shows 5 swing sequence from 10.21.2022 high looking for downside to end 7 swing correction. This article and video look at the Elliott Wave path.

-

Elliott Wave View: IBEX Soon Reaching Resistance Area

Read MoreIBEX is correcting cycle from 5.30.2022 high in 3, 7, 11 swing before turning lower. This article and video look at the Elliott Wave path.