Hello traders and welcome to a new blog post discussing about our blue box trading strategy. In this post, the spotlight will be on CHFJPY currency pair.

The Yen pairs continue to rise as expected, with bullish cycles from last year appearing incomplete despite being in advanced stages. This presents more opportunities for buyers to enter the market from dips. Specifically, CHFJPY has been in the 3rd wave of a bullish cycle since September 2024. This bullish run is developing as an impulse wave structure within an extended 3rd wave, following the conclusion of the 2nd wave in February 2025. Since then, the 3rd wave has been extending.

In December, wave 3 reached 2.618% of wave 1 from wave 2. However, the divergence from July 2025 has been erased, suggesting further upside potential. Furthermore, the Indices seem to have not completed the bullish cycle from April 2025. Consequently, we maintain a bullish outlook on the Yen pairs. In a bullish sequence, we favor buying at the extremes of 3, 7, and 11 swing pullbacks.

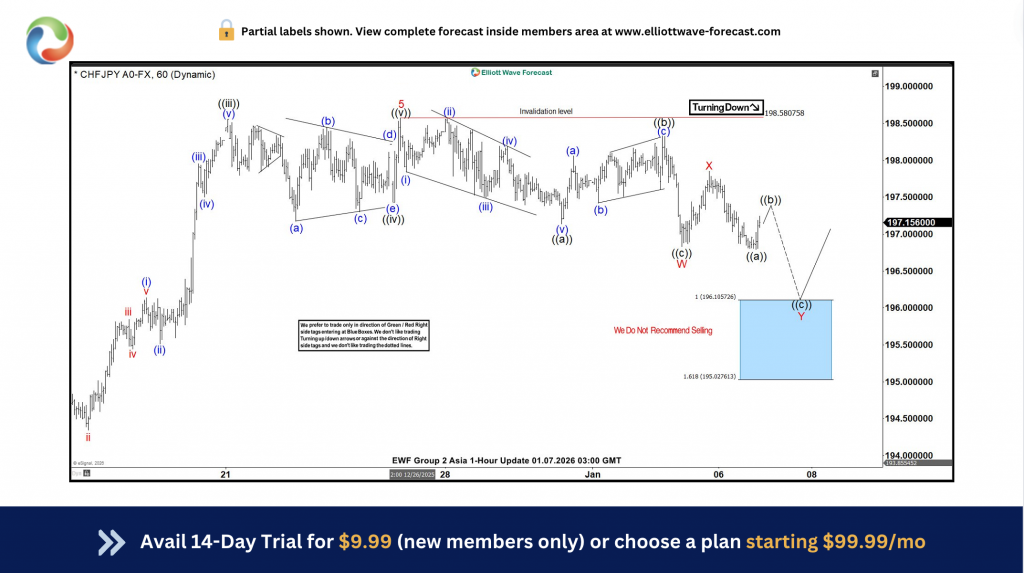

CHFJPY Shorter Cycle Bullish Opportunity – 7th January 2026

In late December, the pair began to pull back. While some may have considered it time to sell against the trend, we remained focused on buying the pullback. It continued through the last week of December and into the first week of January. On January 7, 2026, we identified the pullback structure as a double three corrective setup. Therefore, we shared the chart below, displaying the blue box, with Elliottwave_Forecast members.

The blue box on the chart indicates the buying zone of 196.105-195.027. Traders entered long positions at 196.10, setting their stop-loss at 195.02, anticipating either a recovery or at least a 3-swing bounce. We documented this trade in the trading journal and discussed it with members in the live trading room. In the live trading room, we cover all aspects of trading, from initial setup and entry points to thorough trade management until closure. We also maintain a watchlist and share trade outcomes there to keep members informed.

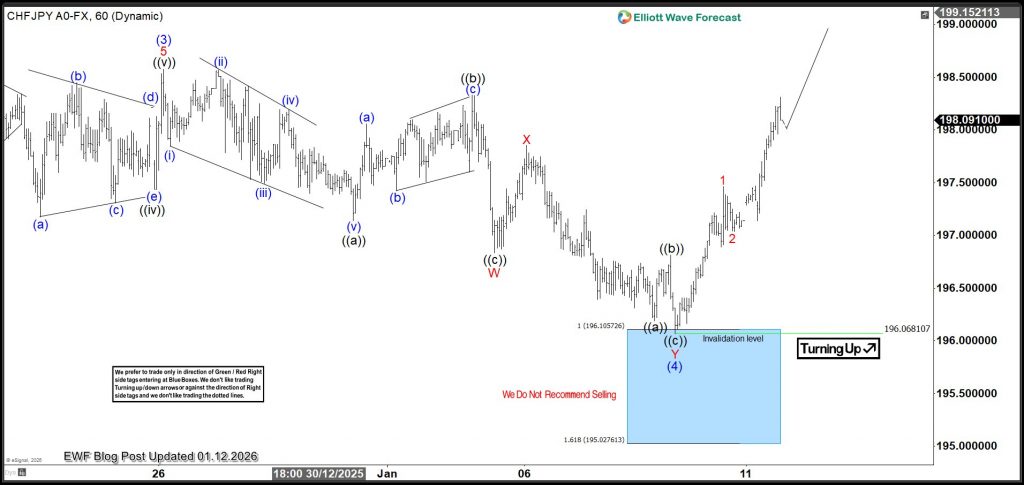

CHFJPY Setup: 12th January, 2026

The pair reached the blue box, triggering buying interest, and subsequently bounced sharply as anticipated. Consequently, our members are realizing significant profits, even after taking partial profits at the initial target. We anticipate continued upside support as the pair moves towards $200 and beyond. This has been a successful trade for all our participating members.

About Elliott Wave Forecast

At www.sifaha.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $9.99. Cancel anytime by contacting us at support@sifaha.com.