-

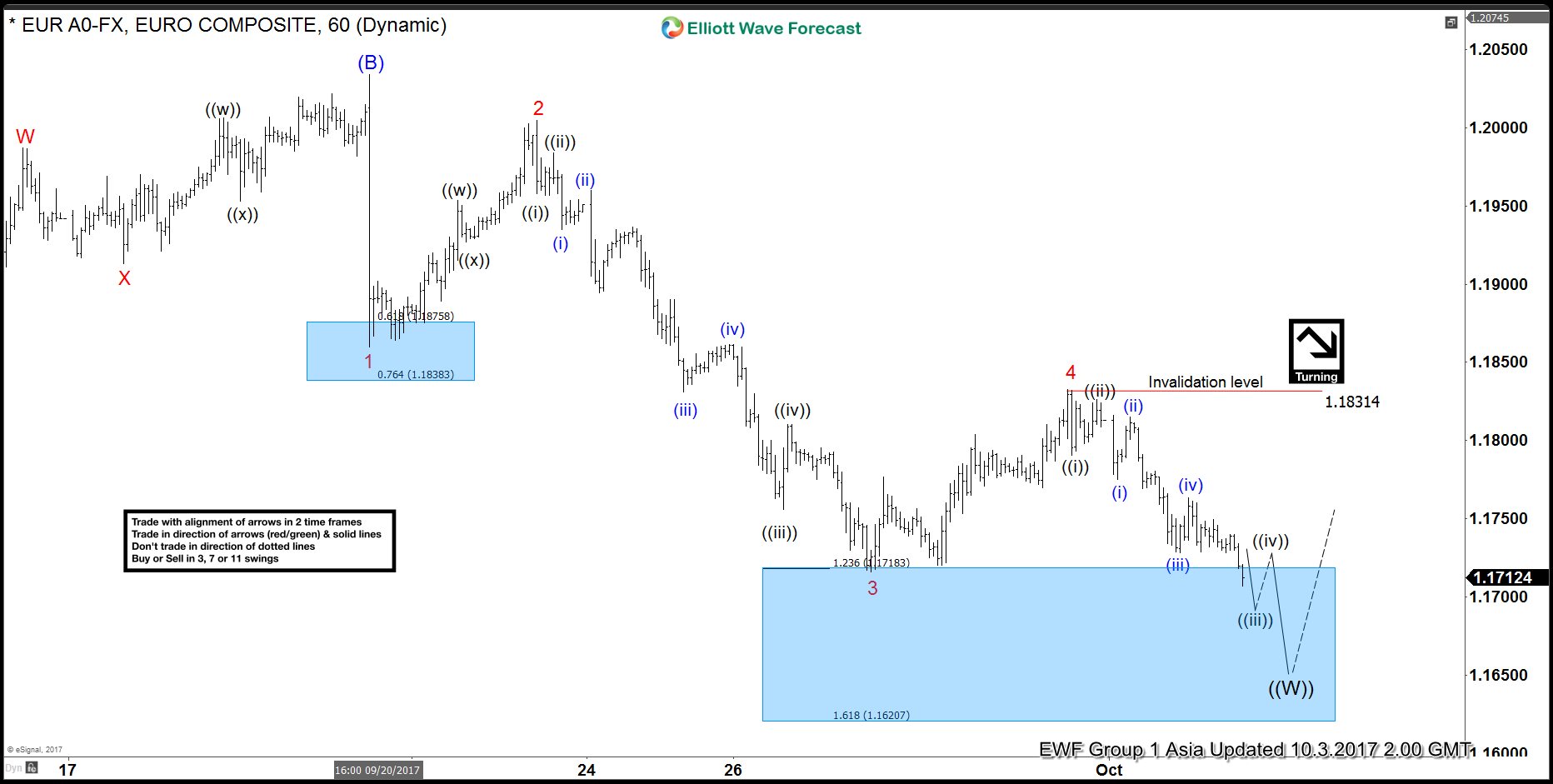

Elliott Wave Analysis: EURUSD in a flat correction

Read MoreEURUSD Short Term Elliott Wave view suggests that the decline from 9/8 peak is unfolding as an expanded Flat Elliott Wave structure. Down from 9/8 high (1.2094), Intermediate wave (A) ended at 1.1837 and Intermediate wave (B) ended at 1.2034. Intermediate wave (C) is in progress as 5 waves. Minor wave 1 of (C) ended at […]

-

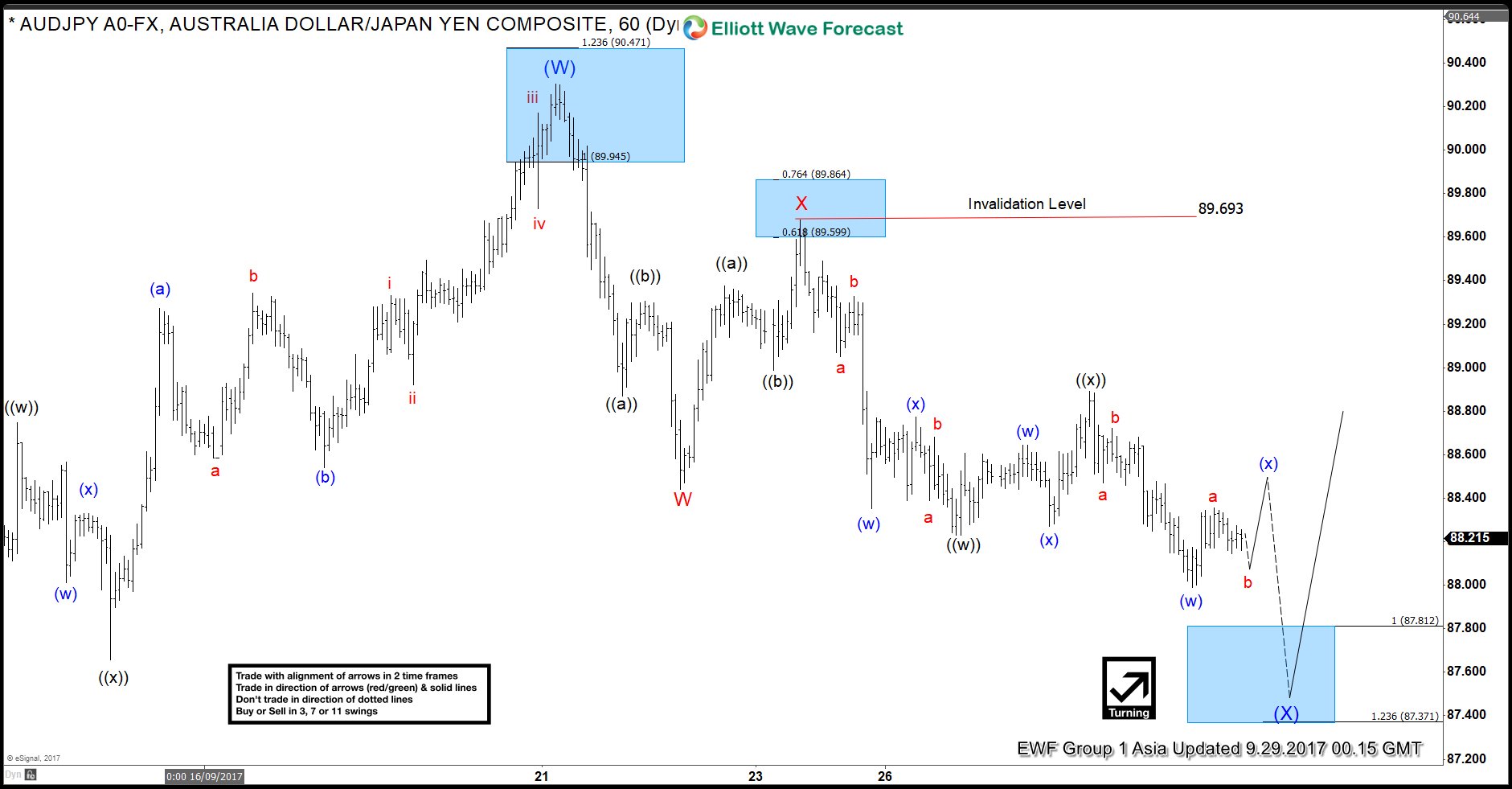

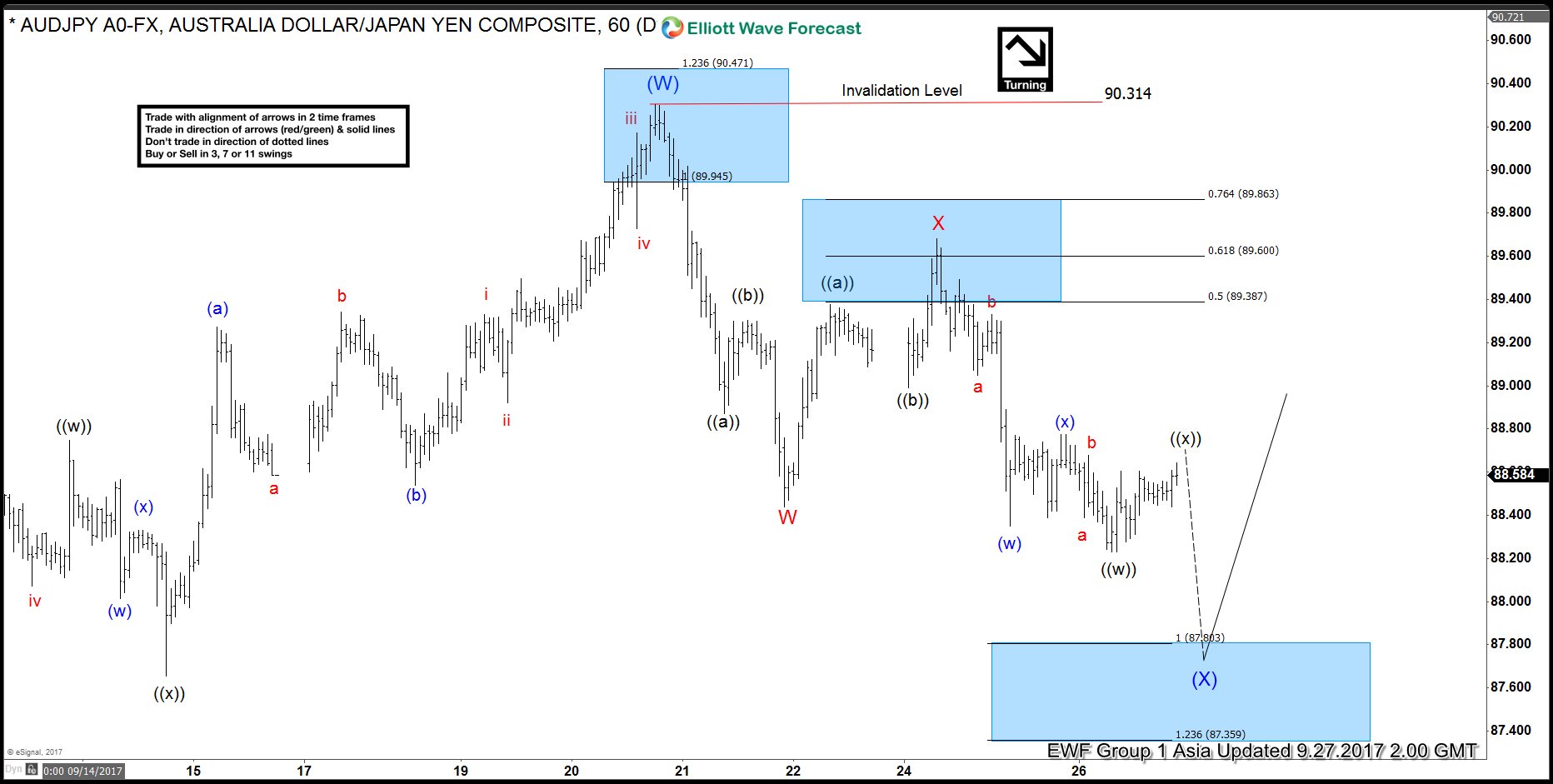

AUDJPY Elliott Wave Analysis 9.29.2017

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave W ended at 88.44 and Minor wave X ended at 89.68. Minor wave Y is unfolding also as a double three Elliott Wave structure. […]

-

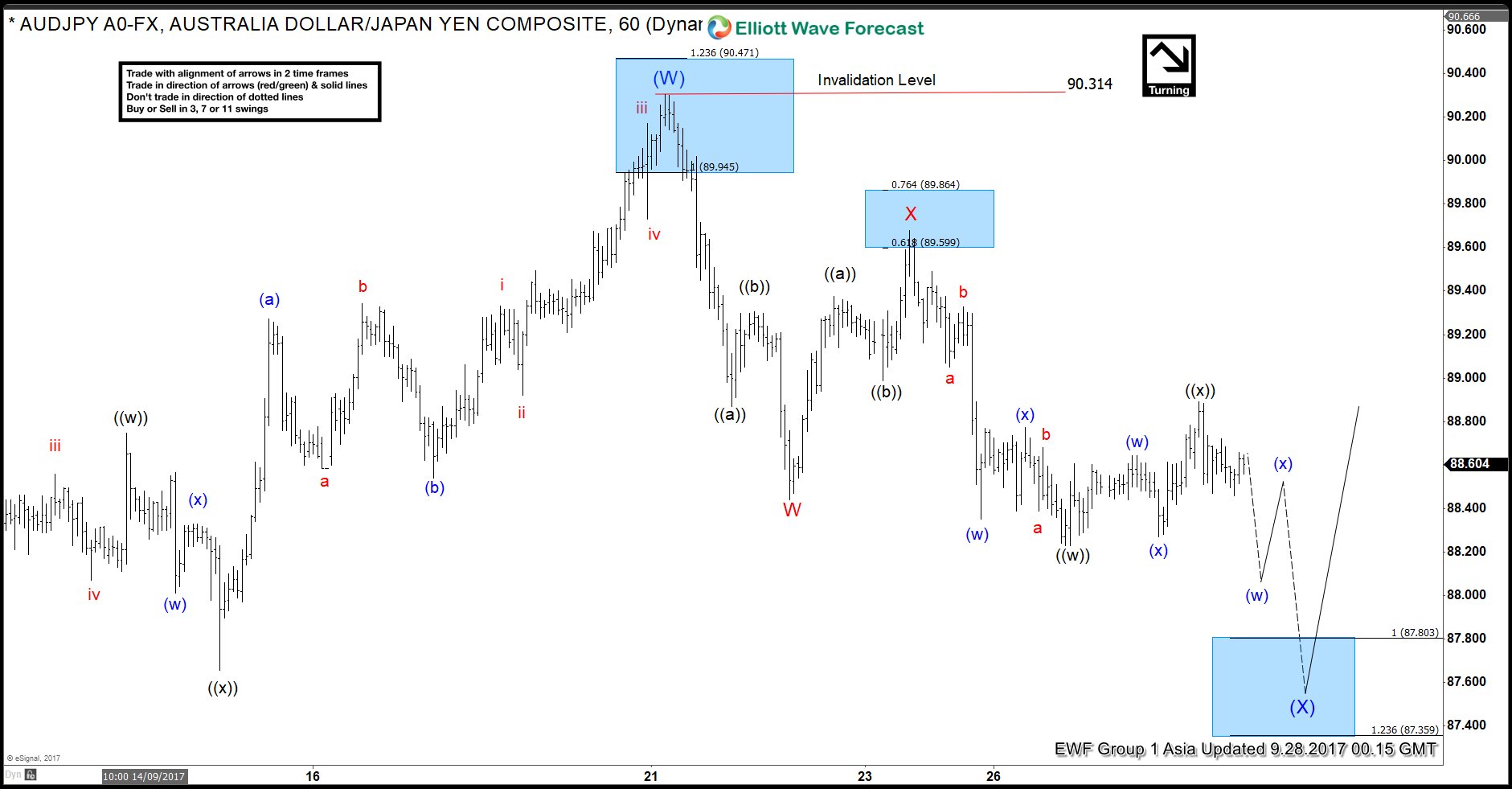

Elliott Wave Analysis : AUDJPY Correction Near Complete

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave W ended at 88.44 and Minor wave X ended at 89.68. Minor wave Y is unfolding also as a double three Elliott Wave structure. […]

-

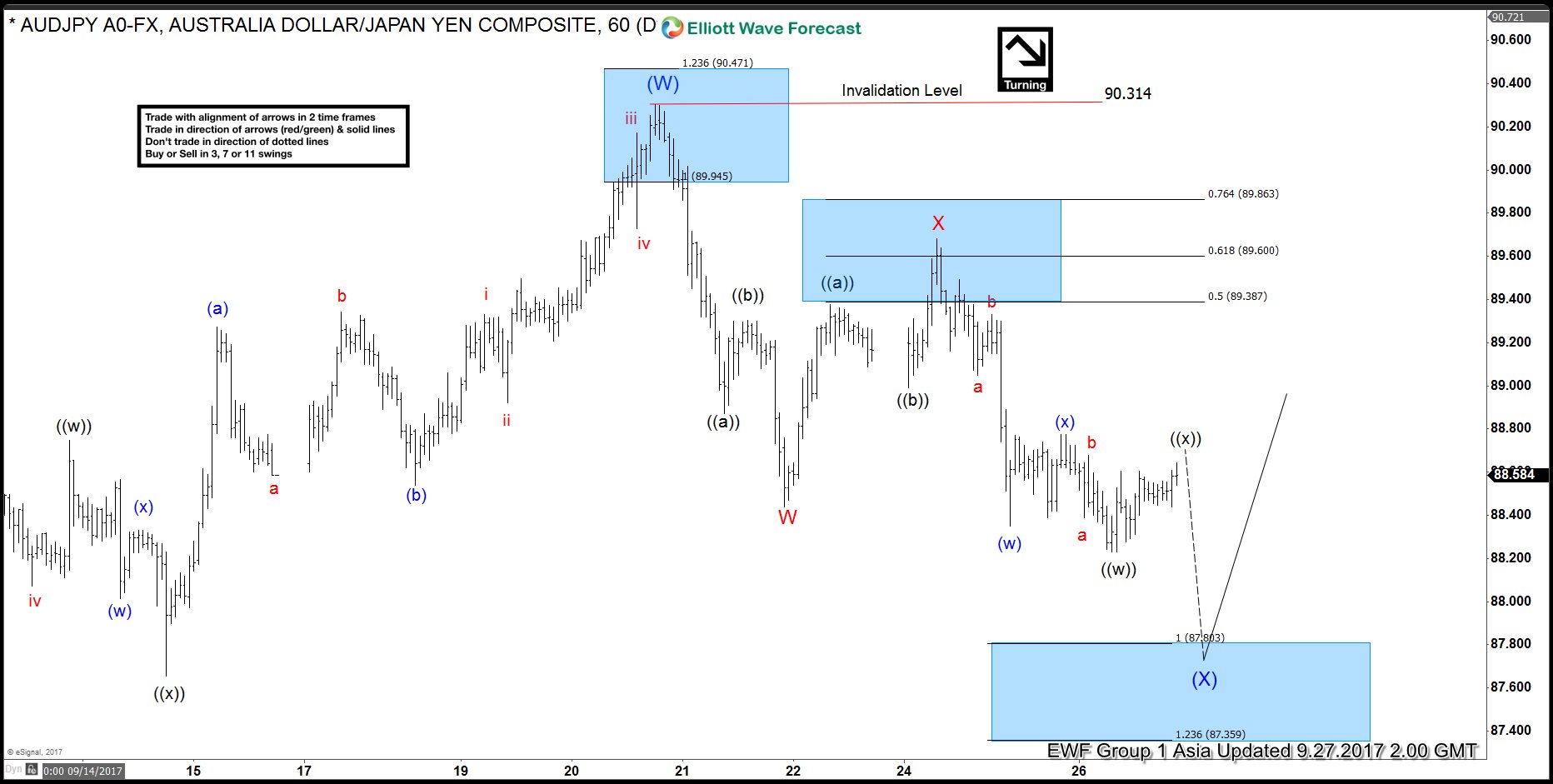

Elliottwave View: AUDJPY Correction in Progress

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

Elliottwave View: AUDJPY Doing a Correction

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

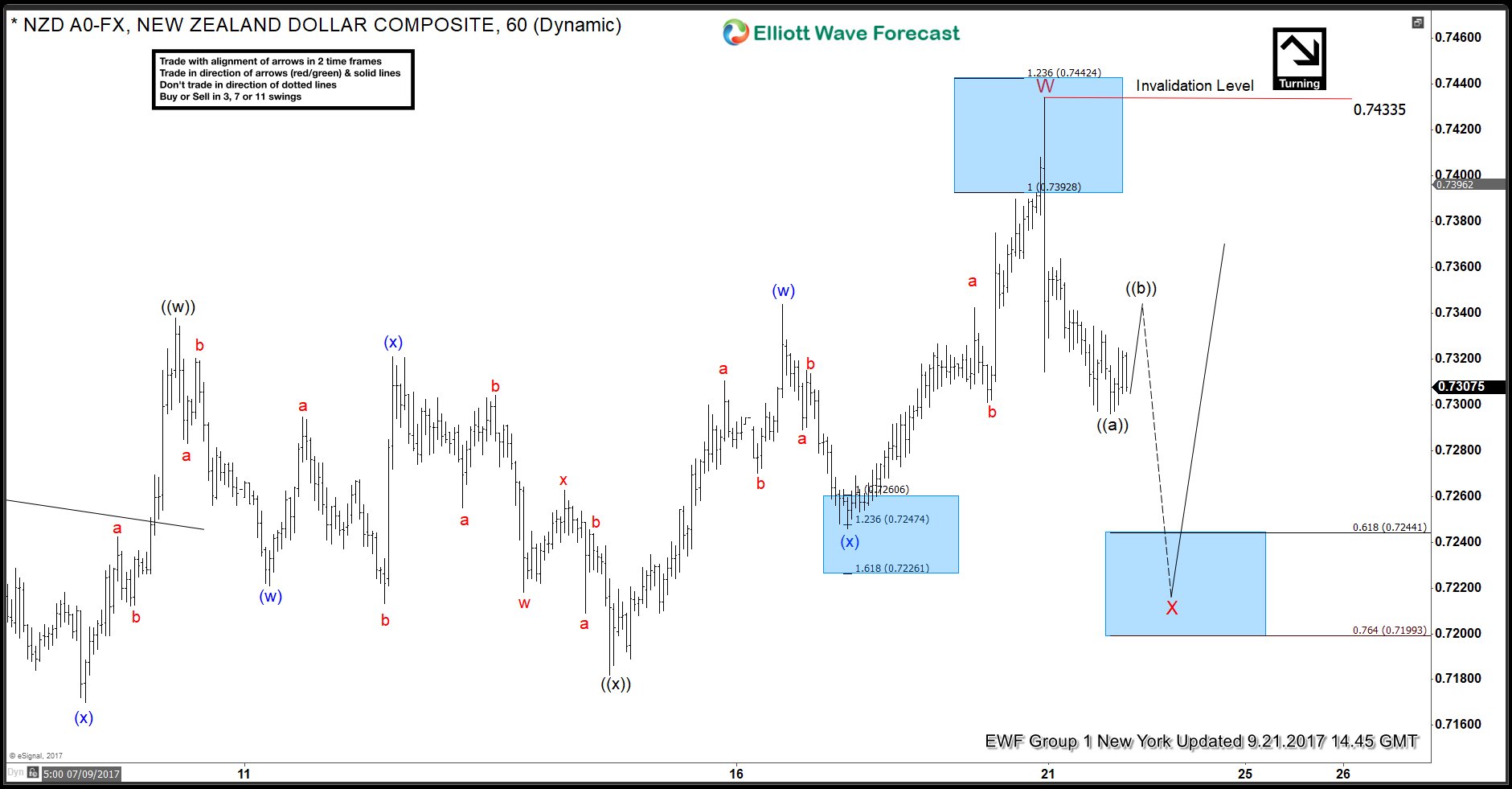

NZDUSD Elliott Wave View: Zigzag Correction

Read MoreNZDUSD Short Term Elliott Wave view suggests the rally from 8/31 low unfolded as a double three Elliott Wave structure and ended with Minor wave W at 0.7434. Up from 8/31 low (0.7127), Minute wave ((w)) ended at 0.7337, Minute wave ((x)) ended at 0.7182, and Minute wave ((y)) of W ended at 0.7433. Minor wave […]