In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

EURUSD in light of Macroeconomics and Geopolitics

Read MoreEuropean Central Bank during last meeting decided to extend the Quantitative Easing program by lowering the EU Banks Deposit Rate down to -0.30% from -0.20% and by postponing the QE expiry towards March 2017. While the Market was expecting more QE via lower Interest Rates and more monthly purchases above the 60bln as of today, […]

-

$USDCAD Building Permits and BOC Governor Speaks on 12/08

Read MoreWe have 2 important news events for Canadian Dollar tomorrow on 12/08 2015 : -Building Permits at 1:30 PM GMT(UK Time) / 8:30 AM EST -Bank Of Canada Governor Stephen Poloz Speaks at 5:50 PM GMT(UK Time)/ 12:30 PM EST Both news events should ideally bring some volatility into CAD pairs, so they could finally complete current cycles. […]

-

$GBPUSD Elliott wave forecast and Services PMI

Read MoreServices PMI December 3 at 9:30 AM GMT/ UK Time PMI (Purchasing Managers’ Index ) is one of the leading indicators of economic health and this announcment could bring some volatility in the GBP pairs on Thursday. Many retail traders will be looking the announcment at 9:30 AM GMT/ UK Time. As we know so […]

-

ECB Rate Decision and EURUSD

Read MoreECB Rate Decision, Monetary Policy Statement and Press Conference due for Thursday the 3rd of December at 12:45 UTC and 13:30 UTC Time respectively. Markets expects ECB will act with additional QE tomorrow, yet unknown how Dovish ECB President Draghi will sound during the Press Conference after today’s weak inflation reading as indicated via the […]

-

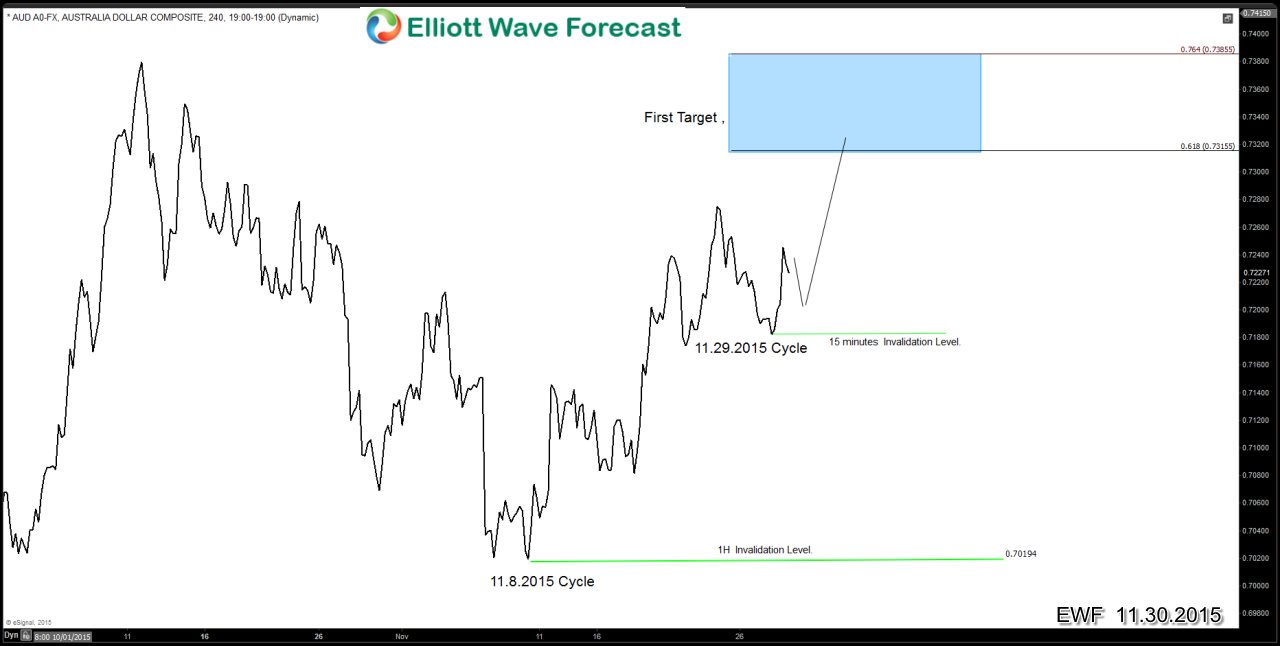

RBA Rate Decision & AUDUSD

Read More– RBA Rate Decision (Dec 1): 10:30 PM EST / 3:30 PM GMT Australia’s Reserve Bank is due to interest Rate Decision in few hours and while Market anticipates official cash rate to hold stable at 2.00%, Traders will be looking for the Statement Release scheduled at 03:30 UTC Time, concerning the RBA’s monetary policy and […]

-

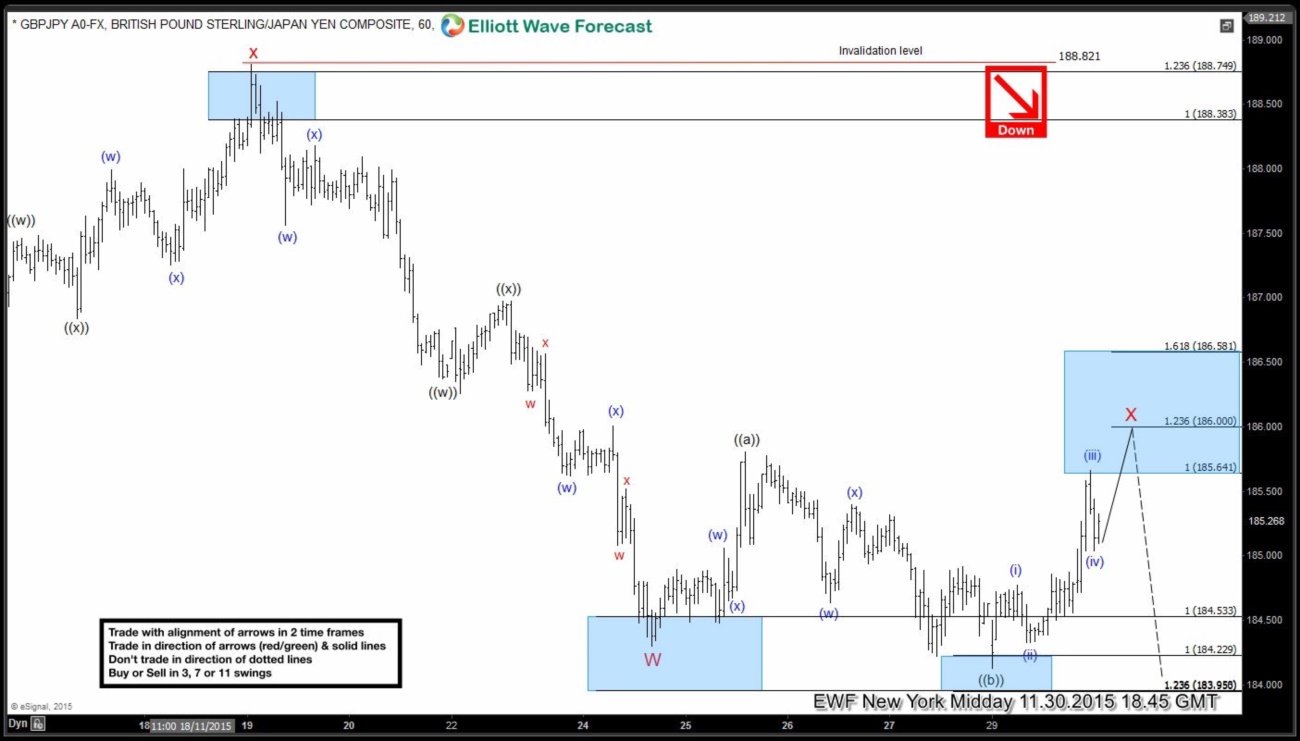

$GBPJPY Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. GBP/JPY Live Trading […]