-

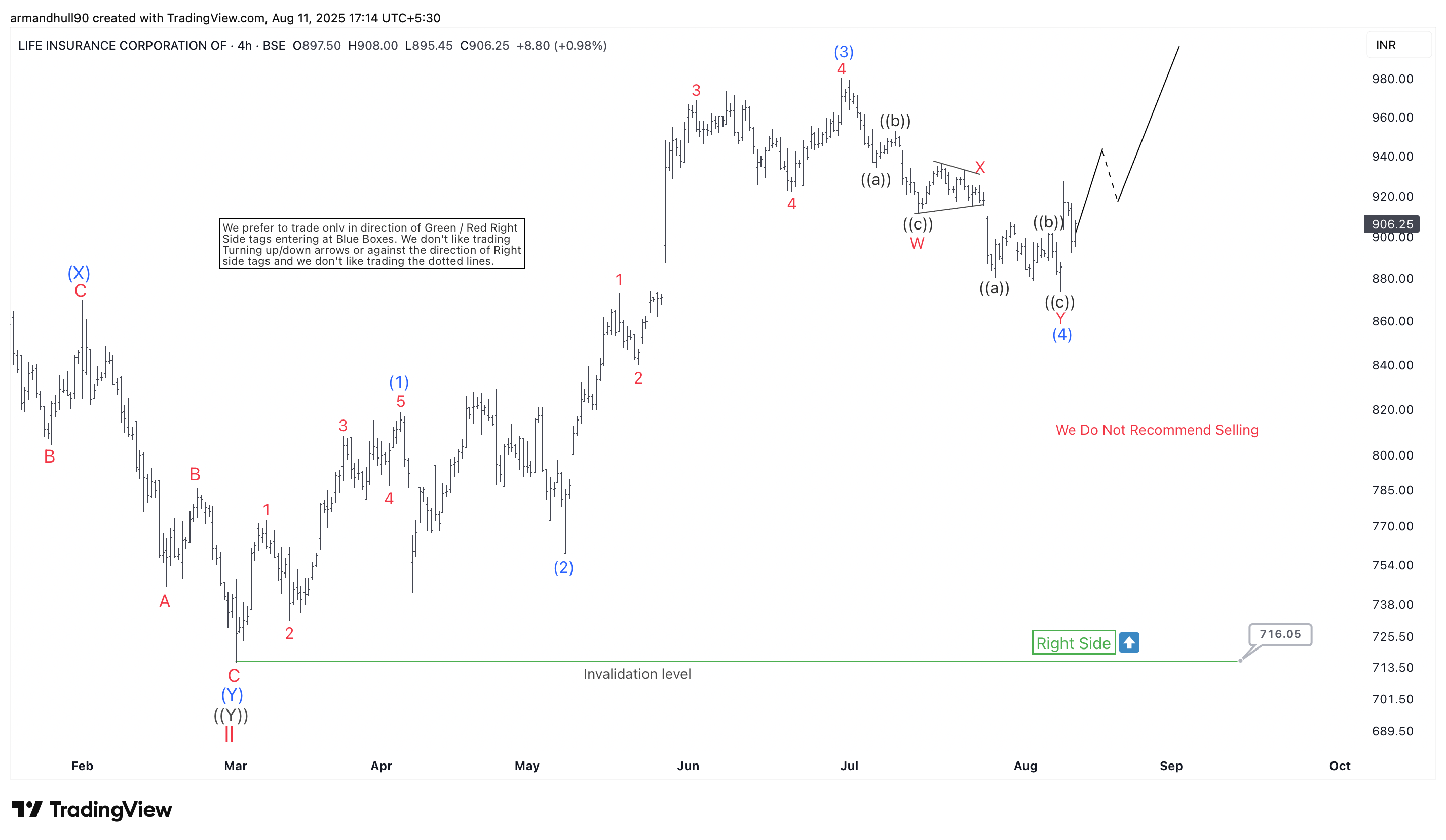

LIC Share Price Extends Rally, Aligning with Elliott Wave Bullish Structure

Read MoreLife Insurance Corporation of India (LIC) advances in line with a bullish Elliott Wave sequence, supported by strong buying momentum. After completing a prolonged correction, Life Insurance Corporation of India (BSE: LICI) has resumed its bullish trend. The stock recently completed wave (4) near the 860 INR area, aligning with the blue box buying zone. […]

-

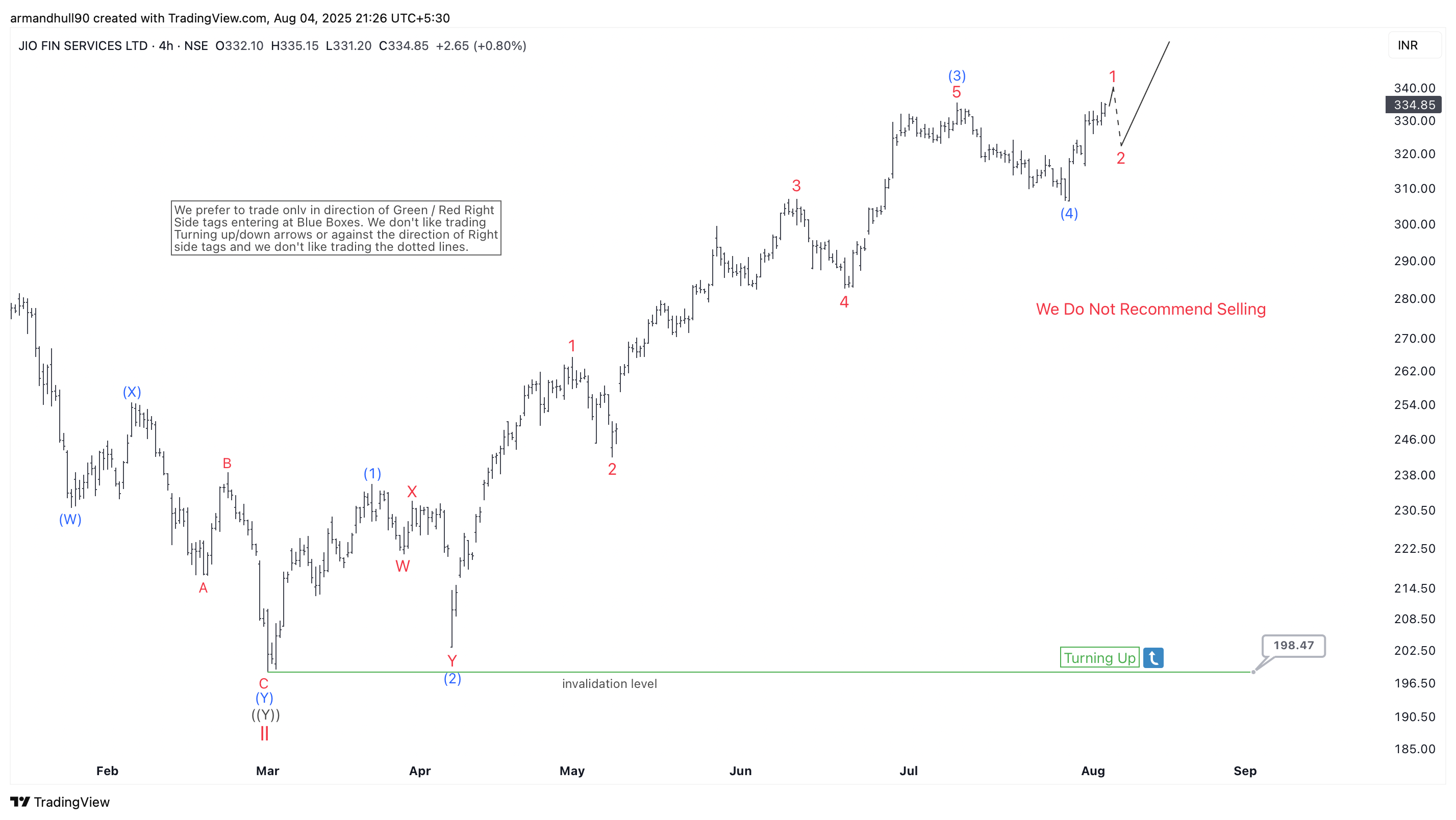

Jio Financial Services Elliott Wave Update: Wave (5) in Progress

Read MoreJIOFIN resumes its bullish trend after completing a correction near 198.47 INR. The stock is now advancing in wave (5) of a larger Elliott Wave sequence. After a prolonged correction, Jio Financial Services Ltd (NSE: JIOFIN) completed its larger wave II near the 198.47 INR level. This area also aligned with the ideal blue box […]

-

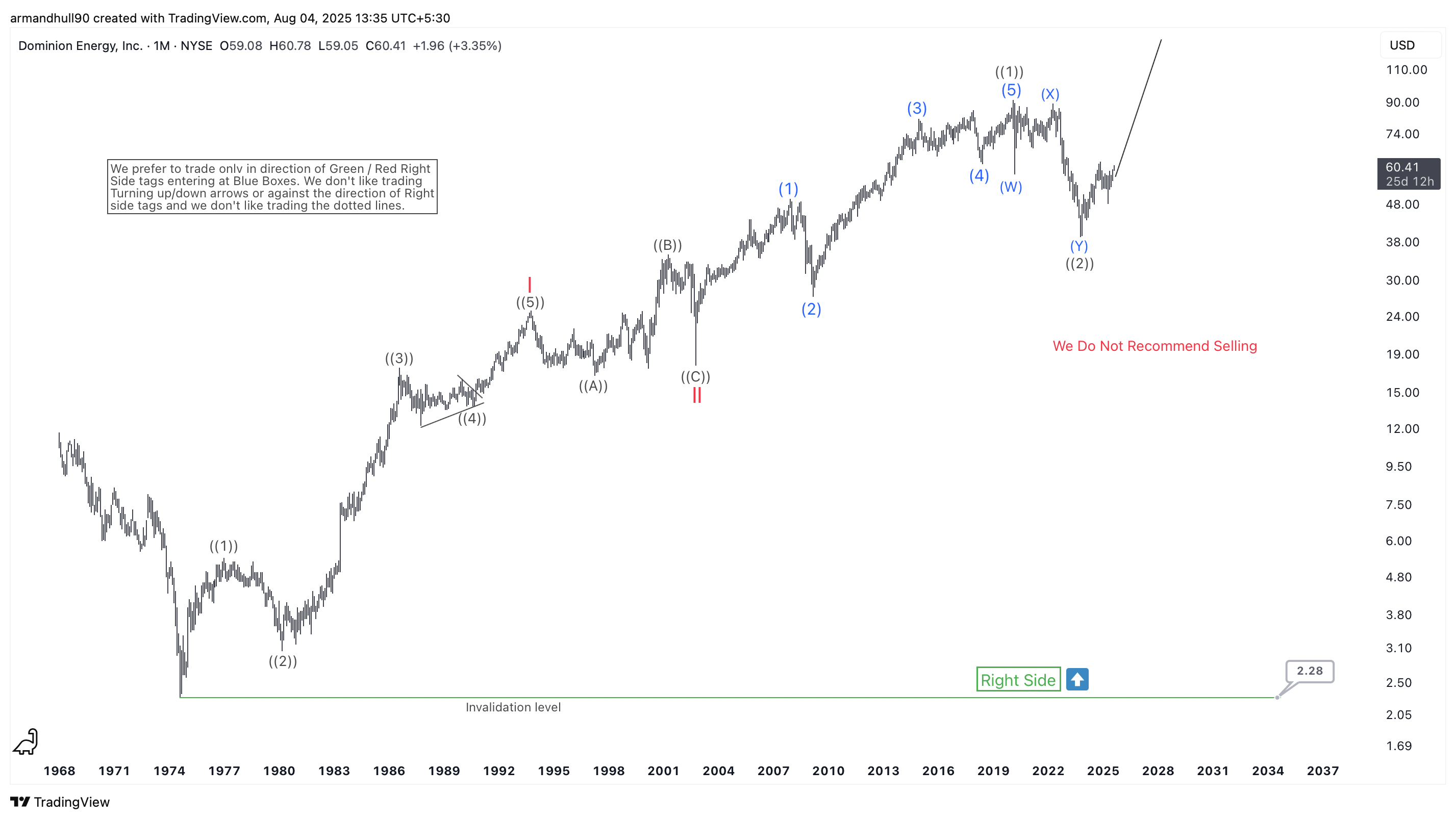

Dominion Energy (D) Elliott Wave Analysis: Major Bullish Cycle in Play

Read MoreWave ((2)) Correction Likely Complete – Long-Term Elliott Wave Rally May Be Underway Toward $100+ Dominion Energy (D) has shown a strong bullish structure on the monthly chart, suggesting a significant Elliott Wave progression. According to the latest analysis, the stock may have completed the corrective wave ((2)). If confirmed, this sets the stage for […]

-

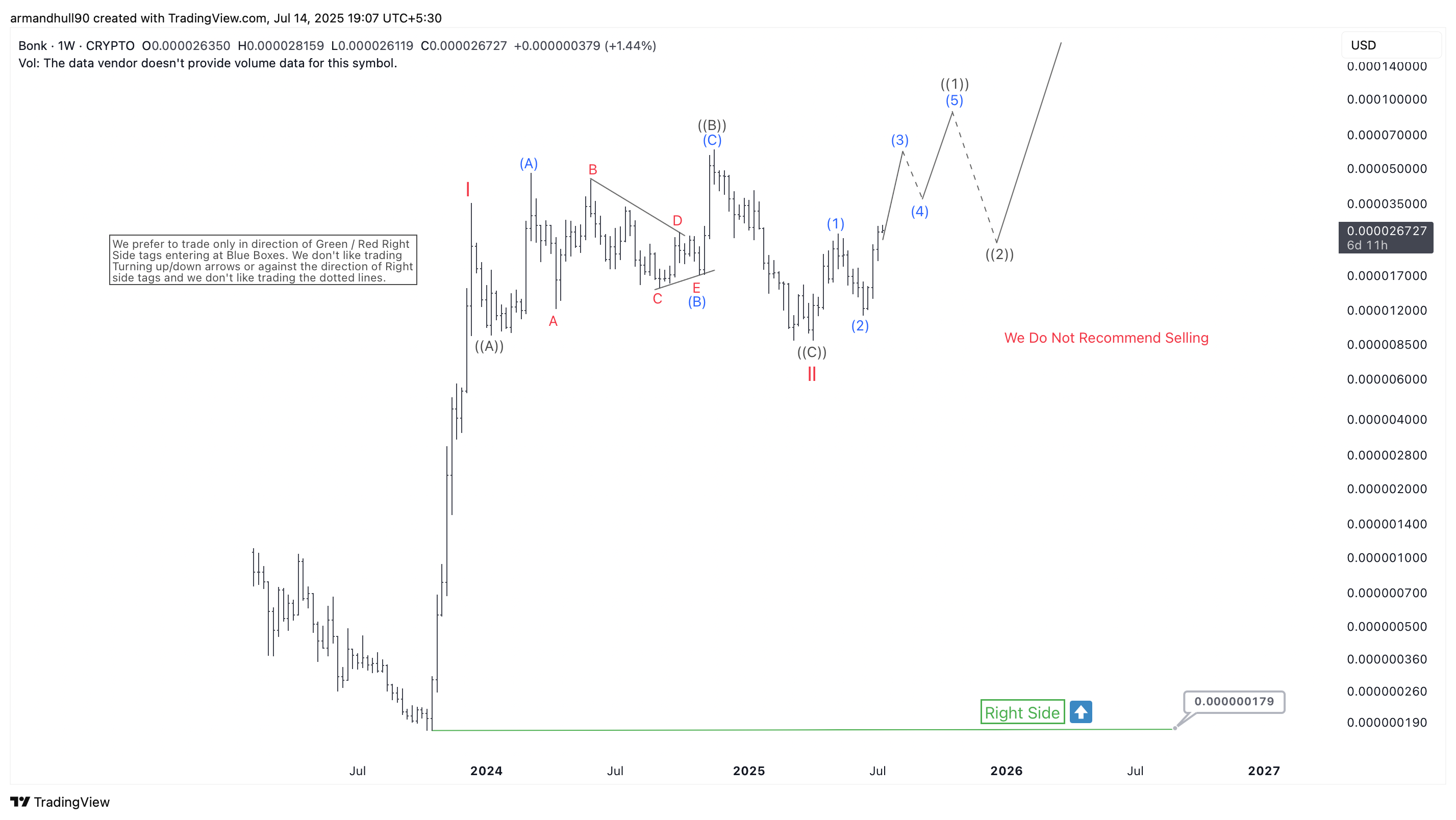

BONK/USD Correction Complete – Elliott Wave Points to Next Bullish Leg

Read MoreAfter finishing a complex corrective structure, Bonk (BONK/USD) begins a fresh bullish cycle. Elliott Wave analysis points to further upside as wave III unfolds. Bonk (BONK/USD), one of the notable meme coins in the crypto space, is showing signs of a fresh bullish cycle following the completion of a complex corrective structure. The weekly chart […]

-

Nu Holdings (NYSE: NU) Completes Elliott Wave (II) Correction

Read MoreWave (II) correction ends as NU begins a new impulsive cycle with strong upside potential supported by Elliott Wave analysis. Nu Holdings Ltd. (NYSE: NU) continues to gain bullish traction as the stock completes a significant corrective phase. The weekly Elliott Wave structure suggests that wave (II) has ended, and a new impulsive wave higher […]

-

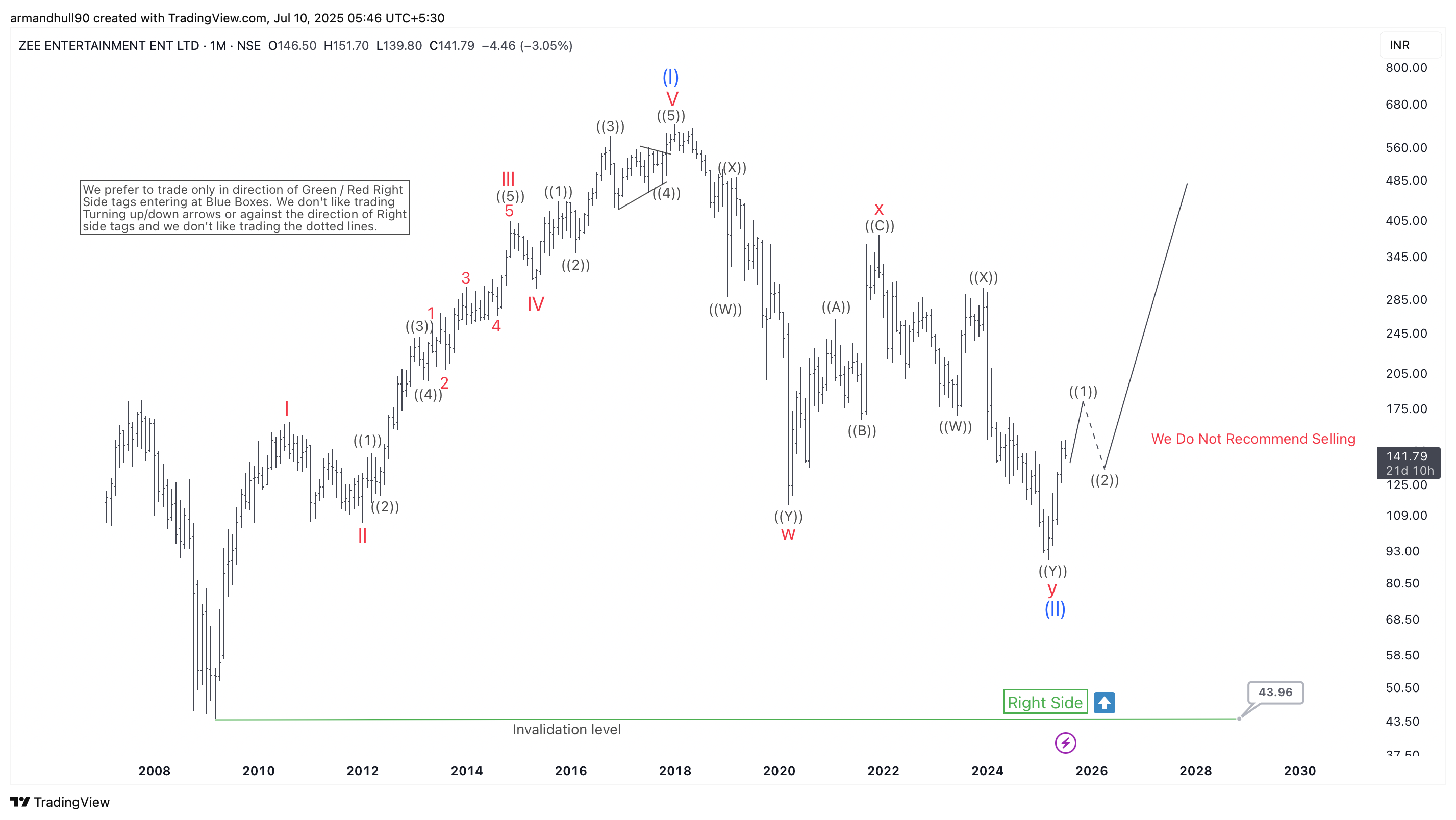

Zee Entertainment (ZEEL): New Elliott Wave Bullish Trend Emerges

Read MoreZEEL finishes a multi-year Elliott Wave correction and begins a fresh impulsive rally, signalling strong upside potential ahead. Zee Entertainment Enterprises Ltd (NSE: ZEEL) appears to be turning the corner after completing a long and complex Elliott Wave correction. According to the weekly chart, ZEEL has finished a multi-year double zigzag corrective structure in wave […]