In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

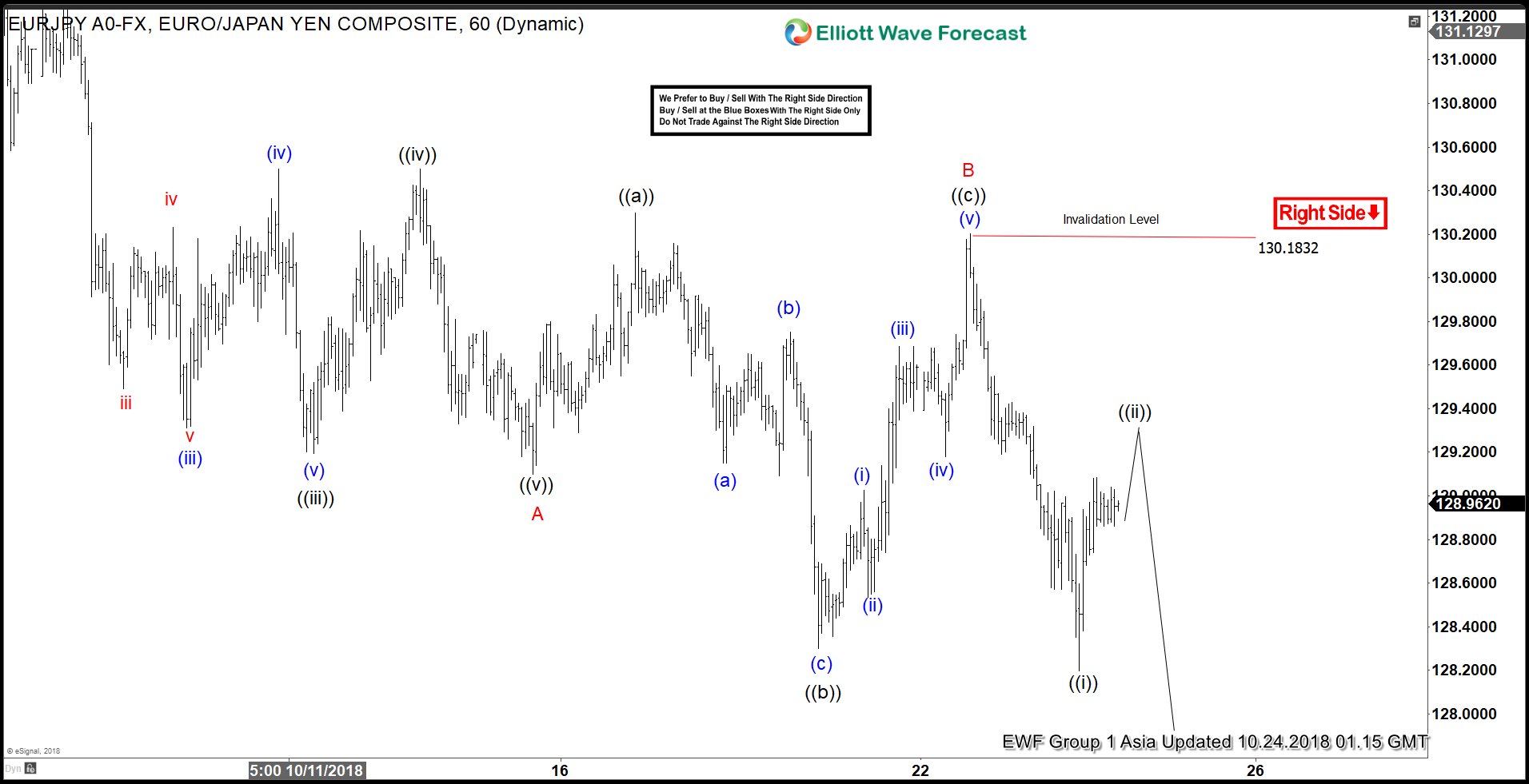

EURJPY Elliott Wave Analysis: More Downside Expected

Read MoreEURJPY short-term Elliott wave analysis suggests that the decline to 129.13 low ended Minor wave A. The internals of that decline unfolded in 5 waves impulse structure in a lesser degree cycle. Thus suggests that the pair can be doing a Zigzag correction lower. Up from there, a bounce to 130.18 high ended Minor wave […]

-

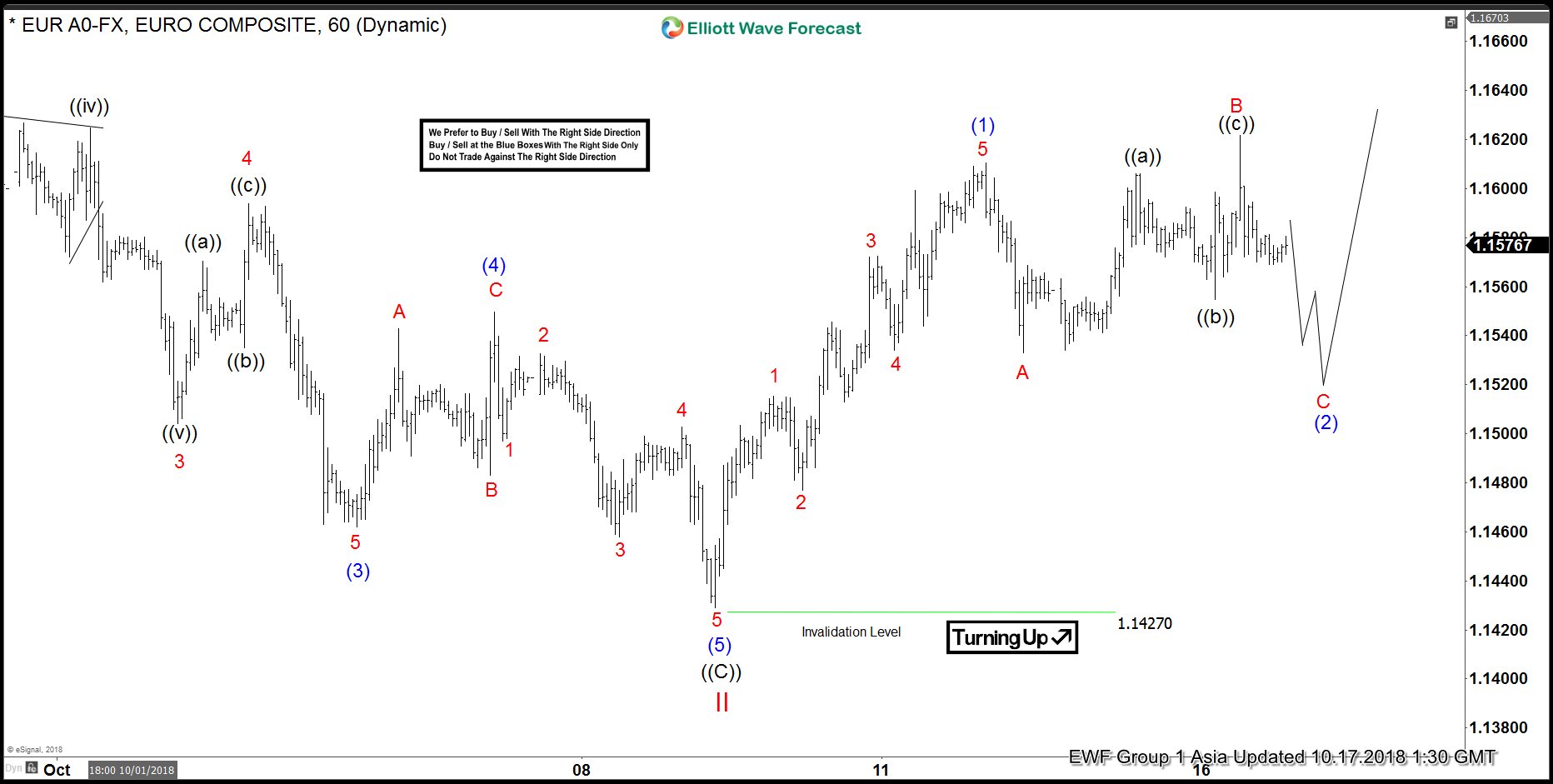

EURUSD Elliott Wave: Ready For Next Leg Higher

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1427 low ended cycle degree wave II pullback. The internals of that pullback unfolded as a Flat structure which ended the correction against 8/15/2018 low. Up from 1.1427 low, the pair is expected to resume the next leg higher in cycle degree wave III. The […]

-

AUDUSD: Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD published in members area of the website. As our members know, AUDUSD has incomplete bearish sequences in the cycle from the January 2018 peak. Price structure suggests that the pair is targeting 0.6938 area as […]

-

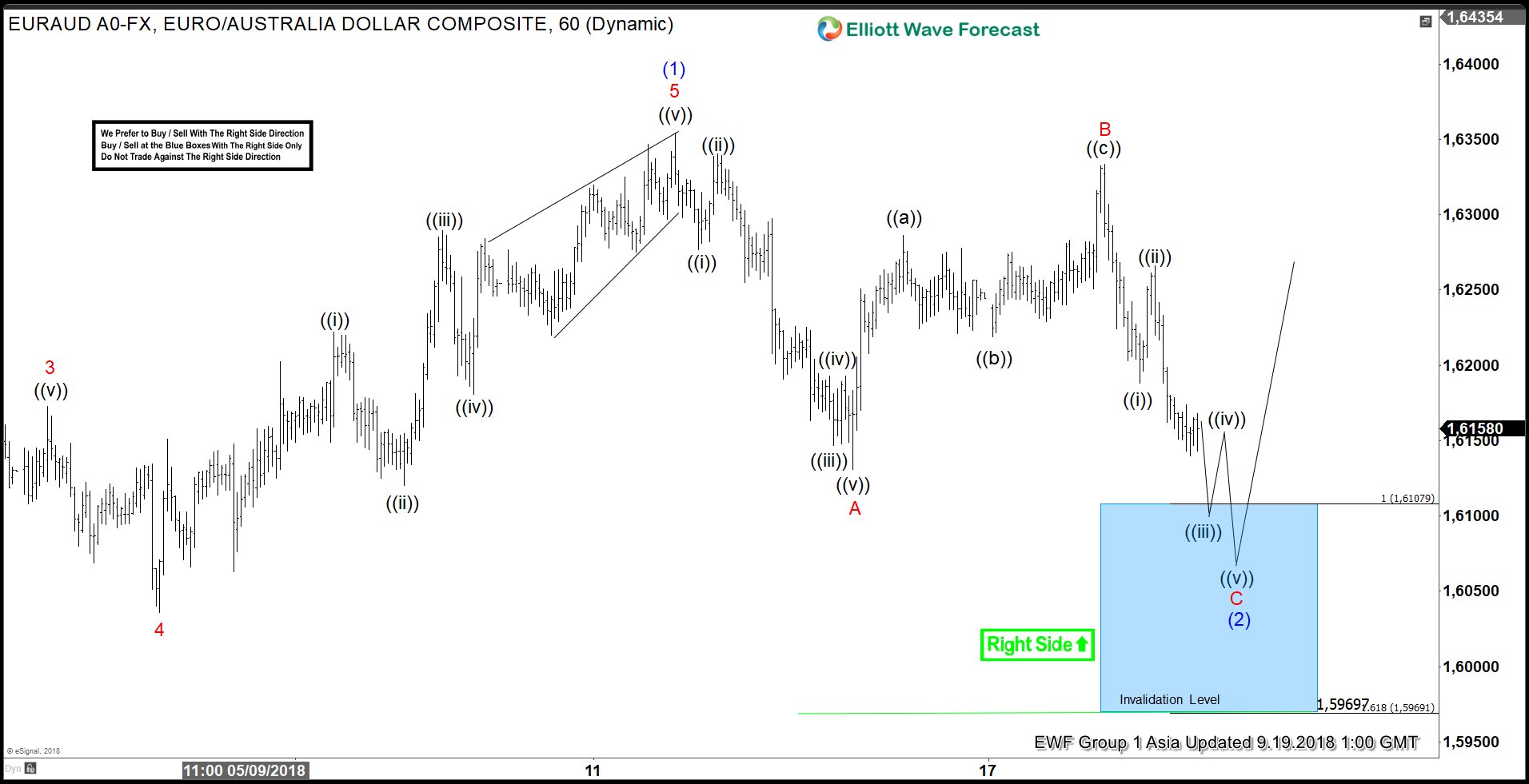

EURAUD Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is EURAUD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURAUD published in members area of the website. As our members know, EURAUD has incomplete bullish sequences. Break of March 28th peak has made cycle from […]

-

AUDUSD Bearish Sequence Support More Downside

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7316 high ended intermediate wave (X). Down from there, intermediate wave (Y) remain in progress as a zigzag structure. Where initial decline to 0.7049 low ended in 5 waves impulse structure & also completed the Minor wave A lower. Also, it’s important to note that […]

-

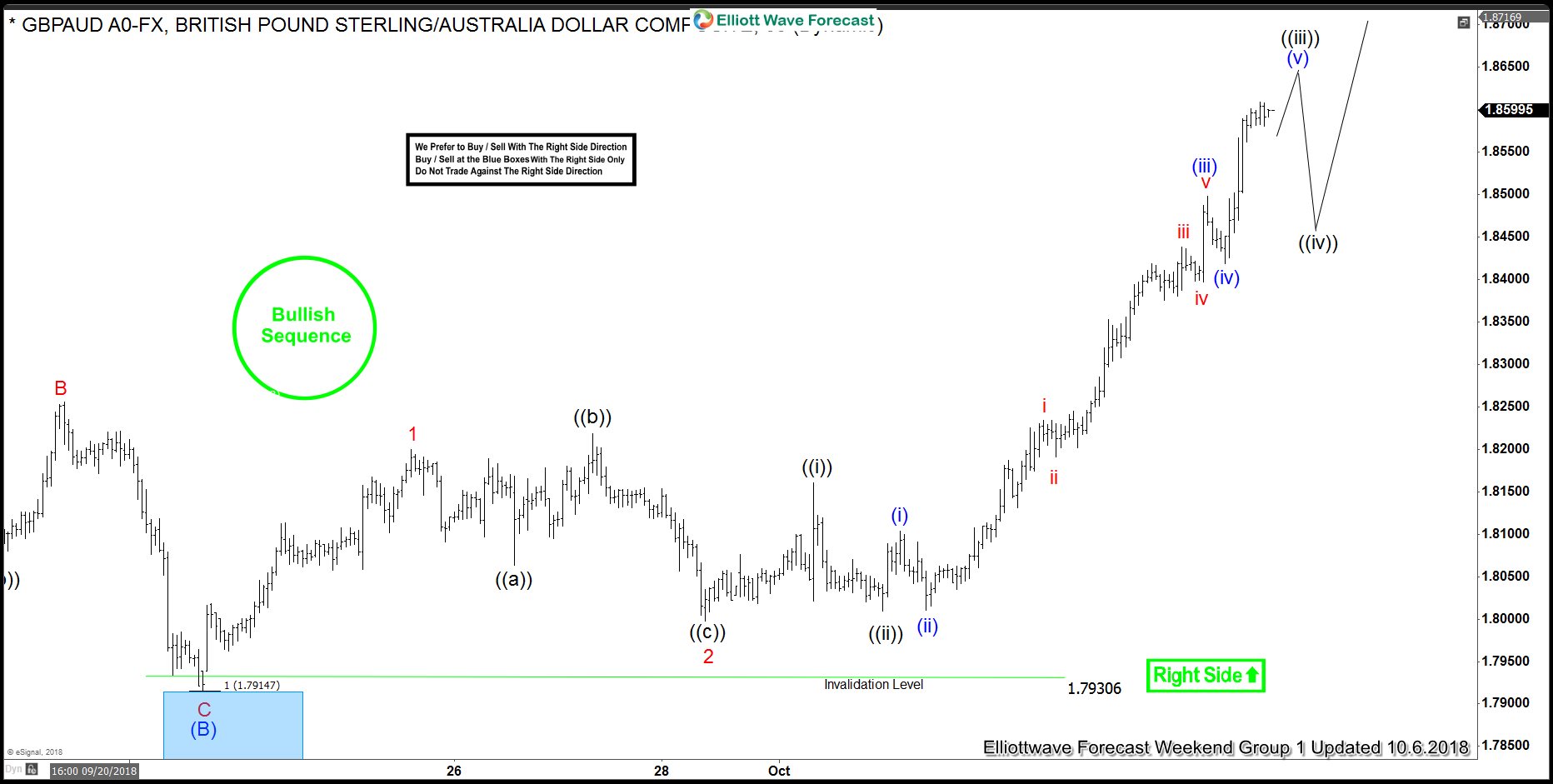

Prospect of Brexit Deal Supports Poundsterling

Read MoreThe UK is going to leave the EU on 29 March 2019. However, currently the EU and UK have not reached agreement on the Irish border issue. In the last few years, the potential for no Brexit deal has given pressure to Poundsterling. But last week, Poundsterling surged higher against other major currencies as EU’s […]