-

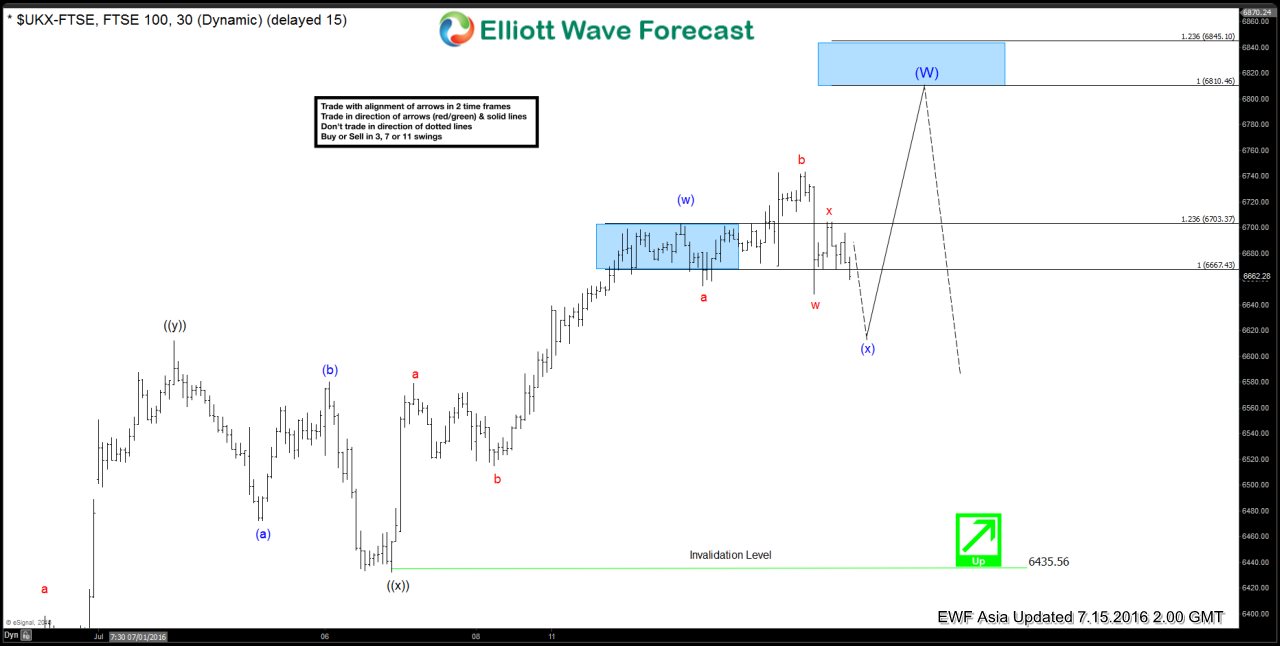

$FTSE Short-term Elliott Wave Analysis 7.15.2016

Read MoreShort term Elliottwave structure suggests rally from 7/6 low is unfolding as a double three where wave (w) ended at 6703.09 and wave (x) pullback is in progress towards 6587.2 – 6609.45 area before turning higher one more leg towards 6810.46 – 6845.1 area to complete wave (W) and end cycle from 2/11 low. Index has reached […]

-

$FTSE Short-term Elliott Wave Analysis 7.14.2016

Read MoreShort term Elliottwave structure suggests rally from 7/8 low is unfolding as a triple three where wave (w) ended at 6579.25, wave (x) ended at 6515.24, wave (y) ended at 6698.54, and 2nd wave (x) ended at 6654.26. While pullback stays above 6654.26, Index is expected to extend 1 more leg higher towards 6810.46 – 6845.10 area before […]

-

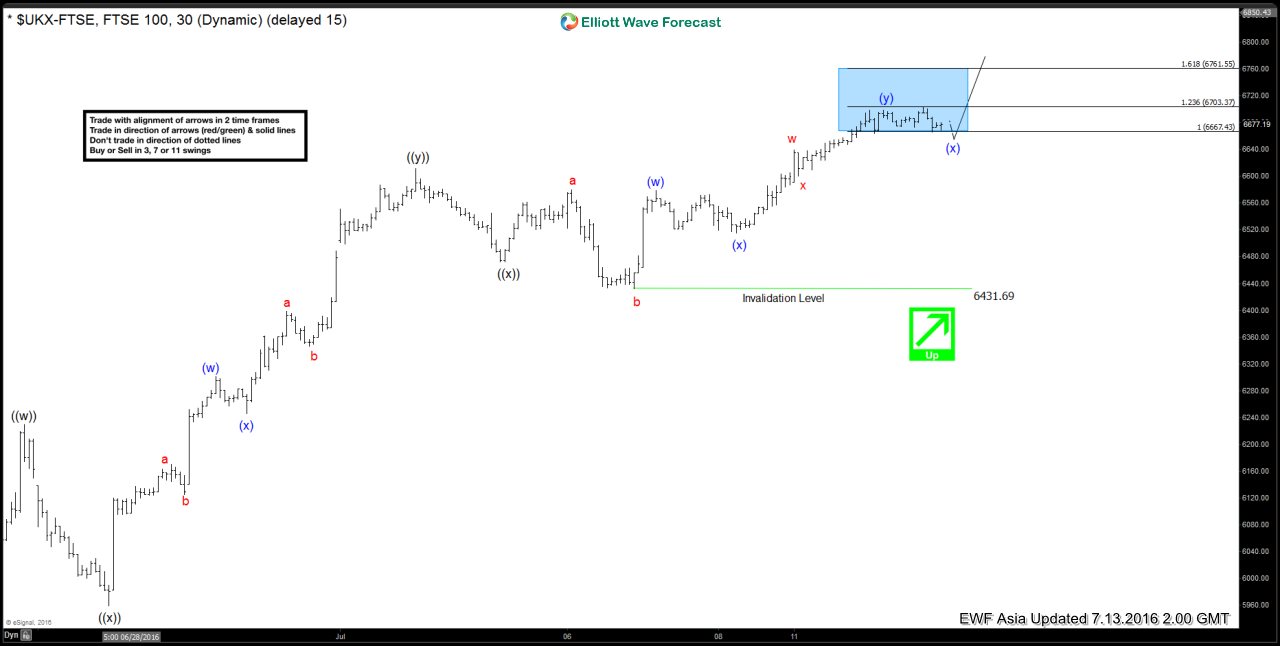

$FTSE Short-term Elliott Wave Analysis 7.13.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6472.25. Near term, while 2nd wave (x) pullback stays above 6431.69, Index has scope to extend higher […]

-

$FTSE Short-term Elliott Wave Analysis 7.12.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6431.69. Near term, wave (w) is expected to complete at 6702.37 – 6760.55 area, then […]