In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

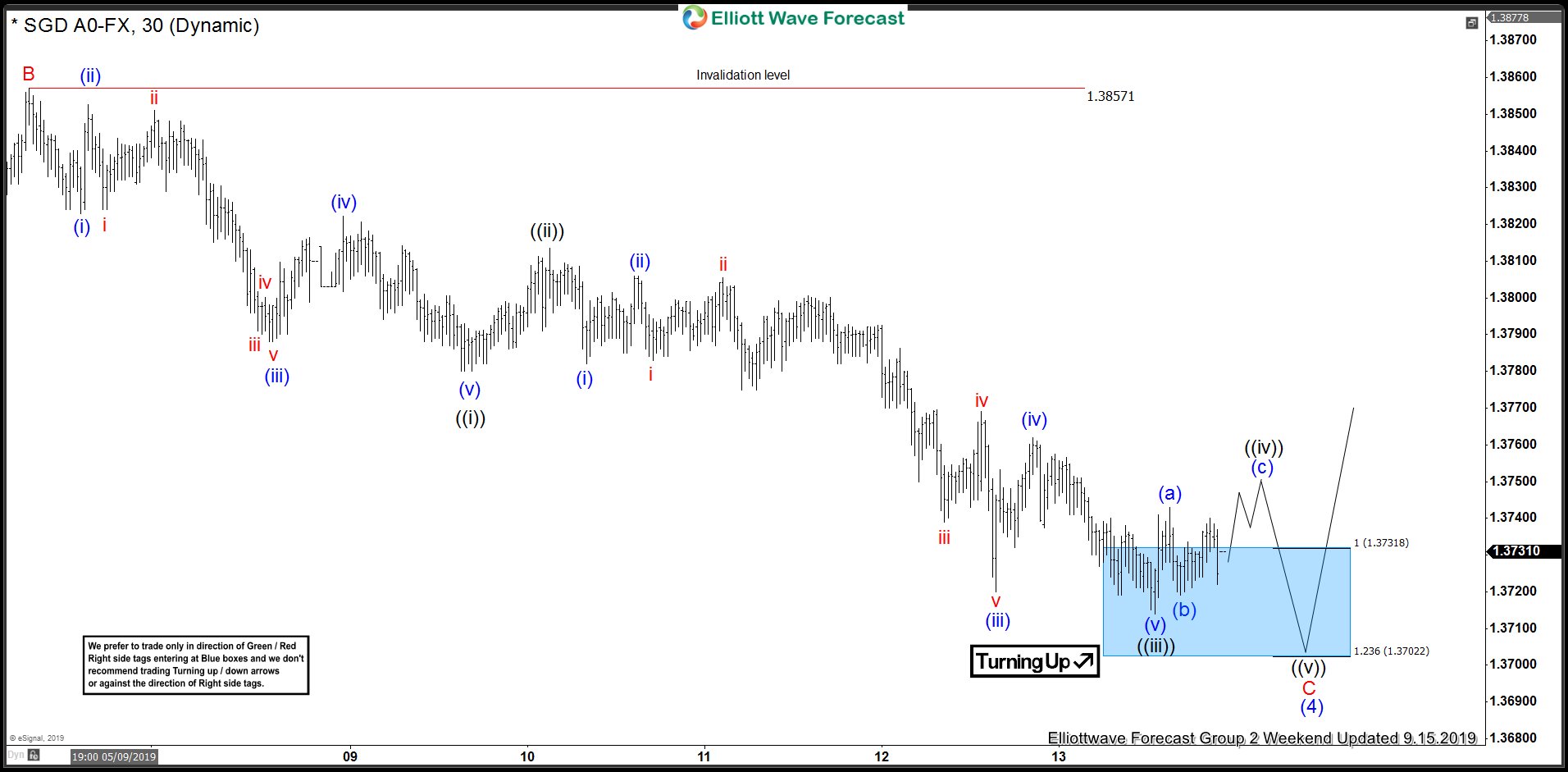

USDSGD Buying Elliott Wave Blue Boxes At Extreme Areas

Read MoreIn this blog, we take a look at the 1 hour Elliott Wave charts performance of USDSGD, which our members took advantage at the blue box extreme areas.

-

Elliott Wave View: Short Term Strength in Bitcoin

Read MoreIn the bigger picture, Bitcoin has been in sideways consolidation since topping out at $13880 on June 26. It did a 3 waves pullback to $9049.54 on July 17 and since then has been sideways. Further correction in larger degree can’t be ruled out as a double zigzag structure from June 26 high, but the […]

-

Euro Fails to Weaken Despite ECB’s Monetary Stimulus

Read MoreLast week, ECB (European Central Bank) decided to reactivate the quantitative easing (QE) programme by €20bn a month. This time the program will be open-ended until Euro Zone’s inflation and growth outlooks return to satisfactory levels. In other words, it’s quantitative easing in perpetuity. ECB said the purchasing will only end shortly before the next rate […]

-

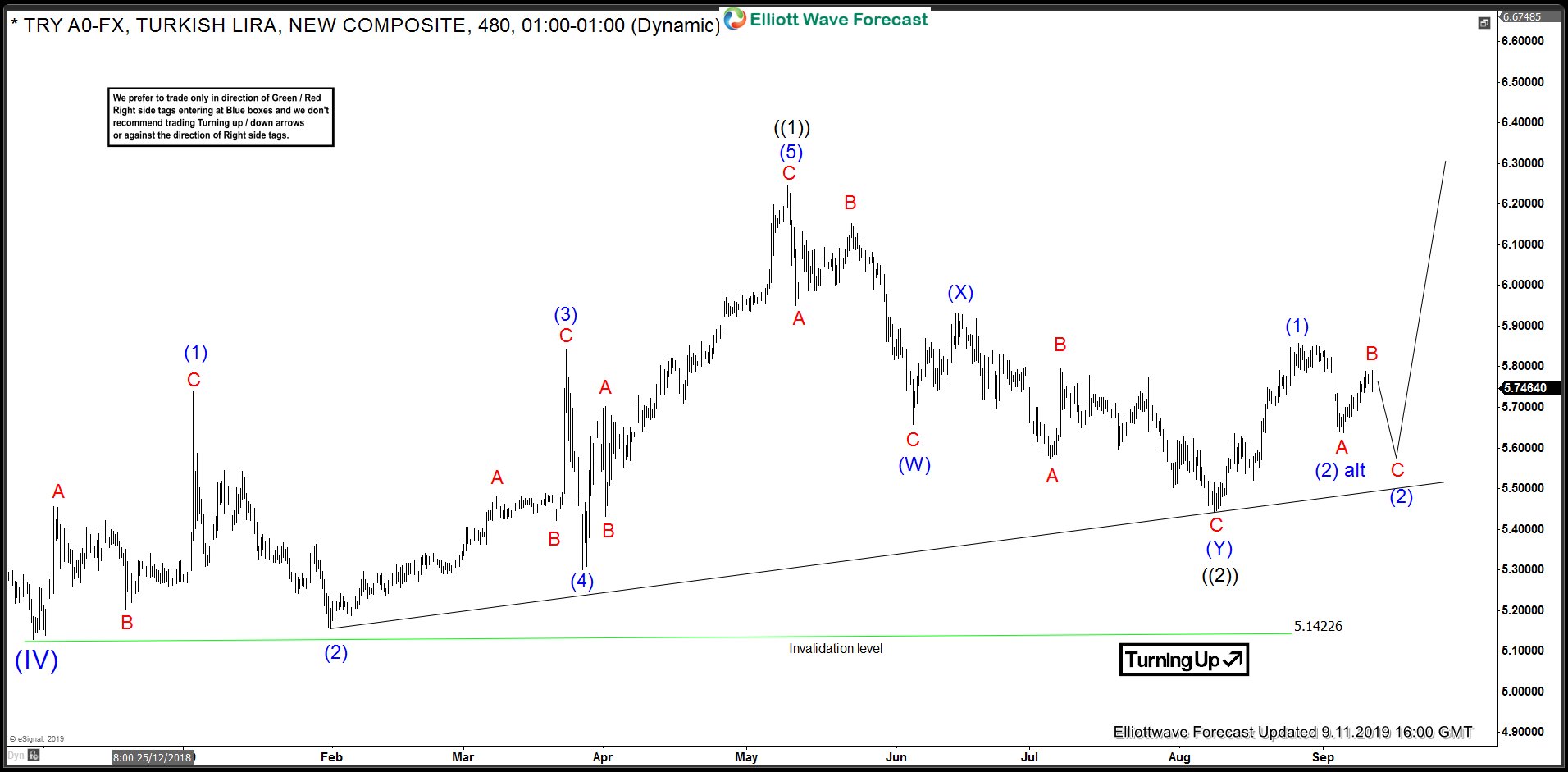

USDTRY Elliott Wave View: Double Three Structure Ended from May

Read MoreWe looked at USDTRY back in June and told the readers that preferred Elliott wave view suggested that cycle from 11/29/2018 low (5.129) ended at 5/9/2019 (6.199) as 11 swings diagonal structure that we labelled as wave (( 1)) and we expected a wave (( 2 )) pull back to unfold as a double three Elliott […]

-

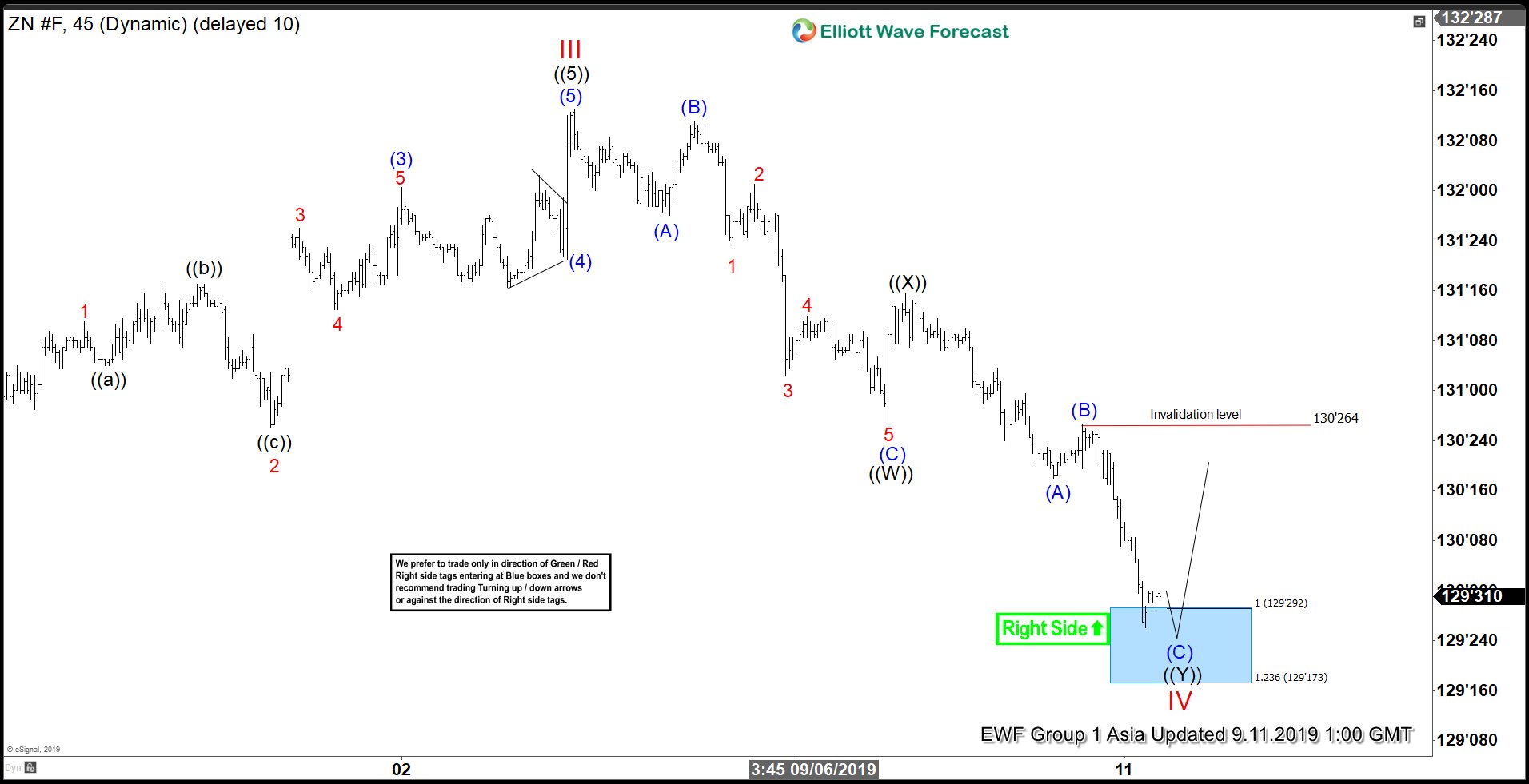

Elliott Wave View: 10 Year Treasury Notes (ZN_F) at Support Area

Read More10 Year Treasury Note (ZN_F) has reached support area in 7 swing where it can find buyers and bounce in 3 waves at least soon.

-

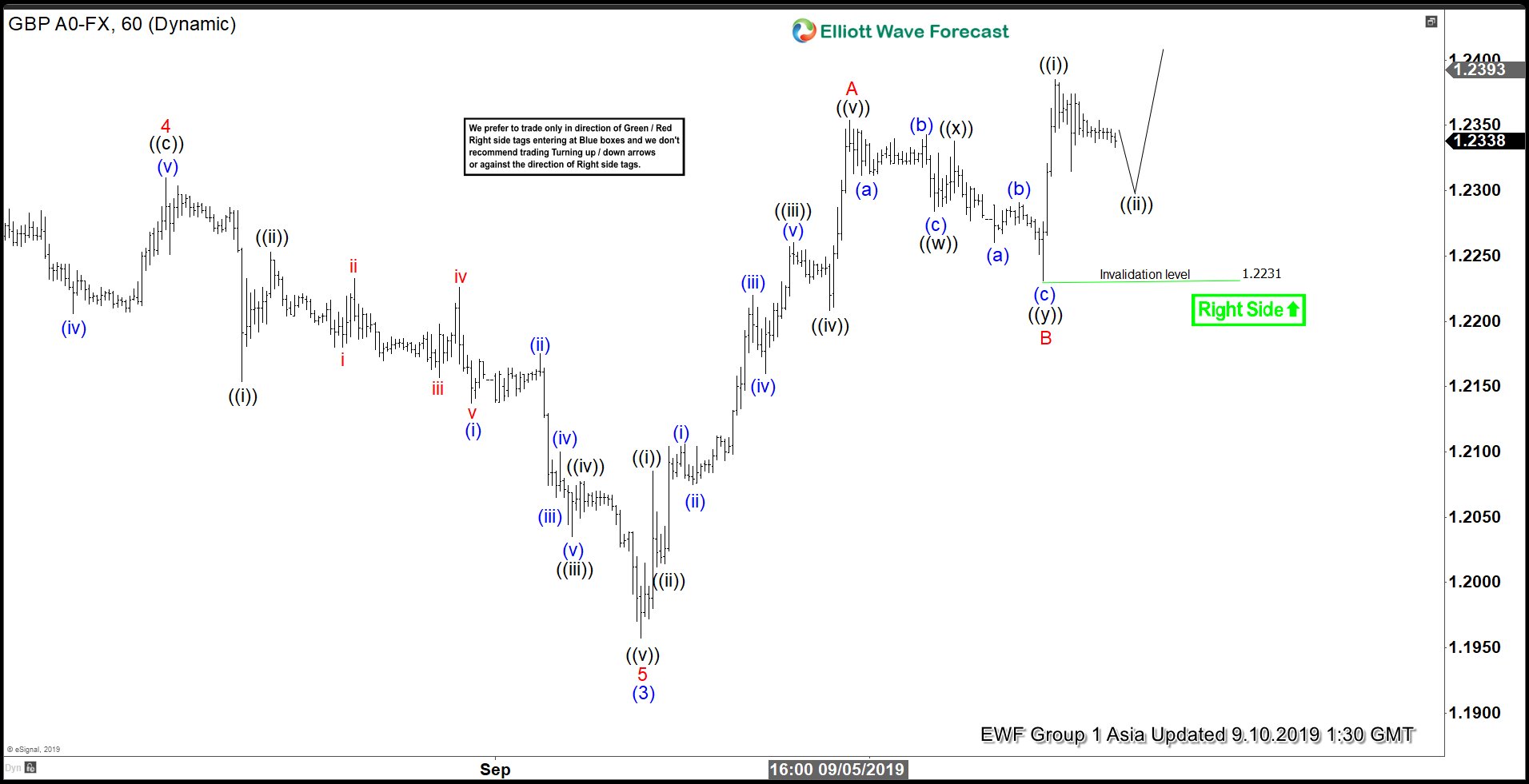

Elliott Wave View: Further Rally in GBPUSD in Zigzag Structure

Read MoreShort term Elliott Wave view in GBPUSD suggests that the decline to 1.1957 on September 3 ended wave (3). Wave (4) bounce is in progress as a zigzag Elliott Wave structure. Up from 1.1957, wave A ended at 1.235 and subdivides as a 5 waves impulse. Wave ((i)) of A ended at 1.2085, wave ((ii)) […]