-

$SPX: Elliott Waves forecasting key turns in the market

Read MoreAt the middle of September our Elliott Wave analysis for SPX suggested that we were ending wave III- impulsive cycle from the 1269.91 low. Wave III has 5 wave structure with Ending Diagonal in wave ((5)). The price was approaching 1.236-1.618 fib inverse extension of wave (4) at 2014.9-2049.06 & diagonnal was about to complete . Let’s take a […]

-

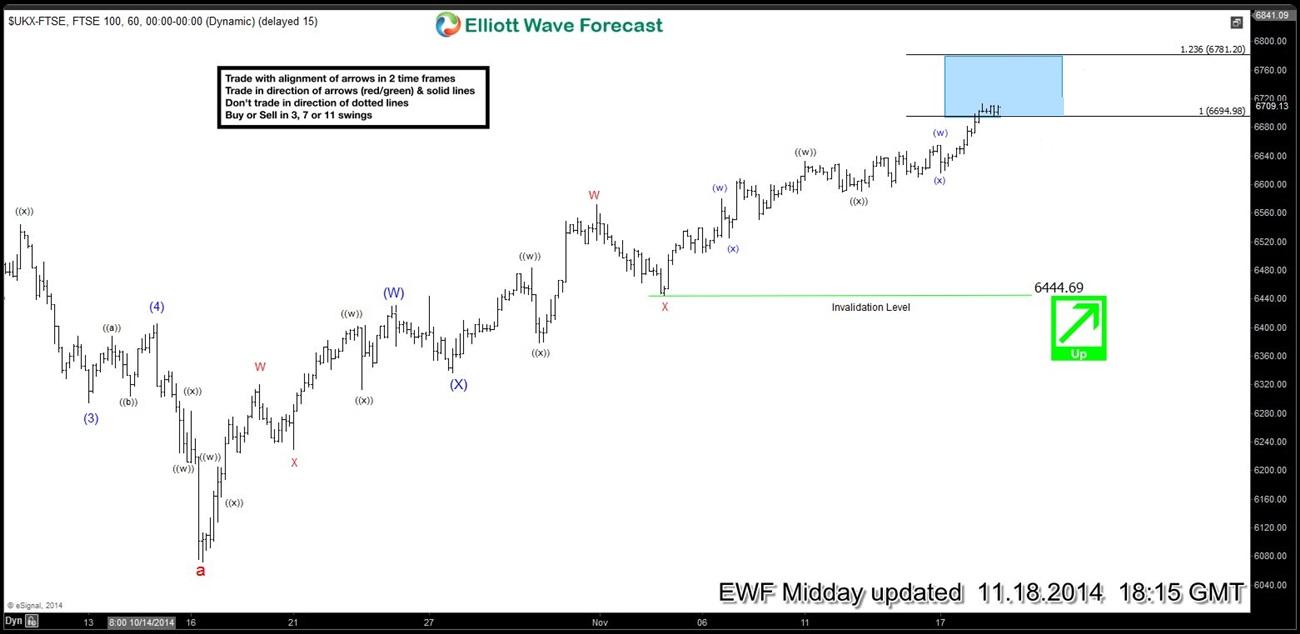

FTSE : Elliott Wave (Long) Setup hits targets

Read MoreFrom the begining of November our Elliott Wave analysis for FTSE suggested rally from 6452.48- 6424.00 zone toward 6693.47 area. Now, after two weeks of trading, FTSE has reached our target. Index gave us the rally that we forecasted and presented in Elliott Wave Setup Video from the 3th November. You can watch the video here : […]

-

Elliott Wave Forecasts : $Dollar pairs before & after FOMC

Read MoreEWF has proven one more time that market news events are insignificant for making good trade decisions. As our members know, we do not follow the news, because further paths are already defined in the price structure. All EWF analysis are based strictly on technical stuff, such as Elliott wave cycles, pivot system and market corelation,as […]

-

7 swings Elliott Wave Structure in GBPCHF ( NY update )

Read MoreOne of the most common patterns in New Elliott Wave theory is 7 swings structure (double three). We spot it in the market every day in many instruments. It’s a very reliable structure by which we can make good analysis and what is most important it’s giving us good trading entries with clearly defined invalidation […]

-

A look at the Gold move up from 1240 low

Read MoreGold has been steadily moving higher since forming a low at 1240. Let’s take a look at some charts from members area to see how we called this move. As you can see on H4 chart below , preferred Elliott wave view was calling for pull back which was supposed to correct cycle from 1240.3 low toward […]

-

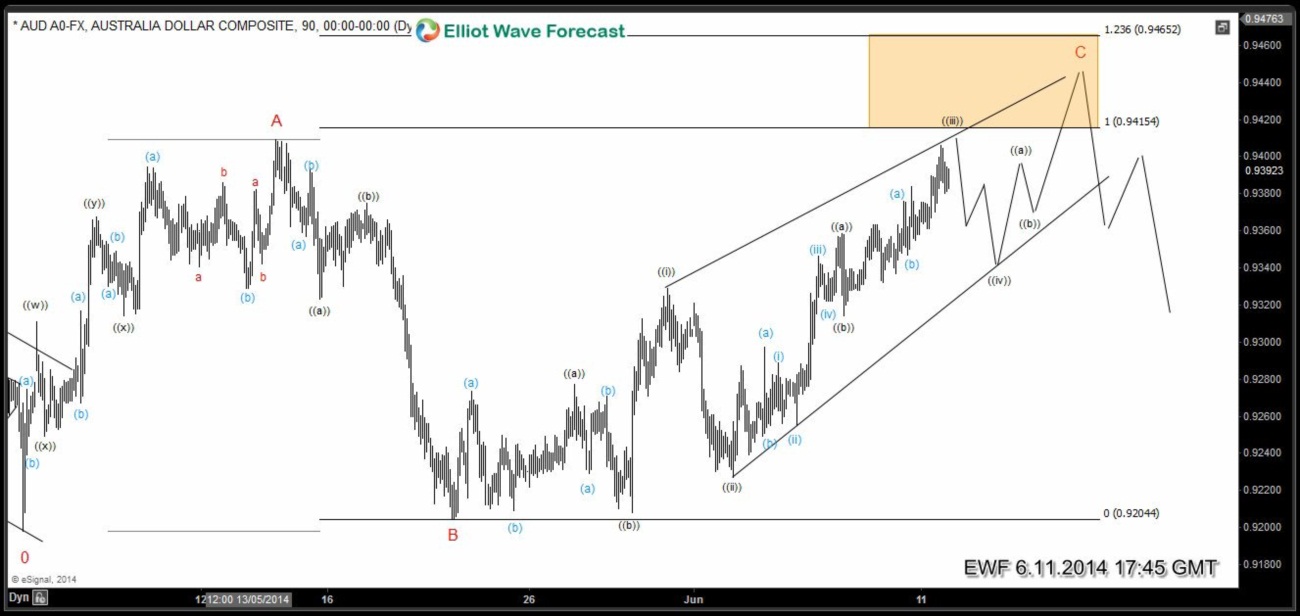

AUDUSD Elliott Wave FLAT / Ending Diagonal Structures

Read MoreAs we can see on AUDUSD 90 min chart pair has been in a sideways consolidation since 0.9198 low (5.2.2014). We believe FLAT structure is in progress which started from 0.9198. To be more precise we are currently in wave C of FLAT. Wave C has taken form of Ending Diagonal and we are nearing […]