In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

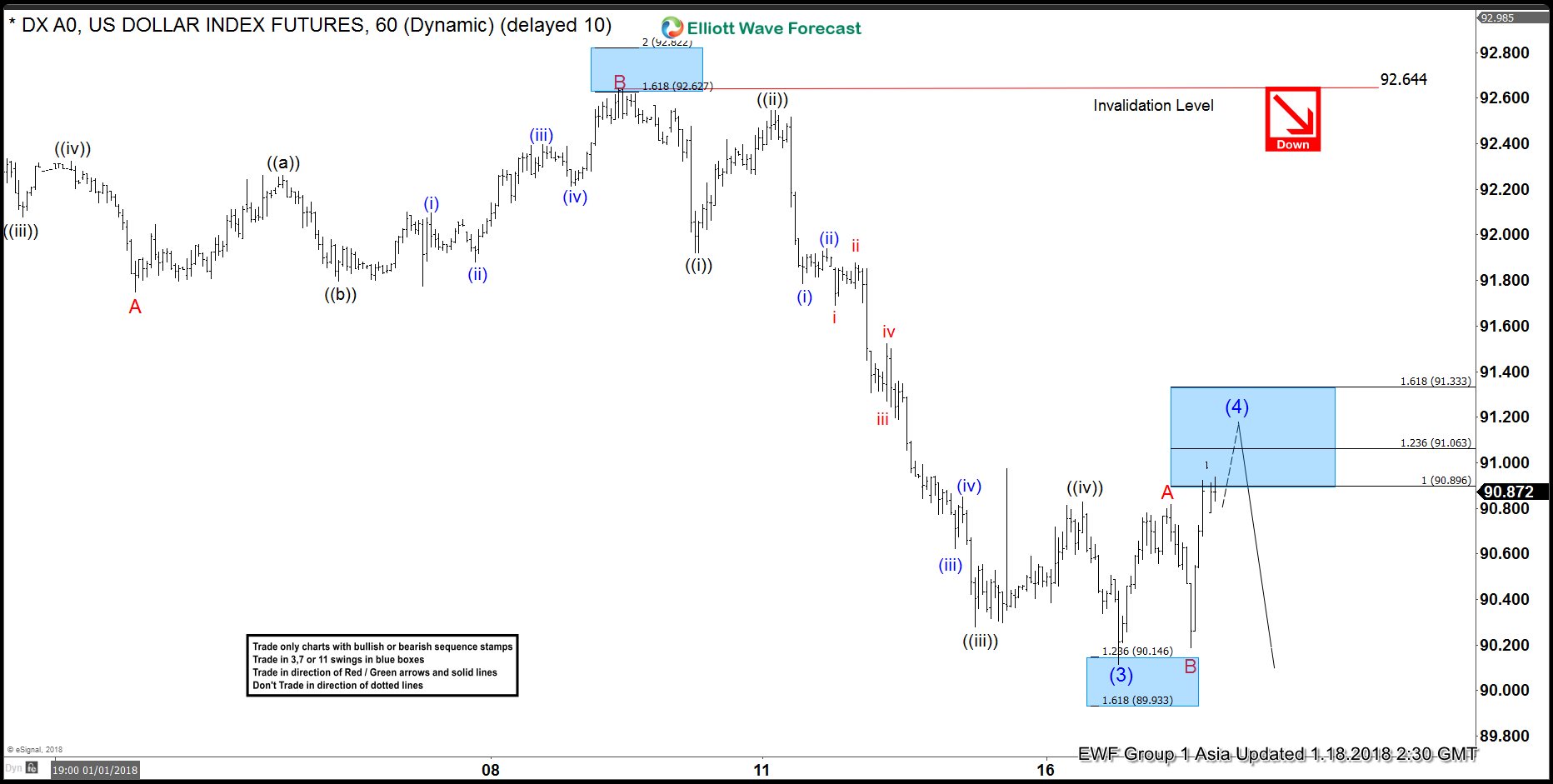

Elliott Wave Analysis: DXY in Double Correction

Read MoreDXY Dollar Index Short Term Elliott Wave view suggests that decline to 88.44 ended Intermediate wave (3). Up from there, Intermediate wave (4) bounce is unfolding as a double three Elliott Wave structure where Minor wave W ended at 89.58 and Minor wave X ended at 88.723. Minor wave Y is in progress with Minute wave ((w)) ended […]

-

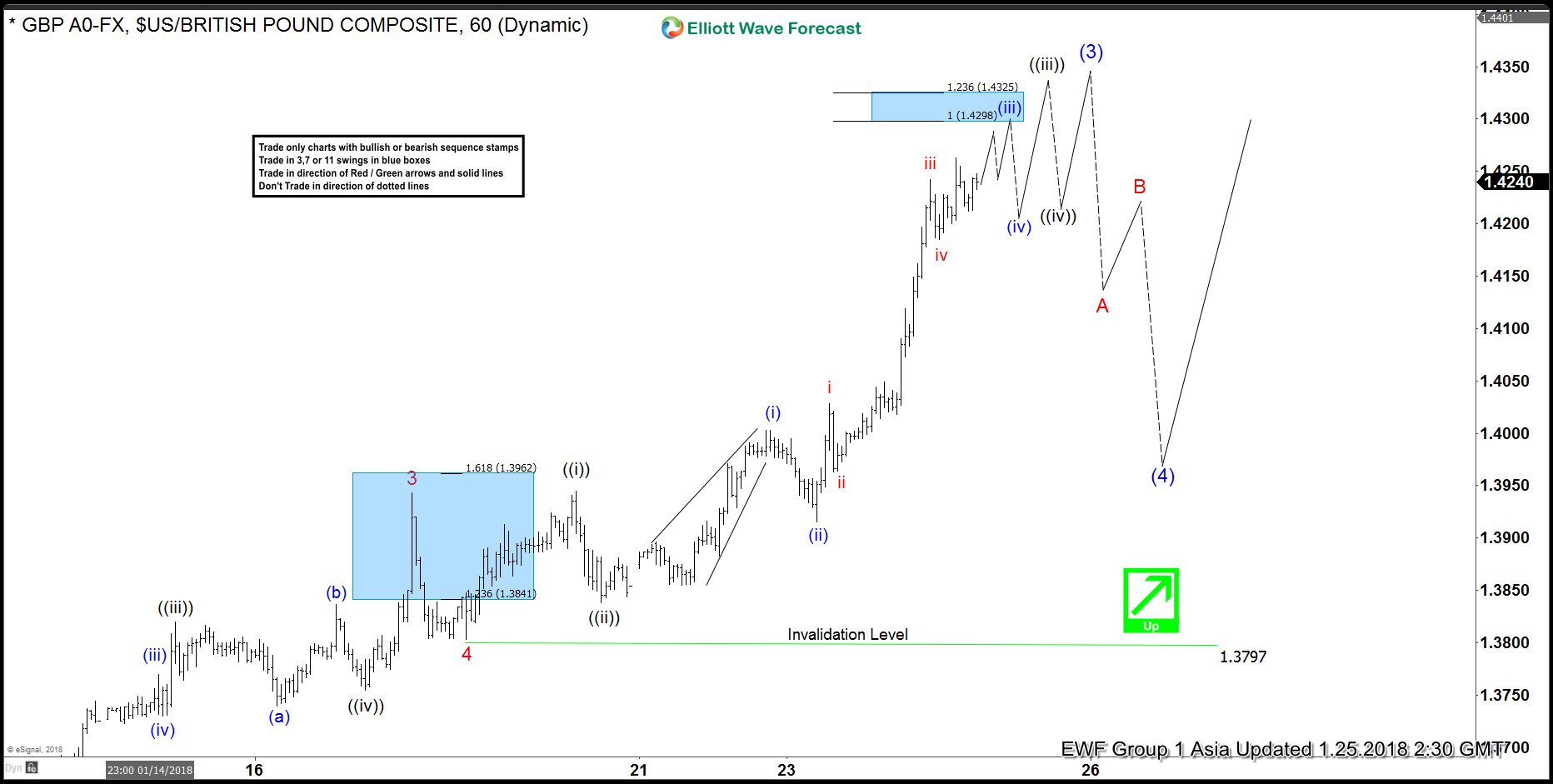

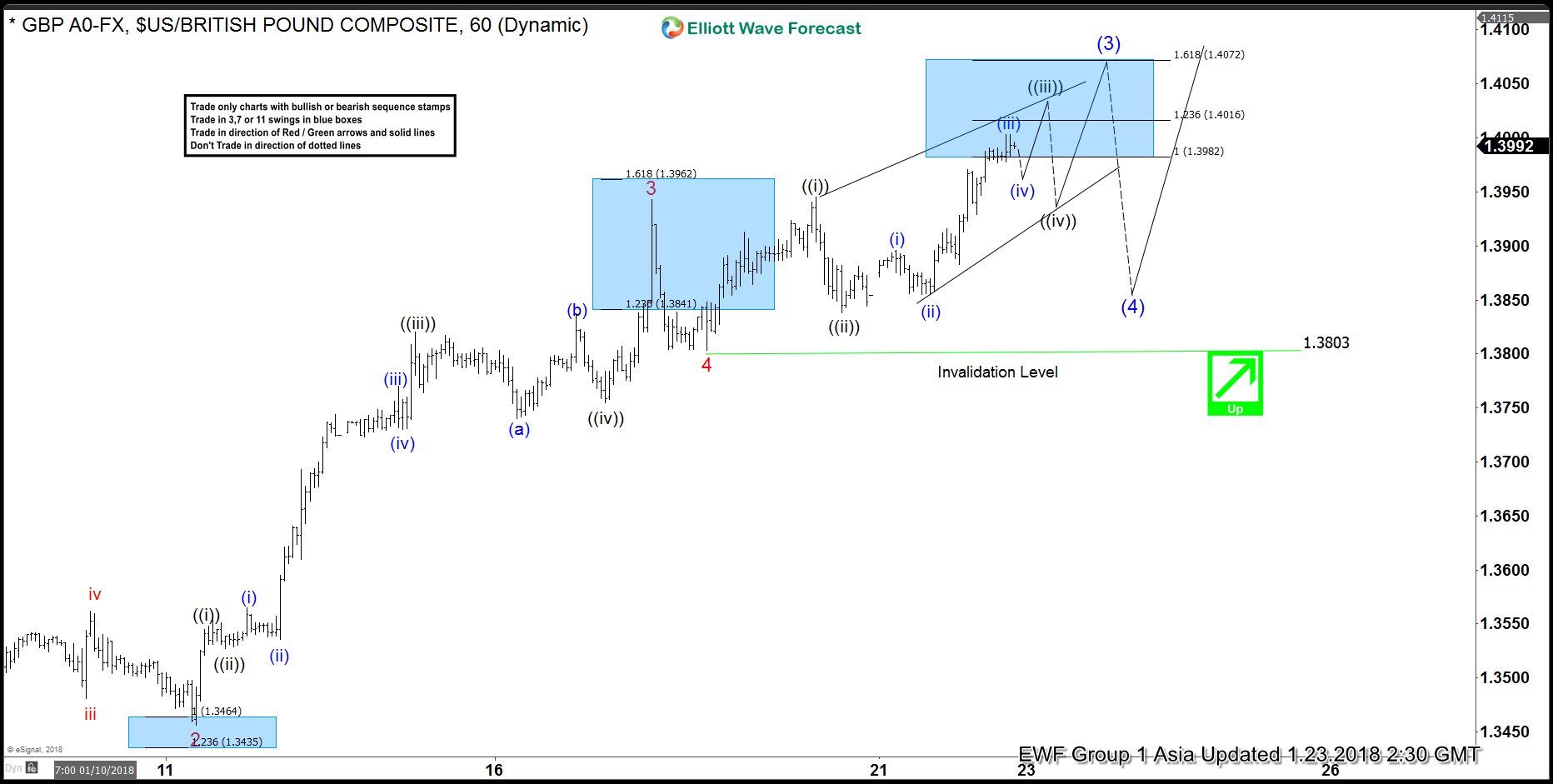

Elliott Wave Analysis: GBPUSD ended wave (4) correction

Read MoreGBPUSD Short Term Elliott Wave view suggests that pair ended Intermediate wave (2) at 1.33 on 16 December 2017. Up from there, Intermediate wave (3) rally is unfolding as 5 waves impulse Elliott Wave structure where Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, Minor wave 4 […]

-

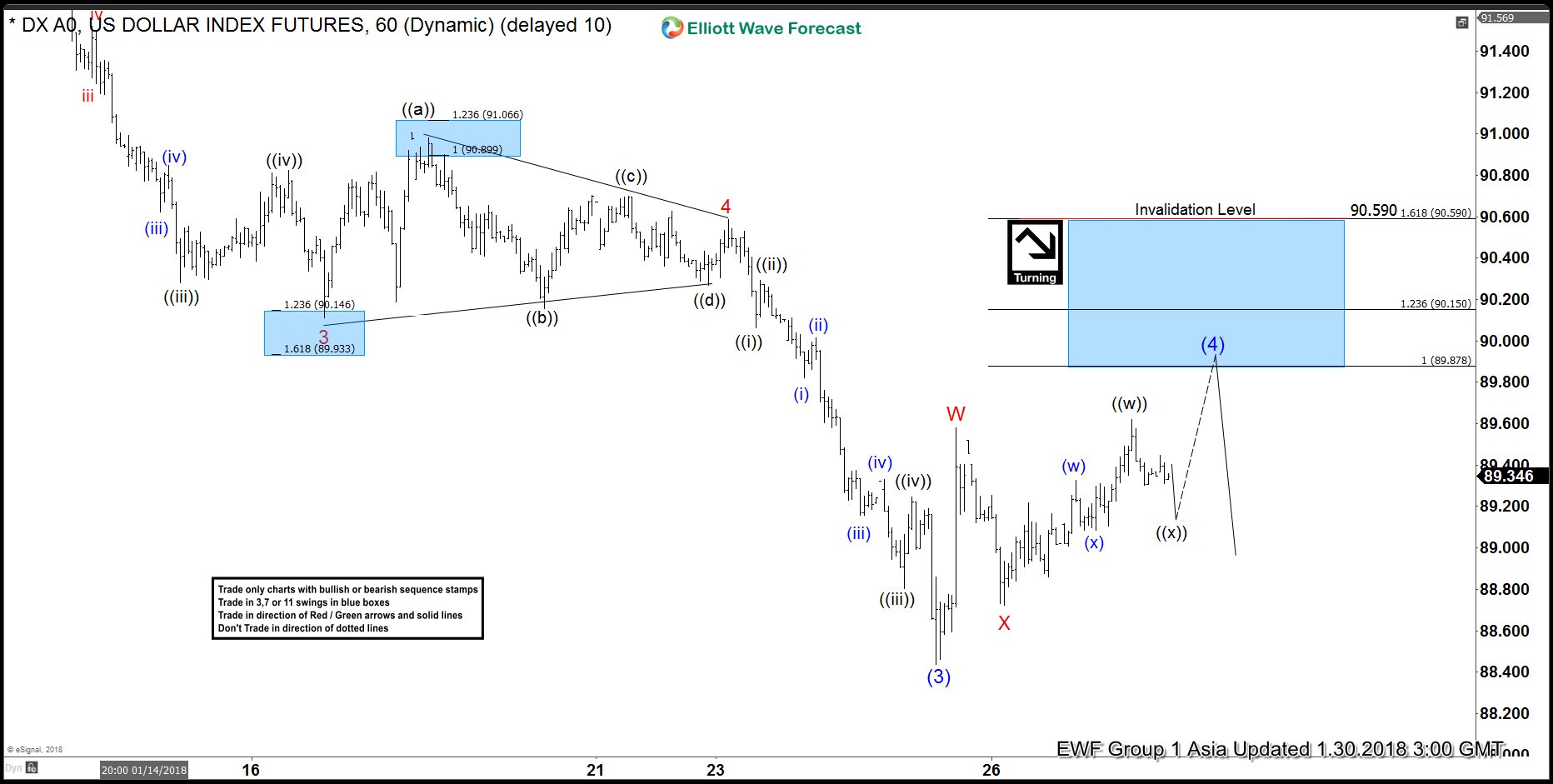

USDX Forecasting Decline & Selling rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Dollar Index USDX published in members area of www.sifaha.com. As our members know, USDX have had incomplete bearish sequences in the cycle from the January peak, suggesting further decline. Consequently , we advised our members […]

-

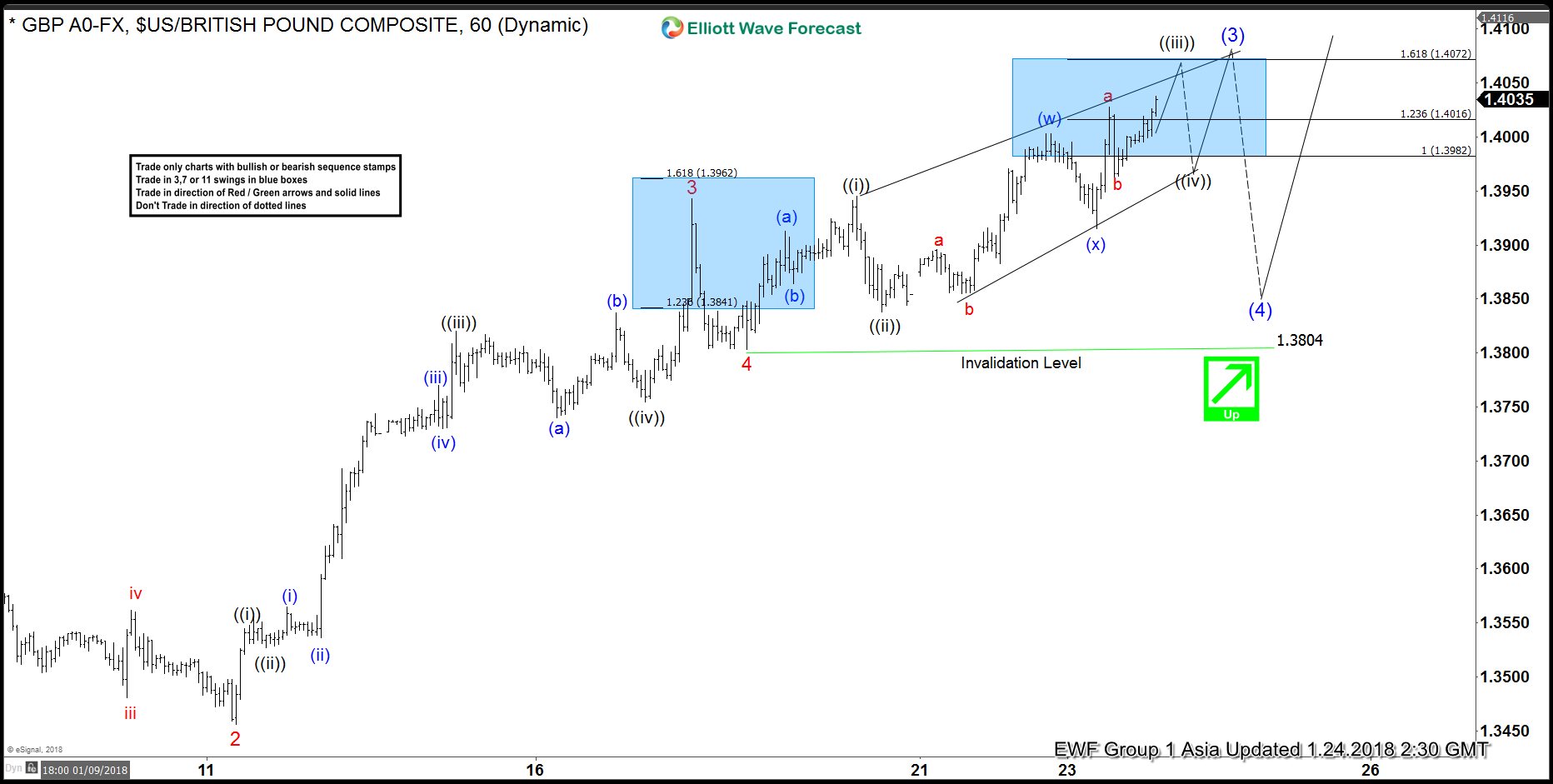

Elliott Wave Analysis: GBPUSD still within wave (3)

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 16 December 2017 low is unfolding as 5 waves impulse Elliott Wave structure. Up from 16 December 2017 low (1.33), Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, and Minor wave 4 ended at 1.3797. Minor […]

-

Elliott Wave Analysis: GBPUSD doing an ending diagonal

Read MoreGBPUSD Short Term Elliott Wave view suggests that the pair rallies as 5 waves impulse Elliott Wave structure from 16 December 2017 low. Up from 16 December 2017 low (1.33), Minor wave 1 ended at 1.3613, pullback to 1.3456 ended Minor wave 2, rally to 1.3943 ended Minor wave 3, and Minor wave 4 ended at 1.3803. […]

-

GBPUSD Elliott Wave Analysis: More Upside Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that rally from 16 December 2017 low is unfolding as 5 waves impulse Elliott Wave structure. Up from 16 Dec 2017 low (1.33), Minor wave 1 ended at 1.3613, Minor wave 2 ended at 1.3456, Minor wave 3 ended at 1.3943, and Minor wave 4 ended at 1.3803. Pair has […]