In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

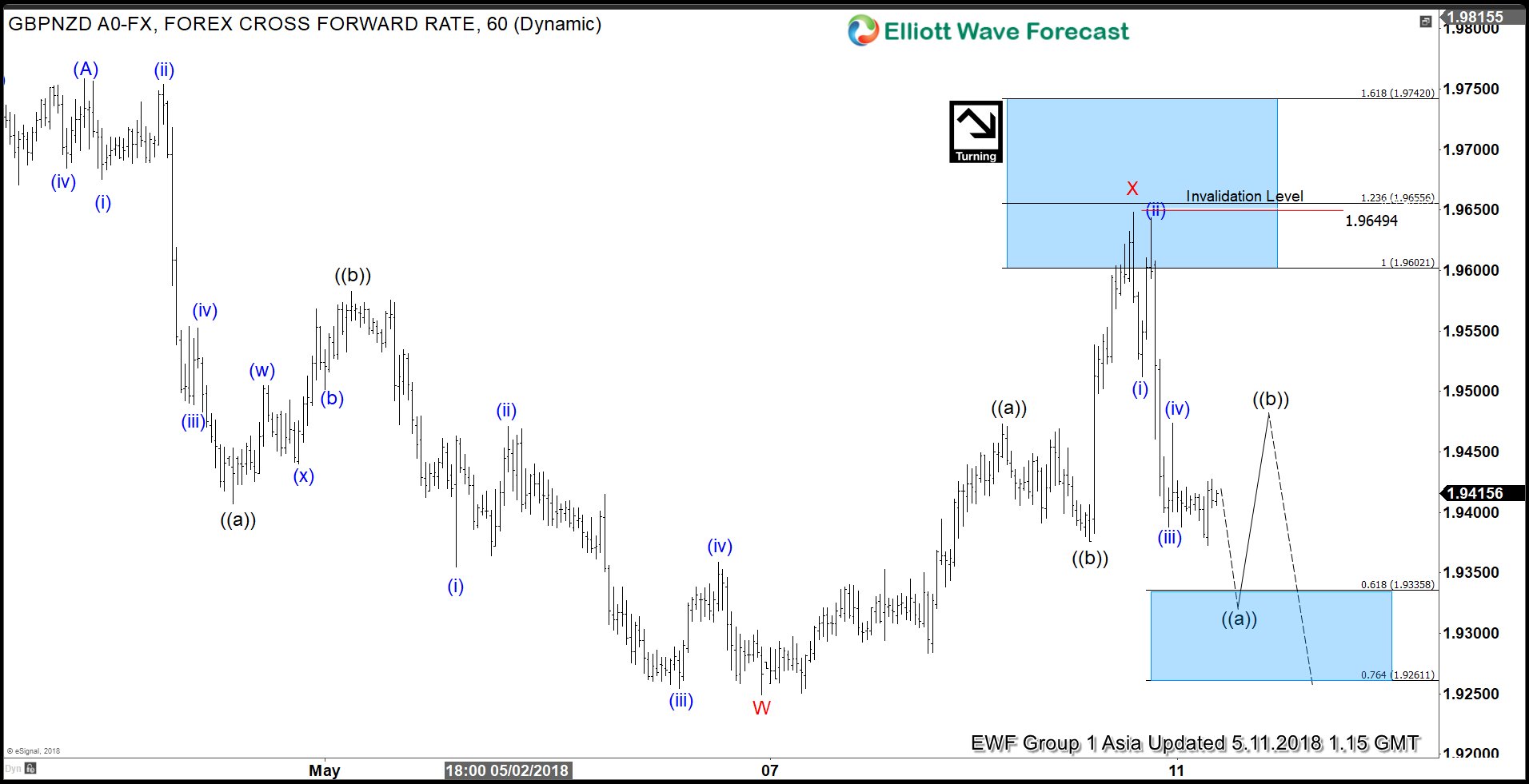

GBPNZD Elliott Wave View: Ending an Impulse Move

Read MoreGBPNZD short-term Elliott wave view suggests that the rally to 1.9758 on 4/26 high ended Intermediate wave (A). Down from there, Intermediate wave (B) remains in progress as a double three Elliott Wave structure. The internals of each leg in double three (WXY) sub-divides into 3 waves corrective sequence and usually is the combination of two […]

-

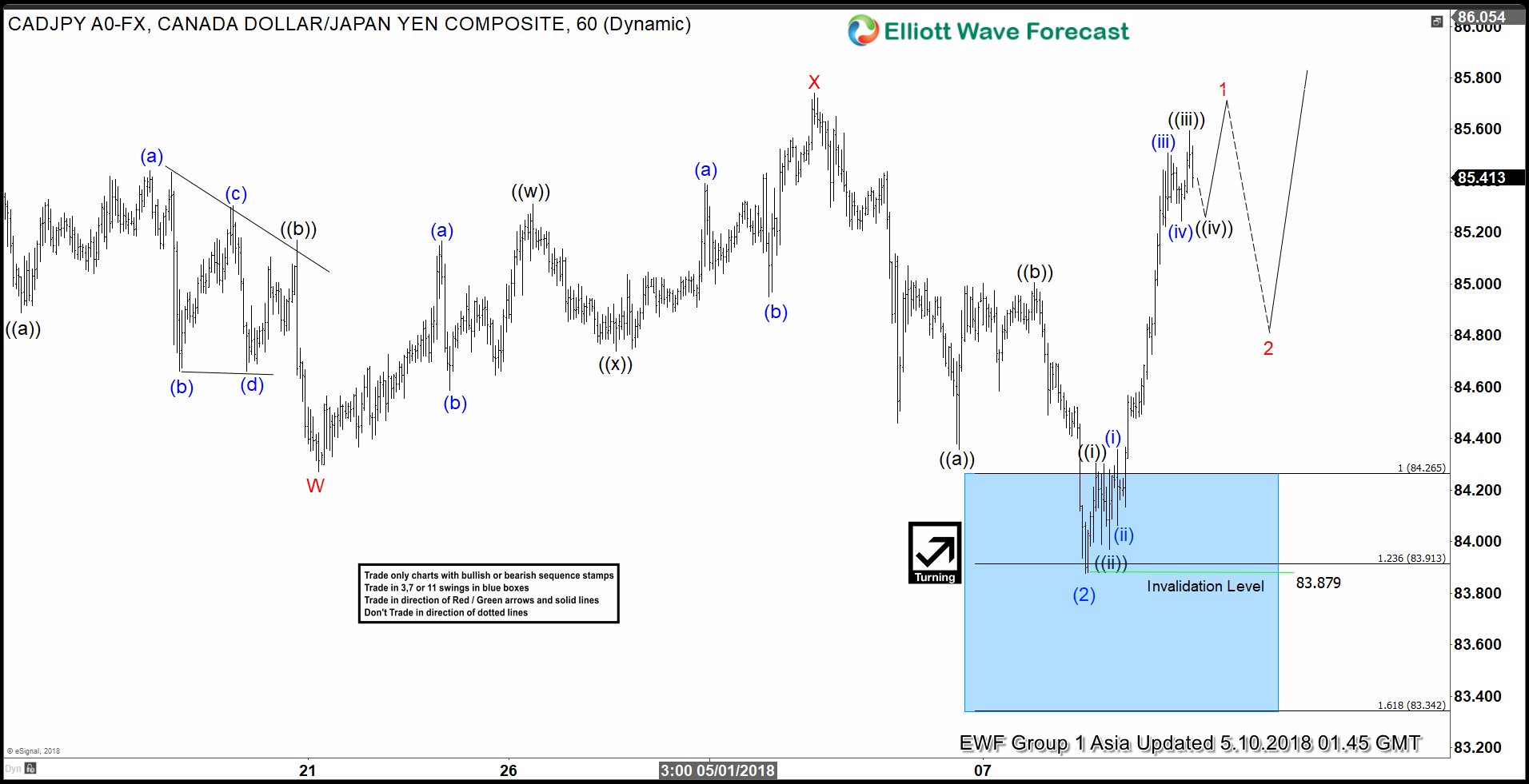

CADJPY Elliott Wave View: Calling Strength Higher

Read MoreCADJPY Short Term Elliott Wave view suggests that the decline from 4/13 peak at 85.76 to 83.87 low ended Intermediate wave (2) as a double three Elliott Wave structure. The internal subdivision of the decline from 85.76 high shows an overlapping structure. This suggests the decline is corrective in nature. We label the correctin as W-X-Y. […]

-

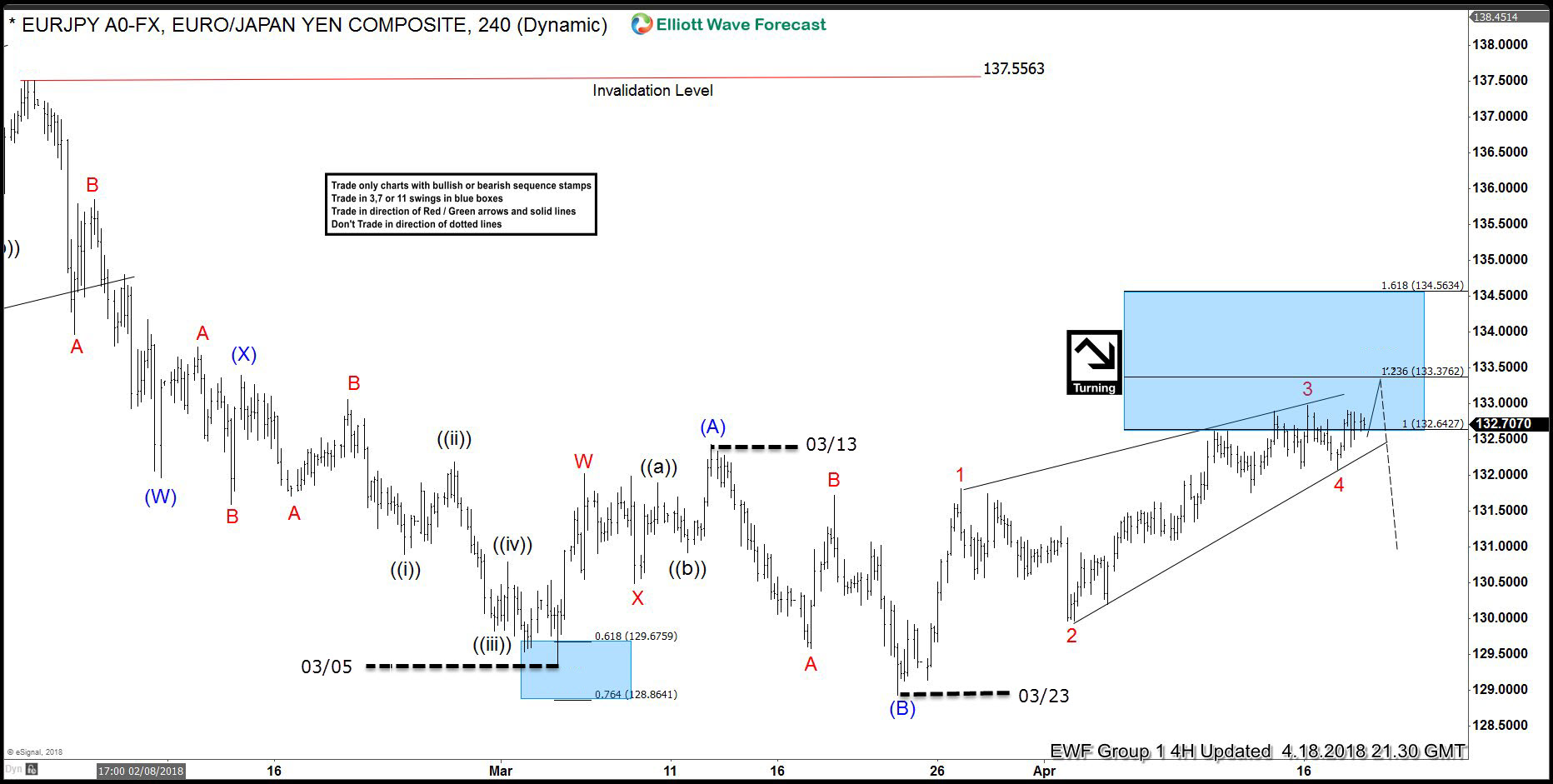

EURJPY Forecasting The Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURJPY published in members area of the website. As our members know, the pair has been trading lately within Elliott Wave Flat structure. In further text we’re going to explain the forecast and Elliott Wave […]

-

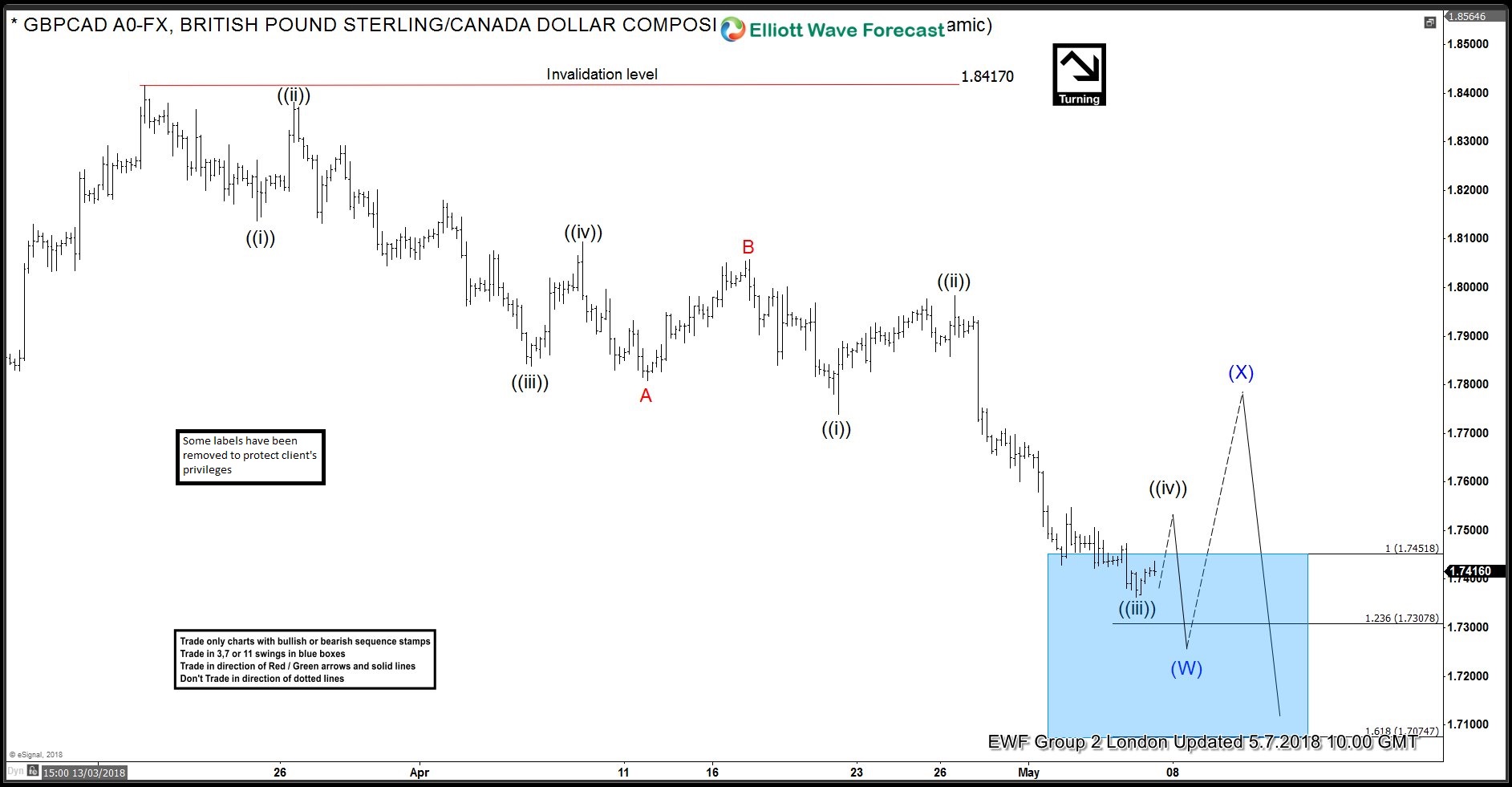

GBPCAD Elliott Wave View: Calling The Bounce Soon

Read MoreGBPCAD Elliott wave view in shorter cycles suggests that the decline from 3/19/2018 high 1.8417 is unfolding as a Zigzag structure in intermediate wave (W) lower. The internals of a zigzag structure unfolds with sub-division of 5-3-5 wave structure when wave A & C consists of 5 waves structure, which can be labeled as impulse […]

-

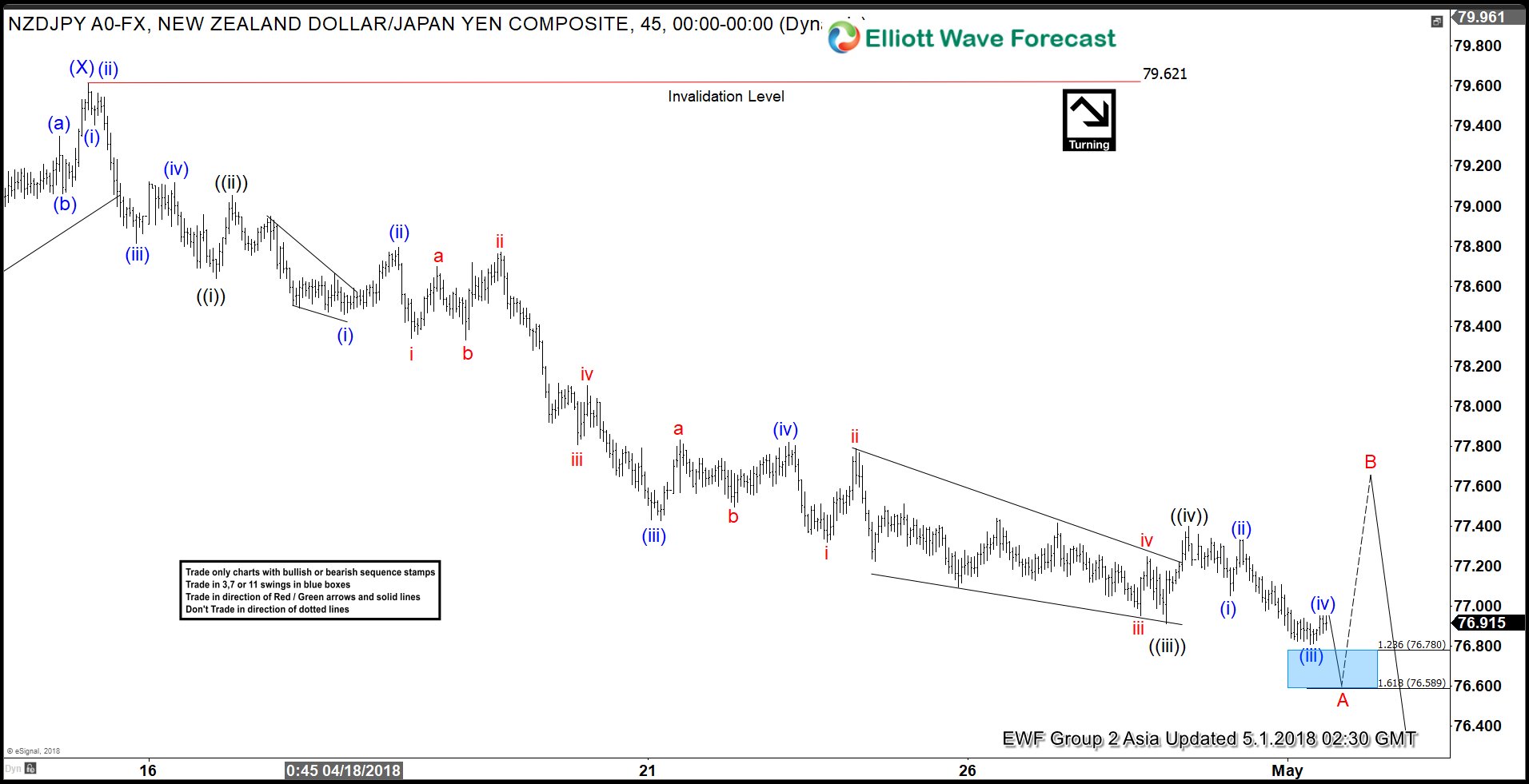

NZDJPY Elliott Wave View: Impulse Sequence In Progress

Read MoreNZDJPY Elliott Wave view in short-term cycles suggests that the bounce to 79.62 high ended Intermediate wave (X). Down from there, Intermediate wave (Y) remains in progress as a Zigzag Elliott Wave structure in which the first leg of the zigzag (Minor wave A) is unfolding as an impulse Elliott Wave structure looking to see another push lower before […]

-

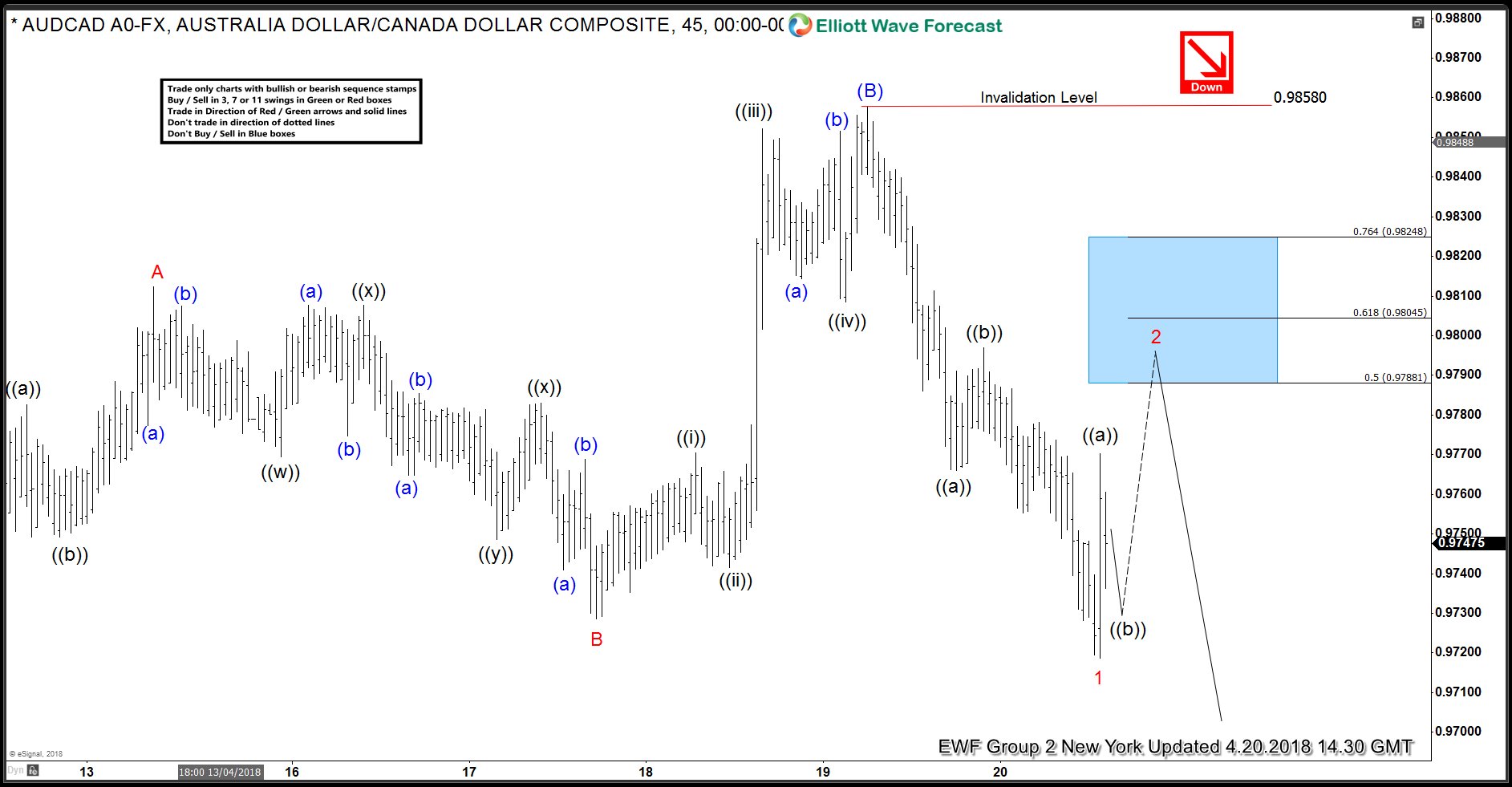

AUDCAD Forecasting the Decline & Selling the Rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDCAD published in members area of the website. On April 20th, the pair broke 04/12 low and open further extension to the downside. Mentioned broke made cycle from the March 13th peak incomplete and the […]