-

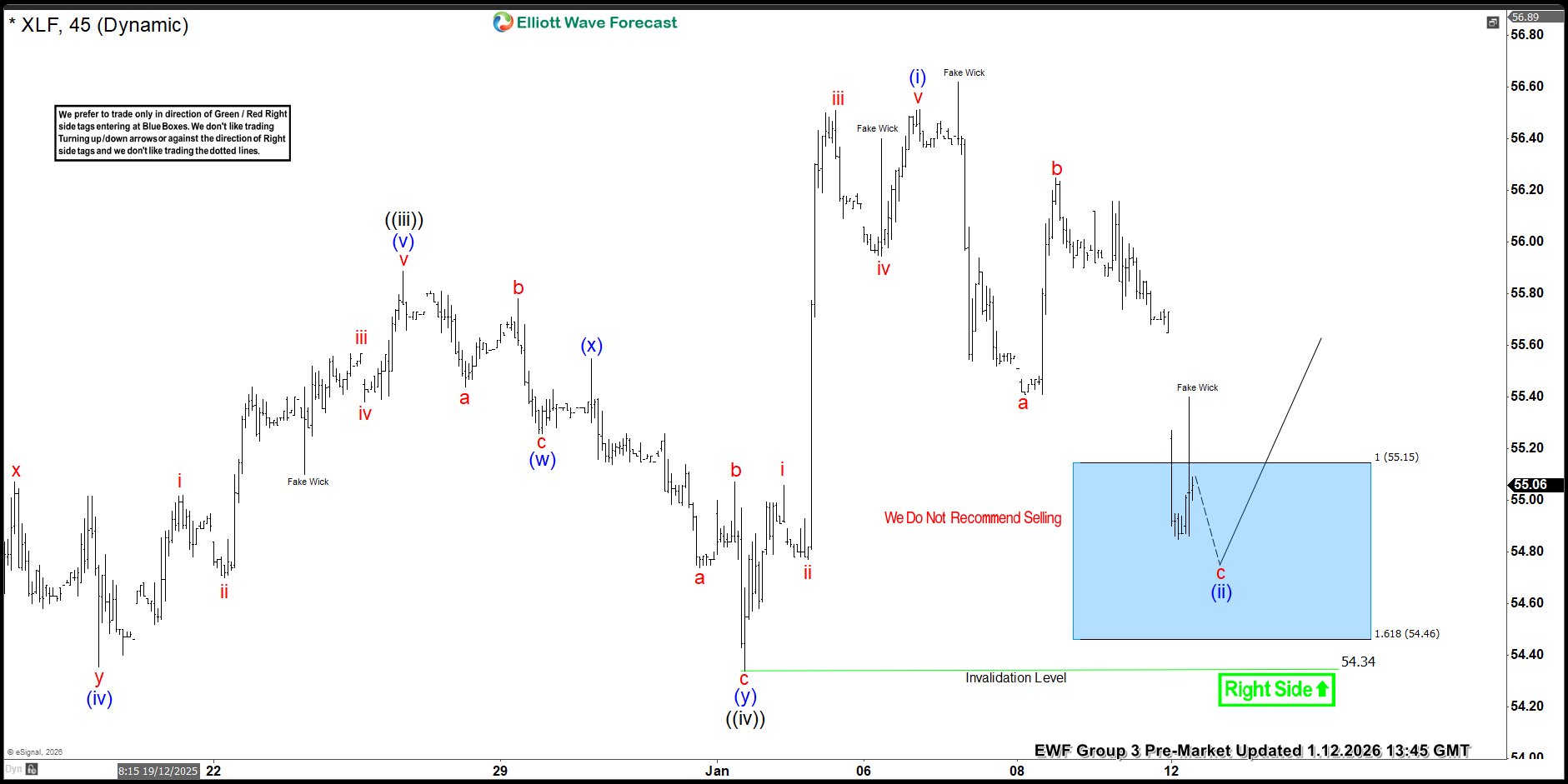

SPDR Financial Sector $XLF Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of SPDR Financial Sector ($XLF) through the lens of Elliott Wave Theory. We’ll look at how the pullback from all-time highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this ETF. 5 Wave […]

-

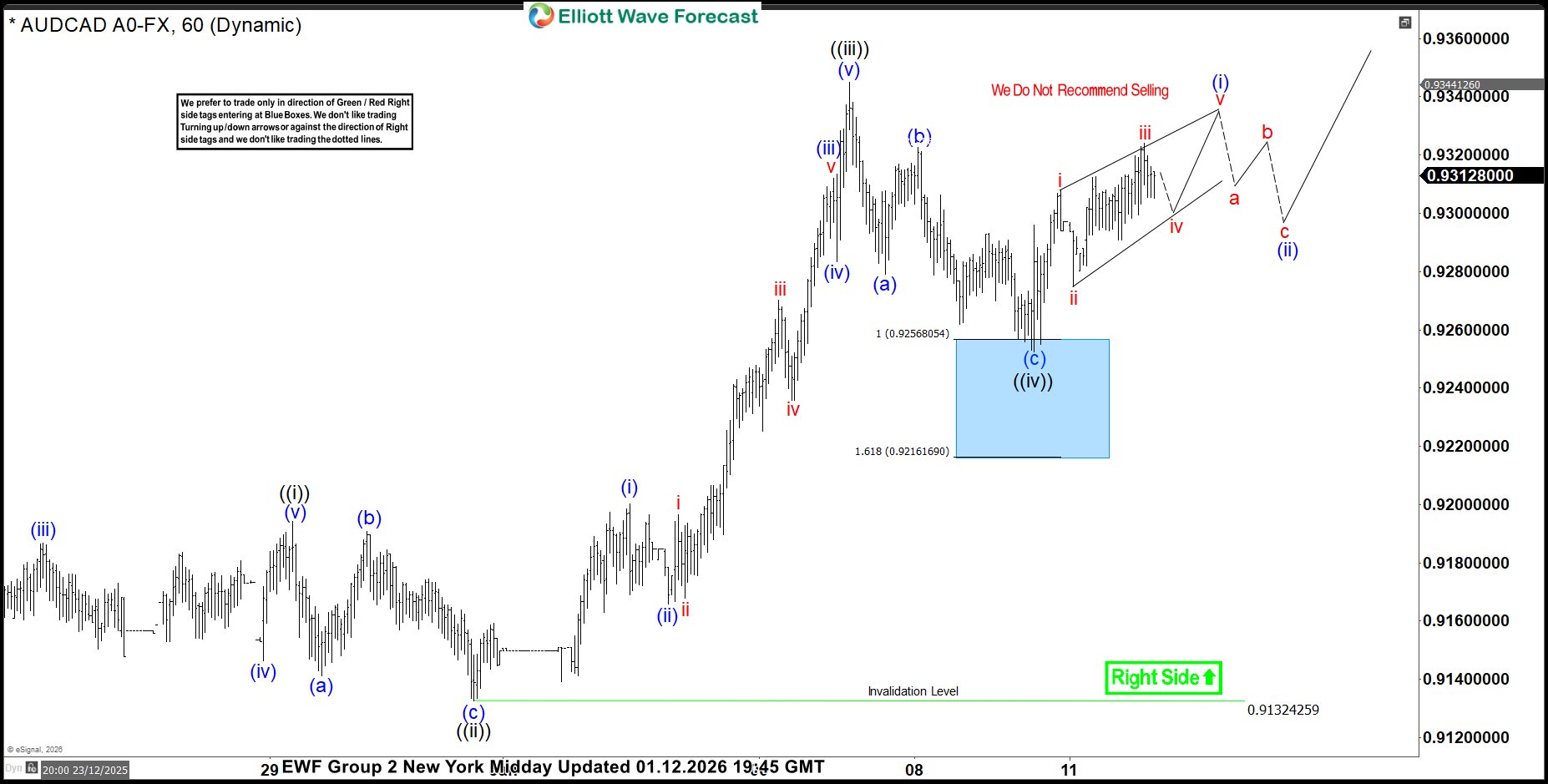

AUDCAD Bounces from Blue Box, Targets Higher Profits

Read MoreHello traders. Welcome to a new blog post where we discuss recent blue box trades. In this one, the spotlight will be on the AUDCAD currency pair. AUDCAD has been in a bullish market since April 2025. From that low, it has rallied in a series of higher highs and higher lows, which is typical […]

-

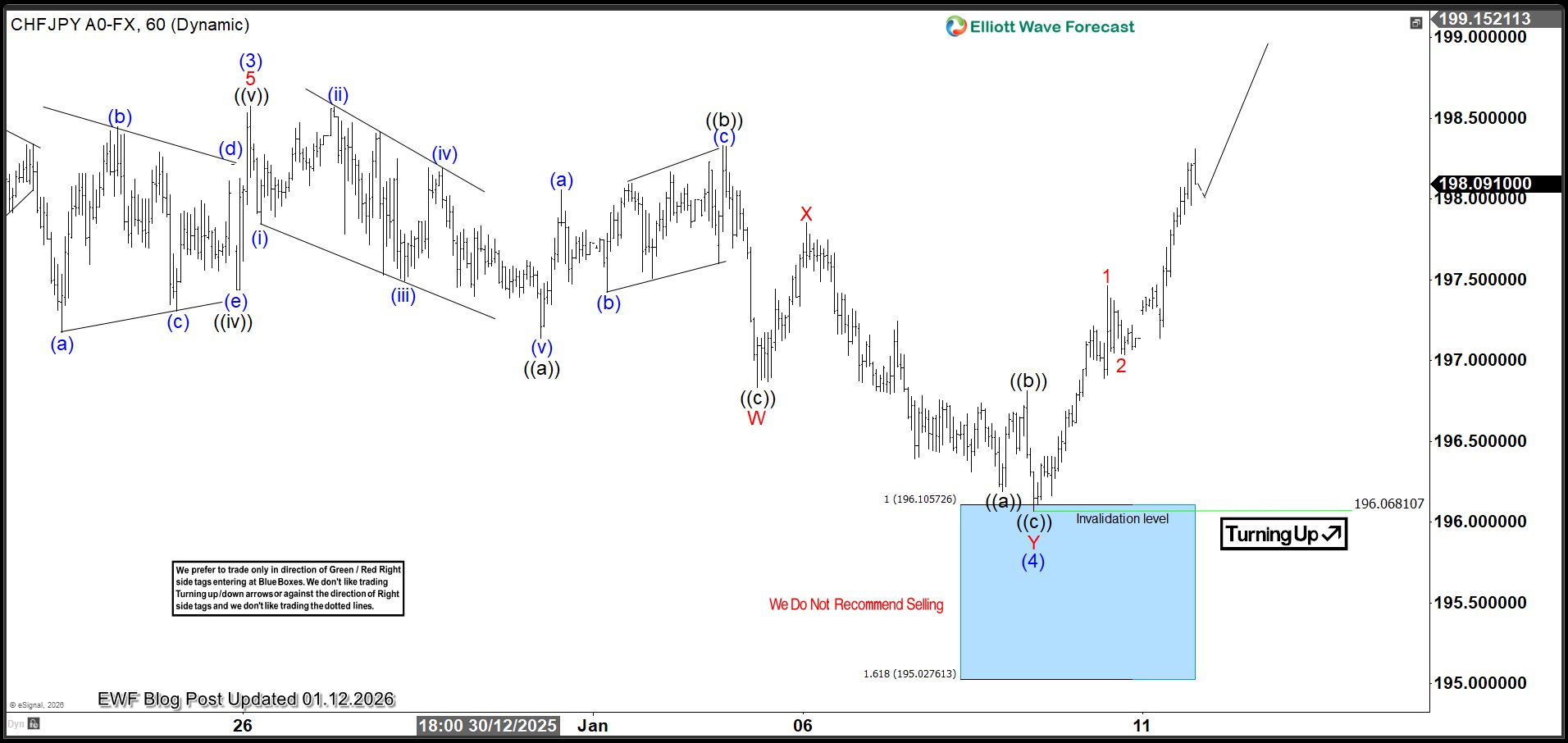

CHFJPY Aims $200 from Blue Box As Buyers Regain Control

Read MoreHello traders and welcome to a new blog post discussing about our blue box trading strategy. In this post, the spotlight will be on CHFJPY currency pair. The Yen pairs continue to rise as expected, with bullish cycles from last year appearing incomplete despite being in advanced stages. This presents more opportunities for buyers to […]

-

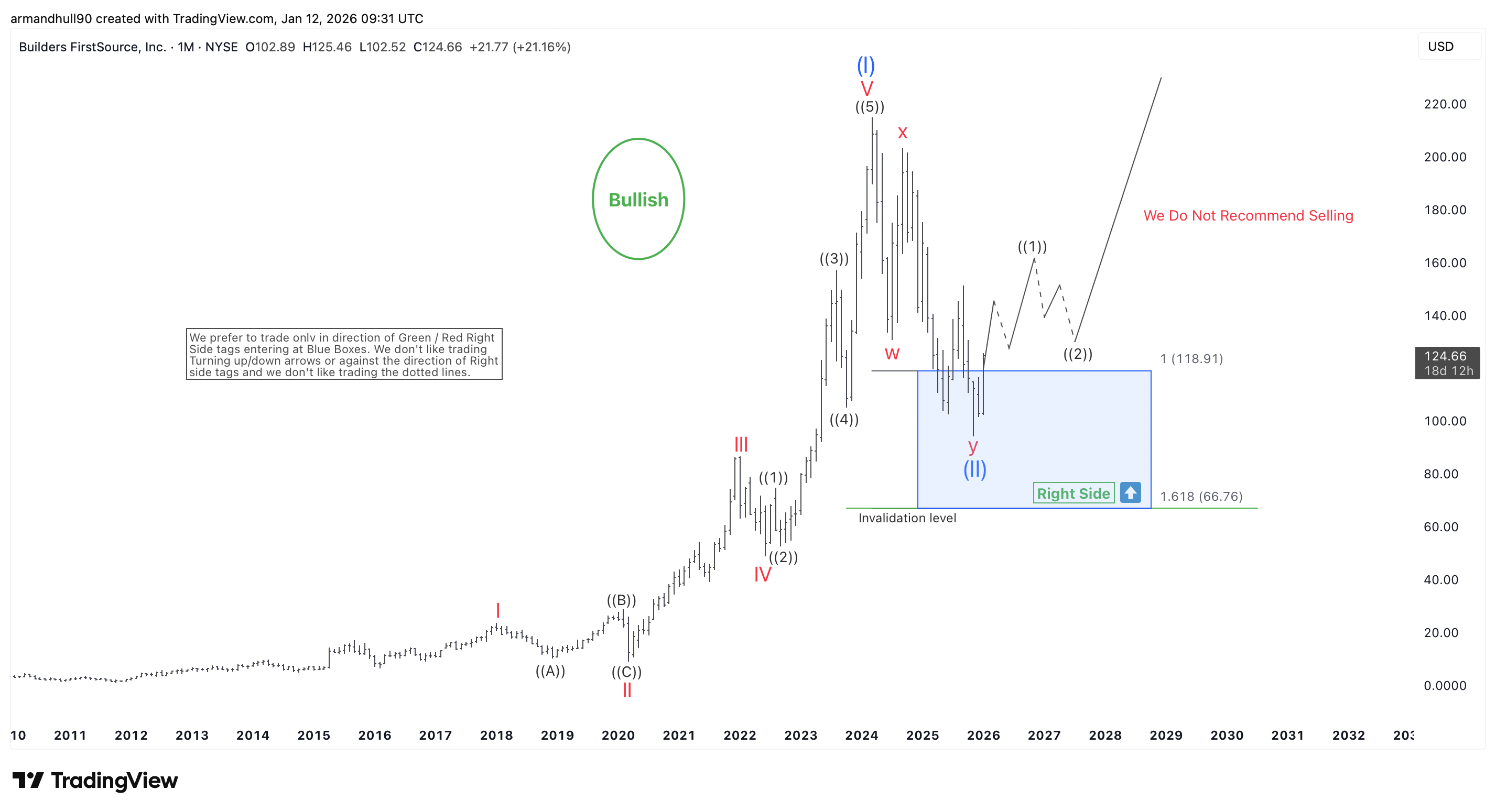

BLDR Elliott Wave Bullish Structure Points Toward New All-Time Highs

Read MoreWave (II) Looks Complete, Right-Side Remains Bullish, and Wave (III) Targets Higher Prices Ahead Builders FirstSource (NYSE: BLDR) continues to show a strong bullish outlook based on Elliott Wave Theory. The monthly chart highlights an impressive impulsive advance into the peak of wave (I). After that strong rally, the stock entered a larger corrective phase. […]