-

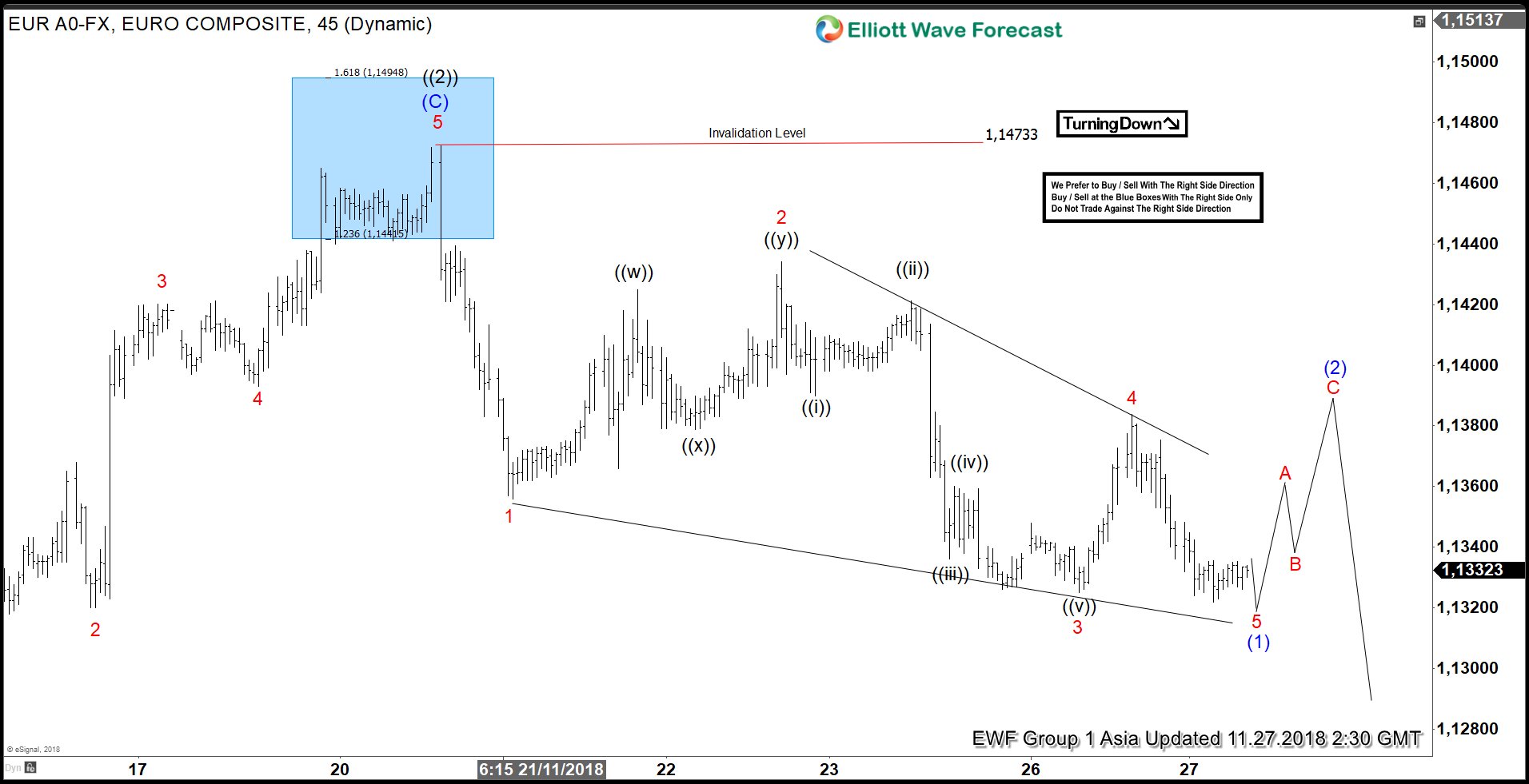

Elliott Wave Analysis: EURUSD 5 waves structure looking for more downside

Read MoreCycle from Sept 24 high (1.182) in EURUSD remains in progress as an Elliott Wave impulse structure where Primary wave ((1)) ended at 1.1214 and Primary wave ((2)) is proposed complete at 1.147. Pair still needs to break below Primary wave ((1)) at 1.1214 to validate this view. Until then, we still can’t rule out […]

-

G20 Meeting May Dictate Path of Stock Market for Rest of the Year

Read MoreGlobal Indices continue to retreat in the fourth quarter of this year as the combination of Fed’s quantitative tightening and escalating trade wars threatens to derail the 10 year bullish market. Below is the Year-to-Date return of the Global Indices as of Friday Nov 24: Next week, global Indices will have a chance to find […]

-

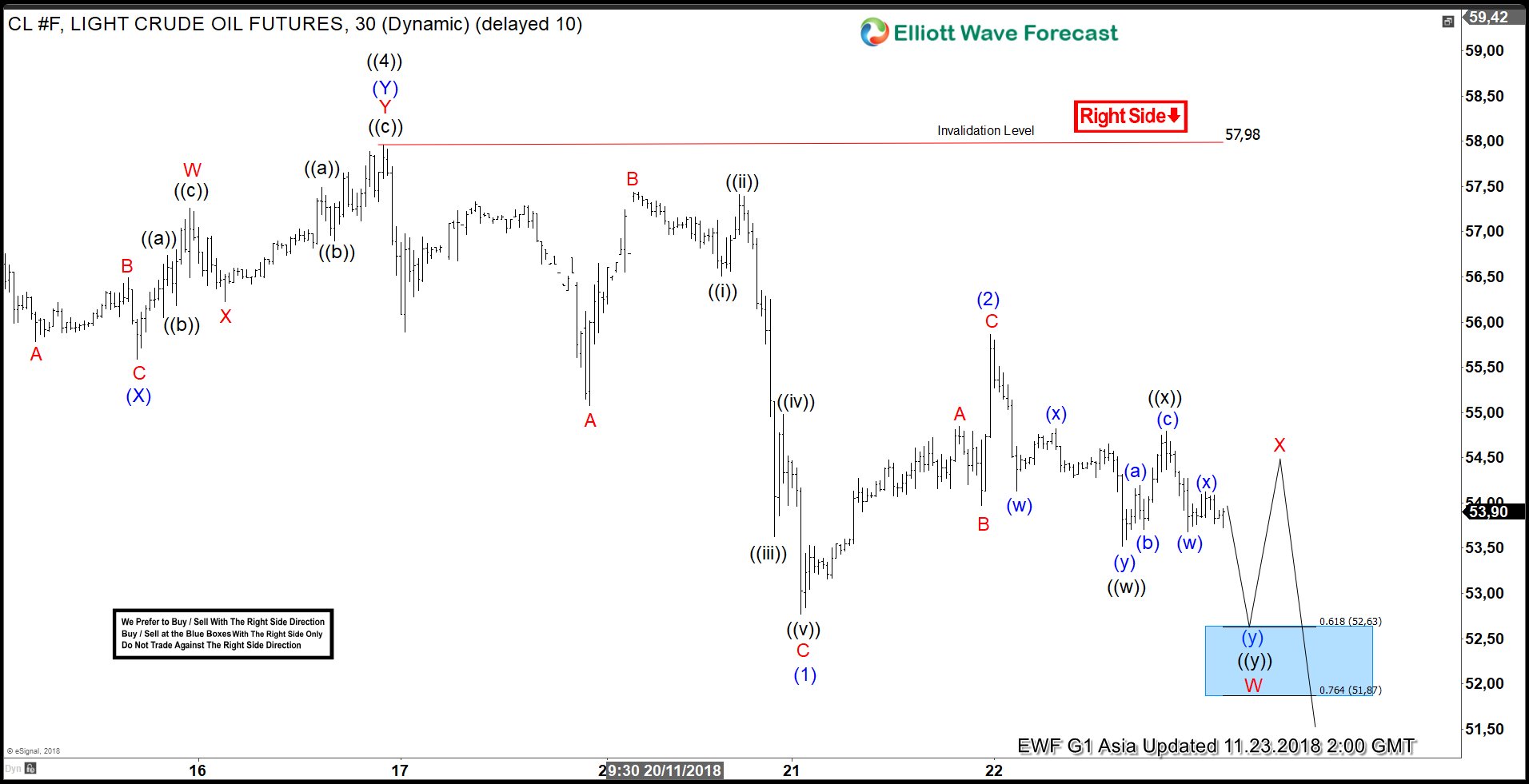

Elliott Wave Analysis: Further Downside Expected in Oil

Read MoreSince forming the high on Oct 3 at $76.9, Oil (CL_F) has dropped more than 30% in just less than 2 months. The move lower is pretty fast and short term Elliott Wave view suggests the decline is unfolding as an impulse Elliott Wave structure. Down from $76.9, Primary wave ((1)) ended at $68.47, Primary […]

-

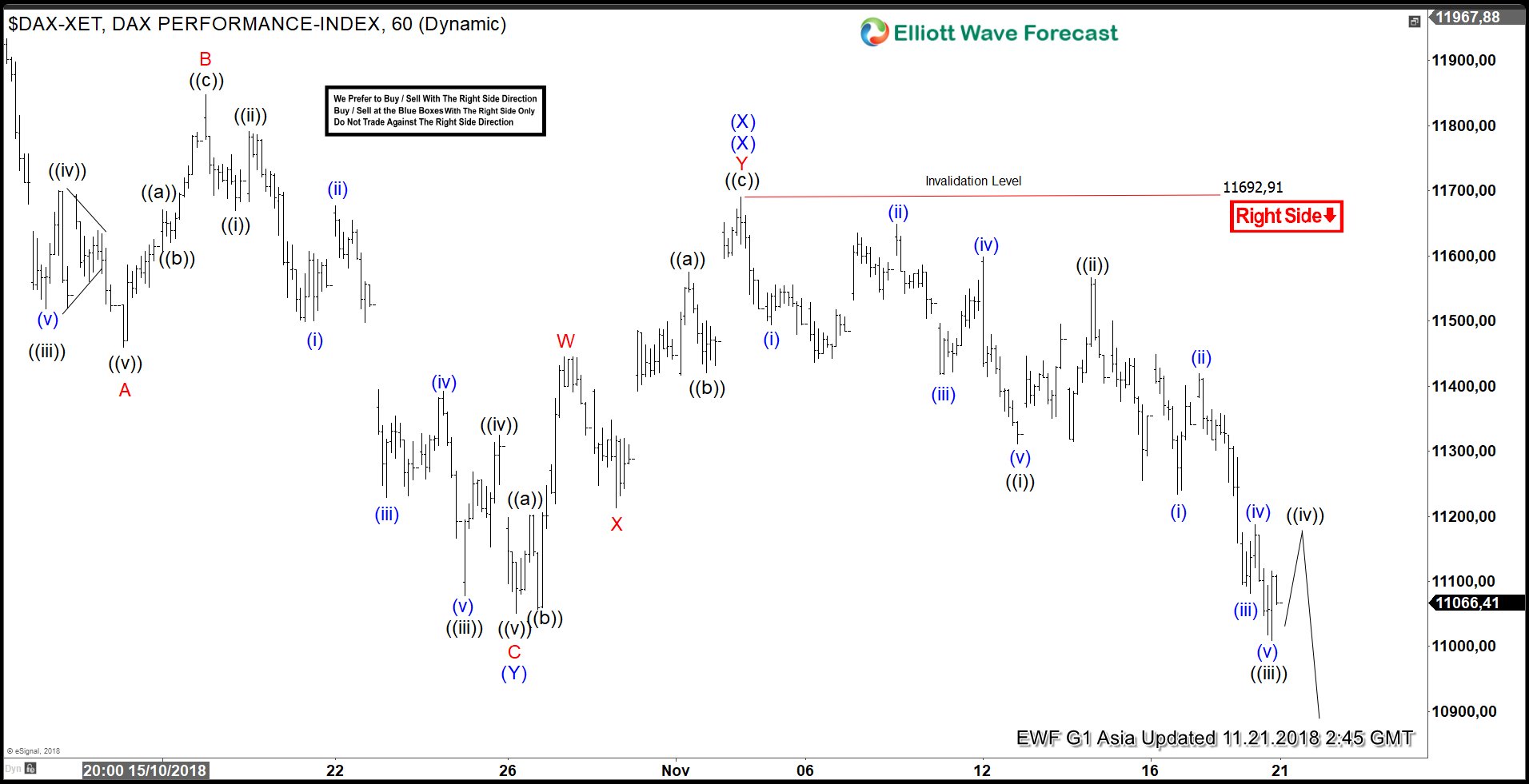

DAX Elliott Wave Analysis Calling Rally to Fail for Extension Lower

Read MoreDAX has broken below Oct 26 low (11051) and suggests that the Index has resumed the decline lower. We are calling the decline from July 27 high (12886.83) as a triple three Elliott Wave Structure. Decline to 11051.04 low on Oct 26 ended Intermediate wave (Y). From there, rally to 11692.91 high on Nov 2 ended […]

-

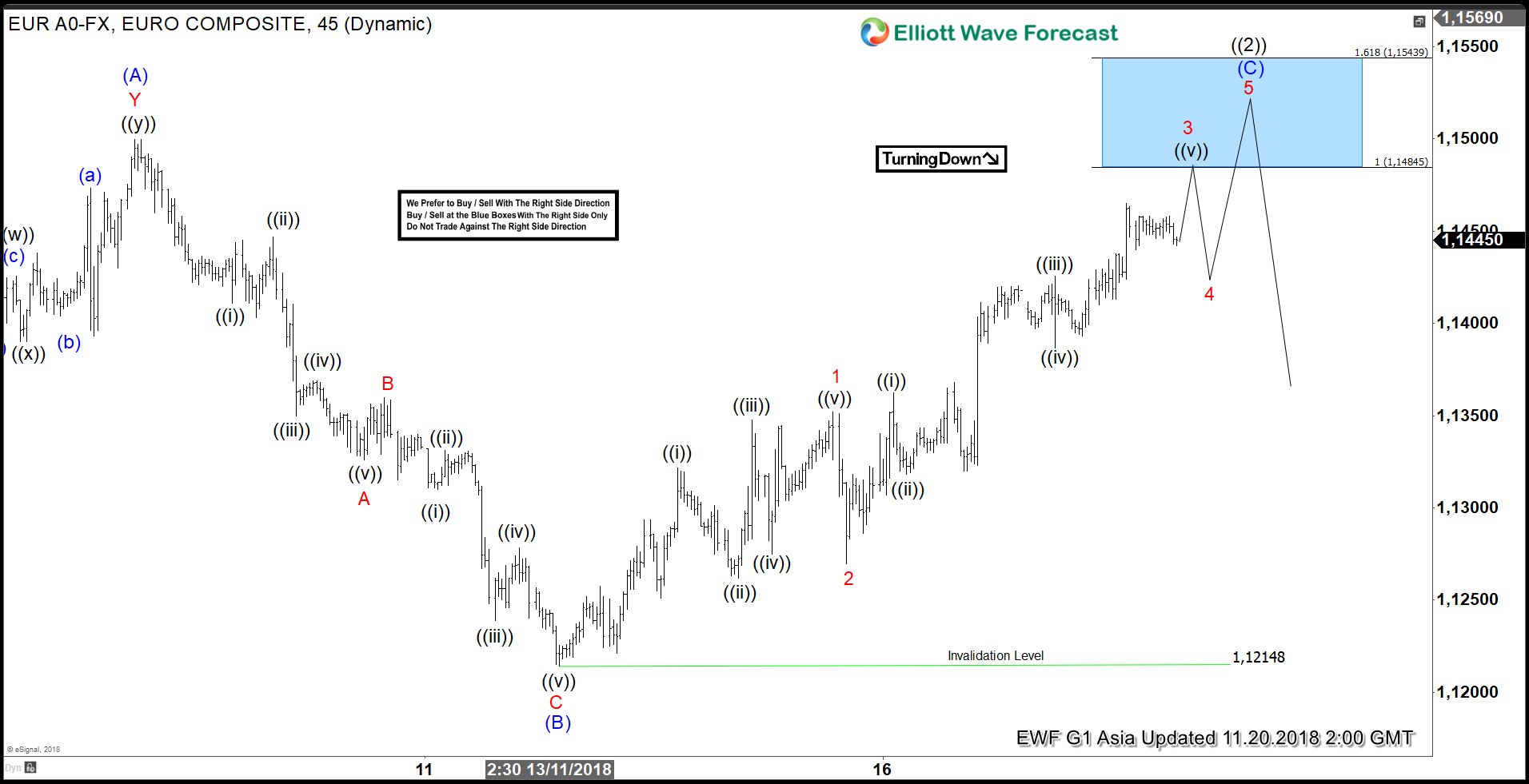

Elliott Wave analysis calling EURUSD to resume lower after Flat correction

Read MoreShort Term Elliott Wave View on EURUSD suggests that pair is currently in Primary wave ((2)) rally to correct cycle from Sept 24 high (1.1815) before the decline resumes. Internal of Primary wave ((2)) is unfolding as a Flat Elliott Wave structure where Intermediate wave (A) ended at 1.15 and Intermediate wave (B) ended at […]

-

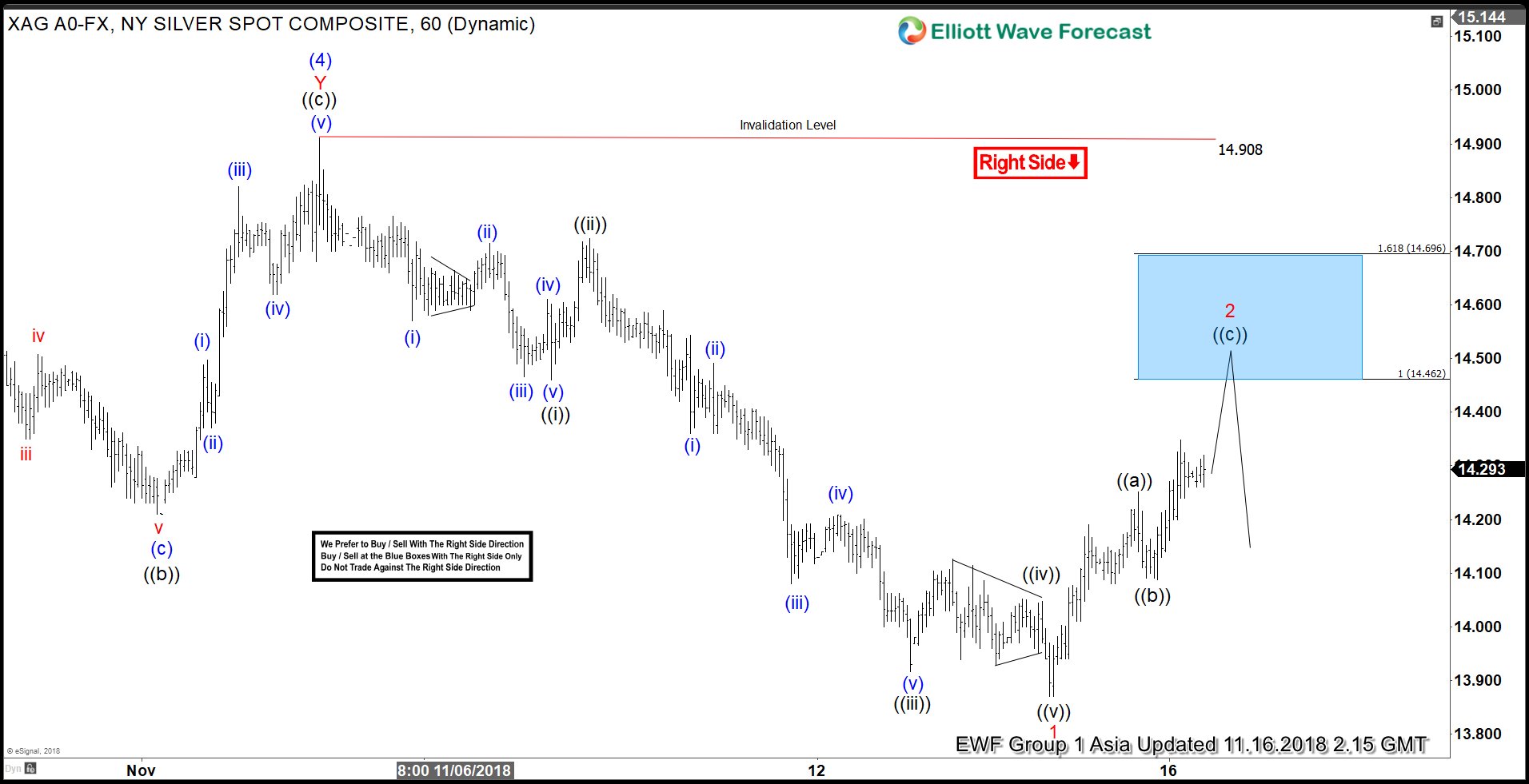

Elliott Wave Analysis: Another Dead Cat Bounce in Silver?

Read MoreThe precious metal group does not get any break in the past 7 years. The move lower has been relentless and rally has been short lived. Silver in particular has corrected 70% from the 2011 high at $50 and still has not shown any sign of serious recovery. Our short term Elliott Wave view suggests […]