In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave View: Bitcoin Impulsive Rally In Progress

Read MoreBitcoin ended pullback from August 2 high. From there, it has extended higher. While above August 2 low, dips in 3,7 or 11 swings can find support.

-

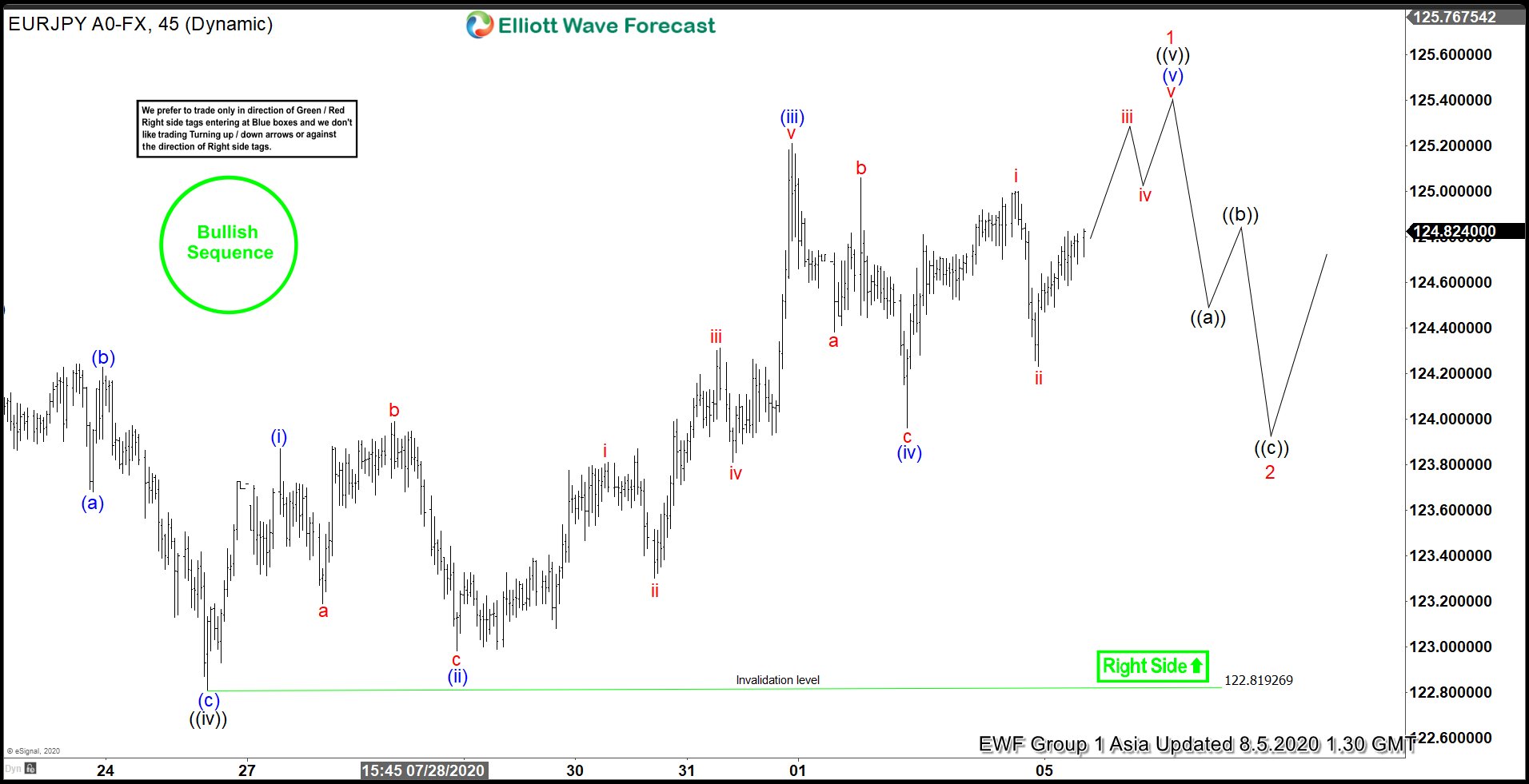

Elliott Wave View: Incomplete Bullish Sequence in EURJPY

Read MoreEURJPY broke above June 5 high. The pair now shows an incomplete bullish sequence. While above July 24 low, expect dips in 3,7 or 11 swings to find support.

-

Has The Euro Dollar Finally Turned the Corner?

Read MoreThe Euro Dollar has continued to slide since topping out on July 2008 at 1.6038. However, sentiment on the euro has recently improved after European Union leaders agreed to massive stimulus plan to counter the corona virus. The deal will see the EU issue 750 billion euro ($882 billion) of joint debt to help member […]

-

Bitcoin Extended Higher From Blue Box

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Bitcoin (BTC/USD). The 1 hour London chart update from July 28 shows that the cryptocurrency ended wave ((iii)) at 11417.11 high. The pair then did a pullback in wave ((iv)). The pullback reached the 100 – 161.8% extension of […]

-

USDINR: The Pair Is Sending A Warning to $USDX

Read MoreThe USDX has been trending higher since the lows in 2008. However, in trading, nothing lasts forever. New traders generally do not last very long in this field, thus most traders only know a strong $USDX due to recency bias. However, in reality, nothing lasts forever, so we at EWF track many different instrument to be able […]

-

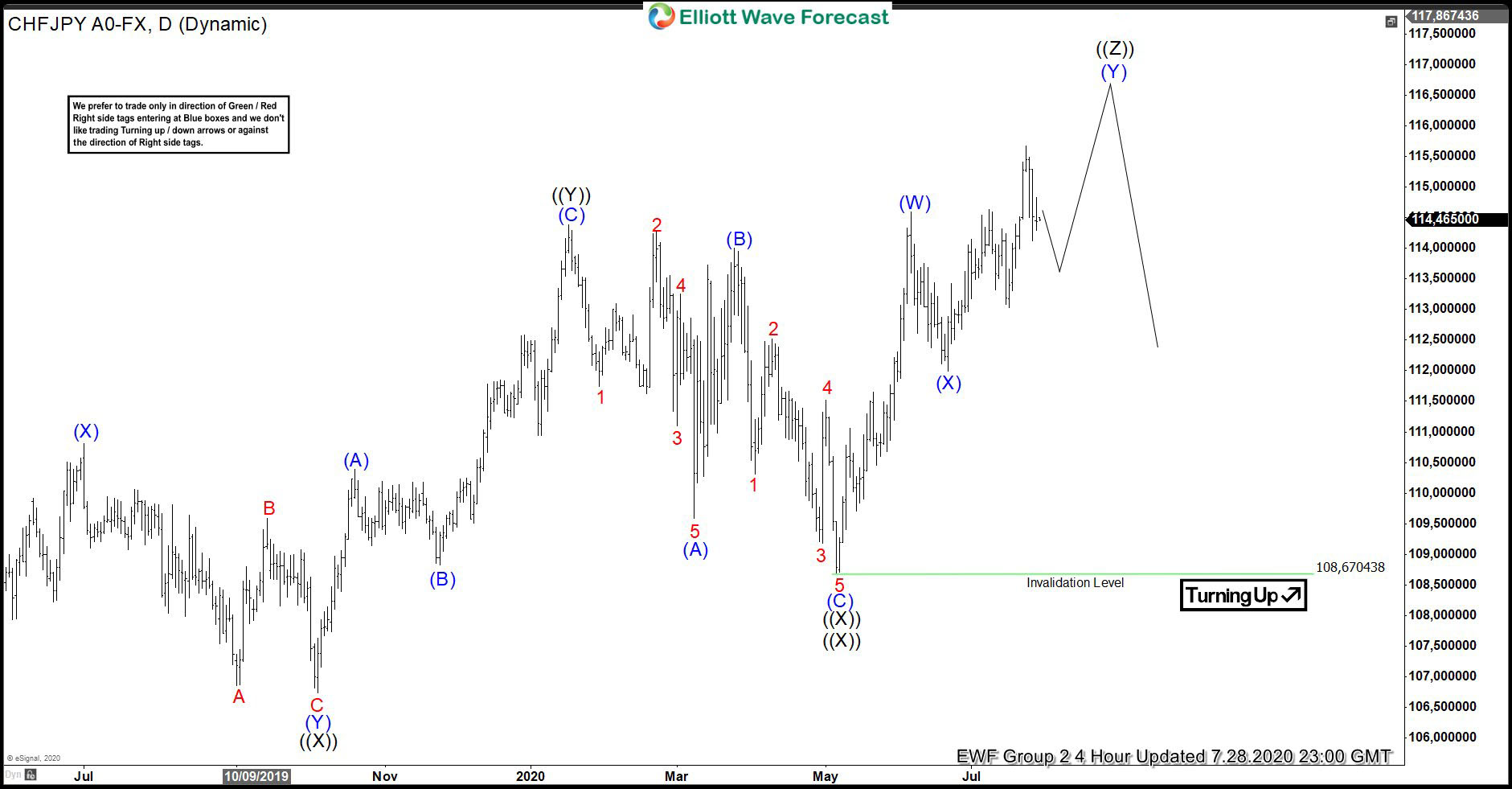

CHFJPY Incomplete Sequence Targeting Higher

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of CHFJPY. The Daily chart update below shows that the pair has continued to extend higher from October 4, 2019 low. Up from that low, the pair ended wave (A) at 110.39 high. The pullback in wave (B) ended at […]