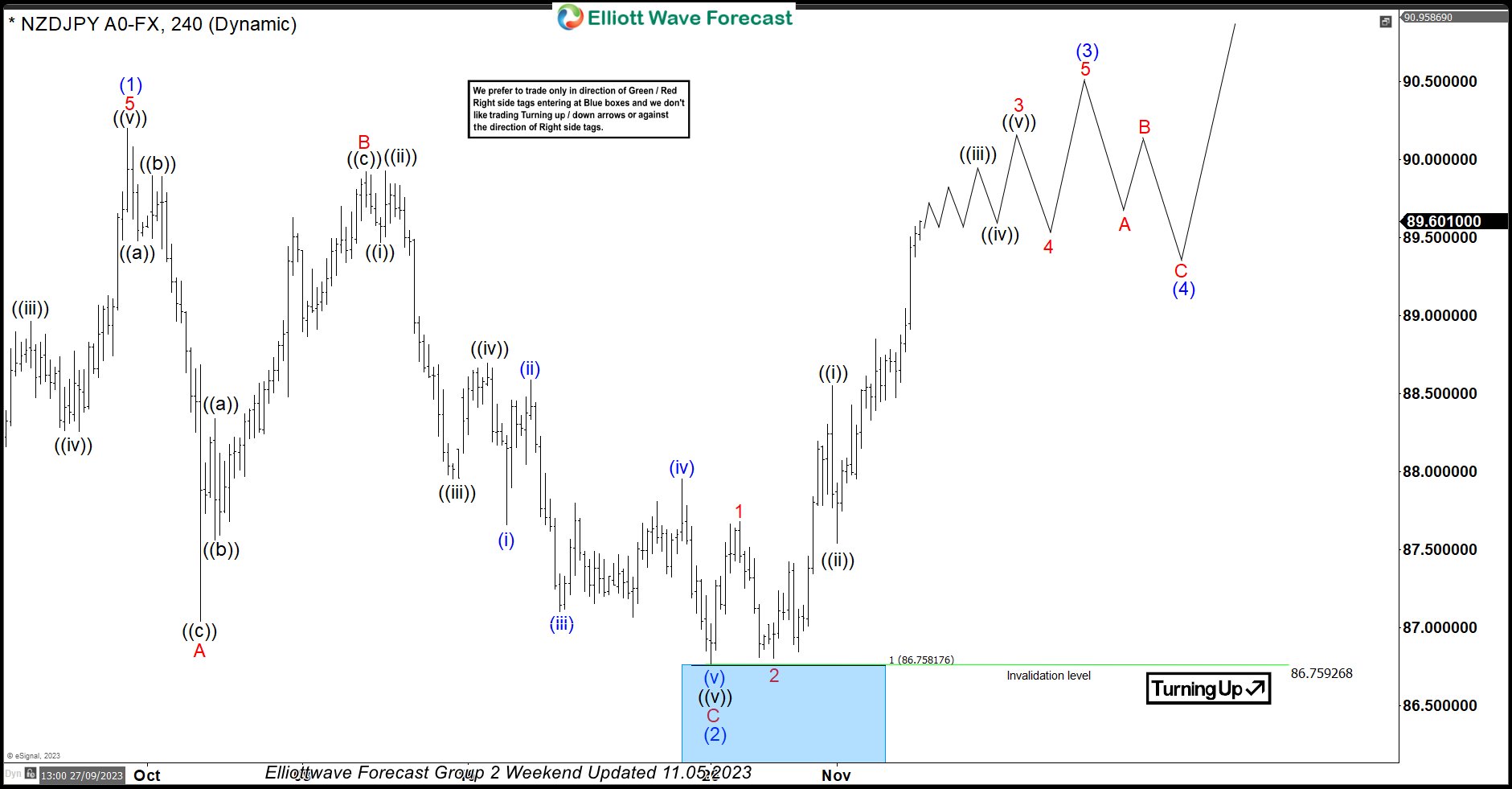

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

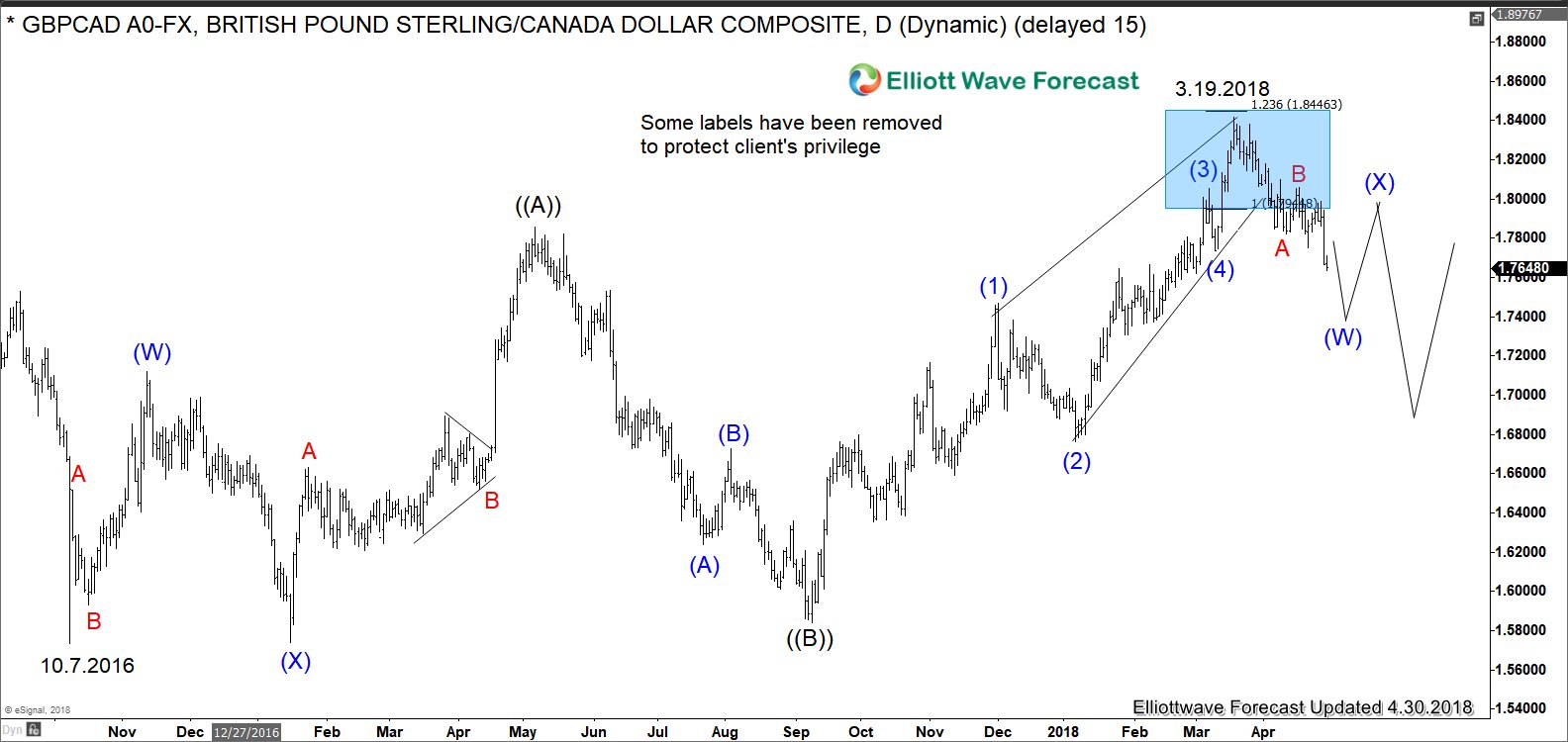

Successful NAFTA Renegotiation May Support Loonie

Read MoreBank of Canada on Holding Cycle due to NAFTA’s Downside Risk Bank of Canada has signaled it’s not in a rush to pursue aggressive interest rate hikes. The Bank cited one of the reasons as NAFTA’s downside risk. With the U.S. threatening to withdraw from NAFTA, it could push up cost, prices, and hurt economic […]

-

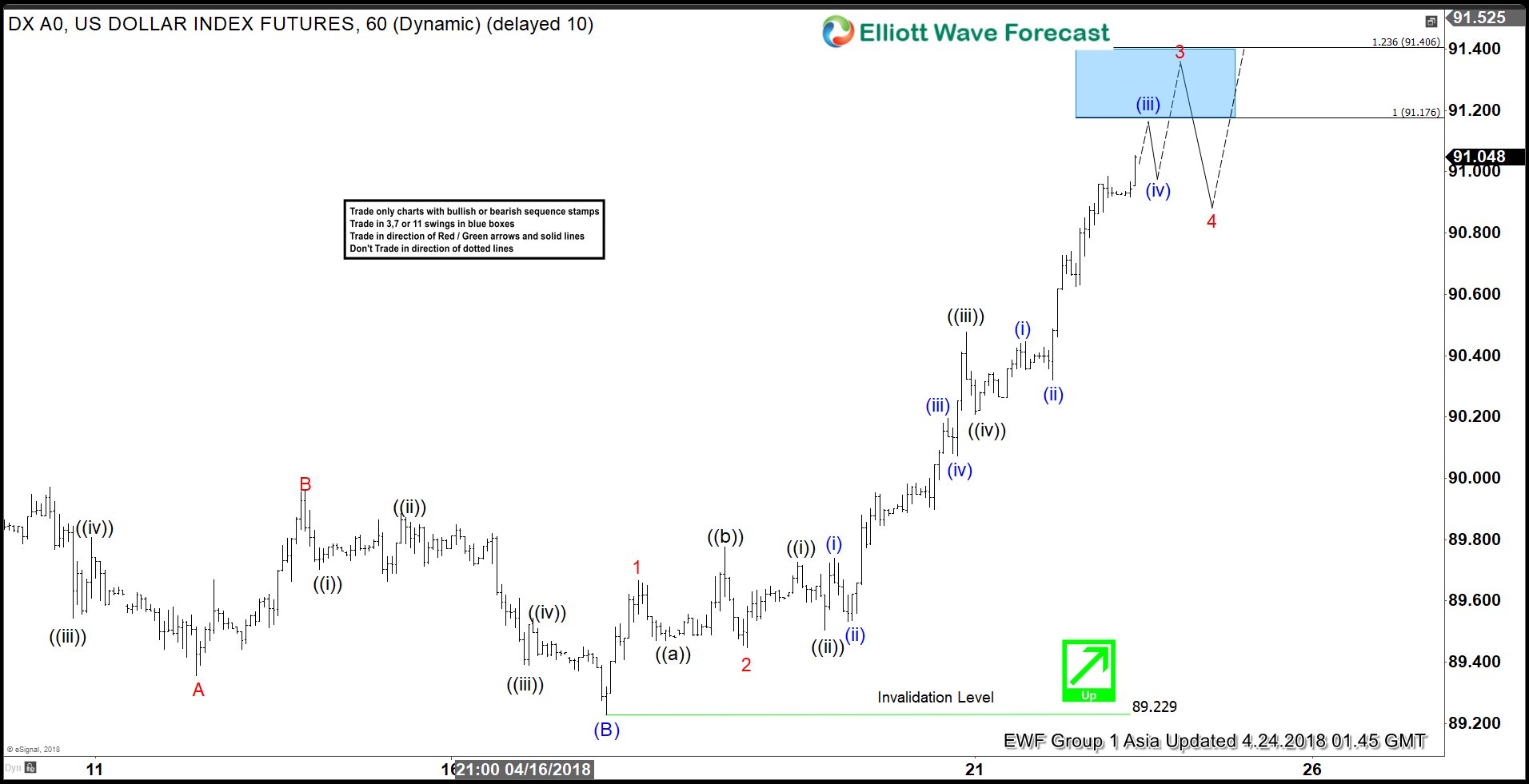

Elliott Wave Analysis: USDX Calling For More Upside

Read MoreUSDX Elliott Wave view in short-term cycle suggests that the decline to 89.22 low on 4.17.2018 ended as a Zigzag correction in Intermediate wave (B). Above from there, the rally is unfolding as 5 waves Impulse Elliottwave structure looking to extend higher 1 more leg in Minor wave 5 at least before ending the 5 waves structure. Above […]

-

EURUSD: Is History Repeating Itself?

Read MoreIn this Blog, we will have a look at the bigger picture of EURUSD pair. One of the reasons why retail traders fail in trading is because they stick to one time frame, analyse that and trade that accordingly. However, traders with this approach will not last long in this business. One of the key elements […]

-

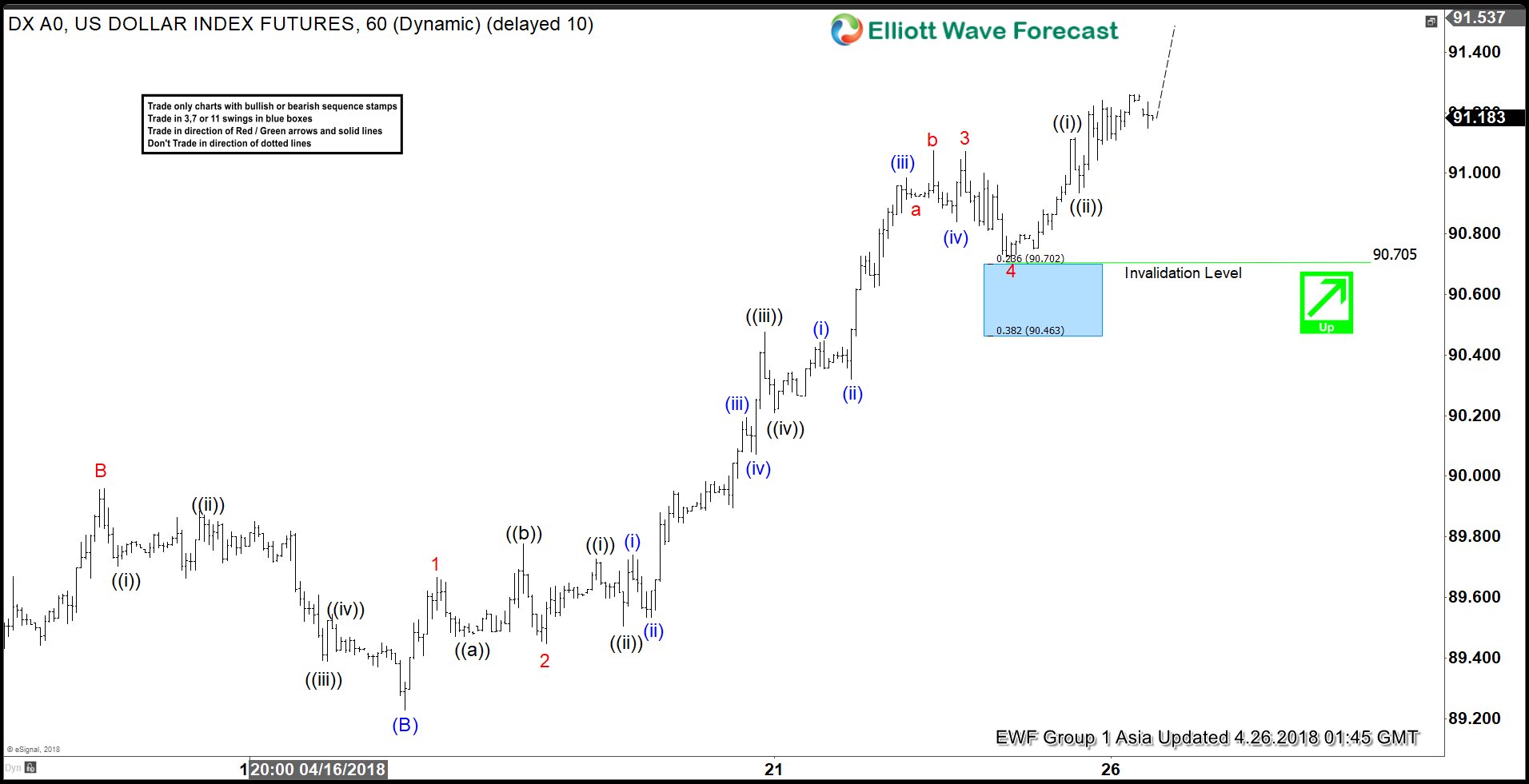

USDX Elliott Wave View: Extending Higher As Impulse

Read MoreUSDX Elliott Wave view in short-term cycle suggests that the decline to 89.22 ended Intermediate wave (B) as Elliott Wave Zigzag correction. Above from there, Intermediate wave (C) remains in progress as Elliott Wave Impulsive sequence with extension looking for further extension higher. The internal distribution of each leg consists of 5 waves structure with […]

-

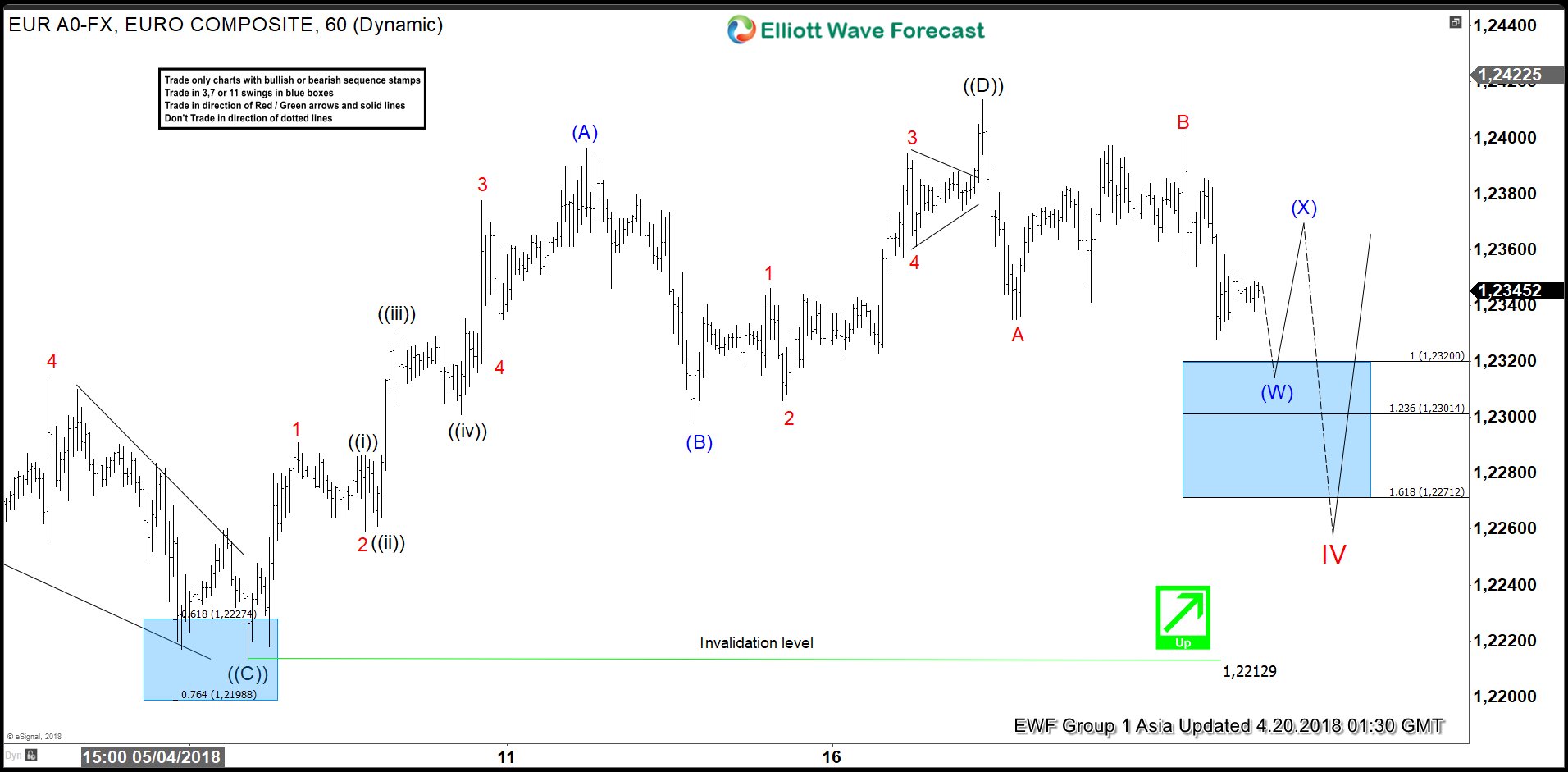

EURUSD Elliott Wave View: Still Trading Sideways

Read MoreShort-term EURUSD Elliott Wave view suggests that the pair remains in a sideways triangle range between 1.2554 and 1.2153 levels as mentioned in the previous post here. Until we break out of the range, we look for the sideways price action to continue. Triangle doesn’t have any particular trend, but it is generally a continuation […]

-

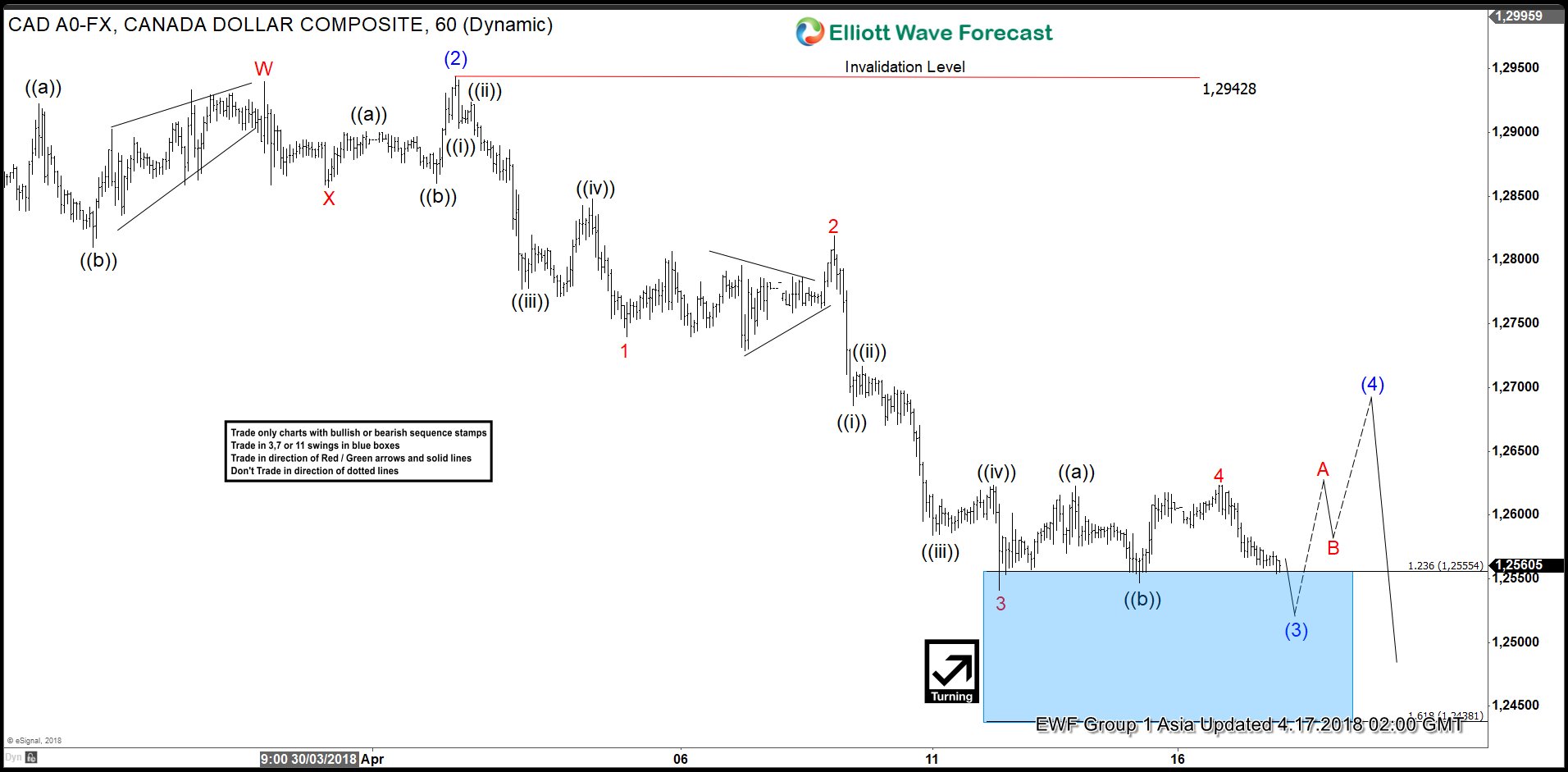

USDCAD Elliott Wave View: Calling Intraday Bounce

Read MoreUSDCAD Elliott Wave short-term view suggests that the bounce to 1.2942 high ended Intermediate degree wave (2). Then the decline from there is unfolding in an impulse sequence with an internal sub-division of each leg lower is showing 5 waves structure thus favored it to be an impulse. Below from 1.2942 high, Intermediate wave (3) […]