-

$GBPNZD Live Trading Room Setup from 8/5

Read MoreHere is a short clip from our Live Trading Room on August 5. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 7:00 AM EST , join us there for more insight into these proven methods of trading. Click […]

-

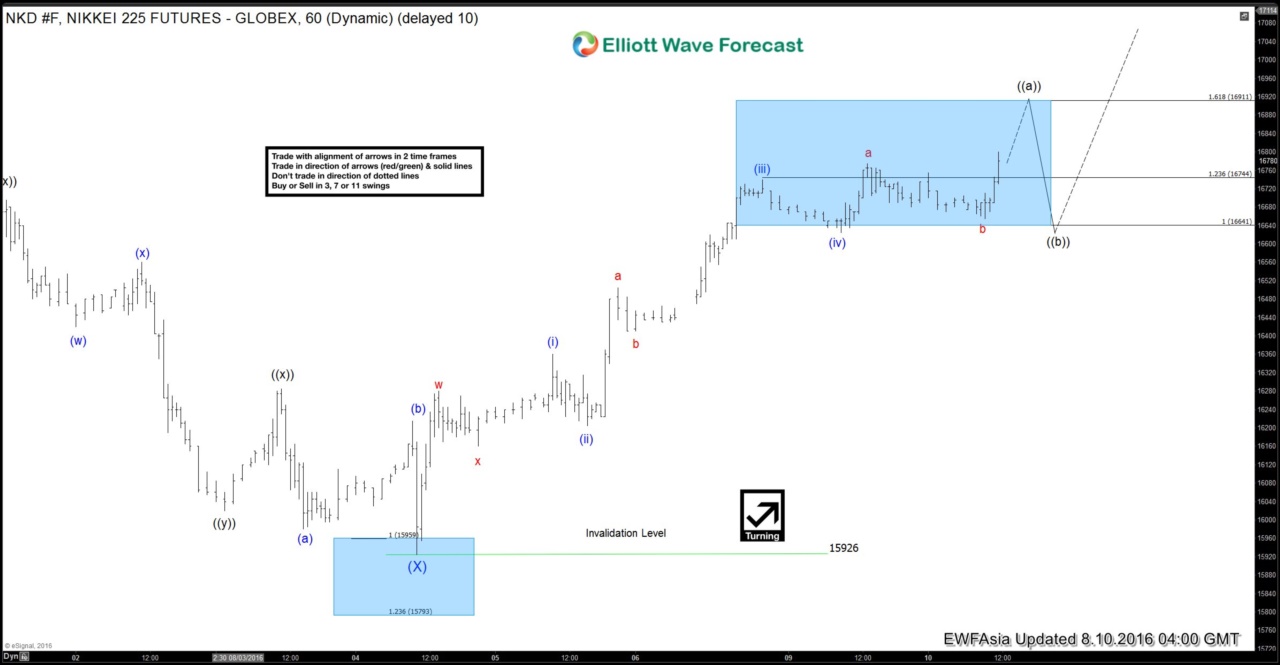

Nikkei Short-term Elliott Wave Analysis 8.10.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started rally higher in the form of a zigzag structure where wave (v) of ((a)) is in progress and can reach as high as 16911, then it should pullback in wave ((b)) in 3, 7, or 11 swing to correct rally from 15926 […]

-

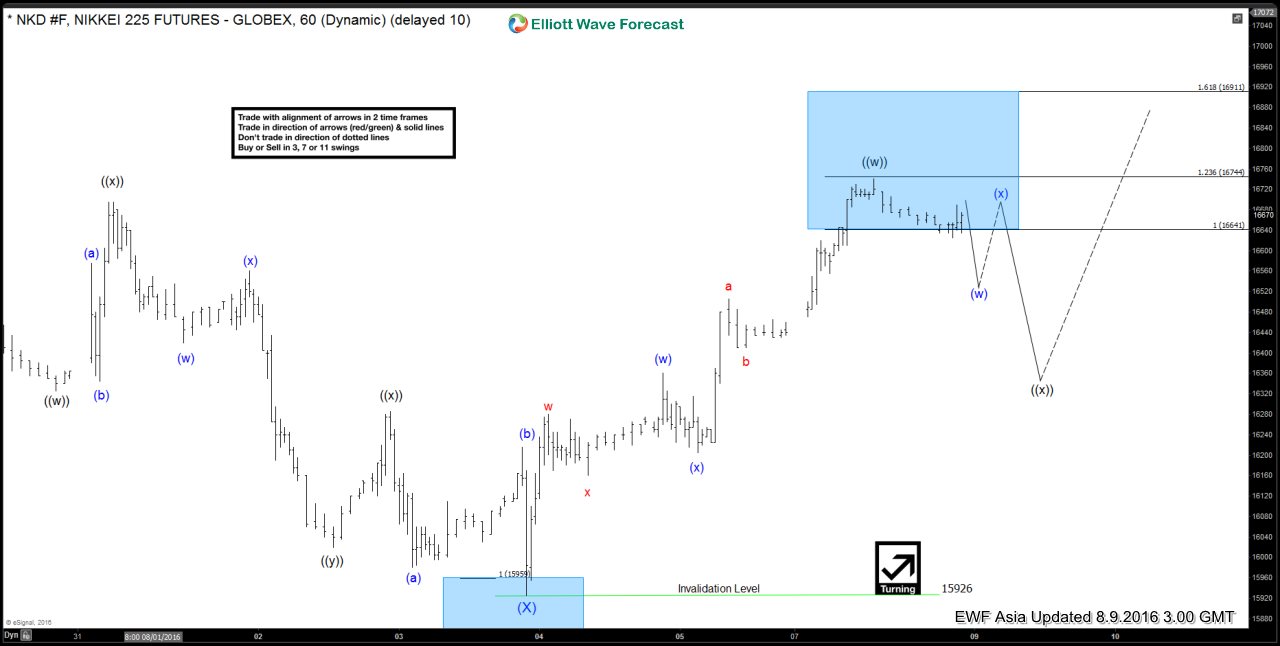

Nikkei Short-term Elliott Wave Analysis 8.9.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started a rally higher in the form of a double three structure where wave ((w)) ended at 16740. While Index stays below there, expect the Index to pullback in wave ((x)) to correct the rally from 15926 in 3, 7, or 11 swing. Then, as far […]

-

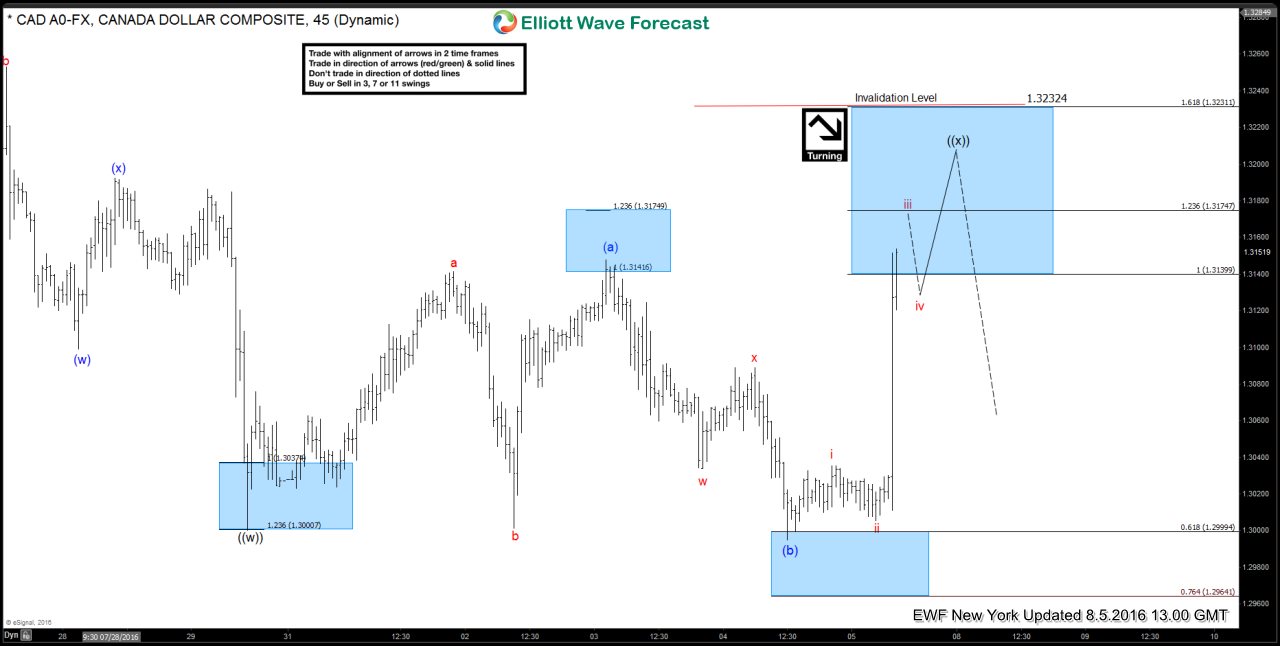

USDCAD Short-term Elliott Wave Analysis 8.5.2016

Read MorePreferred Elliott wave count suggests that rally to 1.324 ended wave W. Wave X pullback is in progress as a double three structure where wave ((w)) ended at 1.30, wave ((x)) is unfolding as as FLAT and should ideally fail below 1.3232 high for another push lower in wave ((y)) of X toward 1.2953 – […]

-

$USDPLN Elliottwave Trade Setup 8/4/2016

Read MoreBelow is a video update on $USDPLN and also the journal to trade it with a clear and concise setup, including risk:reward calculation. This is one of the pairs we like to sell in Live Trading Room. Everyday we will take the heavy groundwork and scan the market for potential trades in commodities, forex, and indices. Then at 7 […]

-

AUDJPY Short-term Elliott Wave Analysis 8.3.2016

Read MorePreferred Elliott wave count suggests that decline from wave X at 79.57 is unfolding as a triple three where wave ((w)) ended at 77.6, wave ((x)) ended at 79.51, wave ((y)) ended at 77.4 and second wave ((x)) ended at 78.18. Wave ((z)) is in progress with the internal unfolding as a double three where wave (w) […]