The ongoing conflict between Russia and Ukraine has raised concerns about the possibility of it escalating into a global conflict, potentially leading to World War III. While such a scenario remains speculative, the economic impact of a large-scale war would be profound, affecting various sectors of the financial markets, including stocks, commodities, forex, and cryptocurrencies.

Stock Market and Indices

Geopolitical instability often triggers immediate reactions in the stock market. In the event of a world war, investors would likely liquidate equities due to fears of disruptions in global supply chains, trade, and economic activity. This risk aversion would drive capital into safer assets like government bonds, gold, or cash. Countries directly involved in the conflict or with significant trade relationships with the combatants would likely experience significant stock declines. For example, the U.S. stock market, which has ties to both Europe and Russia, would see major volatility, and indices such as the S&P 500, Dow Jones, and Nasdaq could fall as uncertainty over supply chains and rising energy costs takes hold.

Futures and Commodities

Futures markets for key commodities like oil, gas, and metals would be directly affected by a war. Russia’s role as a major exporter of oil and natural gas means that any disruption would send shockwaves through global energy markets. This could exacerbate inflation, especially in energy-dependent economies. European natural gas futures might spike as nations look to reduce dependence on Russian energy supplies. Commodities like gold and silver, traditionally seen as safe-haven assets, would likely rise as investors seek stability during global conflict. Additionally, agricultural commodities like wheat, corn, and barley would see price increases due to disruptions in Ukrainian exports.

ETFs (Exchange-Traded Funds)

ETFs, which allow investors to buy baskets of stocks, bonds, or commodities, would also experience significant price movements. Broad market ETFs, such as the SPDR S&P 500 ETF (SPY), would likely decline as stock markets suffer. However, sector-specific ETFs related to energy, defense, and commodities could benefit. Energy ETFs, such as the XLE, might rise with oil and gas price surges. Defense ETFs, like the iShares Aerospace & Defense ETF (ITA), could also see strong performance due to increased military spending during heightened tensions.

Forex (Foreign Exchange)

The foreign exchange market would experience significant volatility. Currencies from countries involved in the conflict would likely depreciate. For example, the Russian ruble could fall further if sanctions increase. Safe-haven currencies like the U.S. dollar (USD), Japanese yen (JPY), and Swiss franc (CHF) would appreciate as investors seek stability. The Euro (EUR) might also weaken if the conflict impacts the European economy. Commodity-linked currencies, such as the Canadian dollar (CAD) and Australian dollar (AUD), could initially rise due to higher commodity prices but might face declines if global trade disruptions occur.

The foreign exchange market would experience significant volatility. Currencies from countries involved in the conflict would likely depreciate. For example, the Russian ruble could fall further if sanctions increase. Safe-haven currencies like the U.S. dollar (USD), Japanese yen (JPY), and Swiss franc (CHF) would appreciate as investors seek stability. The Euro (EUR) might also weaken if the conflict impacts the European economy. Commodity-linked currencies, such as the Canadian dollar (CAD) and Australian dollar (AUD), could initially rise due to higher commodity prices but might face declines if global trade disruptions occur.

Cryptocurrencies

Cryptocurrencies, often seen as safe-haven assets, could experience increased volatility during a global crisis. While Bitcoin and Ethereum may rise due to their decentralized nature and limited supply, the extreme uncertainty could lead to short-term sell-offs. Stablecoins, pegged to fiat currencies, might see higher demand for their stability and ease of cross-border transactions.

Conclusion

The financial markets are highly sensitive to geopolitical events, and a global conflict would have far-reaching consequences. Stock indices would likely decline, while commodities like oil, gold, and agricultural products would see price surges. The forex market would experience volatility, with safe-haven currencies strengthening. Cryptocurrencies could face both volatility and increased demand. Investors should remain vigilant, monitor developments closely, and consider risk management strategies during uncertain times.

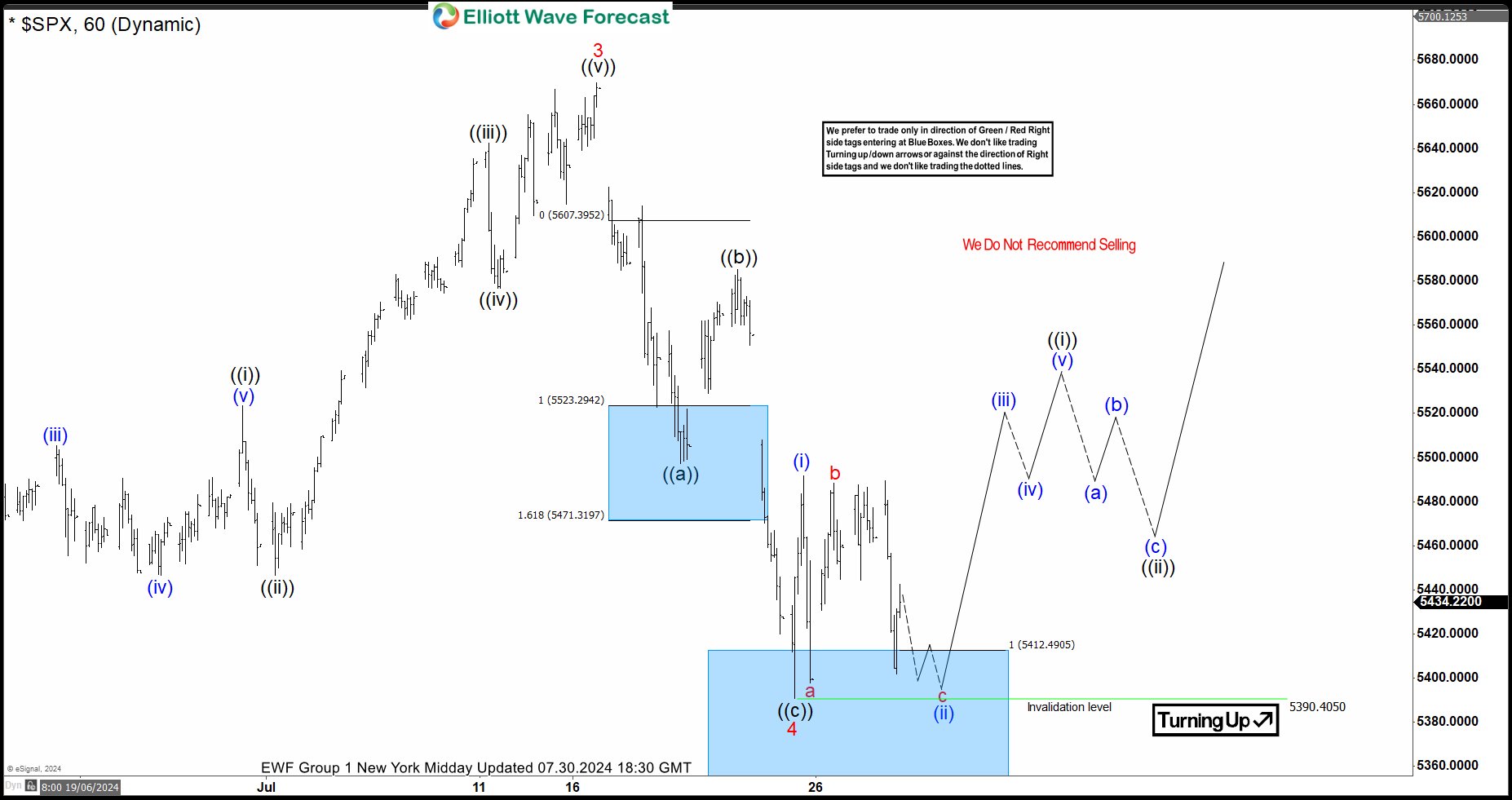

Elliott Wave Forecast

www.sifaha.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a 24 hours chat room where we will help you with any questions about the market.

14 Days Trial costs $9.99 only. Cancel anytime at support@sifaha.com