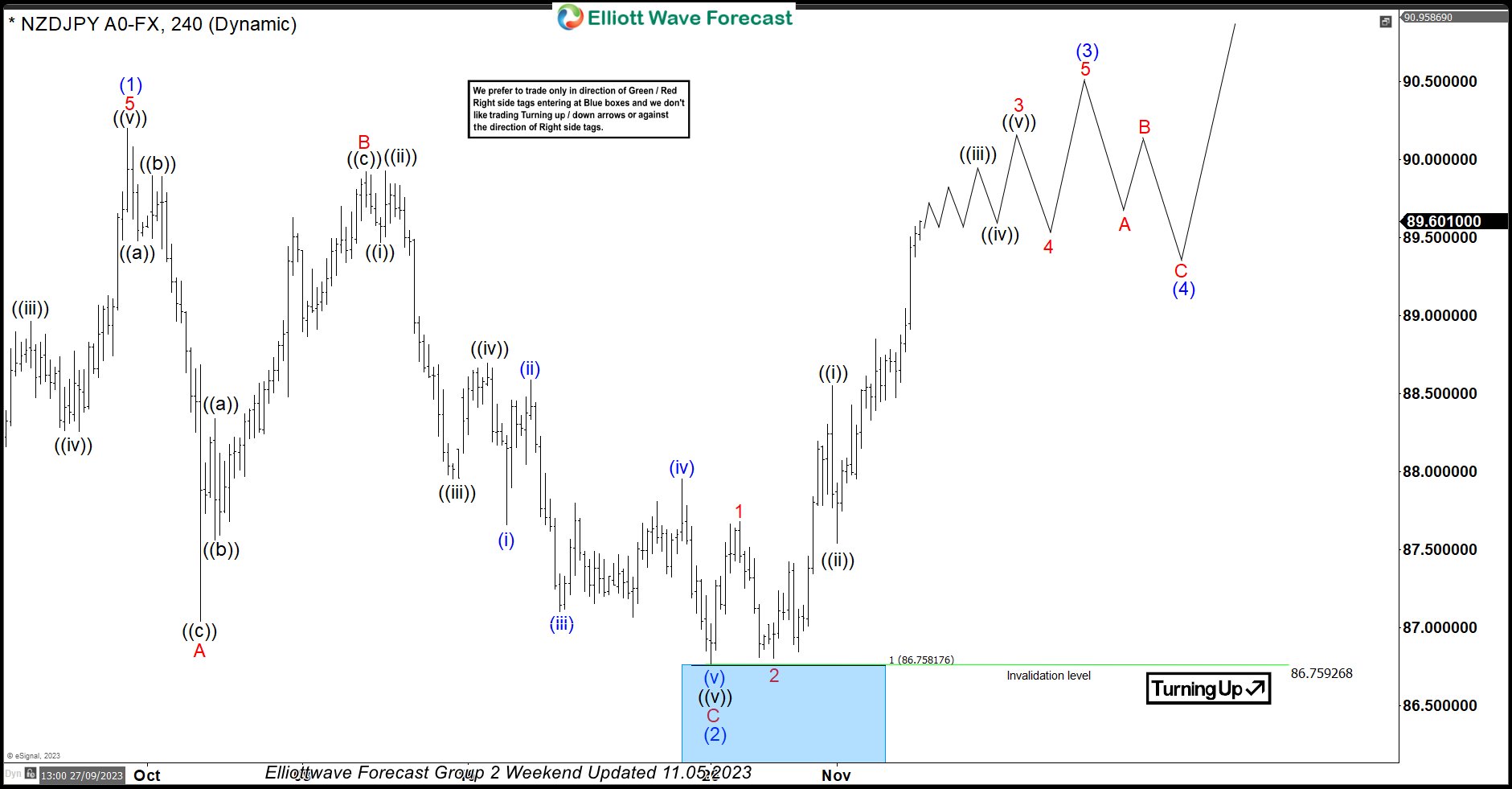

In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

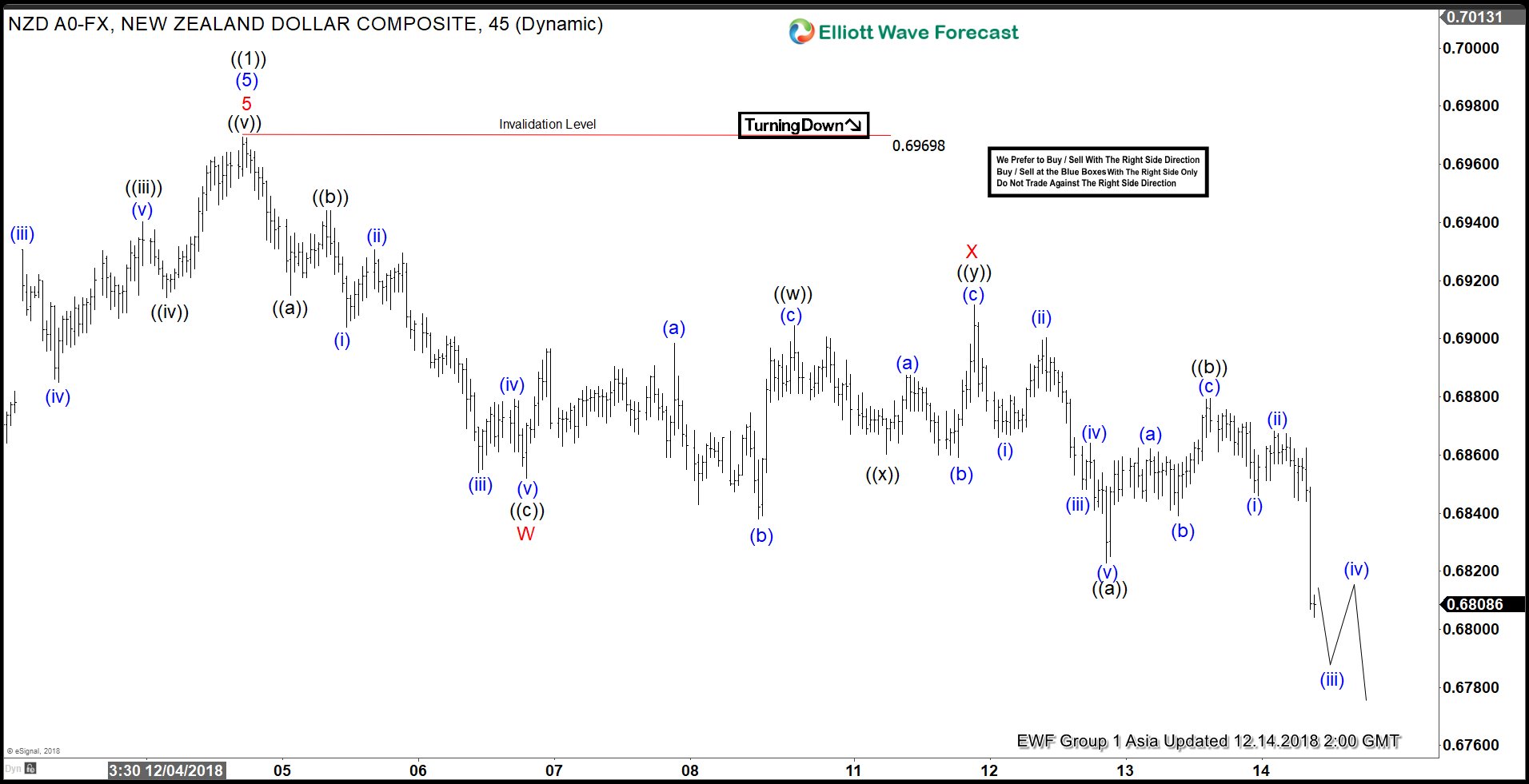

Elliott Wave View: NZDUSD Pullback In Progress

Read MoreShort Term Elliott Wave view suggests that cycle from Oct 8 low (0.642) has ended at 0.697 high as Primary wave ((1)). Pair is now in the process of correcting the rally from Oct 8 low in 3, 7, or 11 swing within Primary wave ((2)). Decline from 0.6968 is unfolding as a double three […]

-

Elliott Wave View Suggests Bitcoin Selloff Not Over

Read MoreShort Term Elliott Wave view suggests that the selloff in Bitcoin is not yet over. Rally to $4409.77 ended Intermediate wave (X). Down from there, the decline is unfolding as a double three Elliott Wave structure where Minor wave W ended at $3210. Internal of Minor wave X unfolded also as a double three Elliott […]

-

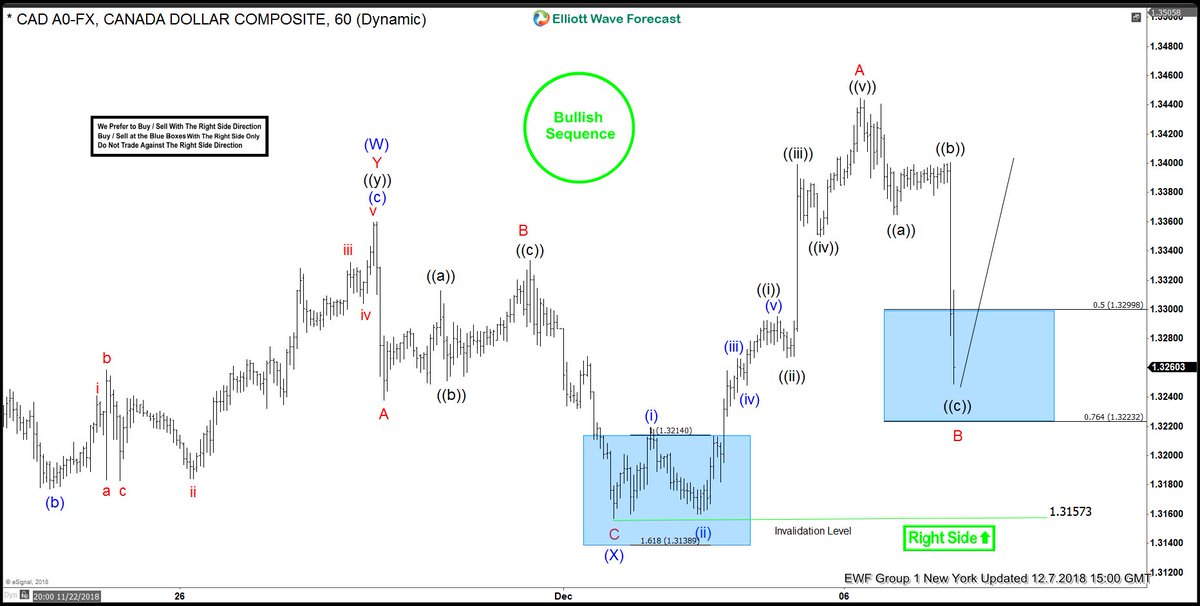

USDCAD Buying The Elliott Wave Dips

Read MoreIn this technical blog, we are going to take a look at the past performance of USDCAD, 1 hour Elliott Wave charts that we presented to our clients. We are going to explain the structure and the forecast below. USDCAD 1 Hour Elliott Wave Chart From 12/06/2018 Above is the 1 hour Chart from 12/06/2018 Asia update, […]

-

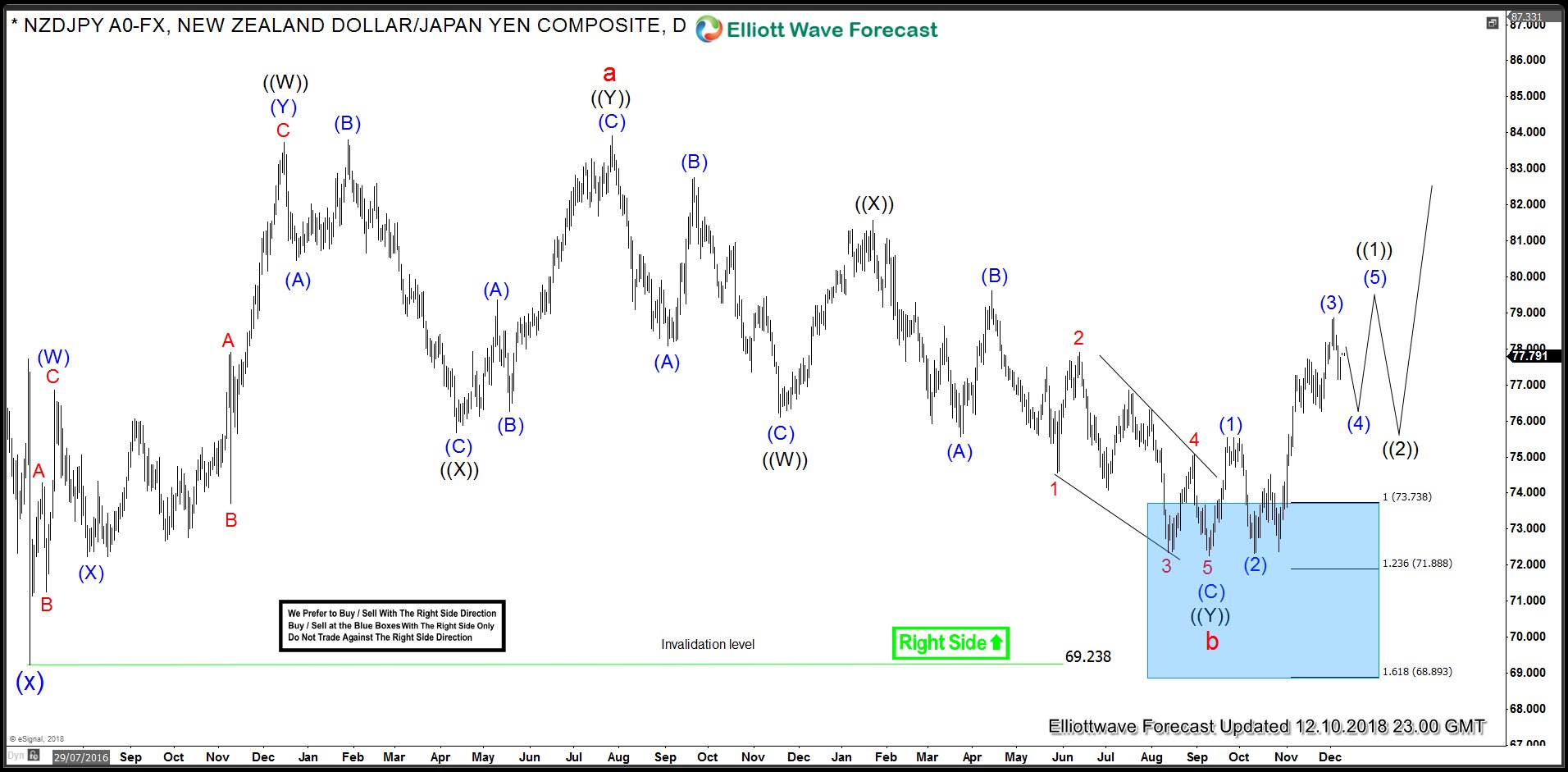

NZDJPY Blue Box Generates 600 Pips

Read MoreNZDJPY has put in a strong rally over the past couple of months gain 9.14% from a low of 72.25 to a high of 78.86. Earlier this year, we advised clients and followers that pair was reaching an inflection area between 73.70 – 68.86 and pair should find a low in this area and start […]

-

Elliott Wave View Supporting Further Strength in USDCAD

Read MoreUSDCAD has broken above 11/29/2018 high (1.336) as well as above 6/27/2018 high (1.3386) creating incomplete bullish sequence. Short term Elliott Wave view suggests the rally to 1.336 on 11/29 ended Intermediate wave (W) and the pullback to 1.3157 ended Intermediate wave (X). Internal of Intermediate wave (X) unfolded as a zigzag Elliott Wave structure […]

-

Elliott Wave Analysis: Further Weakness Expected in USDJPY

Read MoreShort term Elliott Wave view in USDJPY suggests that cycle from 11/12 peak (114.21) remains in progress as a double three Elliott Wave structure. Down from 114.21, Minute wave ((w)) ended at 112.27 and Minute wave ((x)) bounce ended at 114.03. Internal of Minute wave ((x)) unfolded as a zigzag Elliott Wave structure where Minutte […]