-

NASDAQ Futures Reacting From Equal Legs Area

Read MoreIn this blog, we take a look at the past performance of Nasdaq futures charts. The index provided a buying opportunity at the equal legs area.

-

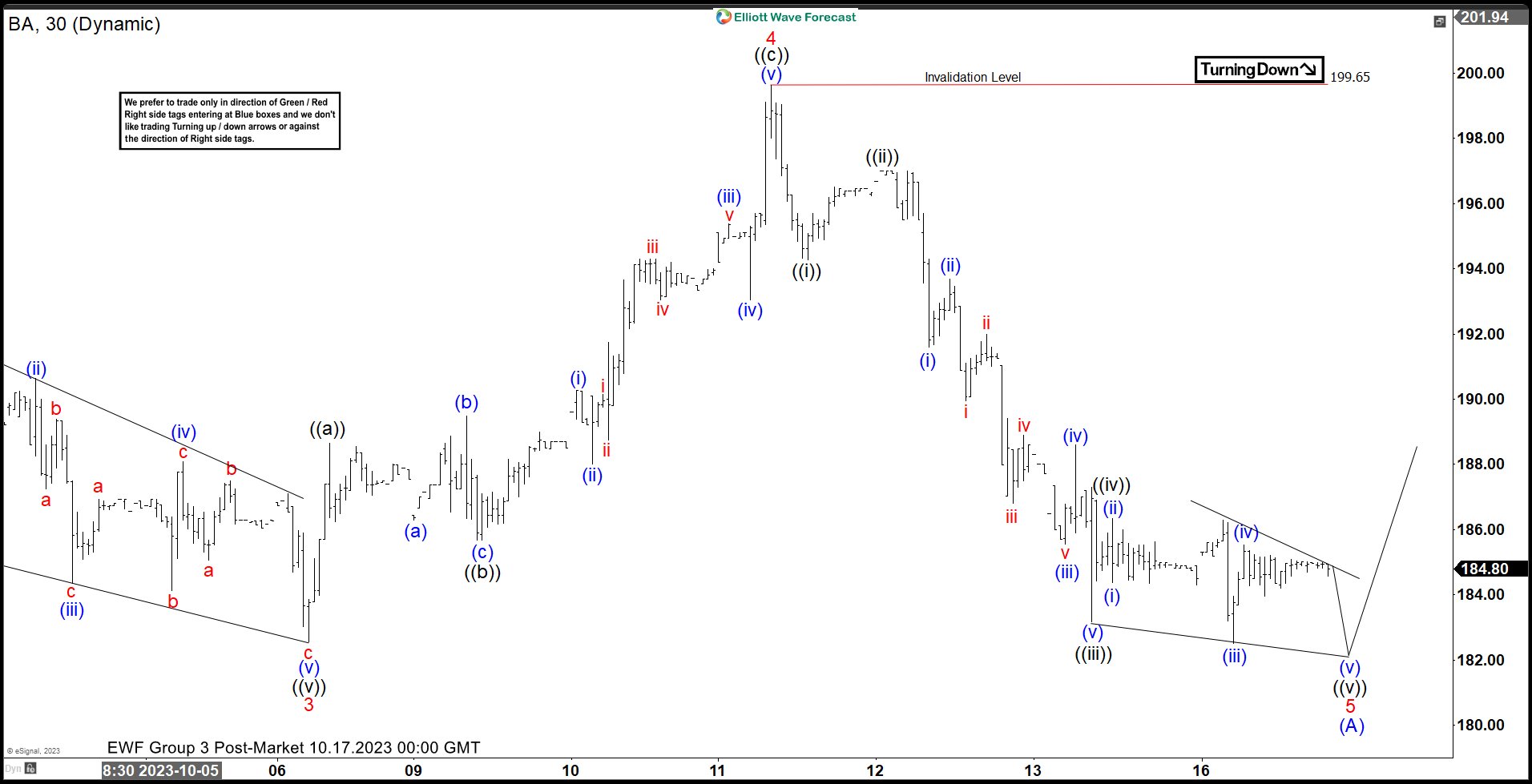

Boeing (BA) Looking to End Impulsive Decline Soon

Read MoreBoeing (BA) is ending cycle from 8.1.2023 high as impulse & should soon rally to correct the cycle. This article & video look at the Elliott Wave path.

-

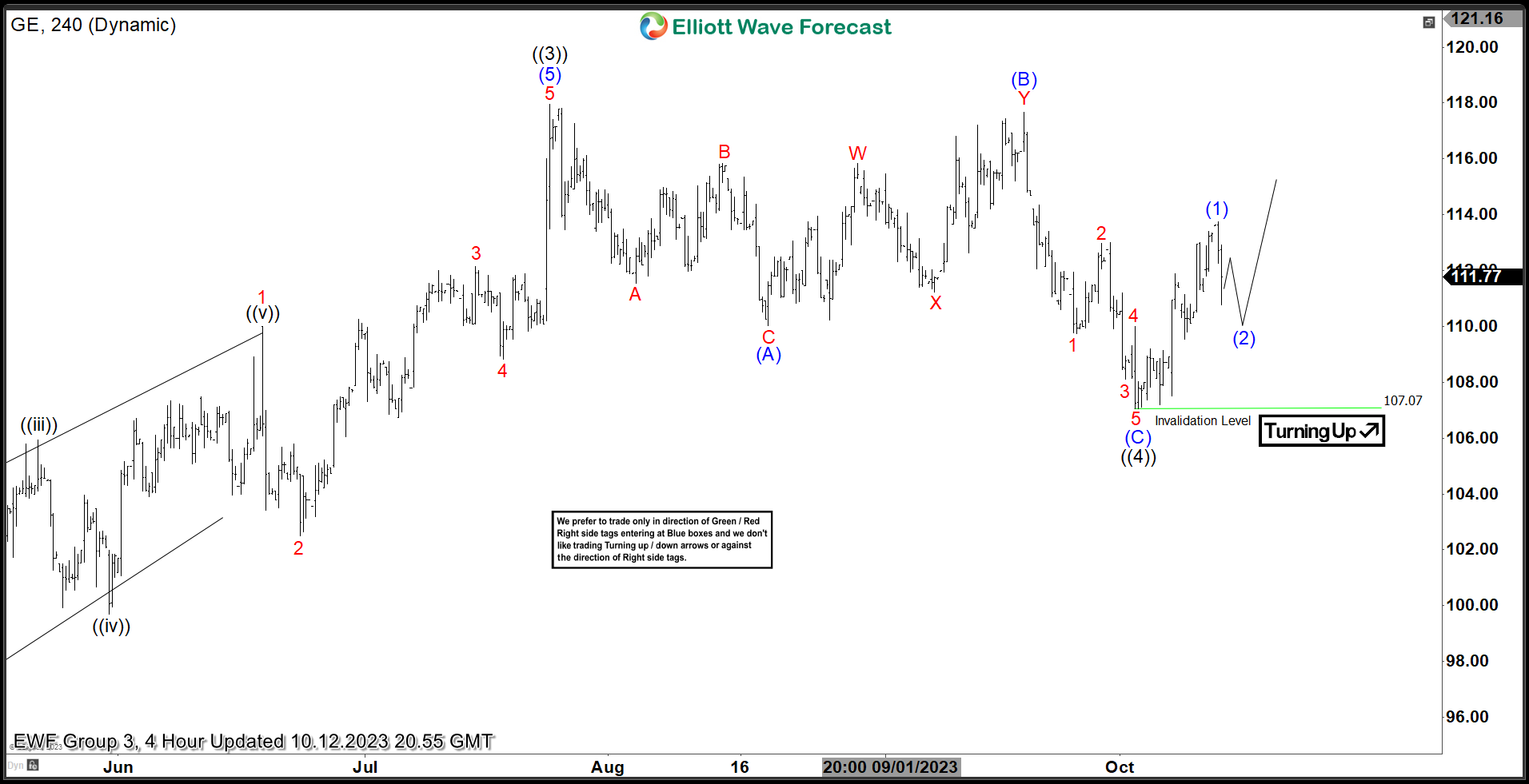

General Electric Co. ($GE) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 8 Hour Elliott Wave chart of General Electric Co. ($GE). The rally from 12.16.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

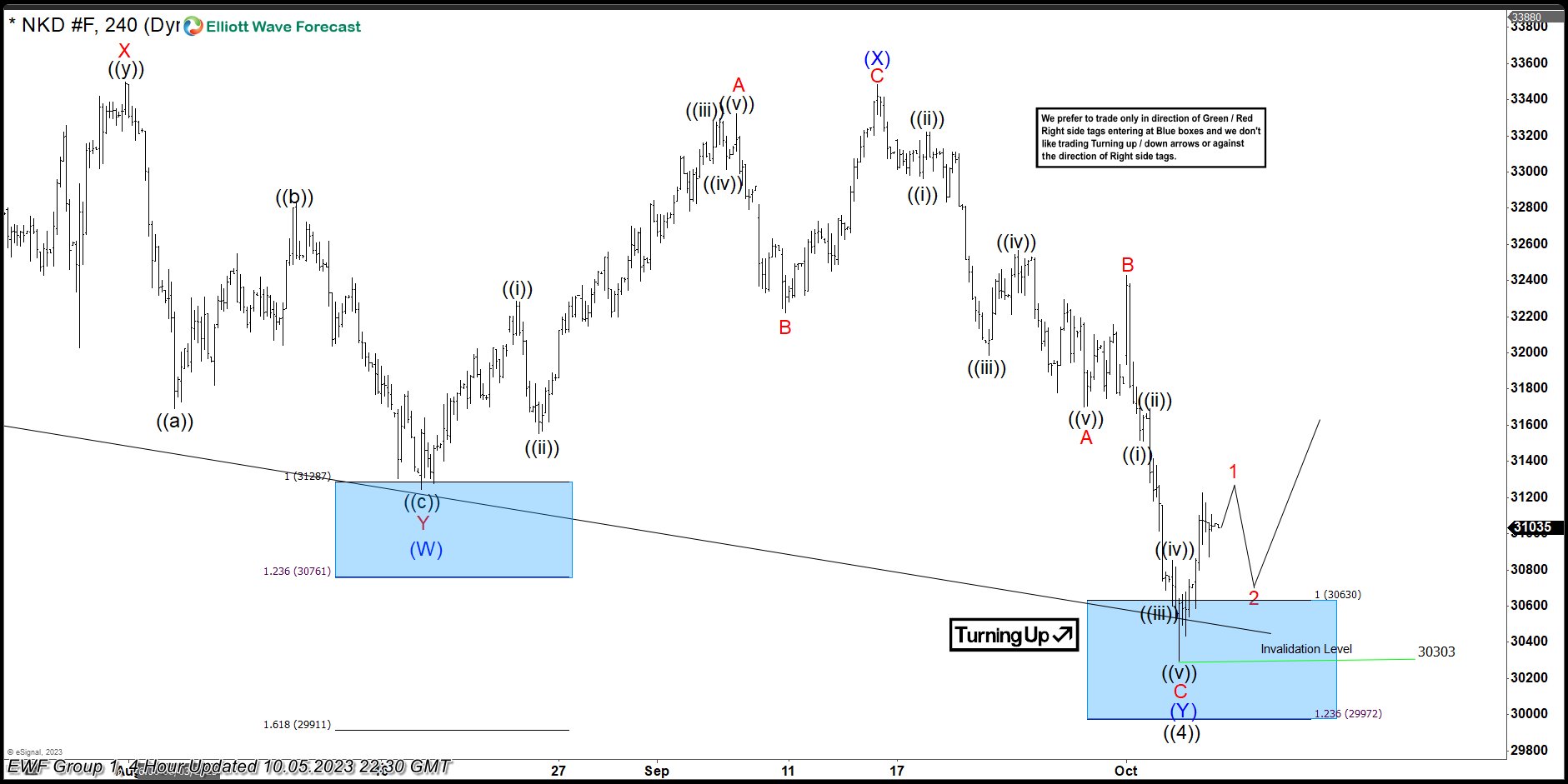

NIKKEI (NKD_F) Found Buyers After Elliott Wave Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of NIKKEI Futures published in members area of the website. As our members know NIKKEI Futures has recently made pull back that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from […]