In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

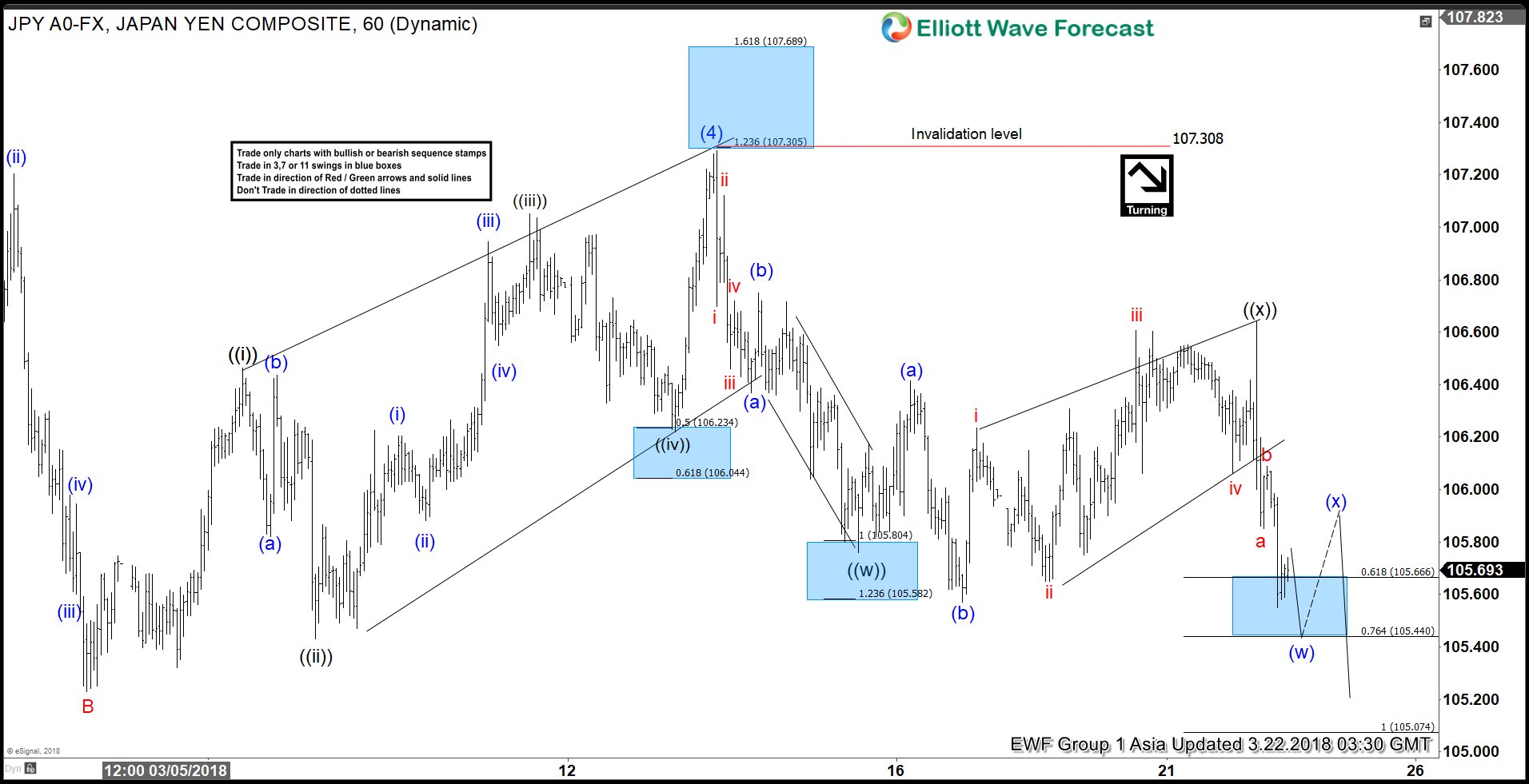

Elliott Wave Analysis: USDJPY Resumes Lower to 104

Read MoreUSDJPY Elliott Wave view suggests that the decline from 11.6.2017 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 11.6.2017 high (114.73), Intermediate wave (1) ended at 110.84, Intermediate wave (2) ended at 113.75, Intermediate wave (3) ended at 105.55, and Intermediate wave (4) ended at 107.3. Intermediate wave (5) is […]

-

Elliott Wave Analysis: AUDJPY Calling the Decline

Read MoreIn this blog, we will have a look at some past Elliott Wave structures of the instrument AUDJPY. In the chart below, you can see the 1-hour weekend update presented to our members on the 03/10/18. Calling for a double correction in an Elliott Wave Flat correction as the internals from black ((a))-((b))-((c)) proposed to be […]

-

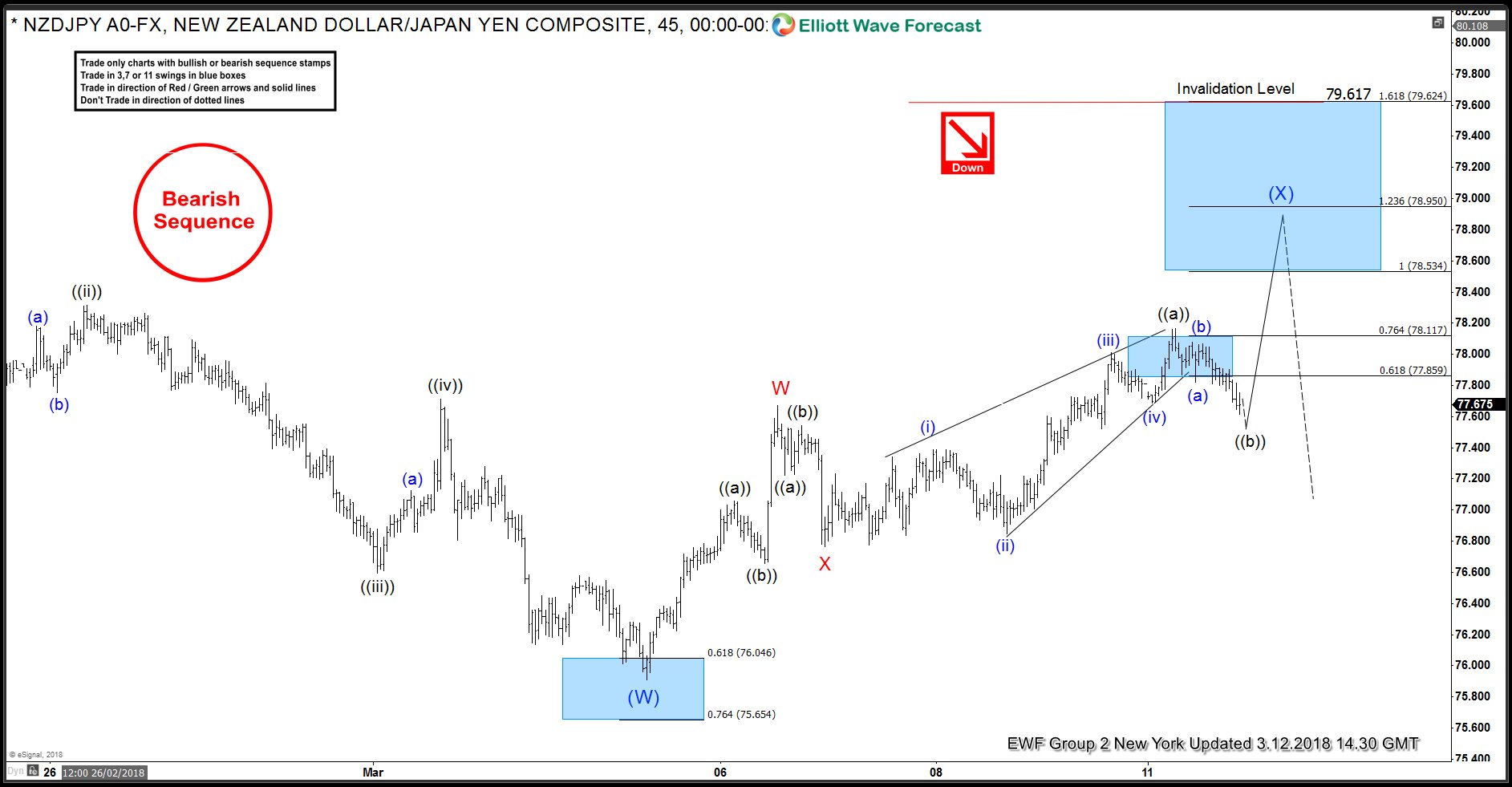

NZDJPY Selling the Elliott Wave bounces

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott Wave Chart performance of NZDJPY. Which we presented to our clients at sifaha.com. We are going to explain the structure and the forecast. As our members know, we were pointing out that the sequence from July 27 2017 peak is incomplete to the downside. Therefore, we advised […]

-

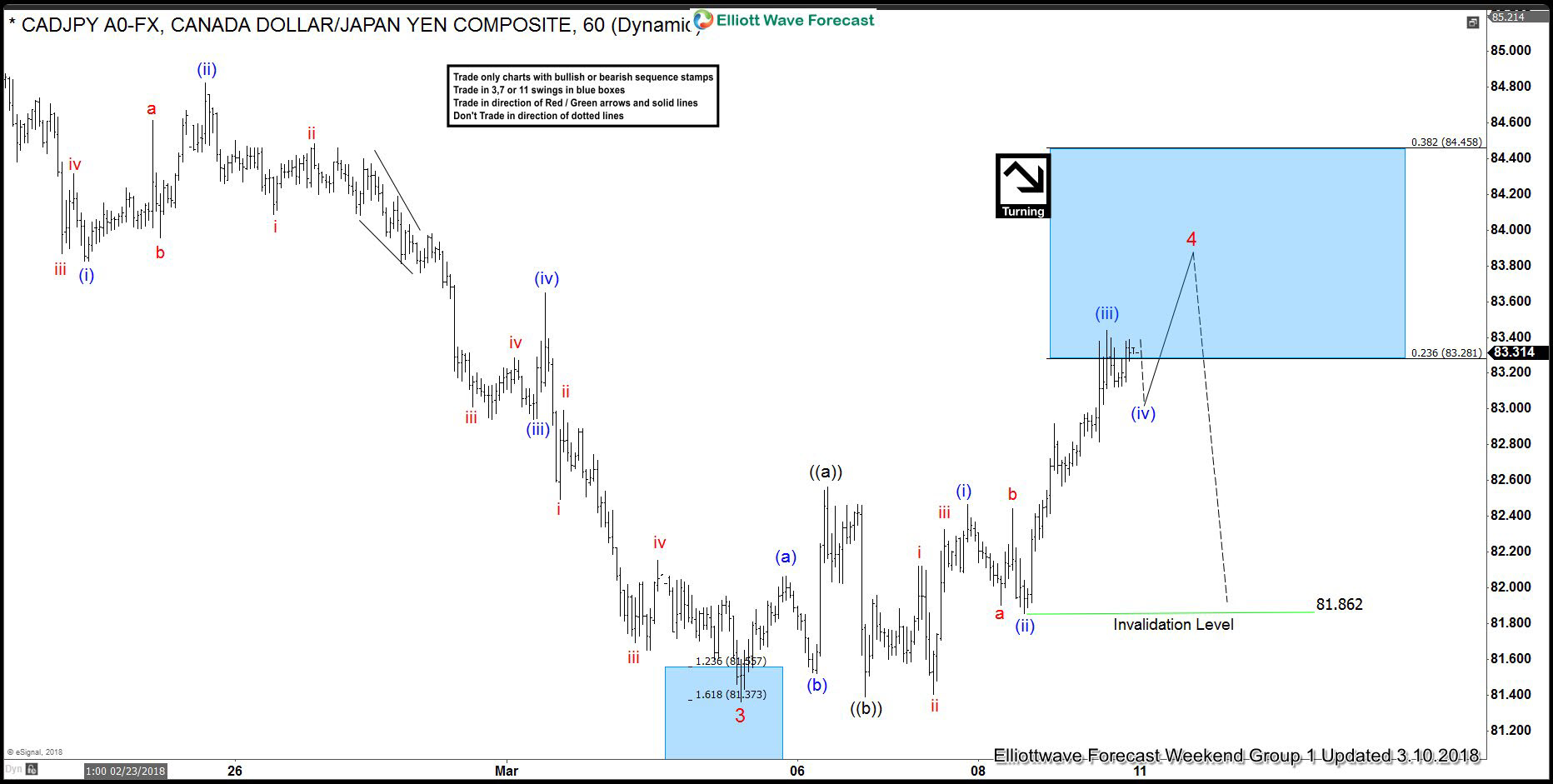

CADJPY Forecasting Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, we have been syaing saying that the pair has reached […]

-

Breakthrough in Brexit Negotiation Boosts Poundsterling

Read MoreBrexit Transition Period Agreement Breakthrough Yesterday the UK has struck a deal with the EU to the Brexit transition period. The transition period is the 21 month period which starts from 29 March 2019 (official Brexit day) to 31 December 2020. UK Prime Minister Theresa May likes to call this period an implementation phase. This […]

-

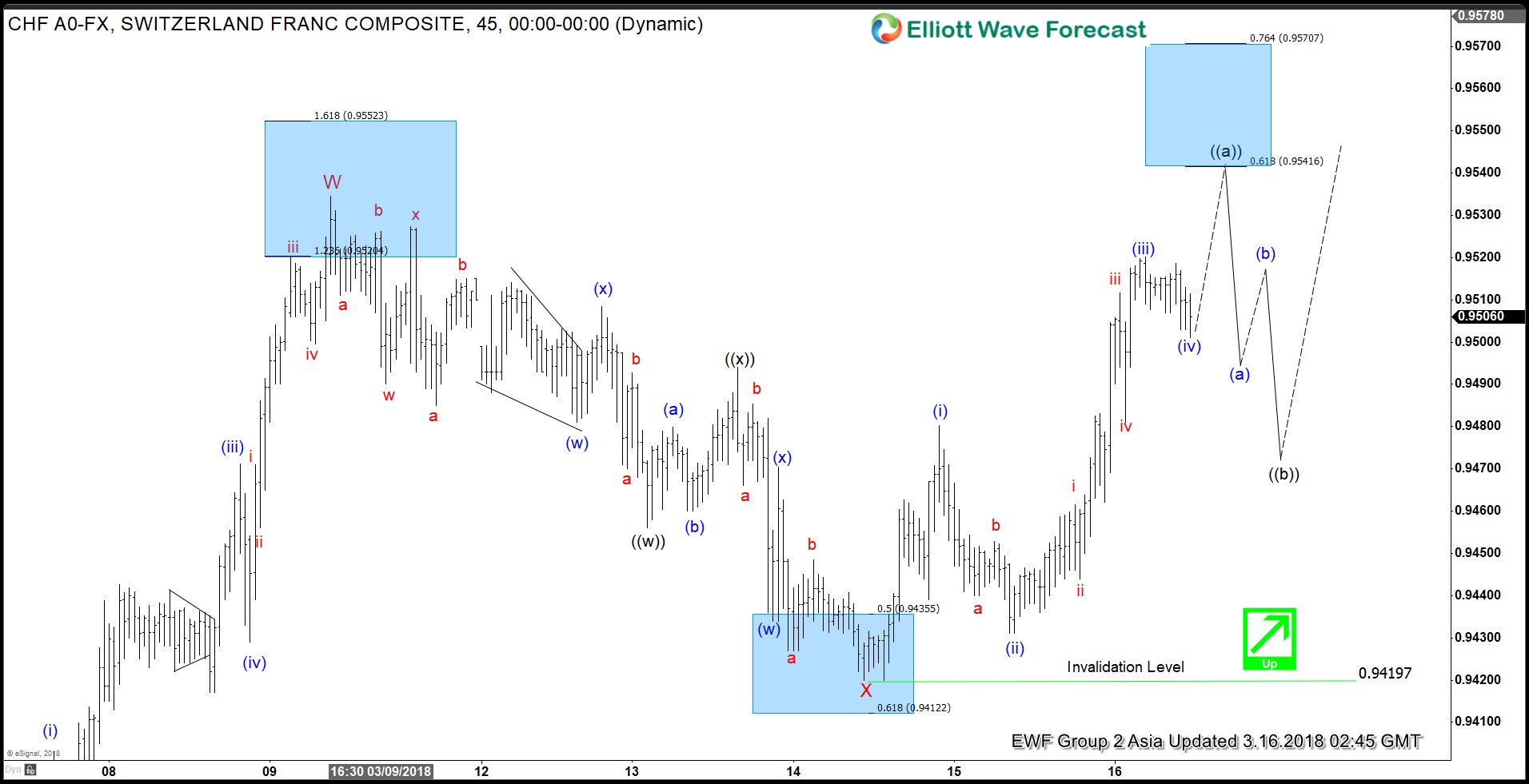

$USDCHF Elliott Wave Analysis: More Upside While Above 0.942

Read More$USDCHF Elliott Wave view suggests that the rally from 3.5.2018 low (0.9336) is unfolding as a double three Elliott Wave structure where Minor wave W ended at 0.9535. Below from here, Minor wave X ended at 0.942 and the internal subdivision unfolded as a smaller degree double three Elliott Wave structure. Down from 0.9535, Minute wave […]