In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

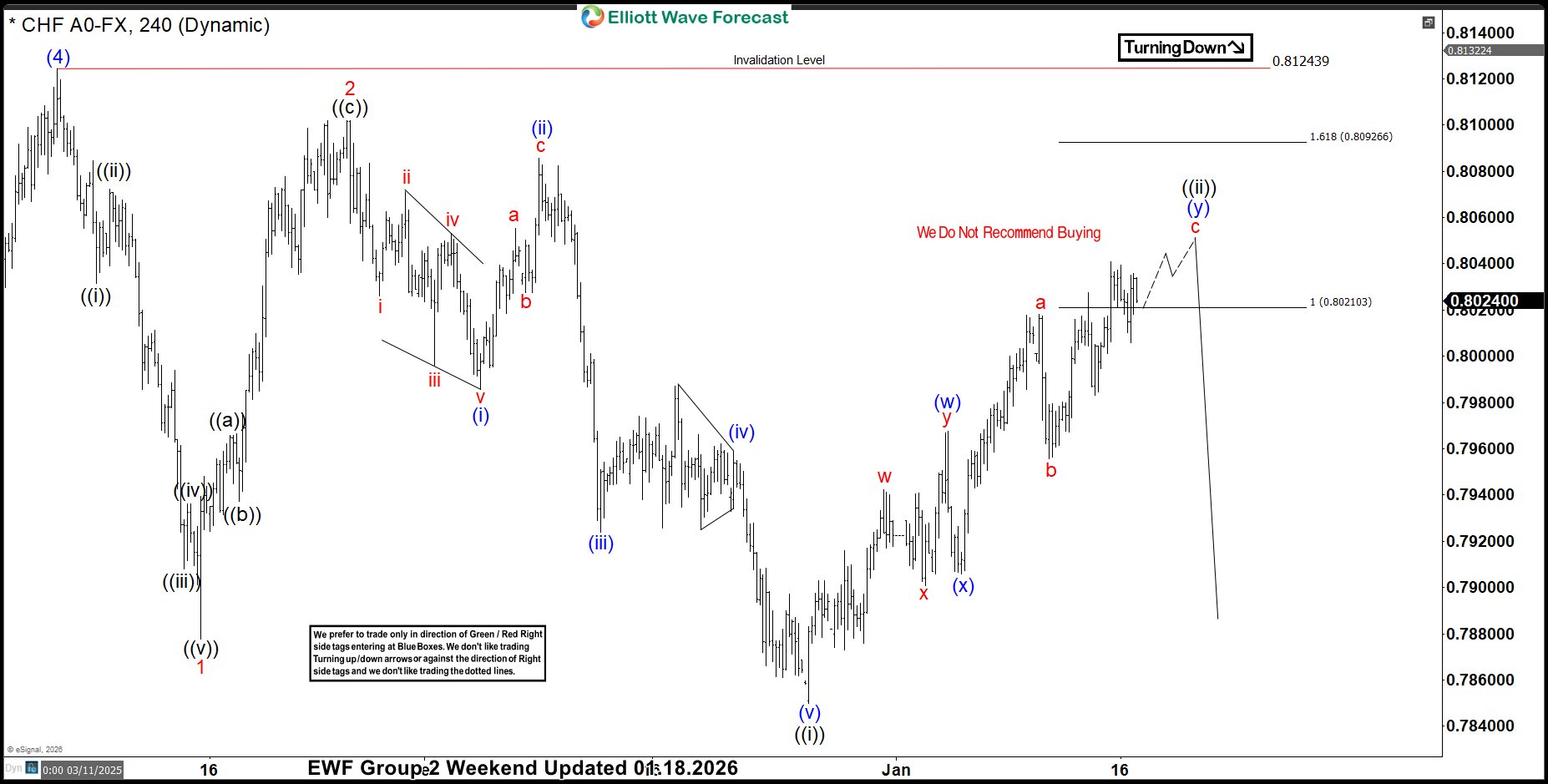

Elliott Wave Analysis: USDCHF Downtrend Set to Extend While Rally Stalls

Read MoreUSDCHF resumes its bearish trend and rally should fail in 3 or 7 swing. This video and article look at the Elliott Wave path.

-

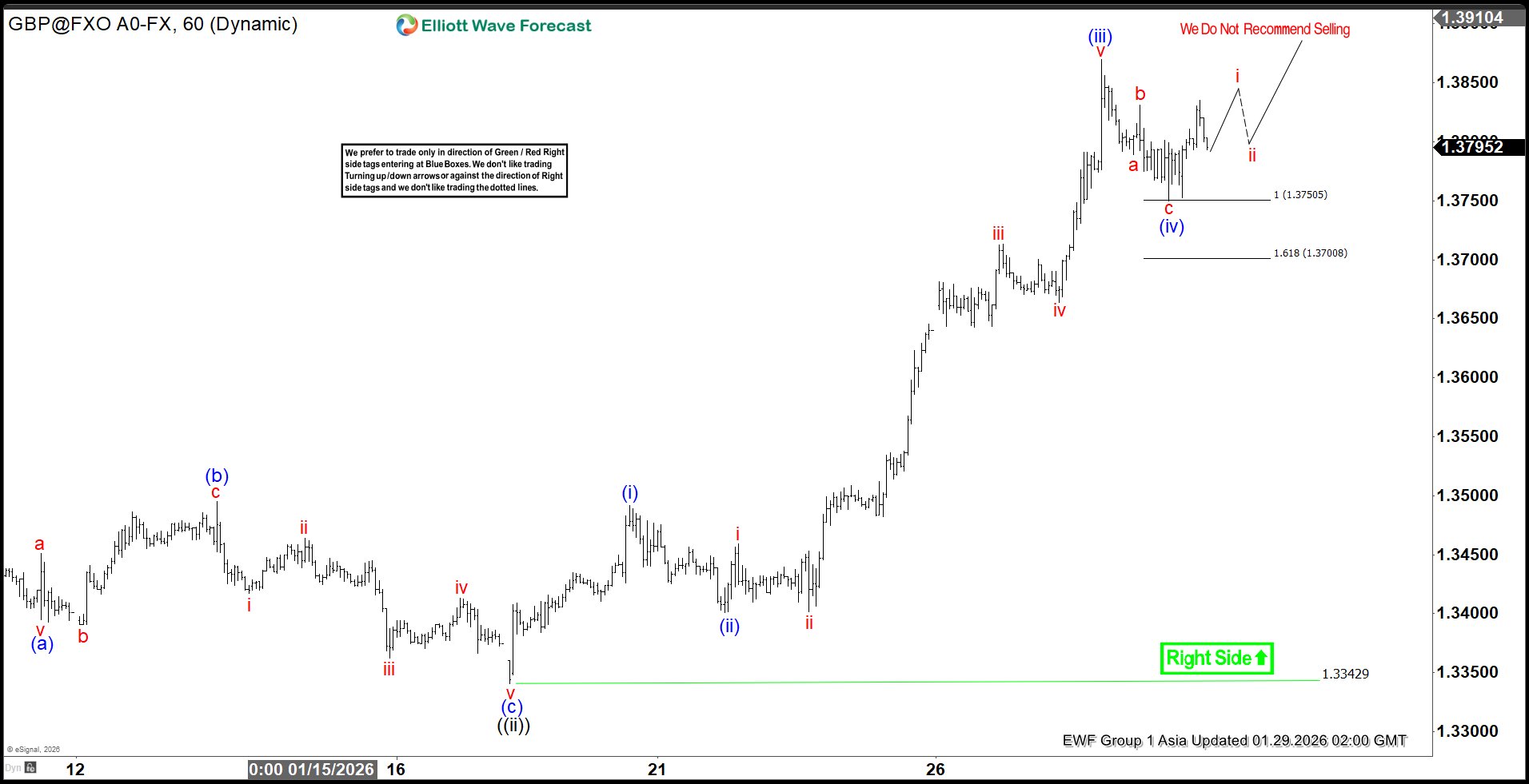

GBPUSD Extends Impulsive Move Higher; Elliott Wave Targets 1.39 and Beyond

Read MoreGBPUSD continues to rally higher impulsively and sequence remains bullish and incomplete. This article and video look at the Elliott Wave path.

-

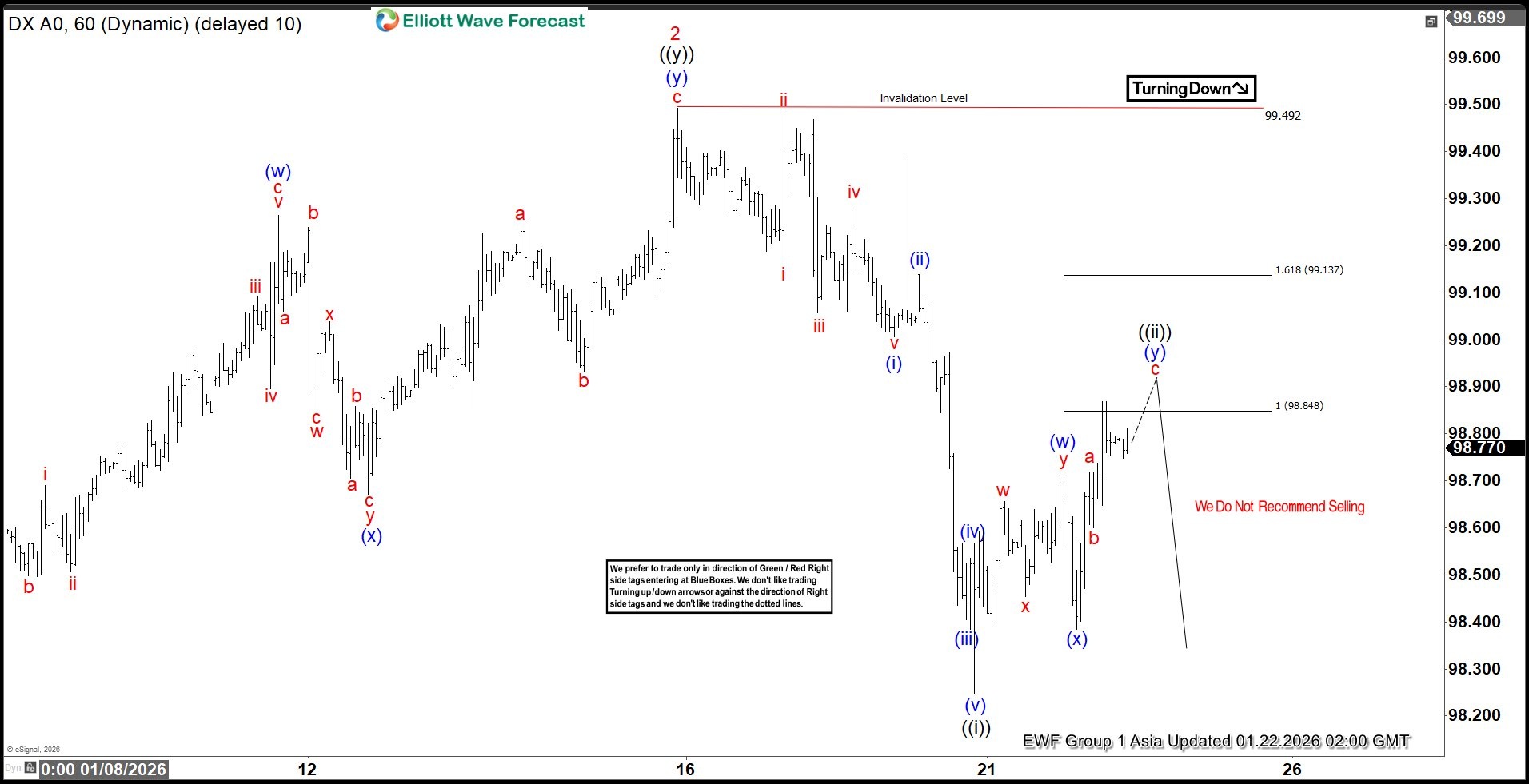

DXY Faces Persistent Selling at Extreme Equal Legs Zone

Read MoreIn this blog, we take a look at the past performance of DXY Charts. The US dollar faces persistent selling at extreme equal legs zone.

-

EURUSD Elliott Wave Outlook: Impulsive Rally Back in Play

Read MoreEURUSD has resumed its rally in an impulsive structure, reinforcing the bullish trend. This article & video examine the Elliott Wave path of the pair.

-

USDCHF: Sellers Reject Fibonacci Extension Zone, Decline Resumes.

Read MoreUSDCHF has provided traders with a textbook example of how Fibonacci extension zones can act as powerful resistance. After an extended move higher, price reached the 0.8020–0.8092 extension area, where sellers decisively stepped in. The rejection at this zone not only halted the advance but triggered a fresh wave of decline, reinforcing the importance of […]

-

EURUSD Elliott Wave : Calling the Rally After Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of EURUSD forex pair published in members area of the website. The pair has recently given us Double Three pull back and found buyers again precisely at the equal legs area as we expected. In the following text, we’ll explain the […]