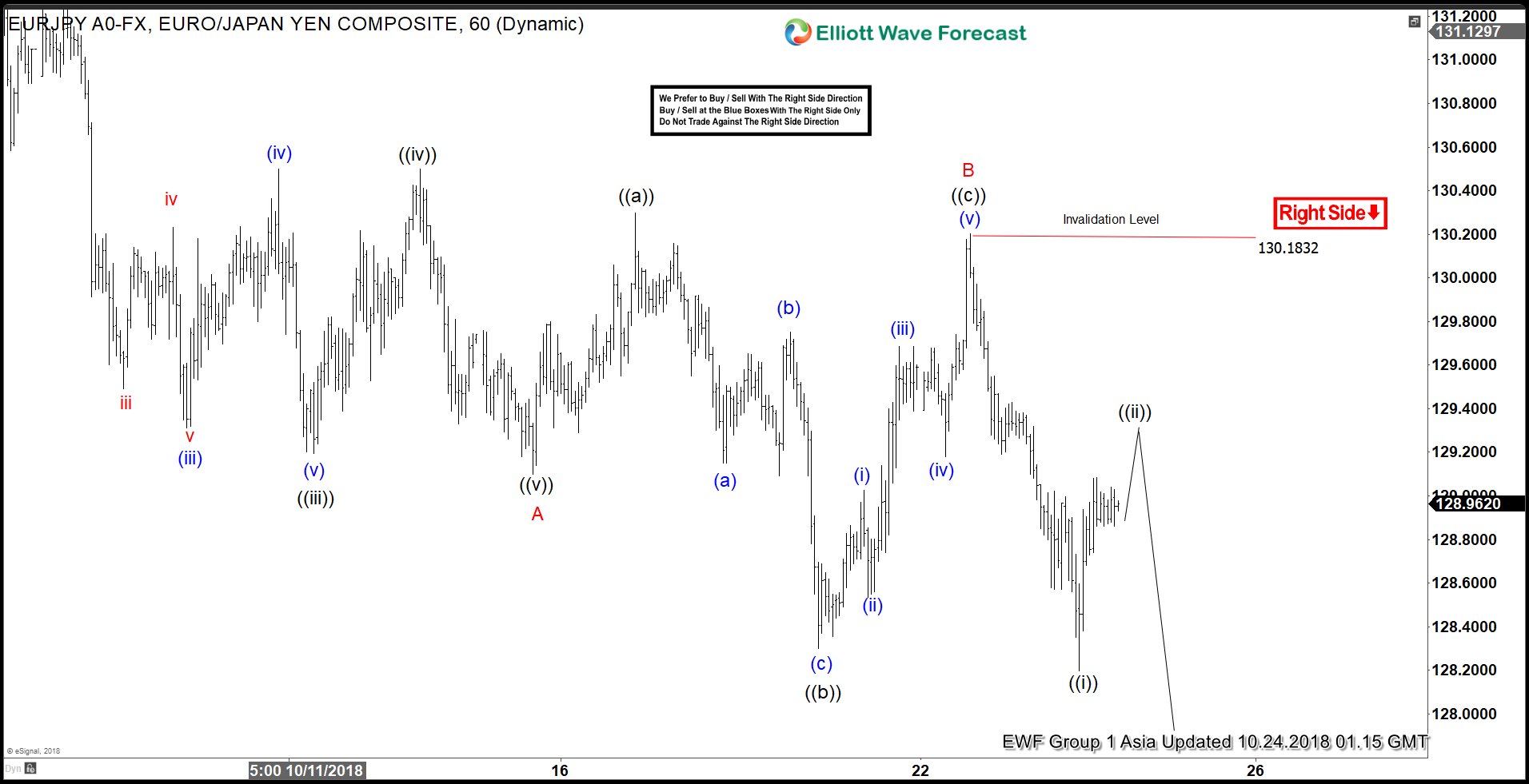

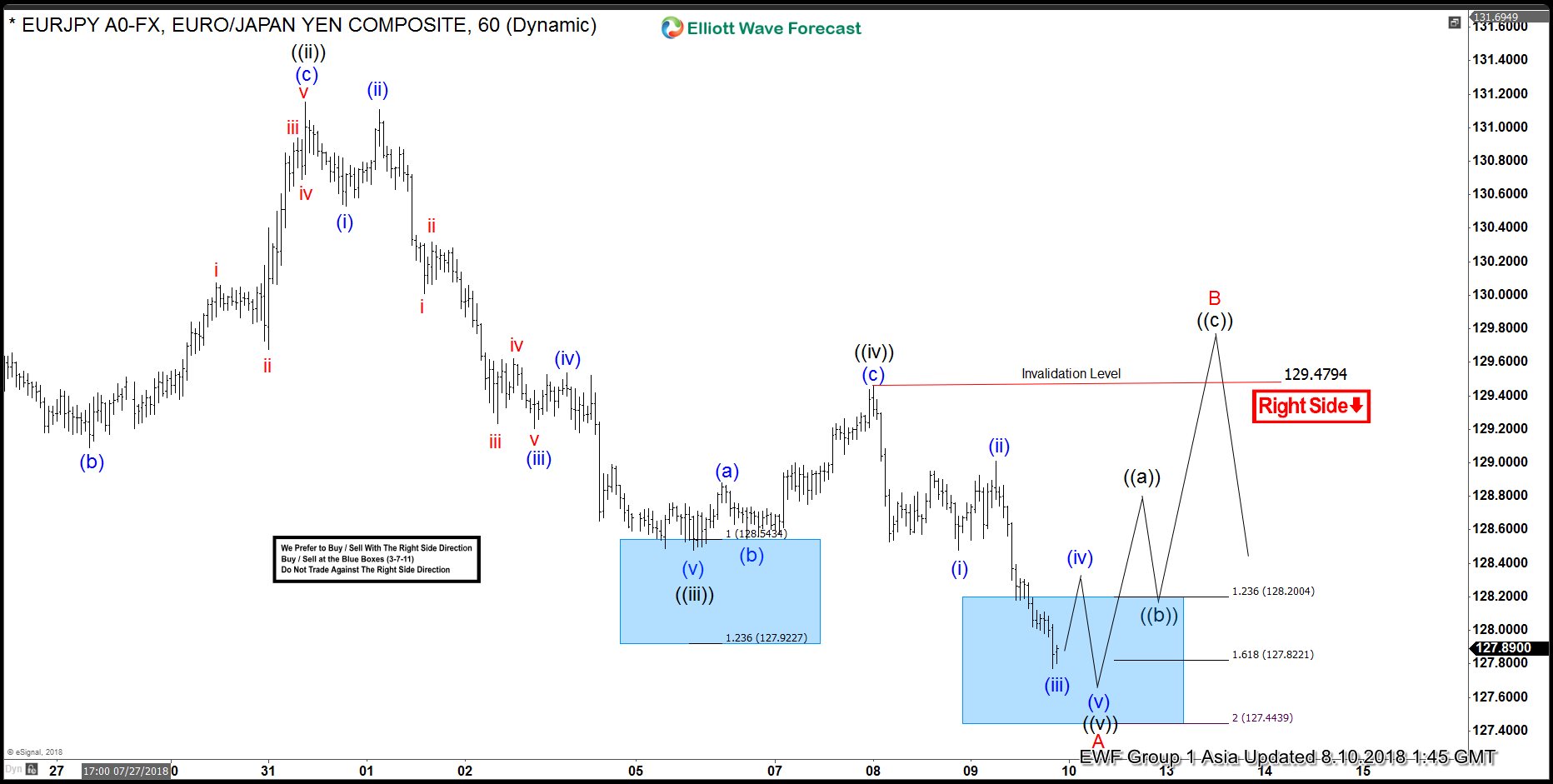

EURJPY short-term Elliott wave analysis suggests that the decline to 129.13 low ended Minor wave A. The internals of that decline unfolded in 5 waves impulse structure in a lesser degree cycle. Thus suggests that the pair can be doing a Zigzag correction lower. Up from there, a bounce to 130.18 high ended Minor wave B bounce as a Flat correction where Minute wave ((a)) ended in 3 swings at 130.30. A decline to 128.32 low ended 3 waves in Minute wave ((b)). Then a rally to 130.18 high ended 5 waves in Minute wave ((c)) & also completed Minor wave B bounce. Down from there, Minor wave C remain in progress & has managed to make a new low below 128.32 low confirming the next extension lower. Where Minute wave ((i)) of C ended in lesser degree 5 waves at 128.22 low. Up from there, pair is doing a 3 wave bounce in Minute wave ((ii)) of C towards 129.64-129.84 area. Then as far as a pivot from 130.18 high stays intact pair is expected to fail for more downside. We don’t like buying the pair and prefer more downside against 130.18 high in the first degree.

EURJPY : Trading Market Pattern Breakouts

EURJPY LONG/BUY Trade Update 9.23.2018

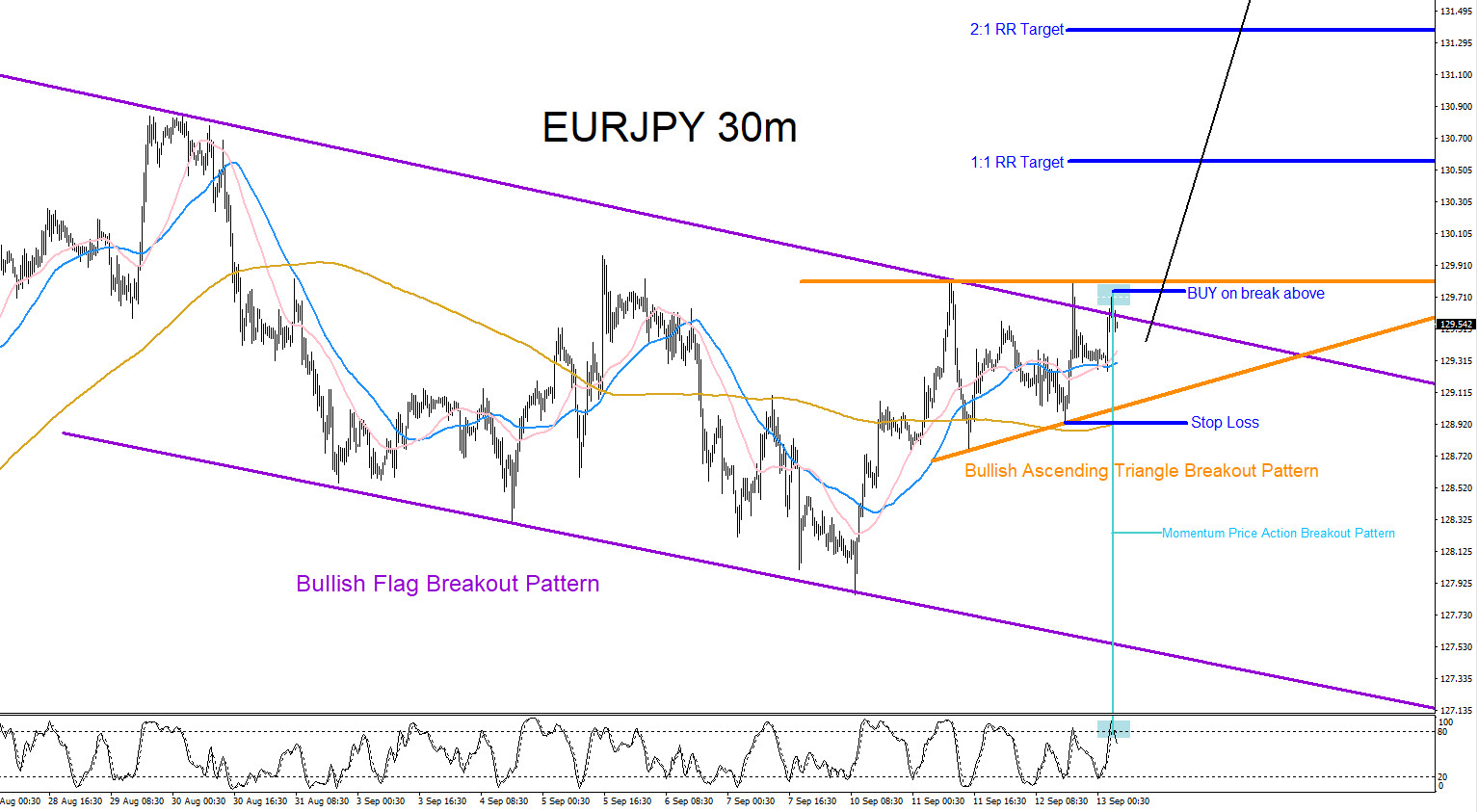

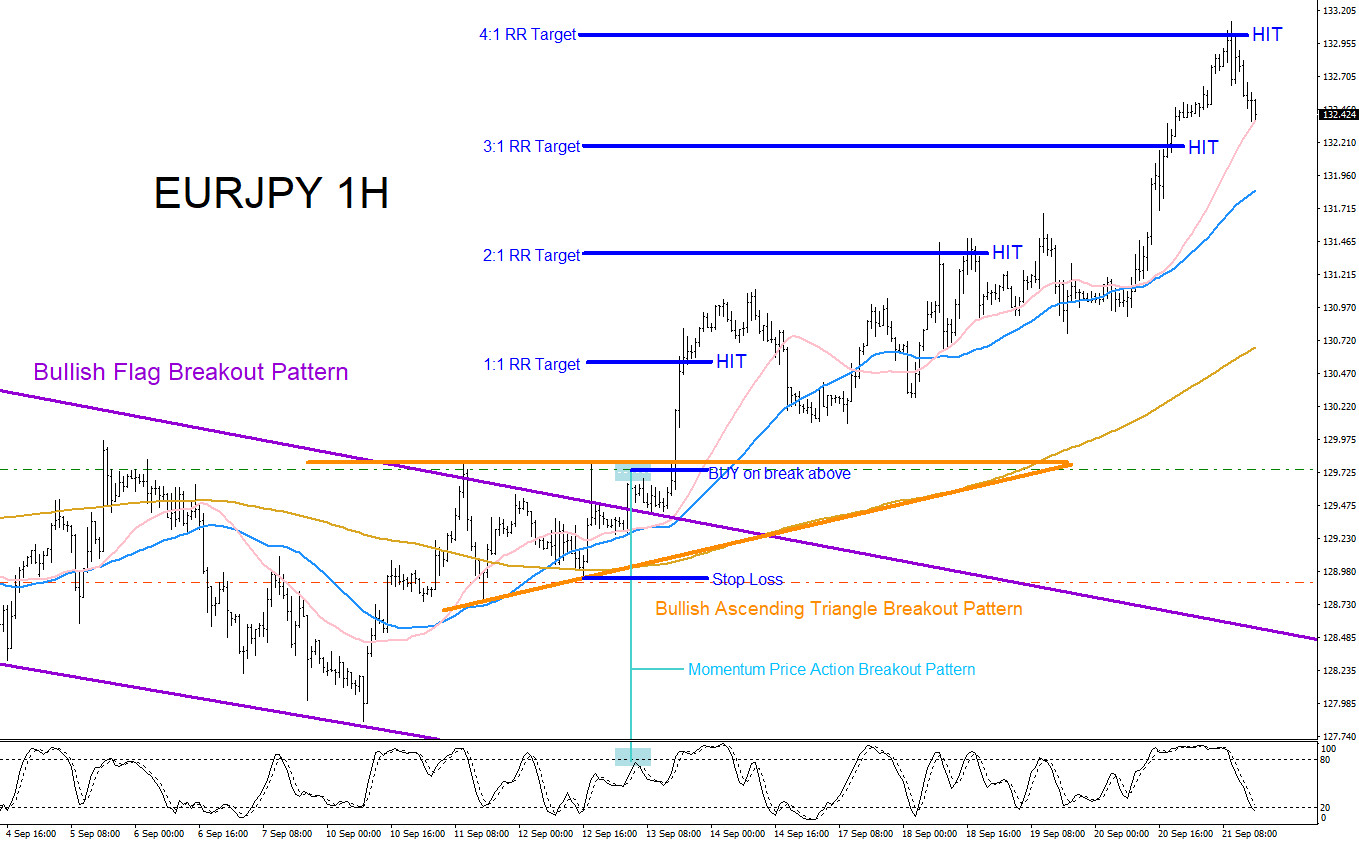

On September 21/2018 I posted on Twitter, @AidanFX , the EURJPY trade setup to look for LONGS/BUYS on the break above two bullish market patterns that was forming. Since September 21/2018 the pair broke above the bullish market patterns and has extended over 300 pips to the upside. The charts below will show how any trader could have caught the EURJPY move higher by trading market pattern breakouts. Traders only need to watch for these patterns to happen and execute the trade when the breakout occurs. Market patterns are Channels, Triangles, Wedges, Head and Shoulders pattern, Cup and Handle pattern, Flags, Pennants, Harmonic Patterns, Elliott Wave Patterns. These patterns form in every market and in every time frame. Each pattern has precise entries and defined stops. Market pattern breakouts can also be used with a simple 50 moving average plotted on the chart on any time frame. Only take the buy breakout if price is above the moving average and only take the sell breakout if price is below the moving average.

EURJPY 30 Minute Chart 9.12.2018

EURJPY 1 Hour Chart 9.21.2018

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 76 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

EURJPY Elliott Wave Analysis: Upside Has Started

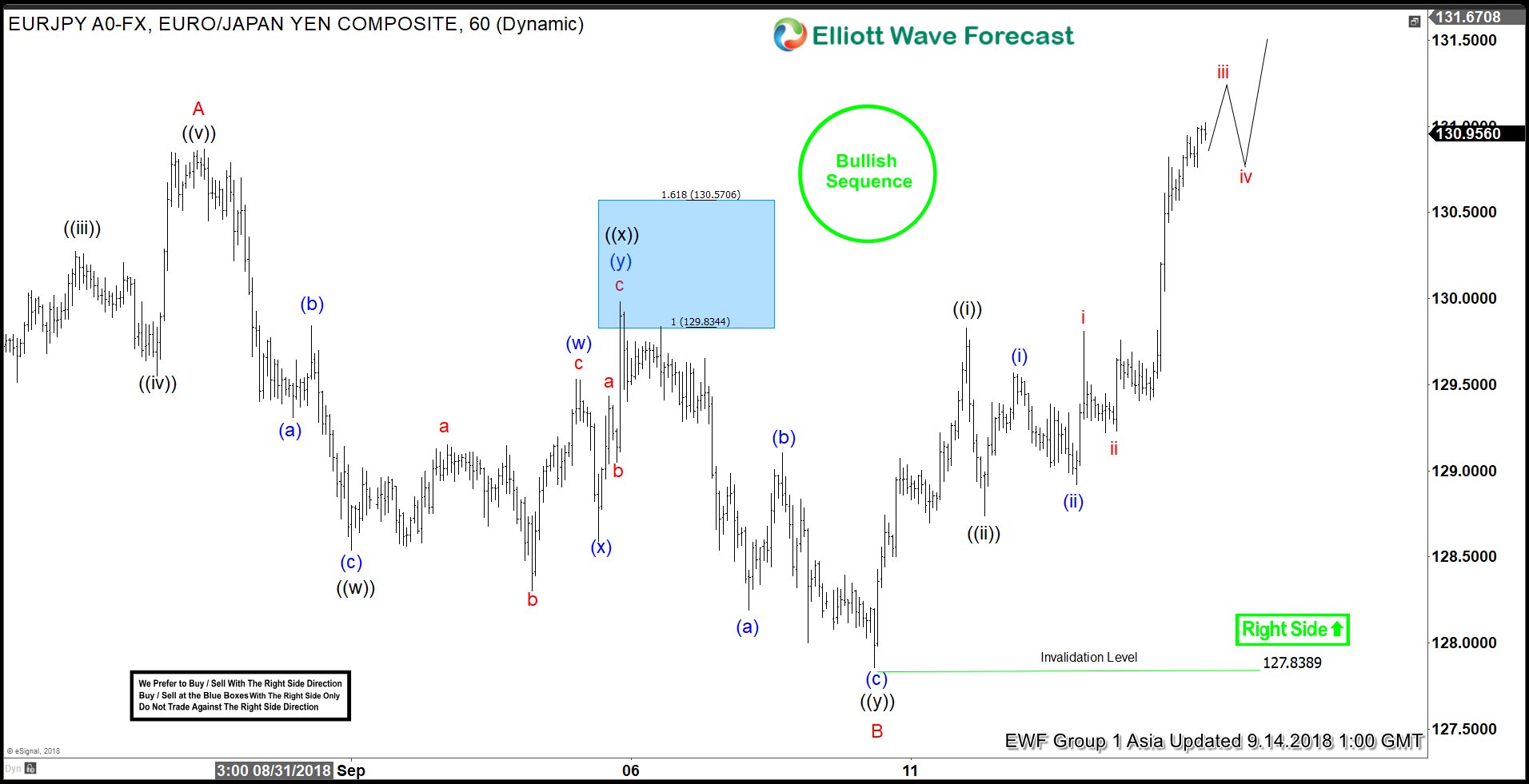

EURJPY short-term Elliott wave analysis suggests that the rally to 130.85 high ended Minor wave A of a Zigzag structure. The internals of that rally higher unfolded in 5 waves impulse structure with the sub-division of 5 waves structure as mentioned previously in the previous post. Down from there, the pullback to 127.83 low ended Minor wave B pullback. The internals of that pullback unfolded as double three structure with the sub-division of 3-3-3 swings in Minute wave ((w))-((x))-((y)).

Below from 130.85 high, the initial decline to 128.54 low ended Minute wave ((w)) in lesser degree zigzag structure. Up from there, the bounce to 129.97 high ended Minute wave ((x)) bounce as double three structure. Then finally, a decline towards 127.83 ended Minute wave ((y)) & also completed the Minor wave B pullback. Up from there, the pair has managed to make a new high above 130.85 creating a cycle from 8/15 low (124.91) incomplete to the upside & also confirms the Minor C. Which can be either impulse or ending diagonal structure. Near-term, while dips remain above 127.83 low pair is expected to see more upside. The 100%-123.6% Fibonacci extension area of Minor A-B comes at 133.76-135.18 to the upside. We don’t like selling it as the right side & sequence tag is suggesting more upside, therefore, expect buyers to appear in 3, 7 or 11 swings against 127.83 low.

EURJPY 1 Hour Elliott Wave Chart

EURJPY Elliott Wave View: Ended 5 Waves Advance

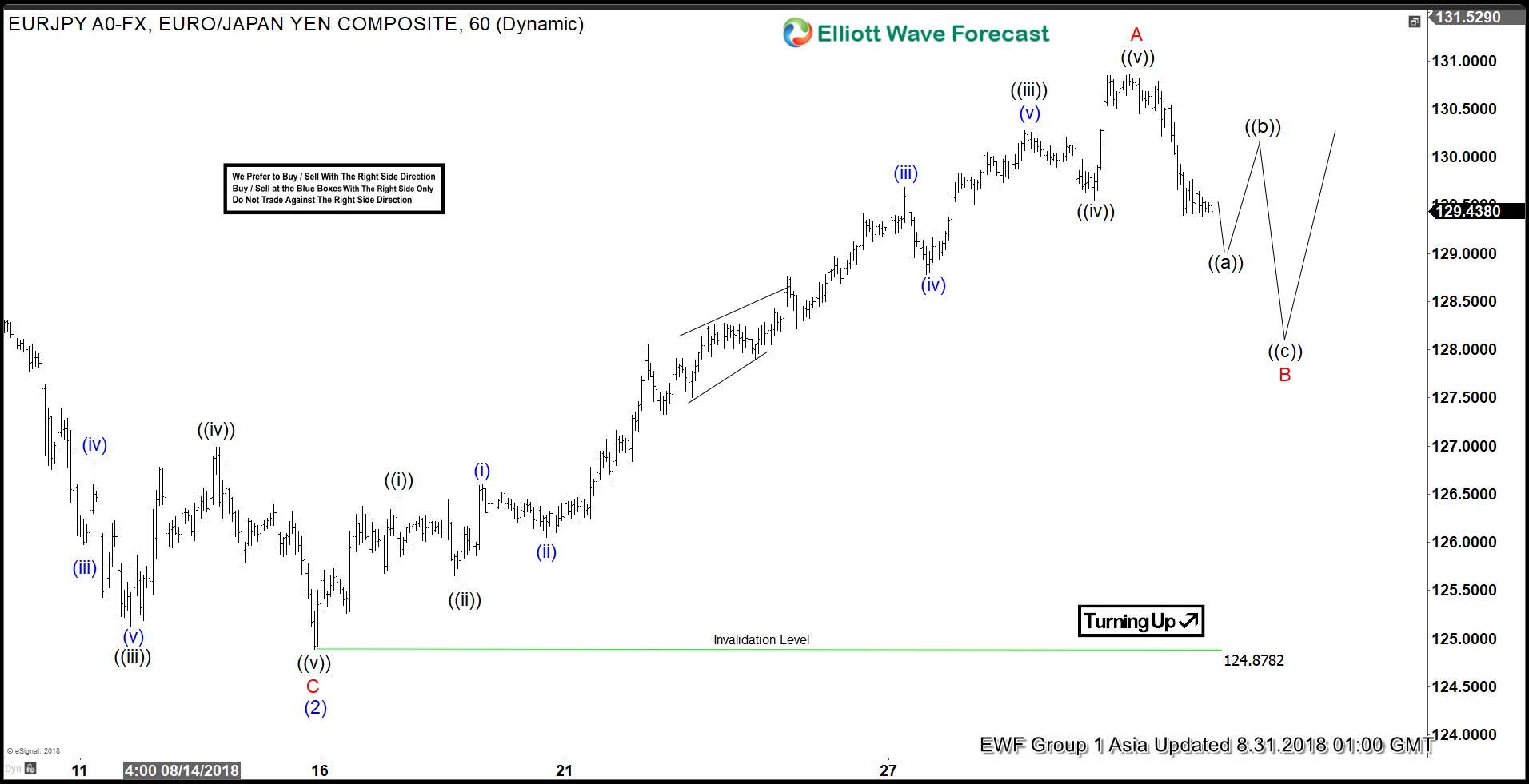

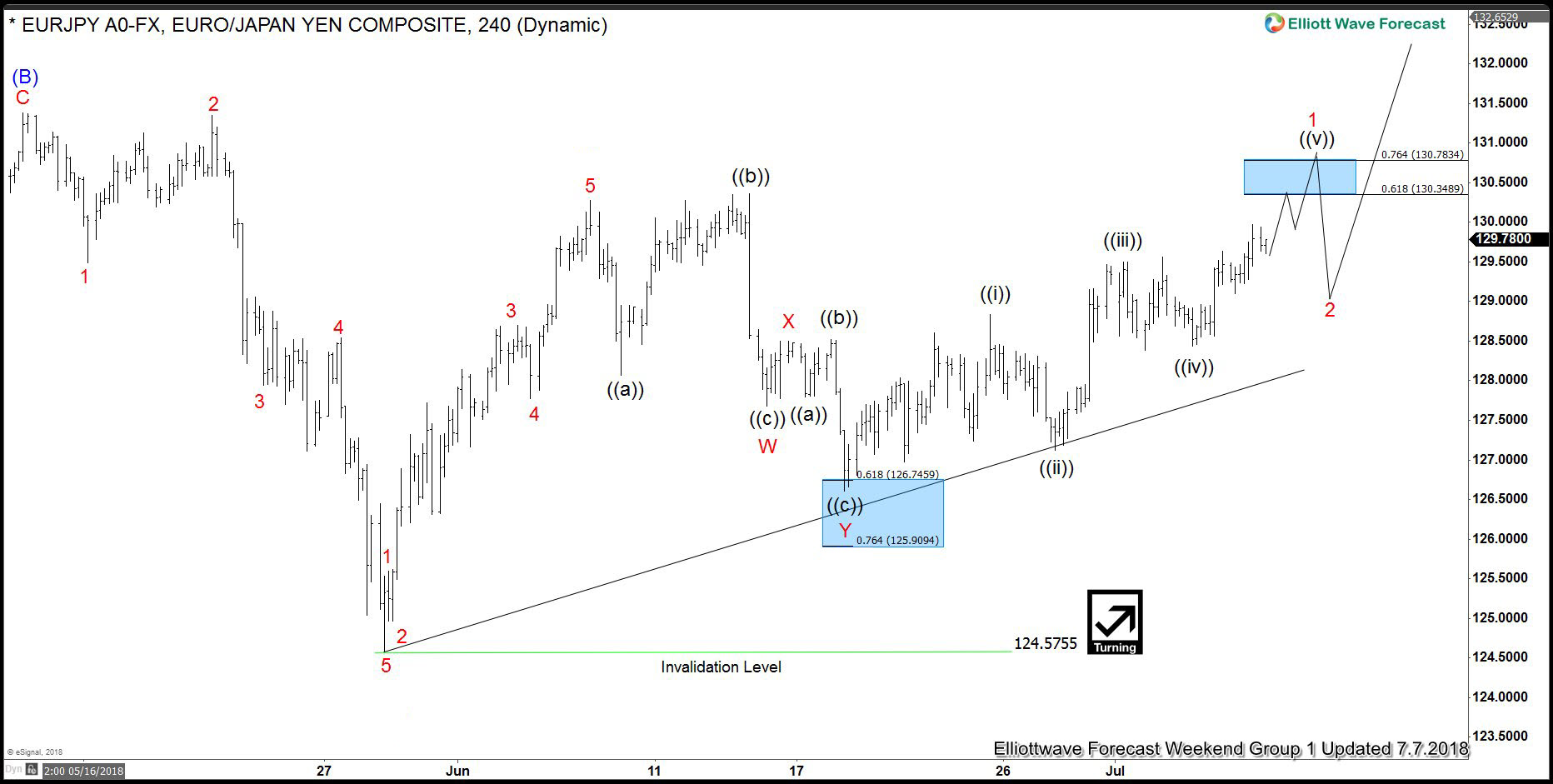

EURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should show sub-division of 5-3-5 structure i.e Minor wave A unfolds in 5 waves either impulse or a leading diagonal, Minor wave B unfolds in 3 swings corrective structure. Whereas Minor wave C unfolds in another 5 waves structure either impulse or Ending diagonal structure.

In EURJPY’s case, the rally higher from 124.87 low unfolded as 5 waves impulse structure in Minor wave A. Up from 124.87 the rally higher to 126.49 high ended Minute wave ((i)) in 5 waves structure. Down from there the pullback to 125.55 low ended Minute wave ((ii)) pullback. A rally higher from there to 130.275 high ended Minute wave ((iii)) with another lesser degree 5 waves structure. Below from there, a pullback to 129.55 low ended Minute wave ((iv)). Finally, a rally to 130.86 high ended Minute wave ((v)) & also completed Minor wave A. Currently Minor wave B pullback remains in progress in 3, 7 or 11 swings to correct the cycle from 124.87 low before the rally resumes, provided the pivot at 124.87 low stays intact. We don’t like selling it.

EURJPY 1 Hour Elliott Wave Chart

EURJPY Elliott Wave Analysis: Nearing 3 Wave Bounce?

EURJPY short-term Elliott wave analysis suggests that the decline from 7/17/2018 peak (131.97) is unfolding as 5 leading diagonal structure in Minor wave A of a possible zigzag correction. The initial decline to 129.39 low ended Minute wave ((i)). Then Minute wave ((ii)) bounce ended at 131.13 as a Flat. Down from there, Minute wave ((iii)) ended at 128.49. The lesser degree cycle of Minute wave ((iii)) also unfolded in 5 waves structure where Minutte wave (i) ended at 130.54. Minutte wave (ii) ended at 131.09, Minutte wave (iii) ended at 129.19 low. Minutte wave (iv) ended at 129.52 low and Minutte wave (v) of ((iii)) ended at 128.49 low.

Up from there, the bounce to 129.47 high ended wave ((iv)) as a Flat correction. Below from there, Minute wave ((v)) is taking place at the moment in another 5 waves structure looking to extend lower 1 more time approximately towards 127.44 200% inverse extension area of Minute wave ((iv)) before ending the Minor wave A lower. In case of further downside extension area, the pair can see 127.29-126.78 100%-123.6% Fibonacci extension area of ((v))=((i)) target area as well before ending Minor wave A lower. Afterwards, the pair is expected to do a bounce in Minor wave B in 3, 7 or 11 swings before pair turns lower again. We don’t like buying the pair.

EURJPY 1 Hour Elliott Wave Chart

EURJPY Forecasting the Path & Buying the Dips

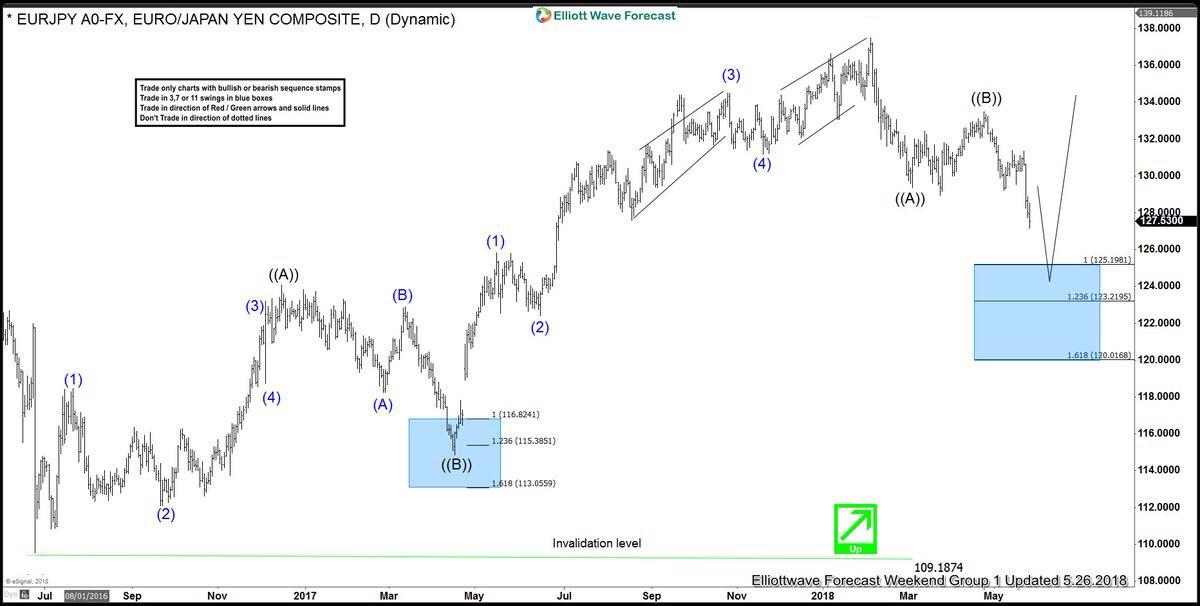

Hello Fellow Traders. Another instruments we have traded lately is EURJPY. As our members know, EURJPY has been correcting the cycle from the June 2016 low ( 109.187). We knew that price will find buyers as soon as it reaches extremes per Elliott Wave hedging strategy. We recommended members to wait for extremes to be reached before buying the dips again in the pair. In further text we’re going to explain the Elliott Wave forecast and trading strategy.

EURJPY Daily Elliott Wave Analysis 5.26.2018

The pair is doing pull back against the 2.0072 low. Current price structure of the pull back is showing incomplete swing sequences. As far as the price stays below ((B)) peak (04/24 2018) the pair is missing a swing to complete cycle from the February peak. We’re calling for another swing down toward 125.198-123.219 . At that area buyers should ideally appear either for further rally or 3 wave bounce at least. Our trading strategy is buying the dips at 125.198-123.219 area, when invalidation level of the trade would be break below 1.618 fib extension ( 120.016). Due to Elliott Wave Hedging bounce is likely to happen and as soon as the price reaches 50 Fibs against the ((B)) peak our recommendation is to make long positions risk free –put Stop Loss at BE.

EURJPY 4 Hour Elliott Wave Analysis 3.26.2018

The price has given us forecasted leg lower and reached buying zone at 125.198-123.219 . Buyers have appeared shortly after and we’re getting nice bounce from the mentioned area. Rally has reached 61.8 Fibs against the ((B)) peak. As a result members are now enjoing profits in risk free long positions.

Recently we got break of 06/14 peak , that has given us confirmation next leg up is in progress. Next target to the upside comes at 132.36+ area.

Note: We have removed some labeling in order to protect clients’ priviliges. Keep in mind market is dynamic and presented view could have changed in the mean time. Not every chart is Trading Signal. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- Next Page »