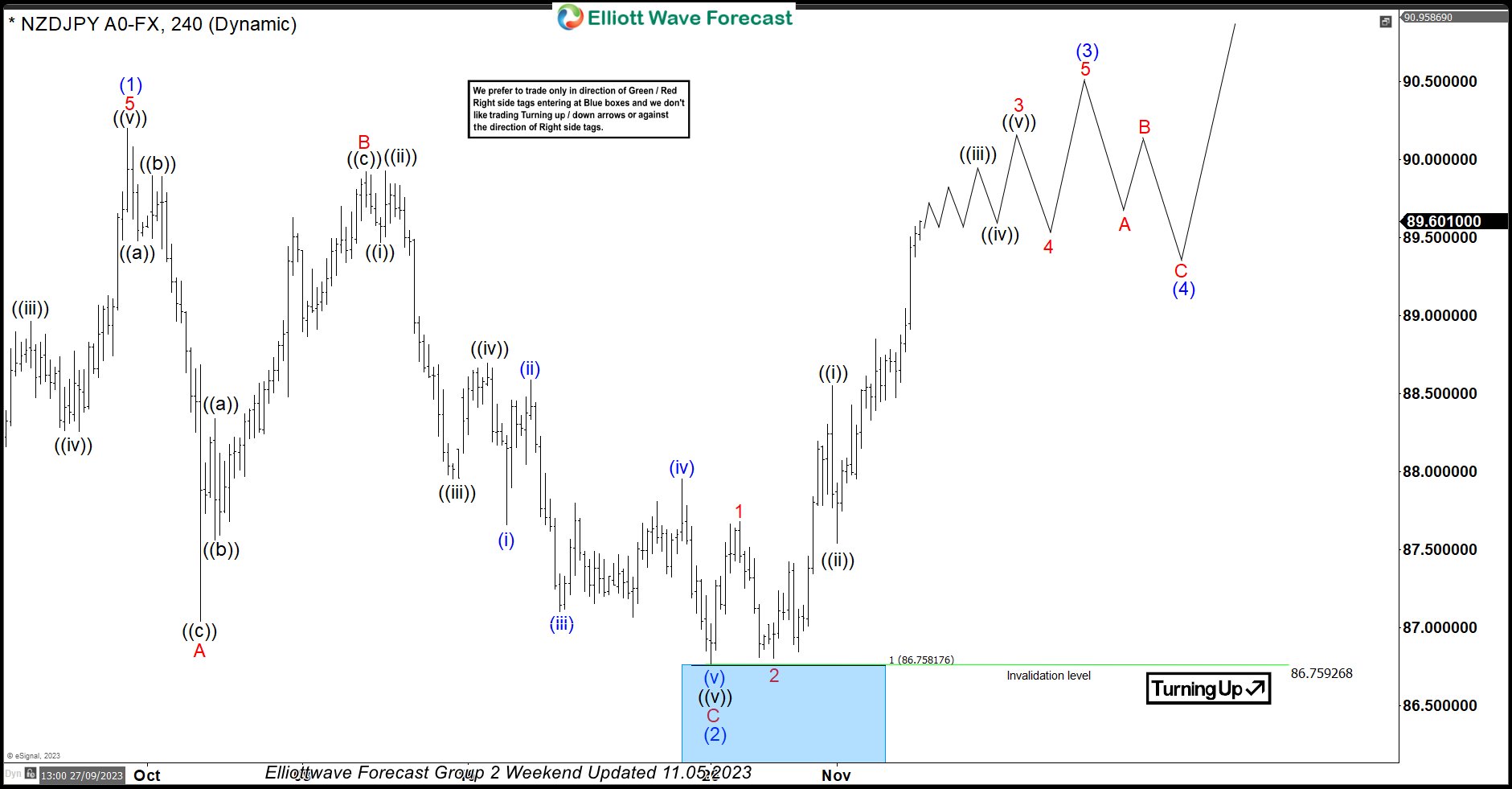

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

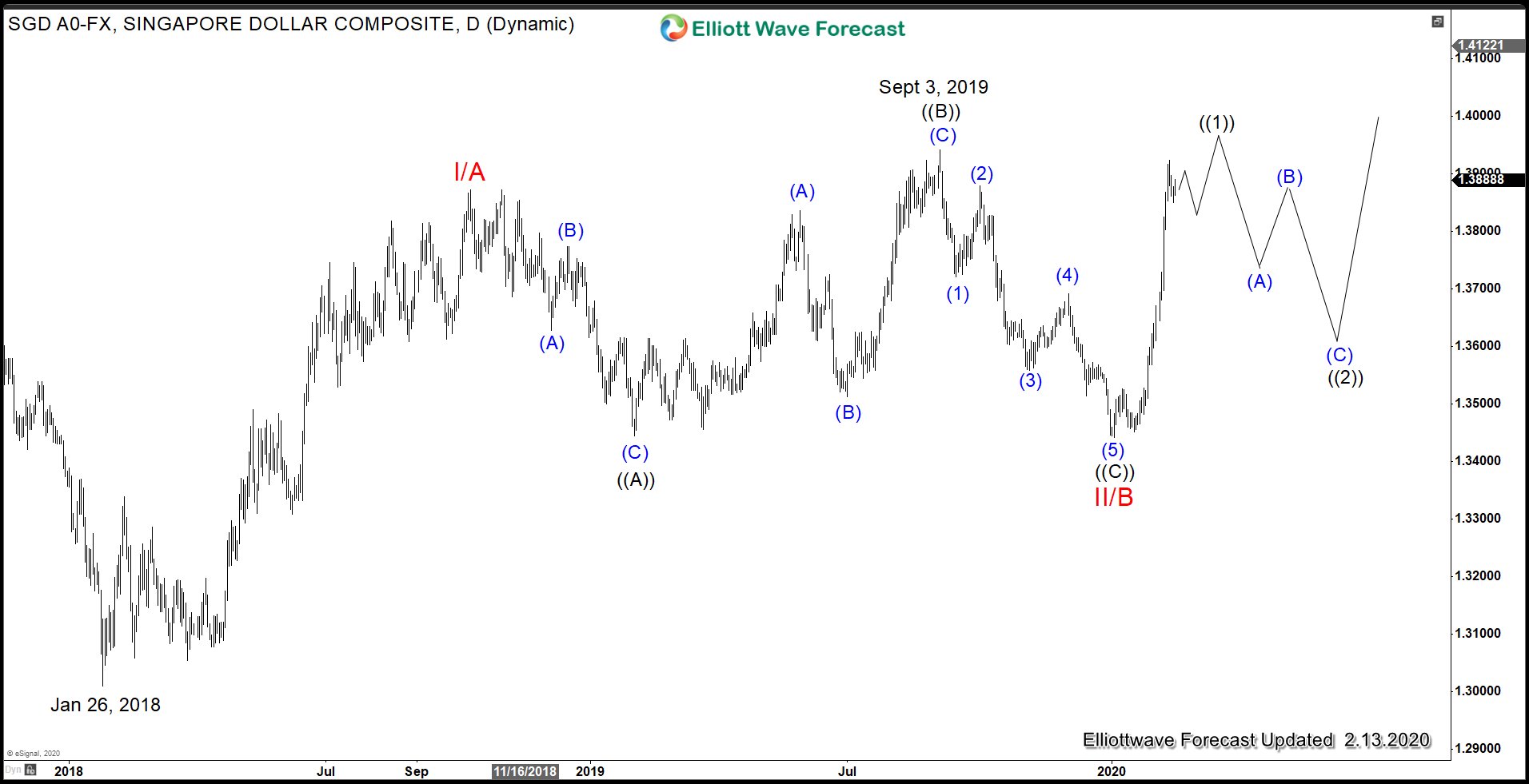

Singapore Dollar (SGD) Plunges as Central Bank Signals Easing

Read MoreSingapore Dollar SGD tumbled last week after Monetary Authority of Singapore (MAS) suggests that Singapore Dollar has room to depreciate. The statement came after the coronavirus infection spread to the territory and the central bank predicts it will hit growth. This comes after the economy shows signs of recovering from last year’s weakest growth in […]

-

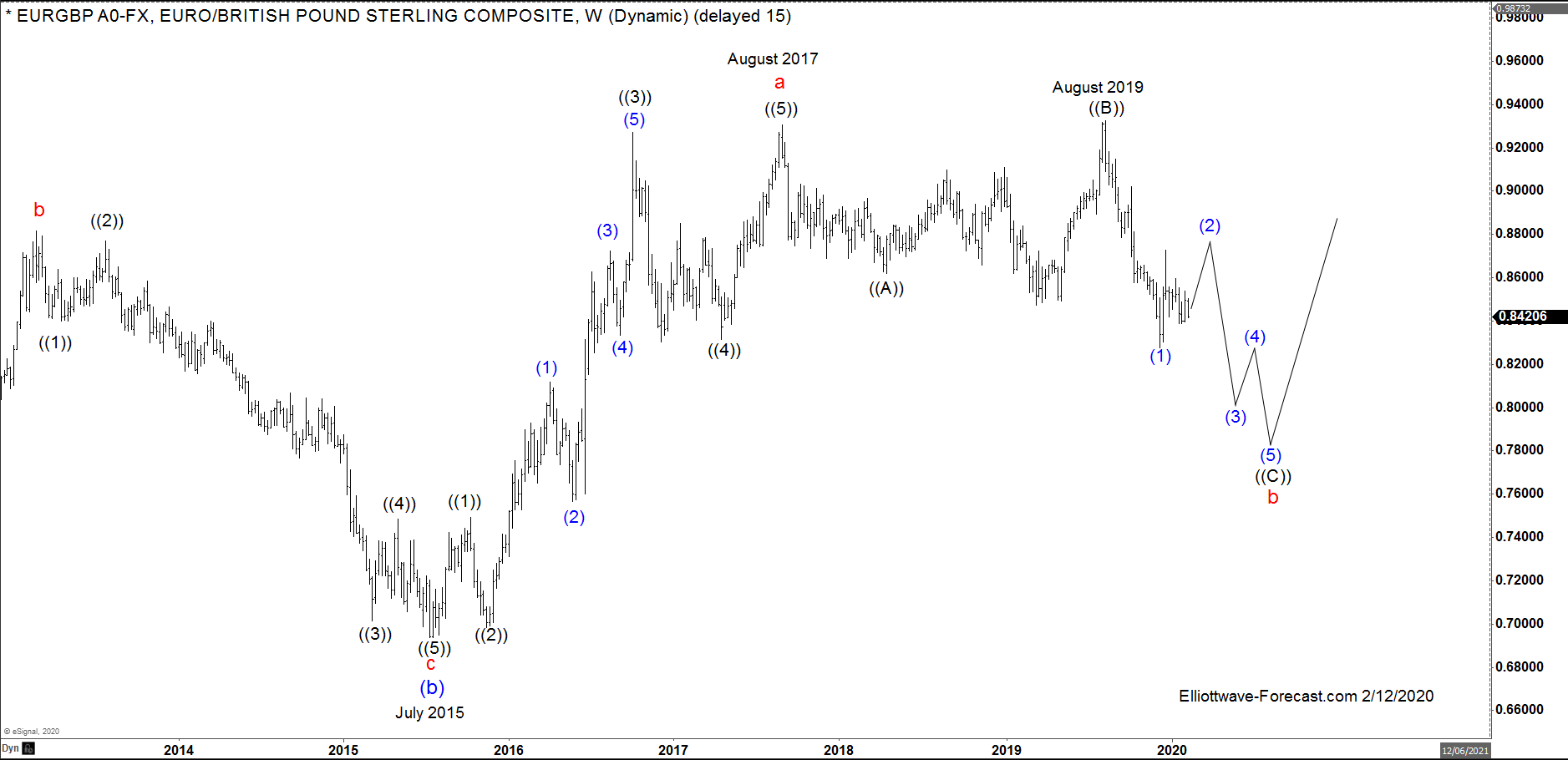

$EURGBP FX Pair Longer Term Cycles and Elliott Wave

Read More$EURGBP FX Pair Longer Term Cycles and Elliott Wave Firstly as seen on the monthly chart below there is data back to January 1975 in the pair. The EUR part being derived from the German Deutsche Mark up until the point EURUSD currency existed. Secondly as seen on the monthly chart below I will describe how I […]

-

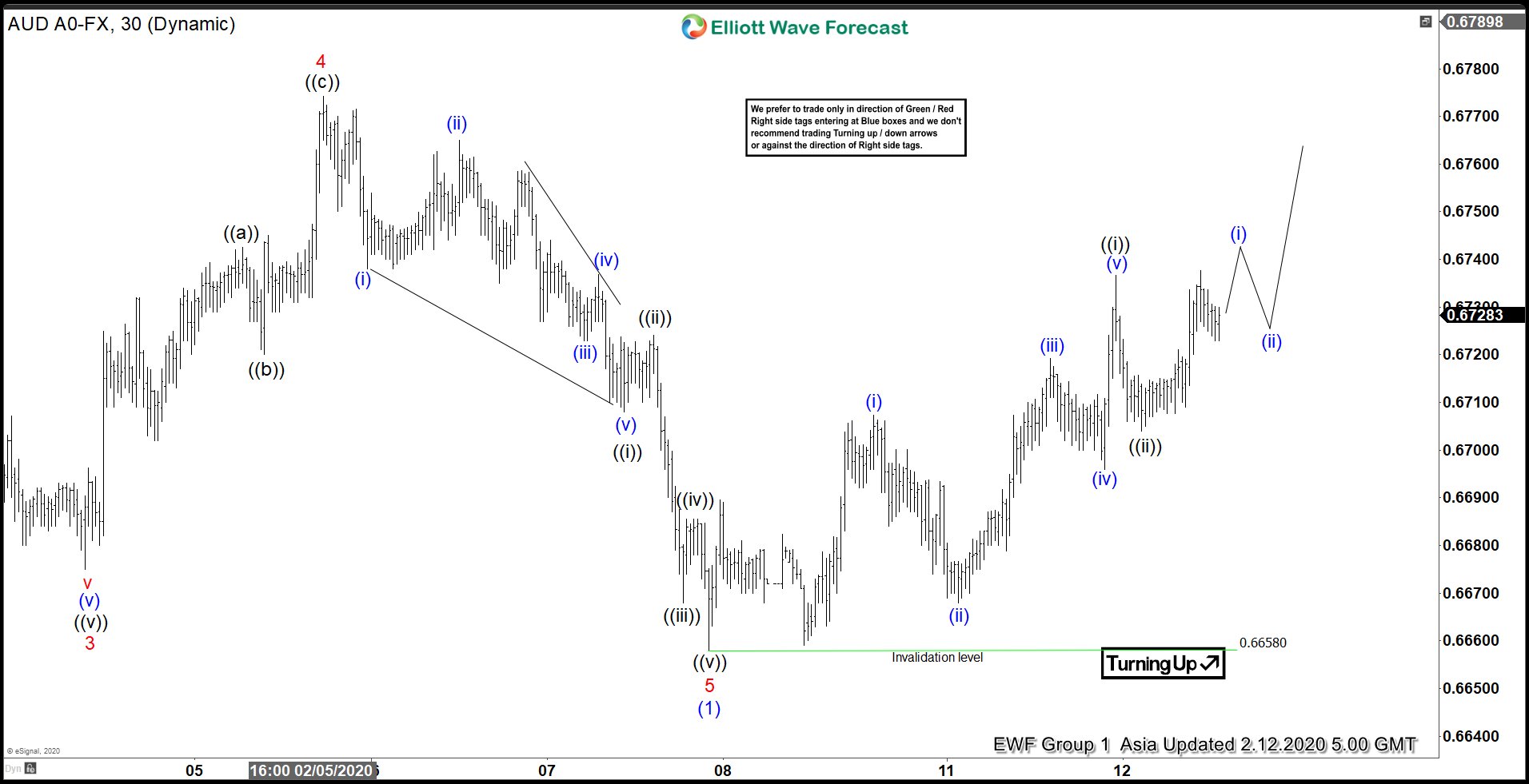

Elliott Wave View: AUDUSD in 3 Waves Correction

Read MoreShort term Elliott wave view in AUDUSD suggests the pair ended the cycle from January 1, 2020 high in wave (1) at 0.6658 low. Down from January 1, wave 1 ended at 0.6845 low and wave 2 ended at 0.6934 high. The pair continues to the downside and ended wave 3 at 0.6675 low and […]

-

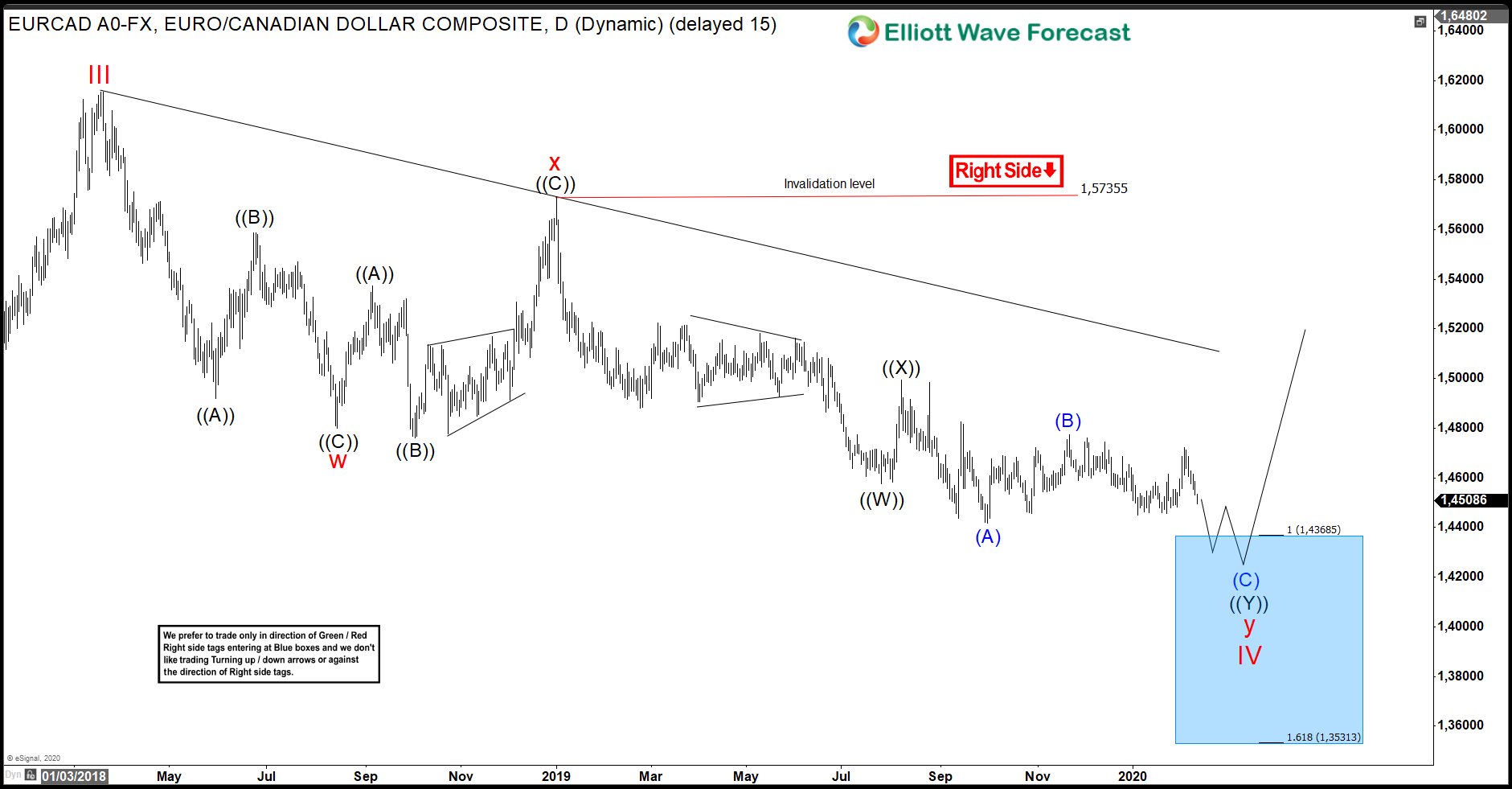

EURCAD Incomplete Sequence Keeps Sellers In Control

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of EURCAD. Based on the daily chart shown below, the pair is doing a correction in wave IV right now. The correction is unfolding as a double three and has an incomplete sequence. It has not reached the 100% -161.8% extension […]

-

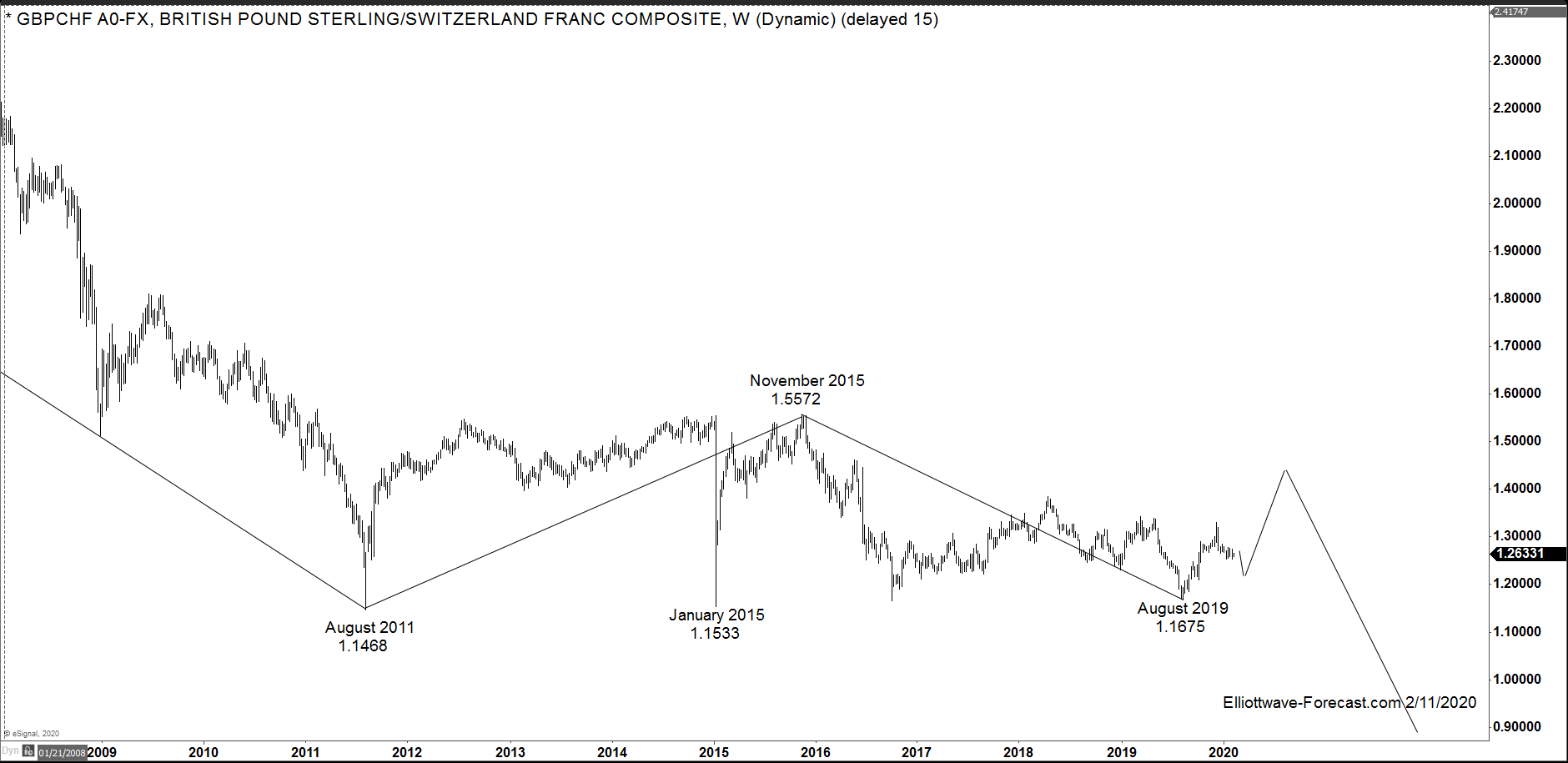

$GBPCHF FX Pair Long Term Cycles & Swings

Read More$GBPCHF FX Pair Long Term Cycles & Swings Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]

-

AUDJPY Forecasting The Bounce From The Blue Box Area

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of AUDJPY. The rally from August 26, 2019 unfolded as 5 waves impulsive move up in wave (A) as a leading diagonal. Based on Elliottwave theory, the impulsive move up will be followed by 3 waves correction before extending higher. Therefore, […]