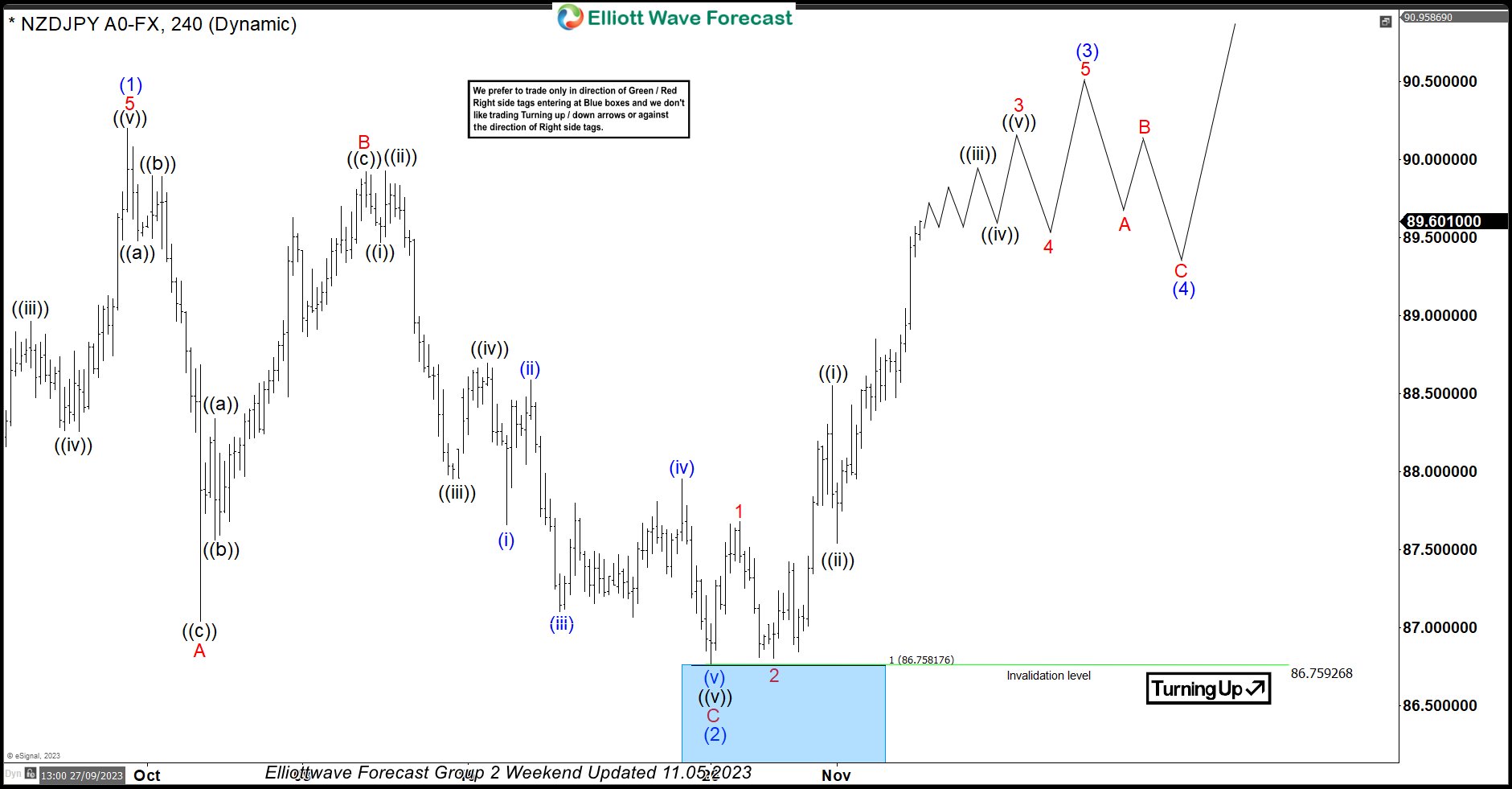

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

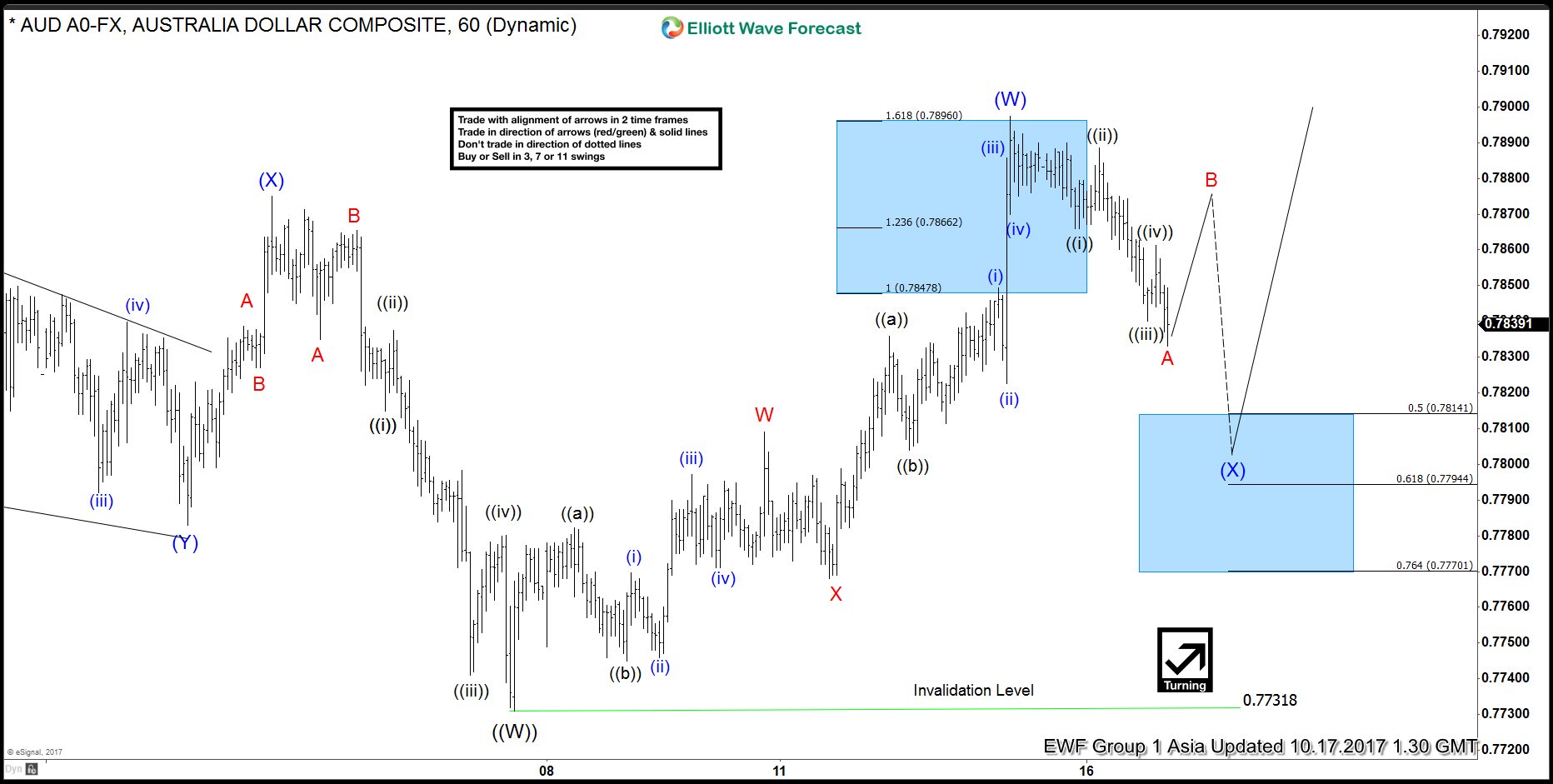

AUDUSD Short Term Elliott Wave Analysis 10.17

Read MoreAUDUSD Short term Elliott Wave analysis suggests decline to 0.7731 ended Primary wave ((W)) on 10/6 low. Bounce in Primary wave ((X)) is proposed to be unfolding as a double three Elliott Wave structure. Intermediate wave (W) of ((X)) ended at 0.7897 and Intermediate wave (X) of ((X)) pullback is in progress as a zigzag Elliott Wave structure. […]

-

Rate Hike Expectation May Support Poundsterling

Read MoreIn the aftermath of Brexit vote, Bank of England (BOE) had cut the cost of borrowing to a new record low of 0.25% in order to support the economy. At the same time, Poundsterling slumped against other major currencies due to the economic uncertainty. Sterling is currently worth 14% less against the Euro and 10% […]

-

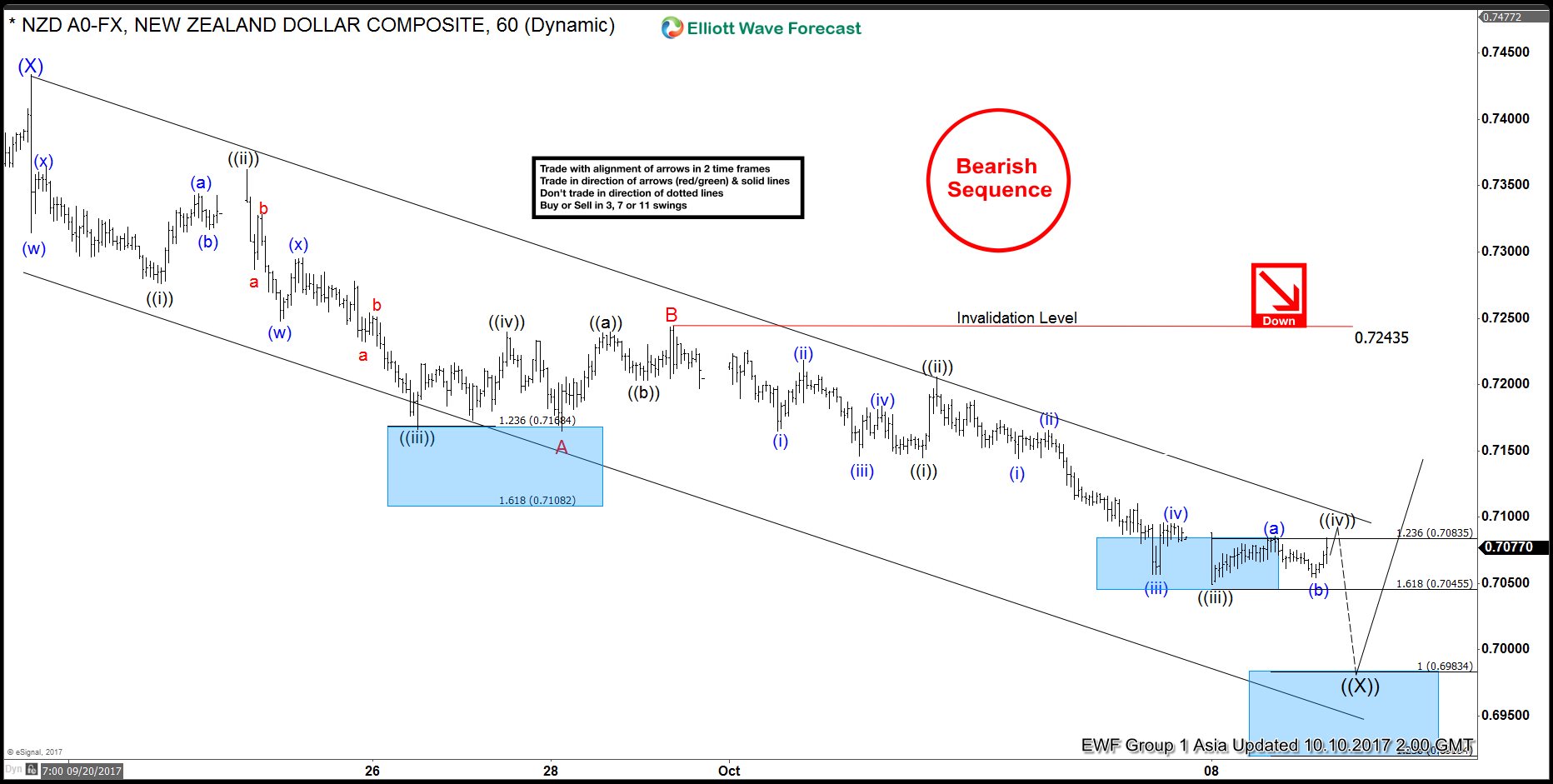

NZDUSD Short-term Elliott Wave Analysis

Read MoreNZDUSD Short term Elliott Wave view suggests the decline from 9/20 peak remains in progress a zigzag Elliott Wave structure. Down from 9/20 high (0.7434), pair ended Minor wave A at 0.7165. Subdivision of Minor wave A unfolded as 5 waves impulse where Minute wave ((i)) of A ended at 0.7276 and bounce to 0.7362 ended Minute […]

-

EURUSD Intra-Day Elliott Wave Analysis

Read MoreEURUSD Intra-Day Elliott Wave view suggests the decline from 9/8 peak remains in progress as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), pair ended Intermediate wave (A) at 1.837. Bounce to 1.2034 ended Intermediate wave (B). Intermediate wave (C) remains in progress and unfolding as 5 waves impulse where Minor wave 1 of […]

-

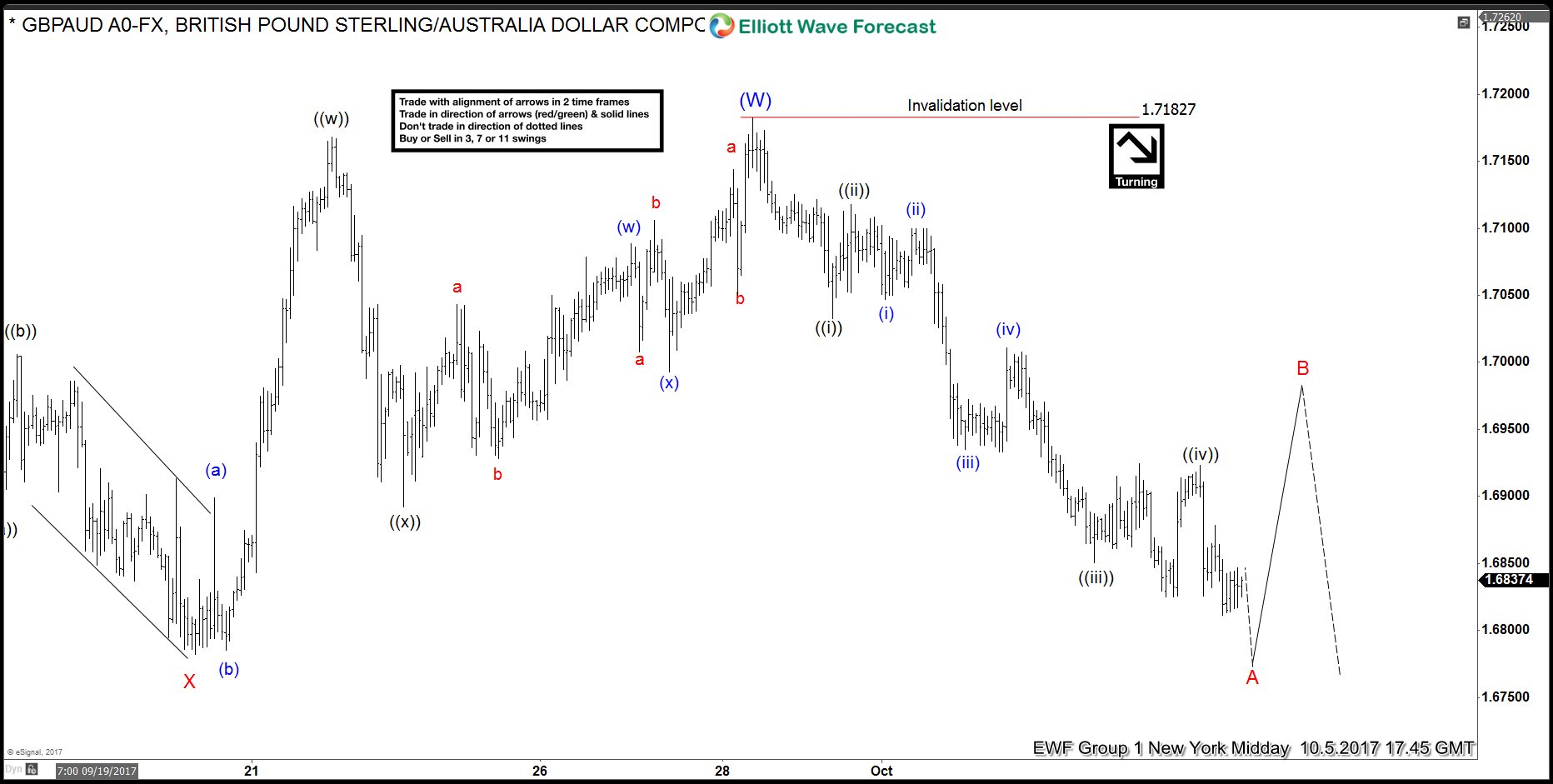

GBPAUD Elliott Wave View: Showing Impulse

Read MoreShort term GBPAUD Elliott wave view suggest that the rally to 1.7182 on 9/28 peak ended the intermediate wave (W). Decline from there is unfolding as an impulse Elliott Wave structure with extension. This 5 waves move should end Minor wave A of an Elliott wave zigzag structure structure or a wave C of a FLAT correction from 9/22 peak (1.7165). In either case, after […]

-

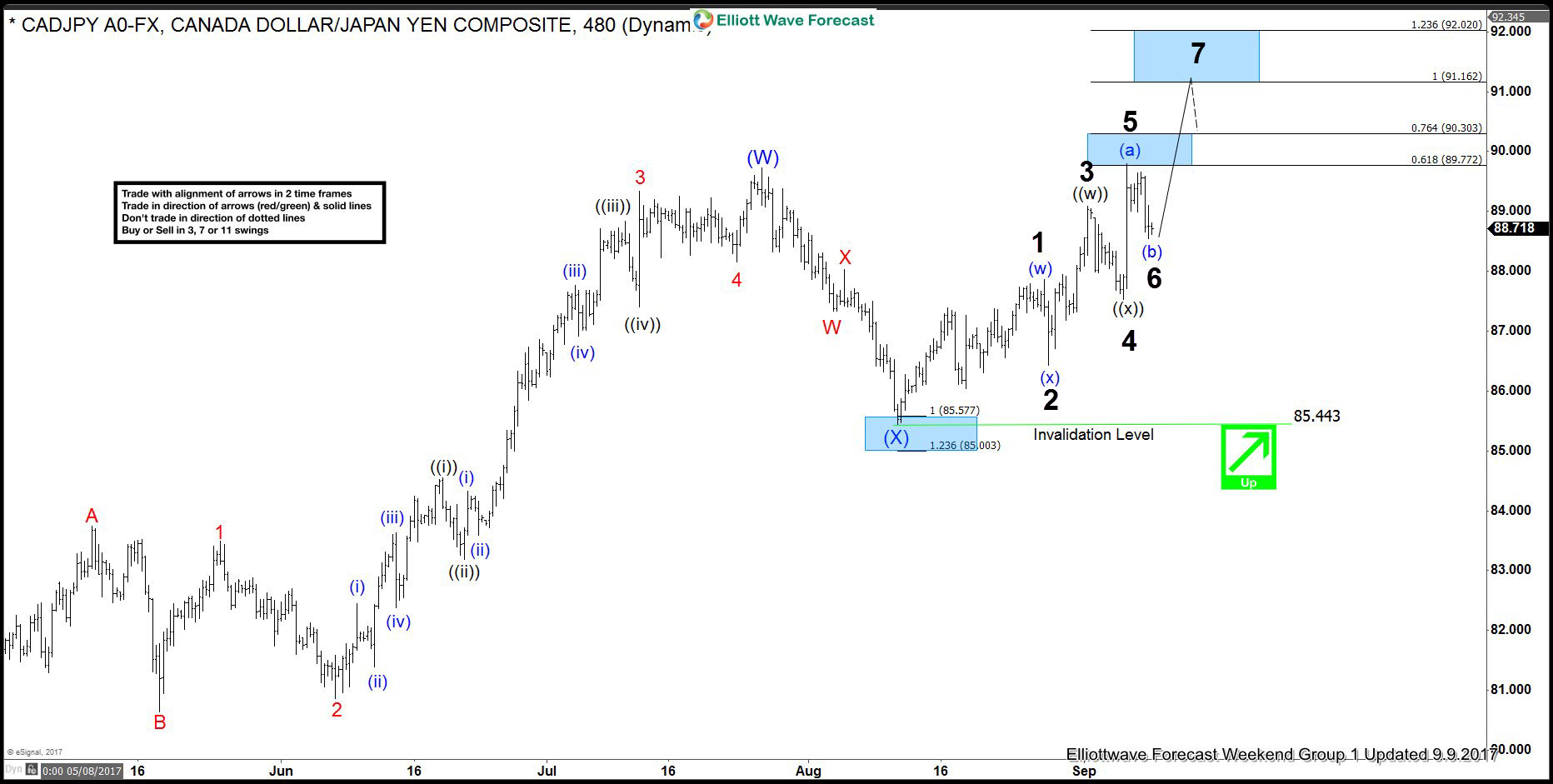

CADJPY Forecasting the Rally using Swings Sequences

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of www.sifaha.com. In further text we’re going to count the swings, explain the Elliott Wave view and trading strategy. Let’s start with 4 hour update. CADJPY Elliott Wave 4 Hour […]