AT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S.

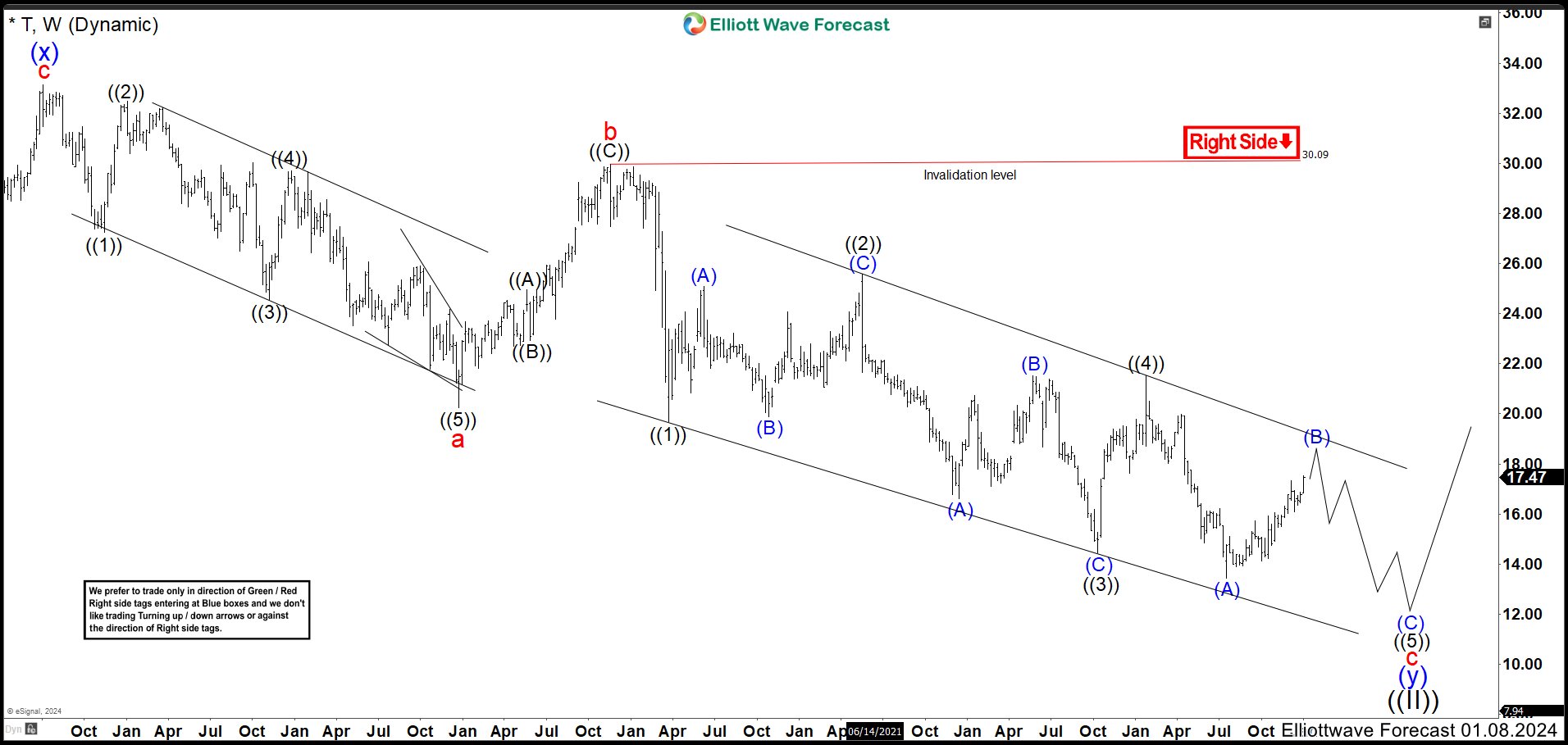

T Weekly Chart Septembre 2023

On the weekly chart of T, we saw in more details the structure of the wave (y). Wave a in red made a leading diagonal that ended at $20.21. Then it bounced in 3 waves ending wave b at $29.96 to continue sharply lower. Wave c took the form of an ending diagonal. Down from wave b in lesser degree, wave ((1)) ended at $19.60 low. Wave ((2)) made 3 swings up to complete at $25.57 high. Another 3 swings lower ended at $14.46 as wave ((3)) and strong rally made wave ((4)). The rally entered in wave ((1)) zone giving the ending diagonal Elliott structure, completing wave ((4)) at $21.53 high. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

T Weekly Chart January 2024

On January weekly chart, we can see the structure needs 3 waves lower to end wave ((5)). Wave (A) of ((5)) has ended at $13.43 and wave (B) started. Therefore, we expect to see a bounce higher in 3, 7 or 11 swings without breaking $21.53 wave ((4)) high to complete wave (B) before resuming lower in wave (C). Wave (B) still remains bullish to end the corrective structure. It could end in 17.82 – 19.00 area. To confirm the view, the stock have to break $13.43 low. In that case, we can calculate the possible area where wave ((5)) could end and also the whole correction of wave ((II)) to look for buying opportunities.

Elliott Wave Forecast

www.sifaha.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@sifaha.com

Back