In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

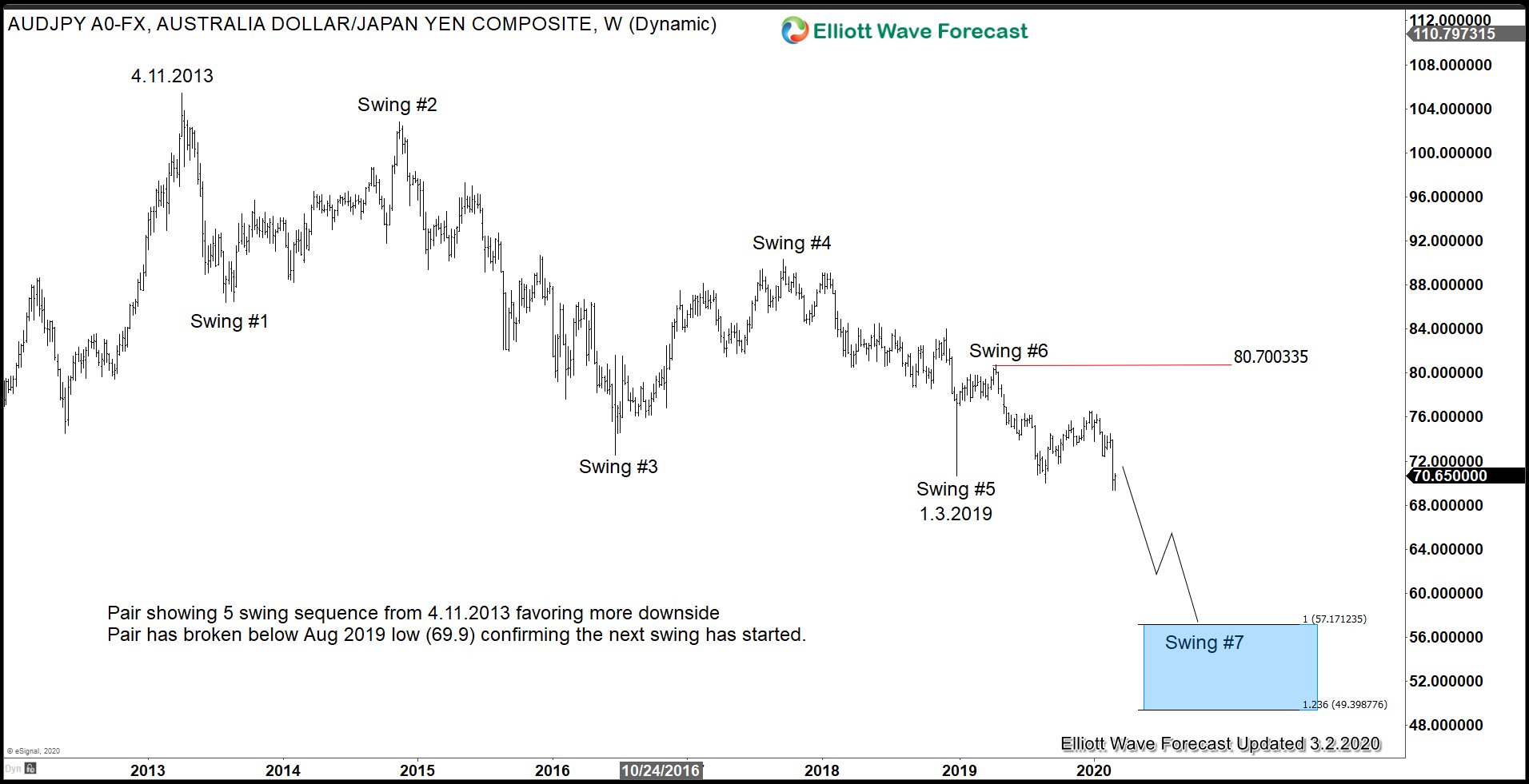

AUDJPY at 11 Year Low Amidst Coronavirus Fear

Read MoreAUDJPY sank to 11 year low last week as the market is pricing in a drastically lower Australia’s growth outlook. The coronavirus outbreak around the world has disrupted everything from travel, supply chain, and daily activities. The virus first originated in Wuhan, China and has infected 81,000 people globally and killed more than 2700 people. […]

-

GBPUSD Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD, published in members area of the website. As our members know GBPUSD has incomplete bearish sequences in the cycle from the 12/13 peak. The pair is targeting 1.2668 area ideally . Consequently, we advised […]

-

CADJPY Forecasting The Bounce From Blue Box Area

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of CADJPY. The rally from August 26, 2019 low unfolded as 5 waves impulsive move up in wave (A) as a diagonal. Based on Elliottwave theory, the impulsive wave up will be followed by 3 waves correction before resuming to the upside. […]

-

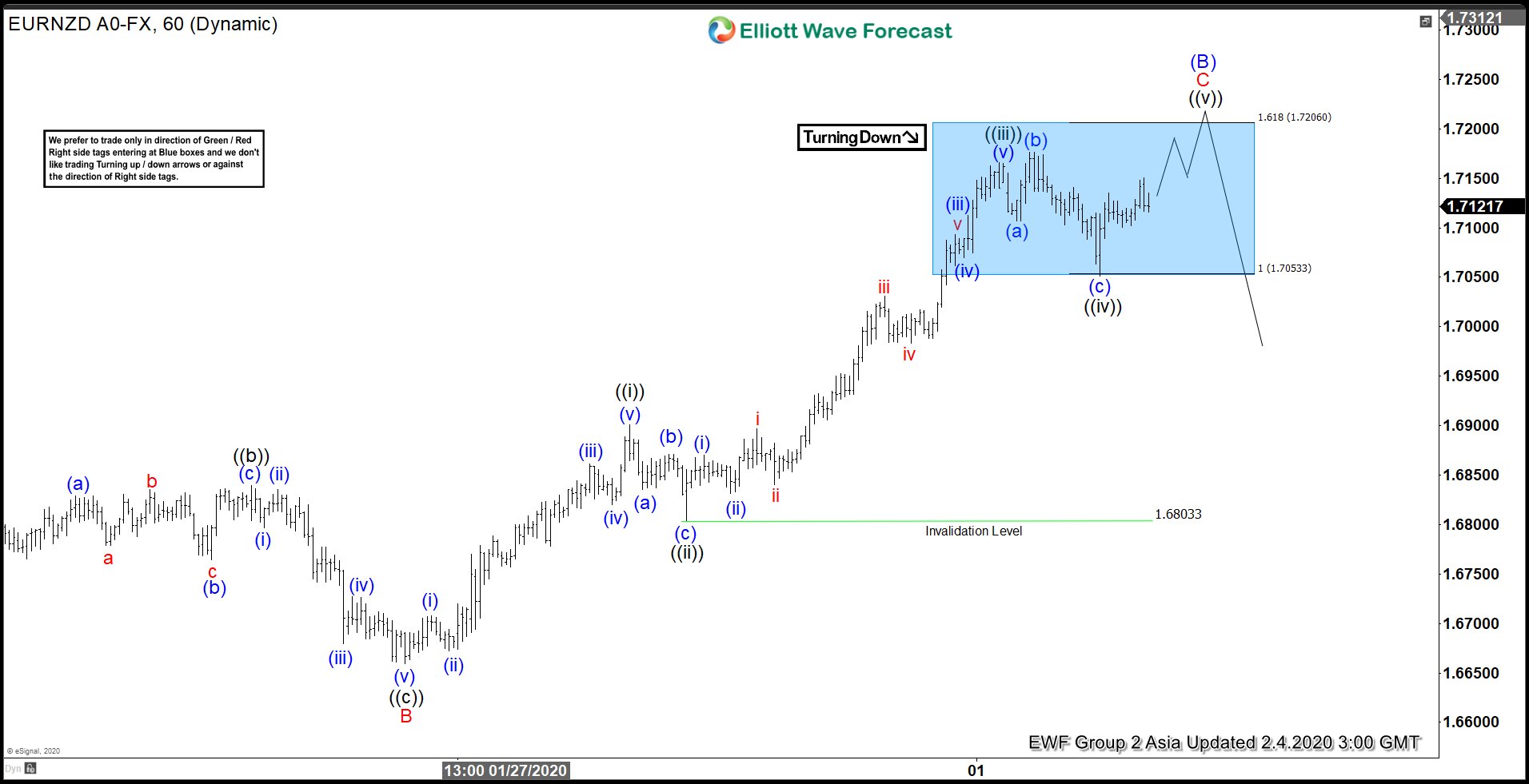

EURNZD Forecasting The Decline Using Elliott Wave Theory

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of EURNZD, In which our members took advantage of the blue box areas.

-

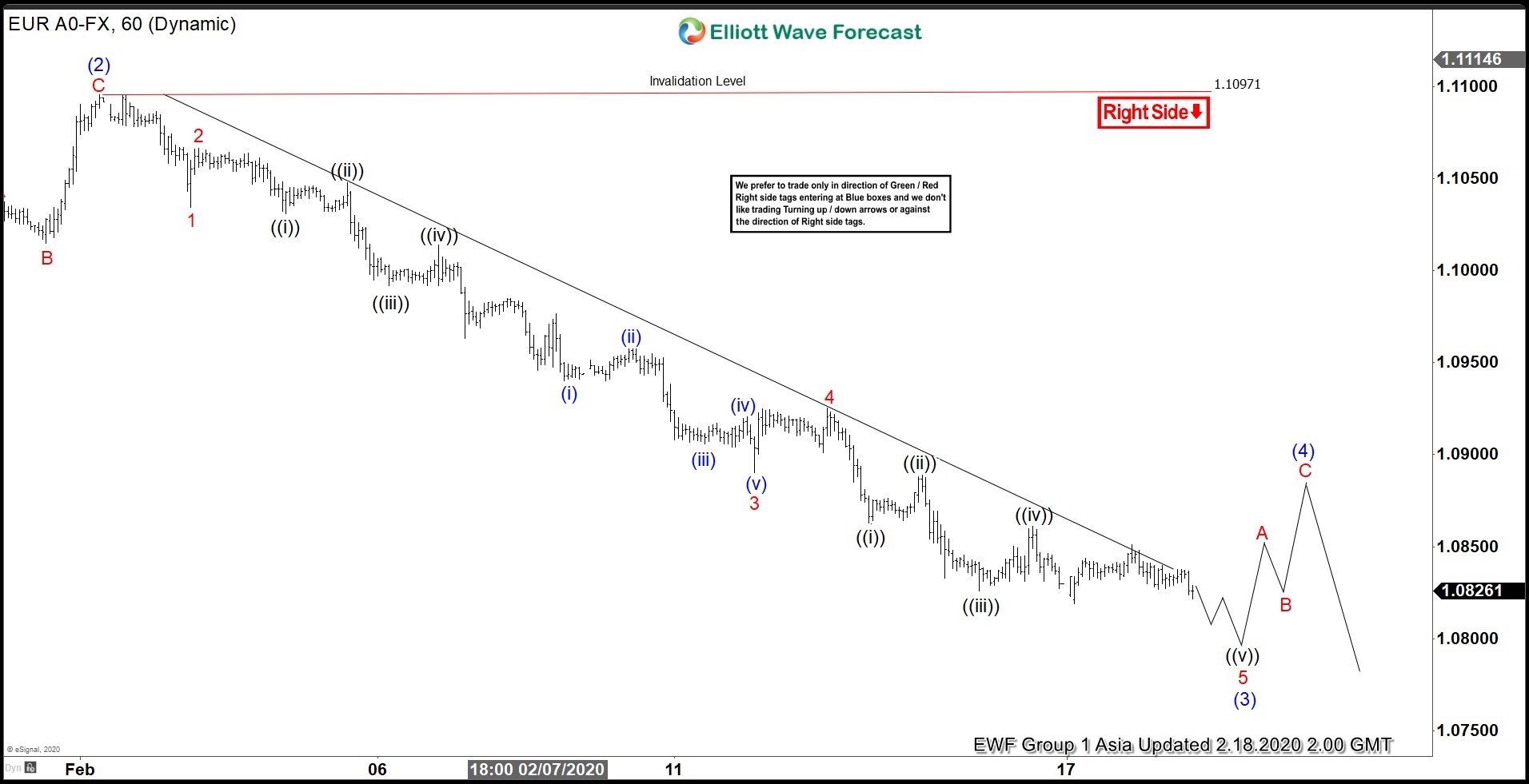

Elliott Wave View: EURUSD Can Bounce Soon

Read MoreShort term Elliott wave view in EURUSD suggests the cycle from December 31, 2019 high is unfolding as an impulse wave. Down from December 31, wave (1) ended at 1.0991 low and the bounce in wave (2) ended at 1.1097 high. The pair continues to the downside and wave (3) is still in progress. Wave […]

-

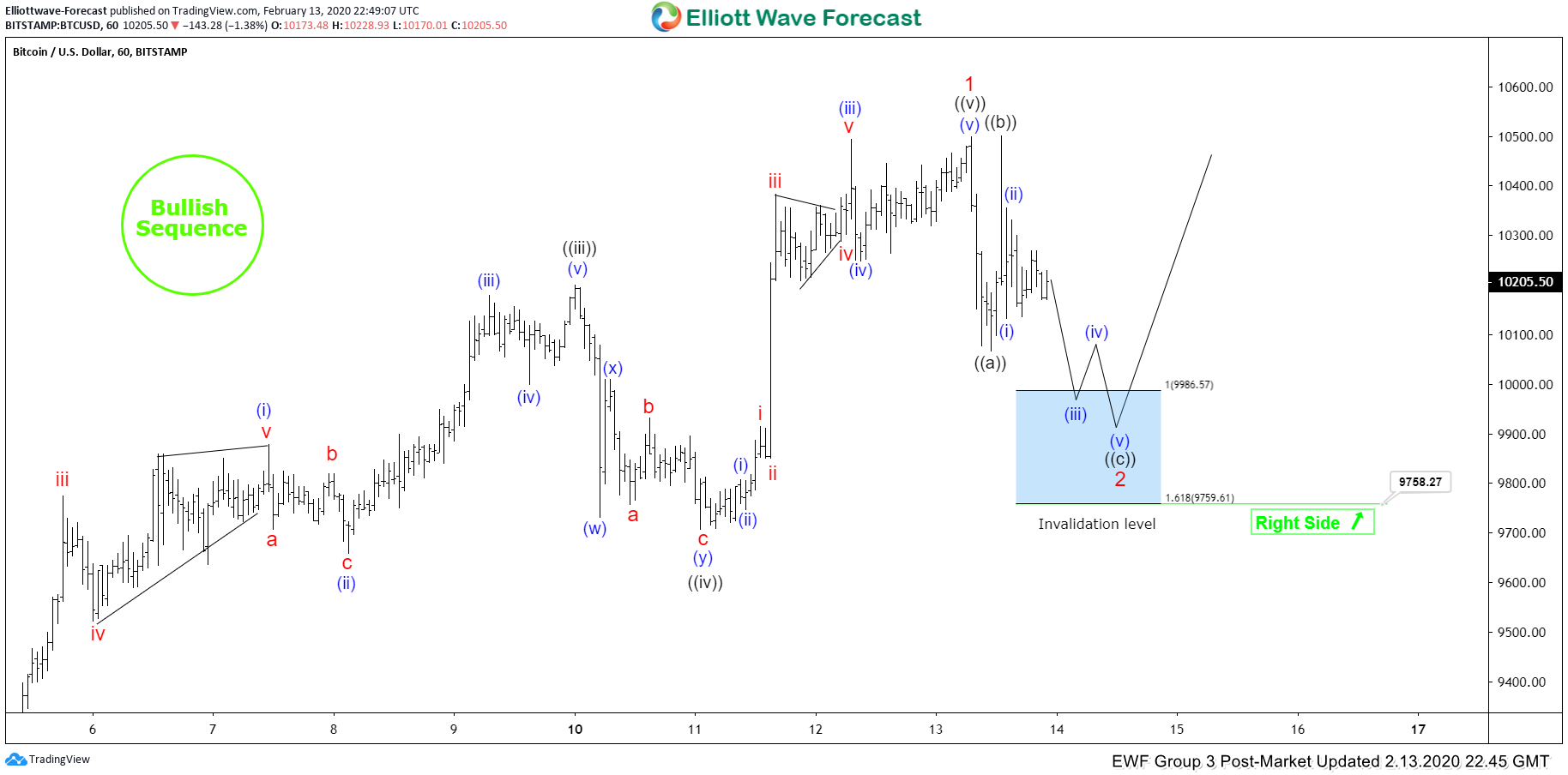

Elliott Wave View: Bitcoin Next Short Term Support Area

Read MoreShort term Elliott wave view in Bitcoin (BTCUSD) suggests the rally from January 24, 2020 low has ended as a 5 waves impulse Elliott Wave structure. Up from January 24 low, wave ((i)) ended at 9570 and pullback in wave ((ii)) ended at 9075. The crypto currency then resumed higher in wave ((iii)) towards 10199.85 […]