In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

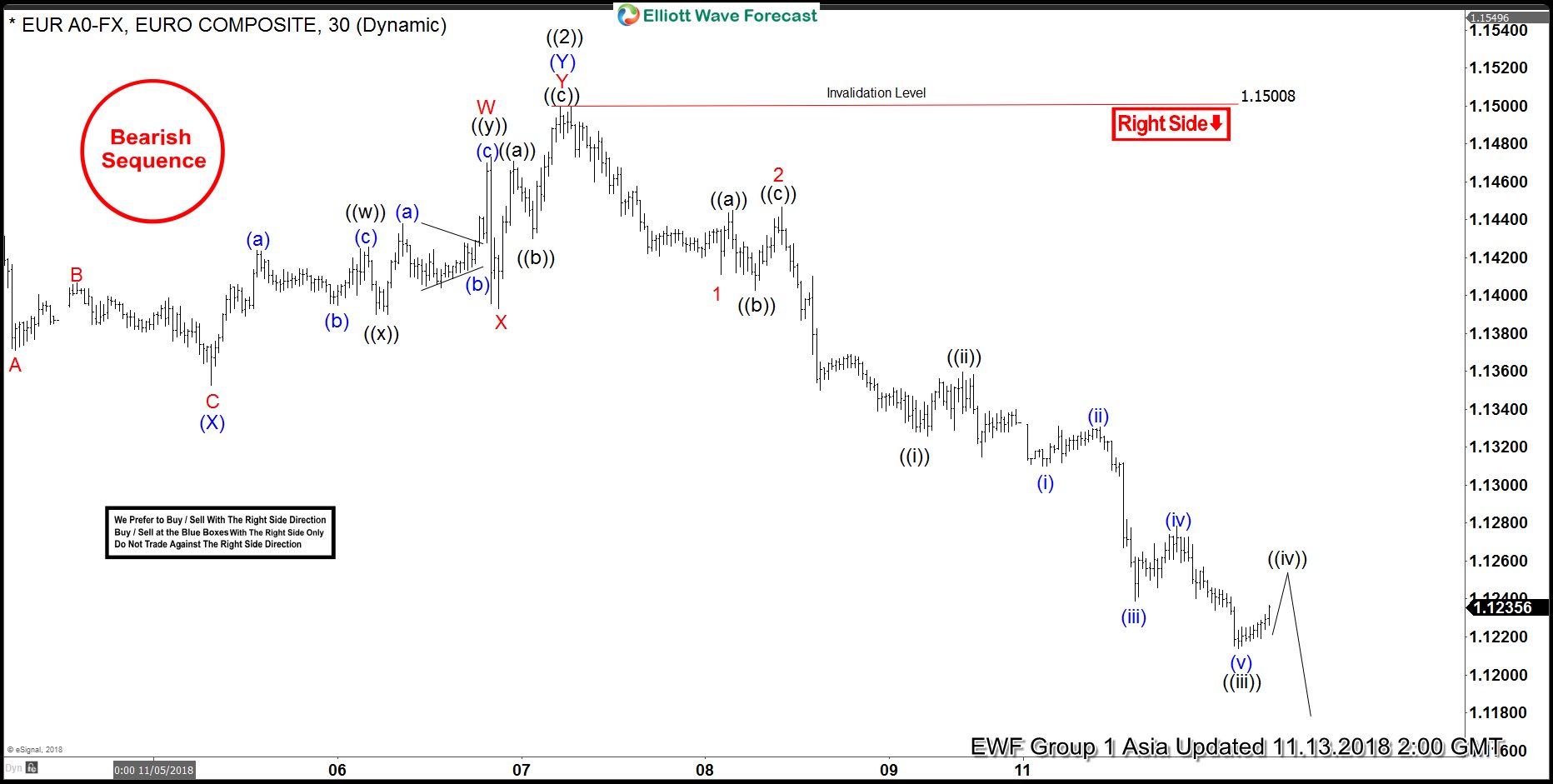

Elliott Wave Analysis: Further Downside Expected in EURUSD

Read MoreEURUSD has broken below Nov 1 low (1.13) and now the pair shows a 5 swing bearish sequence from Sept 24 high (1.1815), favoring further downside. Short term Elliott Wave view suggests that the move higher to 1.15 ended wave ((2)) in Primary degree. Internal of wave ((2)) unfolded as a double three Elliott Wave […]

-

Elliott Wave Analysis: GBPJPY in Correction Before Next Leg Higher

Read MoreShort Term Elliott wave view in GBPJPY suggests that the decline to 142.77 ended wave (2) in Intermediate degree. Up from there, the pair rallies as an impulse and ended Minor wave A at 149.49. Minor wave B pullback is currently in progress to correct cycle from Oct 26 low (142.77) before the next leg […]

-

EURGBP Found Sellers After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURGBP published in members area of the website. We’ll explain the Forecast and the Price Structure. As our members know EURGBP has ended April 2018 cycle at the 0.90976 peak. We were calling for pottential turn lower […]

-

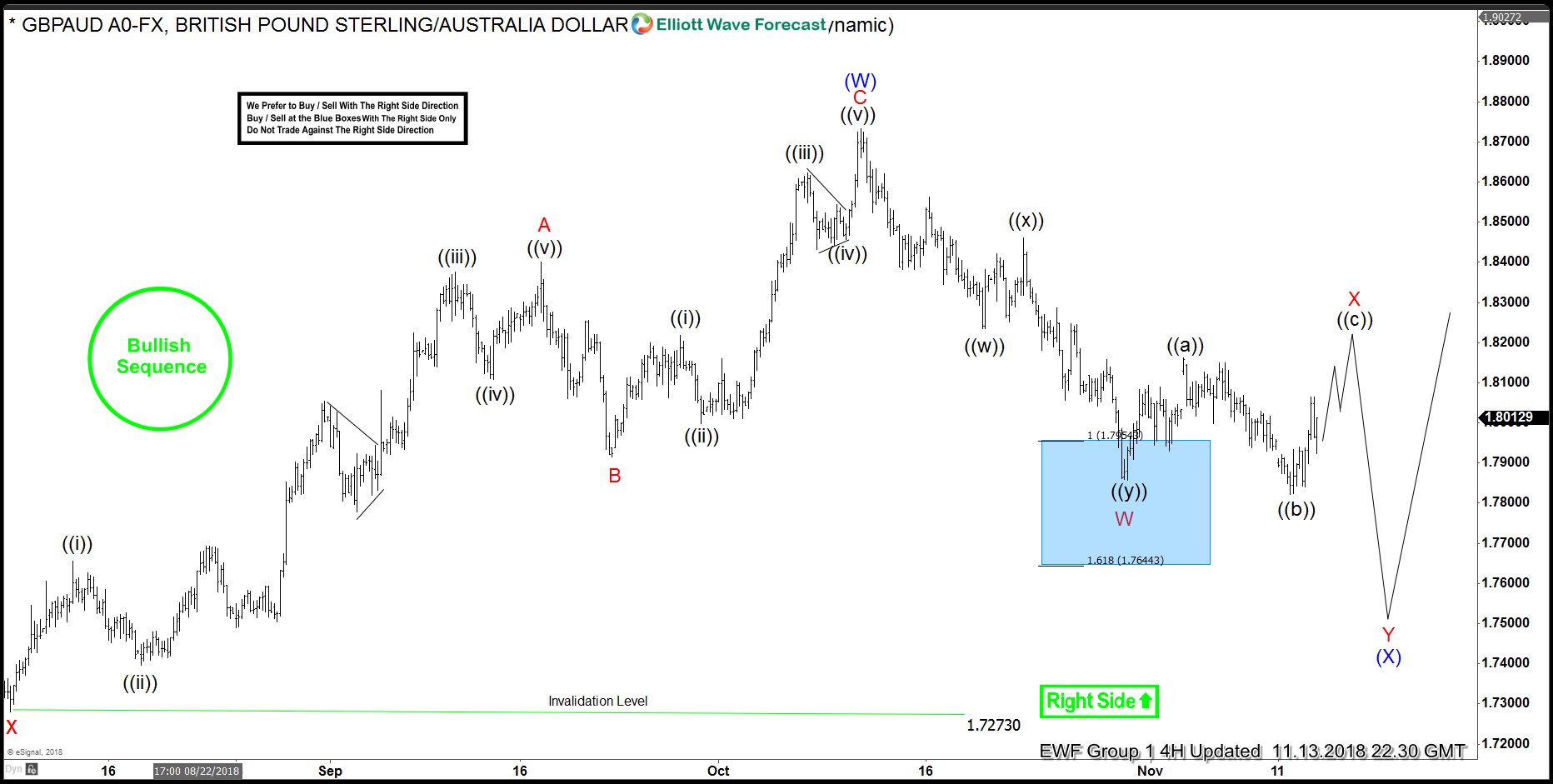

Brexit Progress May Turbocharge Poundsterling

Read MoreThere’s no question the most important risk event and near term key driver for Poundsterling remains to be Brexit. This month may shape up to be an important week for Poundsterling as Prime Minister Theresa May’s Cabinet discusses about it throughout the month of November. The Sunday Times reports last weekend that Mrs. May has […]

-

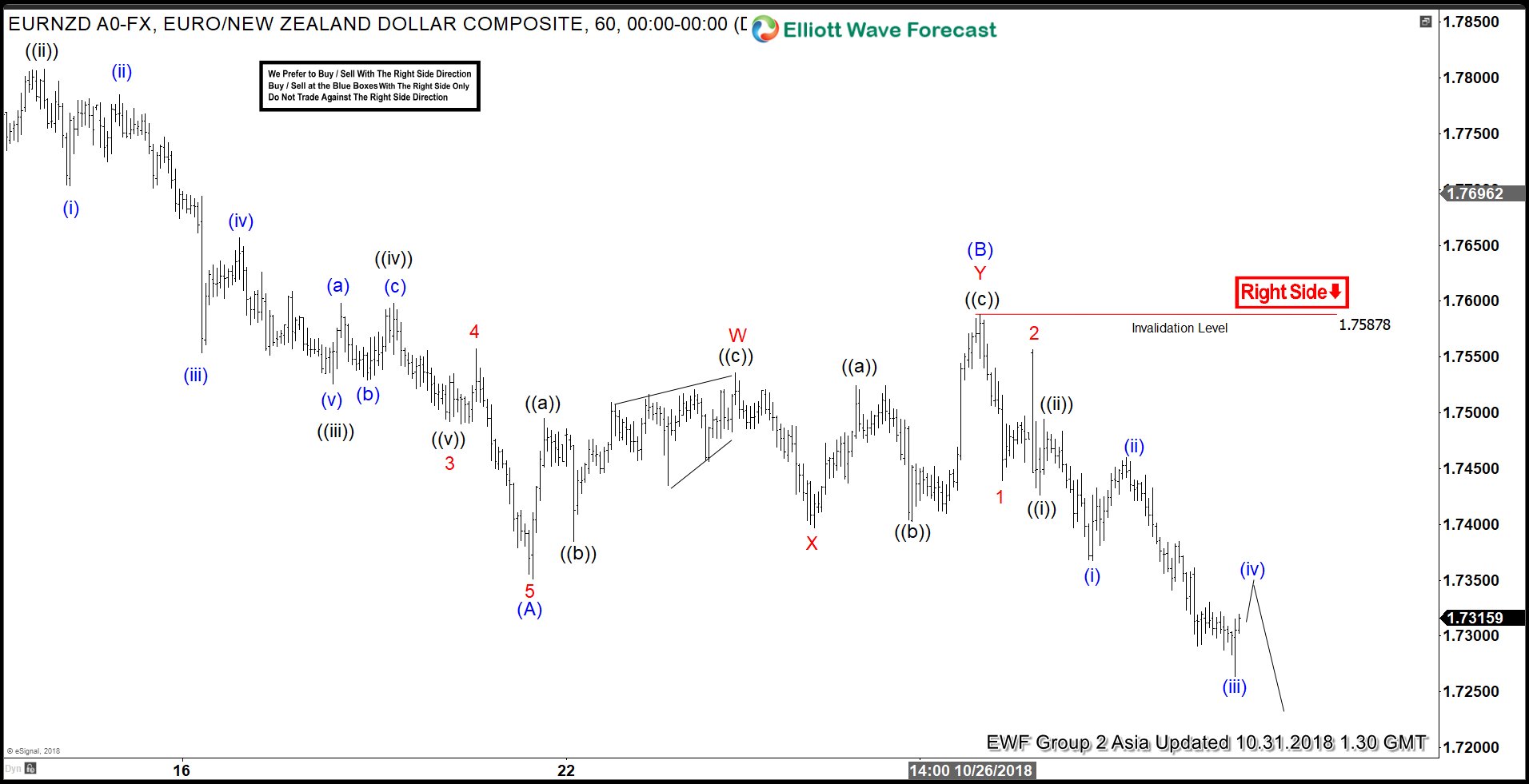

EURNZD: Elliott Wave Showing Incomplete Sequence

Read MoreEURNZD short-term Elliott wave analysis suggests that the decline from 10/08/2018 peak is unfolding as Zigzag structure. Where a bounce to 1.7881 high ended Minute wave ((ii)), Minute wave ((iii)) ended in lesser degree 5 waves at 1.7528 low. Minute wave ((iv)) ended at 1.7596 high. And Minute wave ((v)) ended at 1.7493 low which […]

-

BTCUSD Soon To Break Sideways Consolidation?

Read MoreBitcoin ticker symbol: BTCUSD short-term Elliott wave view suggests that instrument is trapped in a sideways price action since August 2018 lows. Which suggests that pair can be doing a bearish triangle structure. Where lesser degree price action shows Minutte wave (b) ended at 6656.63 as a bearish triangle. Down from there, Minutte wave (c) ended […]