-

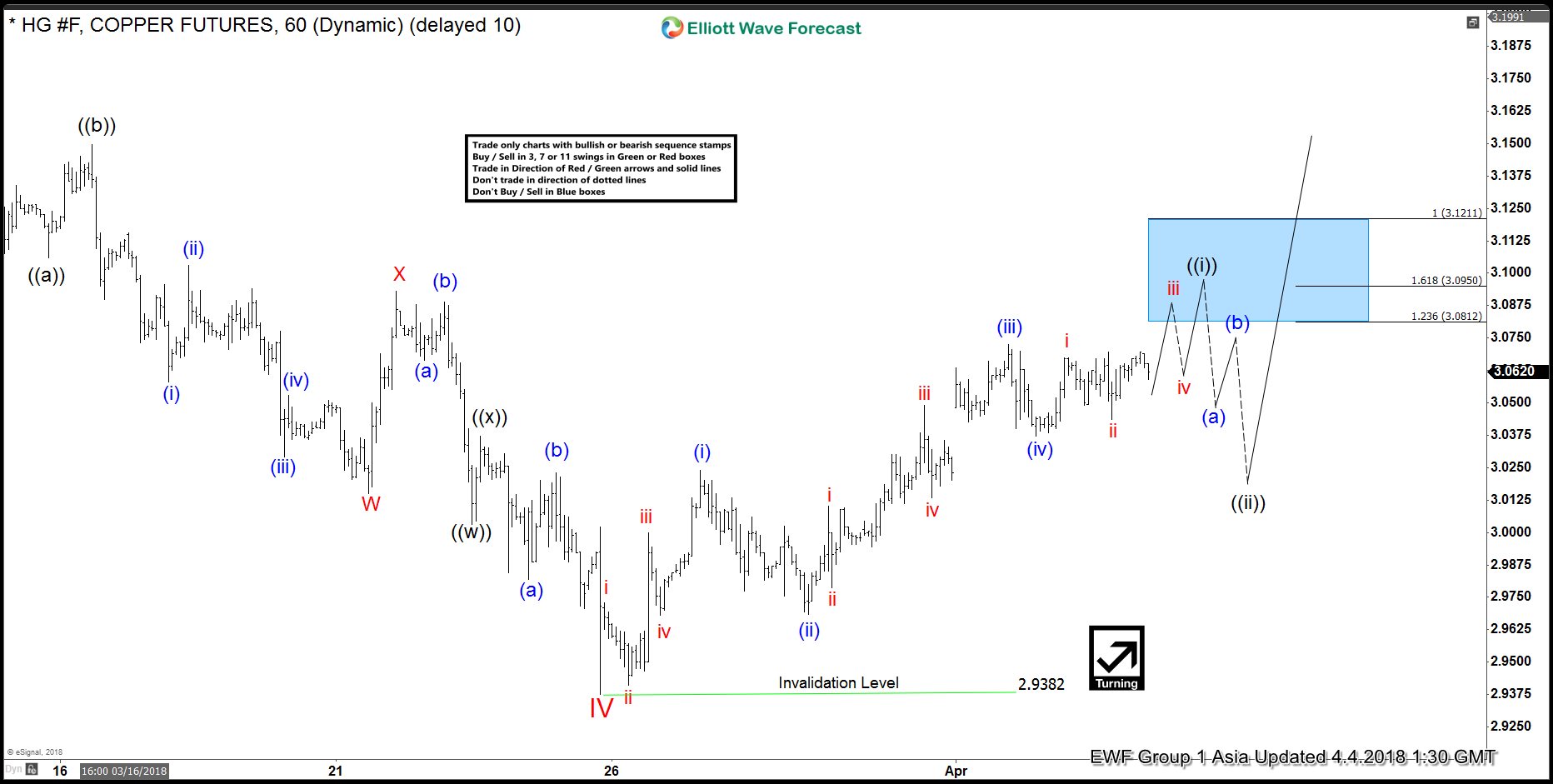

Elliott Wave View: Copper Starts a New Leg Higher

Read MoreShort Term Elliott Wave view in Copper suggests that the decline to 2.938 on 3.26.2018 ended Minor wave IV. The metal started a new leg higher from there in Minor wave V. Subdivision of Minor wave V is unfolding as an impulse Elliott Wave structure. An Impulse Elliott Wave structure is a 5 waves structure where […]

-

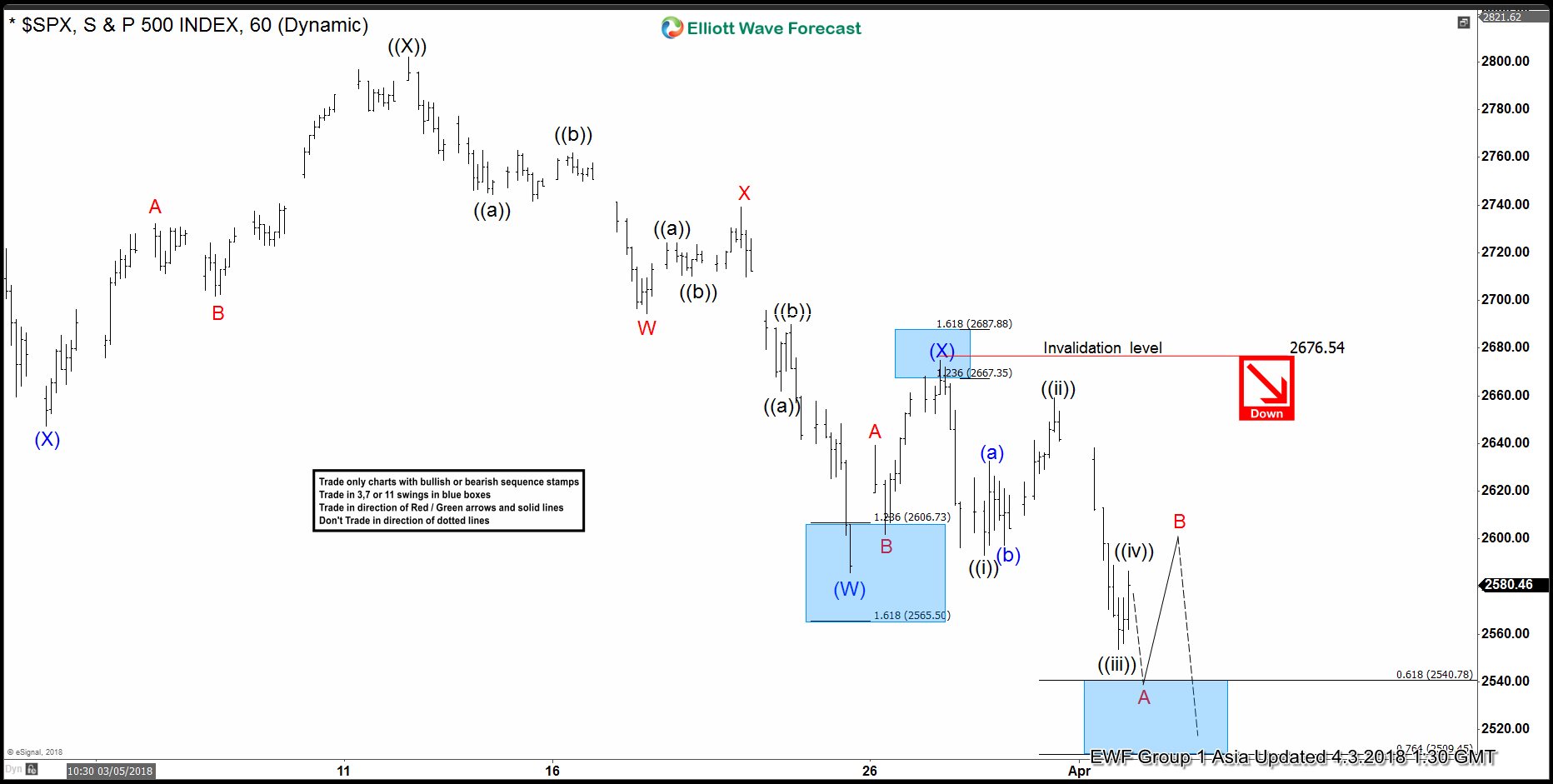

SPX Elliott Wave View: Further Weaknesses Likely

Read MoreSPX Elliott Wave view suggests rally to 2801.90 on 3/13/2018 ended Primary wave ((X)). Decline from there is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 2585.89 and Intermediate wave (X) ended at 2674.22. Subdivision of Intermediate wave (W) unfolded as another double three of a lower degree where Minor […]

-

FTSE Elliott Wave Analysis: Inflection Area for Next Leg Lower

Read MoreLatest Elliott Wave view in FTSE suggests that the Index ended Primary wave ((B)) at 7326.02 on 2/27/2018 high. From there, Index starts a decline which is unfolding as a 5 waves impulse Elliott Wave structure with an extension in wave (3). Down from 2/27/2018 high, Intermediate wave (1) ended at 7062.13, Intermediate wave (2) ended at 7256.33, […]

-

Elliott Wave Analysis: EURUSD in Sideways Consolidation

Read MoreCurrent Elliott Wave view in EURUSD suggests that the pair remains in sideways triangle Elliott Wave structure between 1.2153 low and 1.255 high. Triangle is a consolidation structure with ABCDE label. It has no particular trend and is usually a continuation structure. Since the previous trend in EURUSD up to 1.255 high on 2.16.2018 is bullish, […]

-

DAX Elliott Wave Analysis: Further Weakness Ahead?

Read MoreShort term Elliott Wave view in DAX suggests Primary wave ((B)) ended at 12434.7 on 3.16.2018. The decline from there is unfolding as a 5 waves impulse Elliott Wave structure. Down from 12434.7, Minor wave 1 ended at 12160, Minor wave 2 ended at 12375.5, Minor wave 3 ended at 11827, Minor wave 4 ended […]

-

Will Trade War Weigh on the Market?

Read MoreTrade war with China Hurt Global Economy Last week global stock market slumped due to the prospect of all-out trade war which could destabilize global economy. US market closed sharply lower for the week with S&P 500 falling 5.6% and Dow Jones Industrial Average falling 6%. Asia markets also skidded with Nikkei 225 falling 6.3%, […]