In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

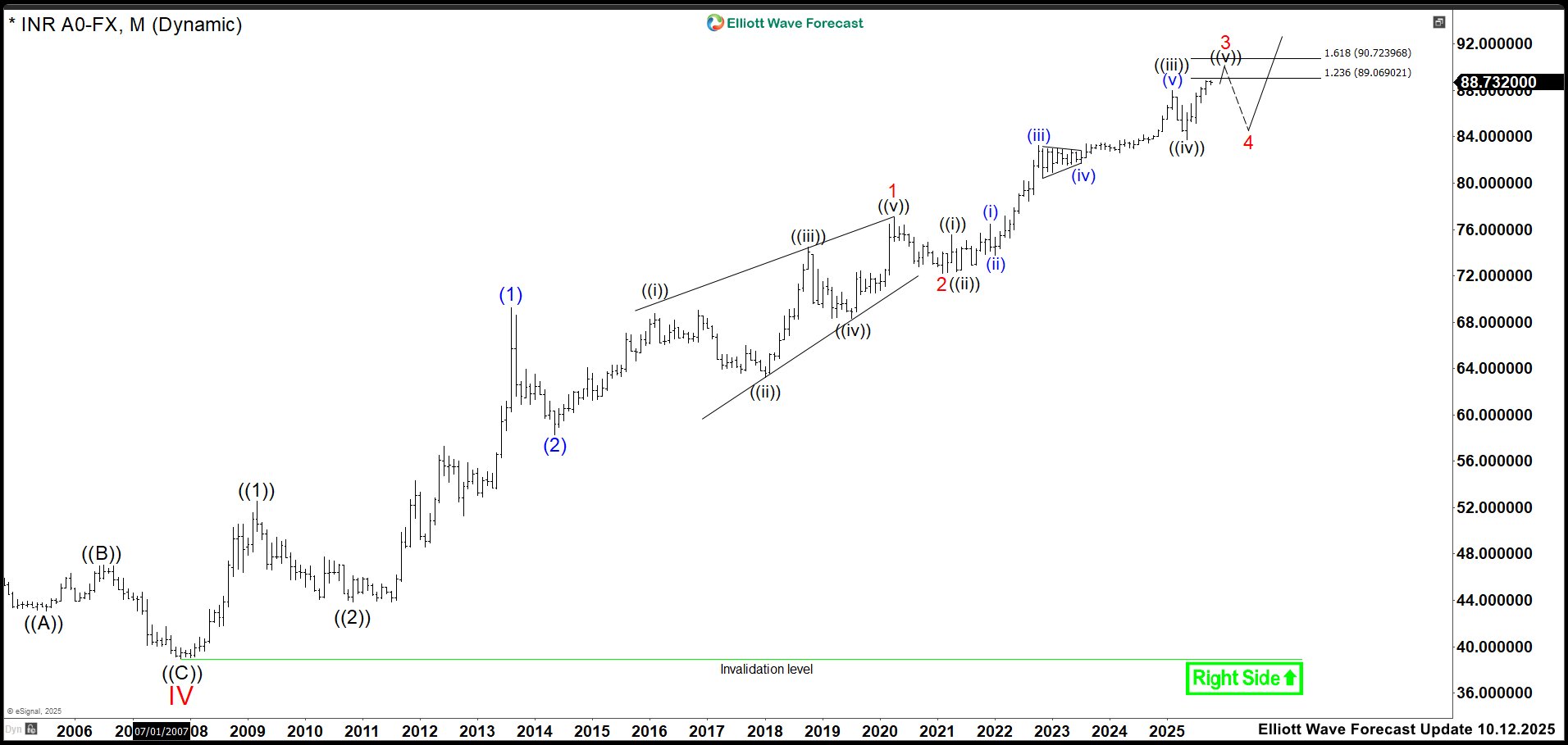

India Faces Rupee (USDINR) Pause Before Renewed Slide

Read MoreThe Indian rupee (USDINR) has faced steady pressure in 2025 due to global uncertainty and rising import costs. Higher oil prices and reduced foreign investment have made the currency weaker. The Reserve Bank of India has limited its support, allowing more market-driven movement. As a result, the rupee has dropped closer to 91 against the […]

-

USDJPY’s Impulsive Bullish Pattern Points to Continued Upside

Read MoreUSDJPY is looking to rally in impulsive Elliott Wave structure from 17 September low. This article and video look at the Elliott Wave path of this pair.

-

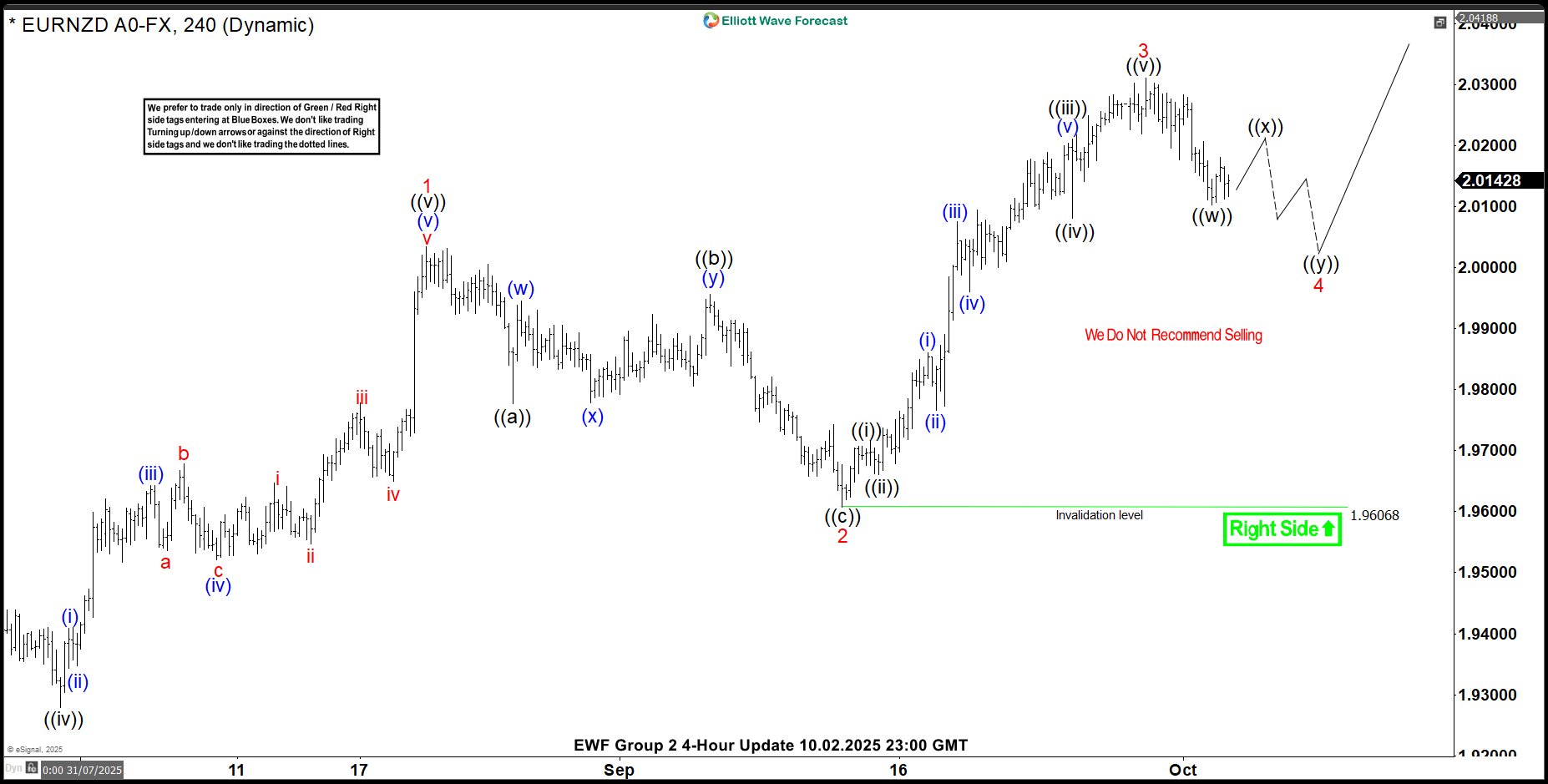

EURNZD Analysis: Bullish Sequence Targets Further Rally From Lows

Read MoreHello traders and welcome to a new blog post. In this one the spotlight will be on the EURNZD currency pair. This pair has been in a long-term bullish sequence since February 2017. Thus, it makes for an interesting instrument to add to the watch list. Is a setup imminent? EURNZD continues to rise in […]

-

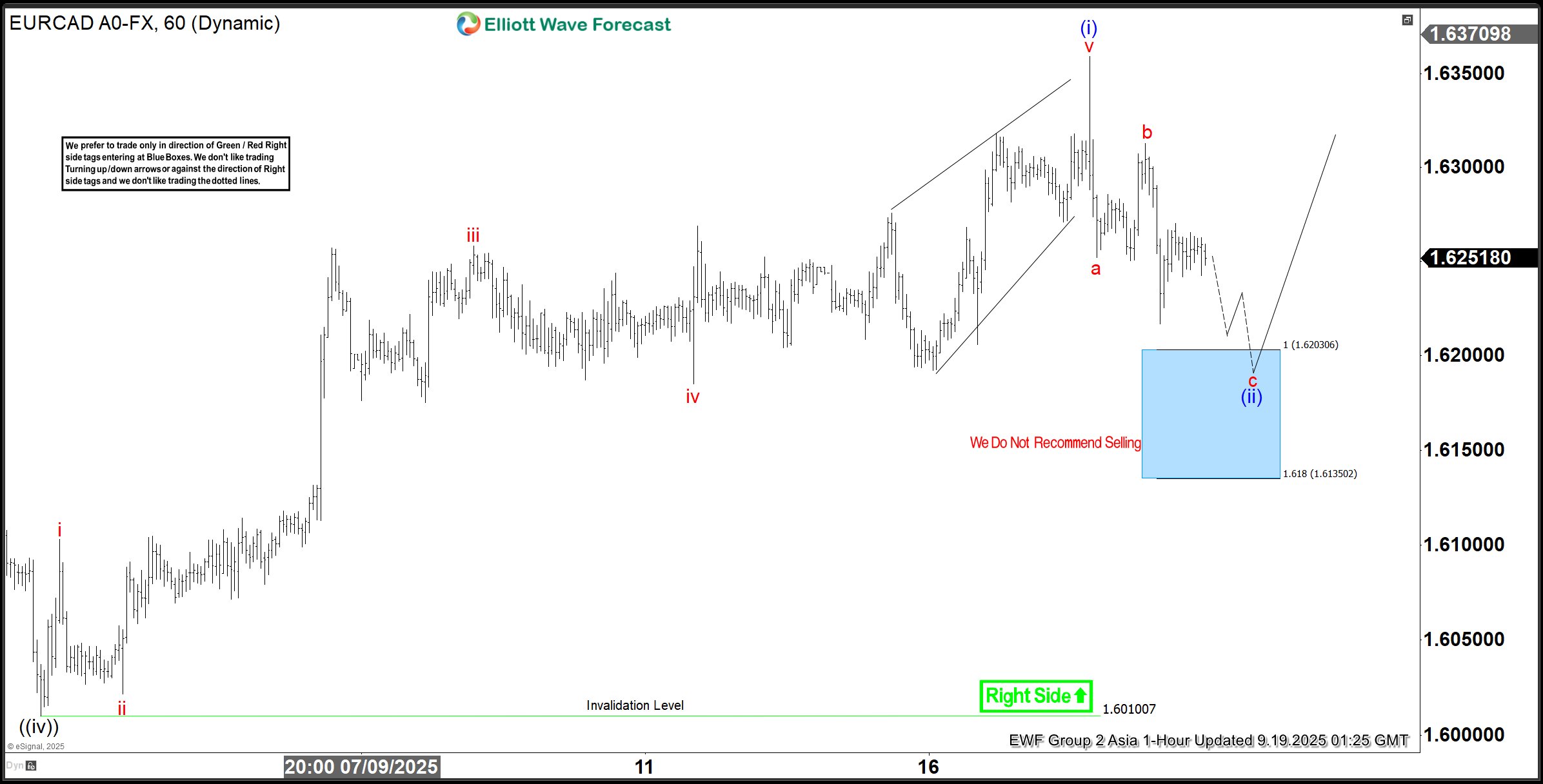

EURCAD Bounces Back: Reaction Higher from Blue Box Area

Read MoreIn this technical blog, we have looked at the past performance of EURCAD 1-Hour charts. In which, the pair bounces back & reacting higher from blue box.

-

GBPAUD Elliott Wave : Calling the Decline from the Equal Legs Zone

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of GBPAUD Forex Pair published in members area of the website. As our members know, GBPAUD has recently given us a 3 waves recovery that found sellers precisely at the equal legs area as we expected. In this discussion, we’ll break […]

-

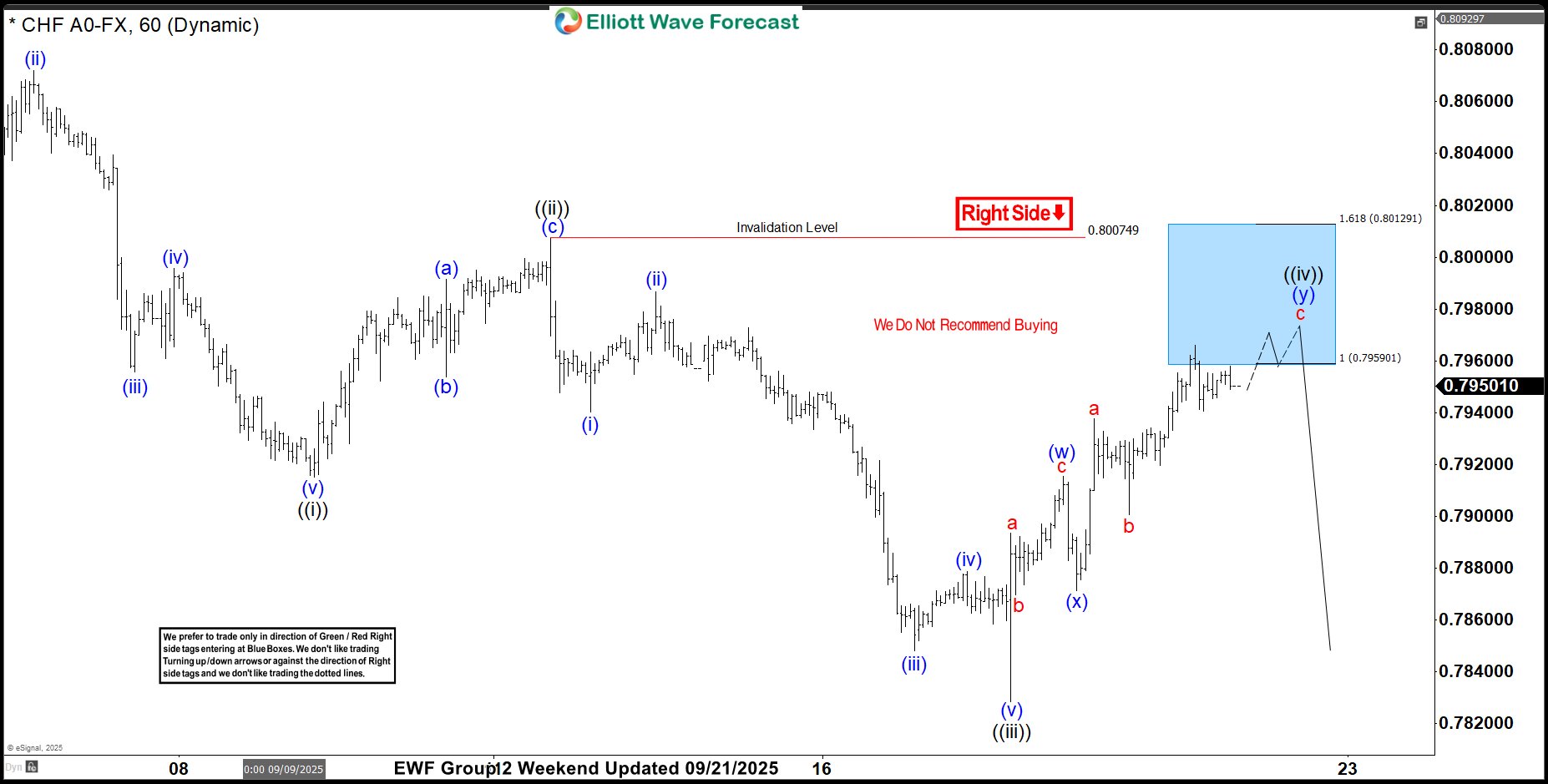

USDCHF Elliott Wave Analysis Shows Fresh Sell-Off From Bluebox

Read MoreHello traders. Welcome to a new blog post where we discuss recent trade setups from the blue box to the Elliottwave-forecast members. In this one, the spotlight will be on the USDCHF currency pair. The USDCHF currency pair remains clearly bearish. This trend is driven by dollar weakness since September 2022 and more recently January […]