The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Dow Jones (YM #F) Made New All Time High

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of YM #F (Dow Jones DJI Mini Futures) published in members area of www.sifaha.com. We’re going to take a look at the price structure and explain Elliott Wave forecast. As our members know , we were pointing out that […]

-

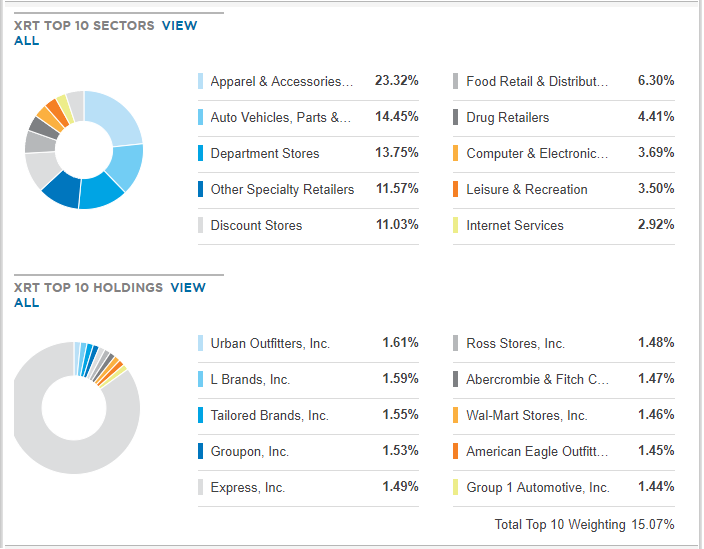

Retail Industry Index Providing The Next Long

Read MoreThe S&P Retail Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS retail sub-industry. For this article we’ll be using The SPDR S&P Retail ETF (XRT) which tracks an equal-weighted index of stocks in the US retail industry and correspond generally to the total return performance of the S&P Retail Select Industry Index. The performance […]

-

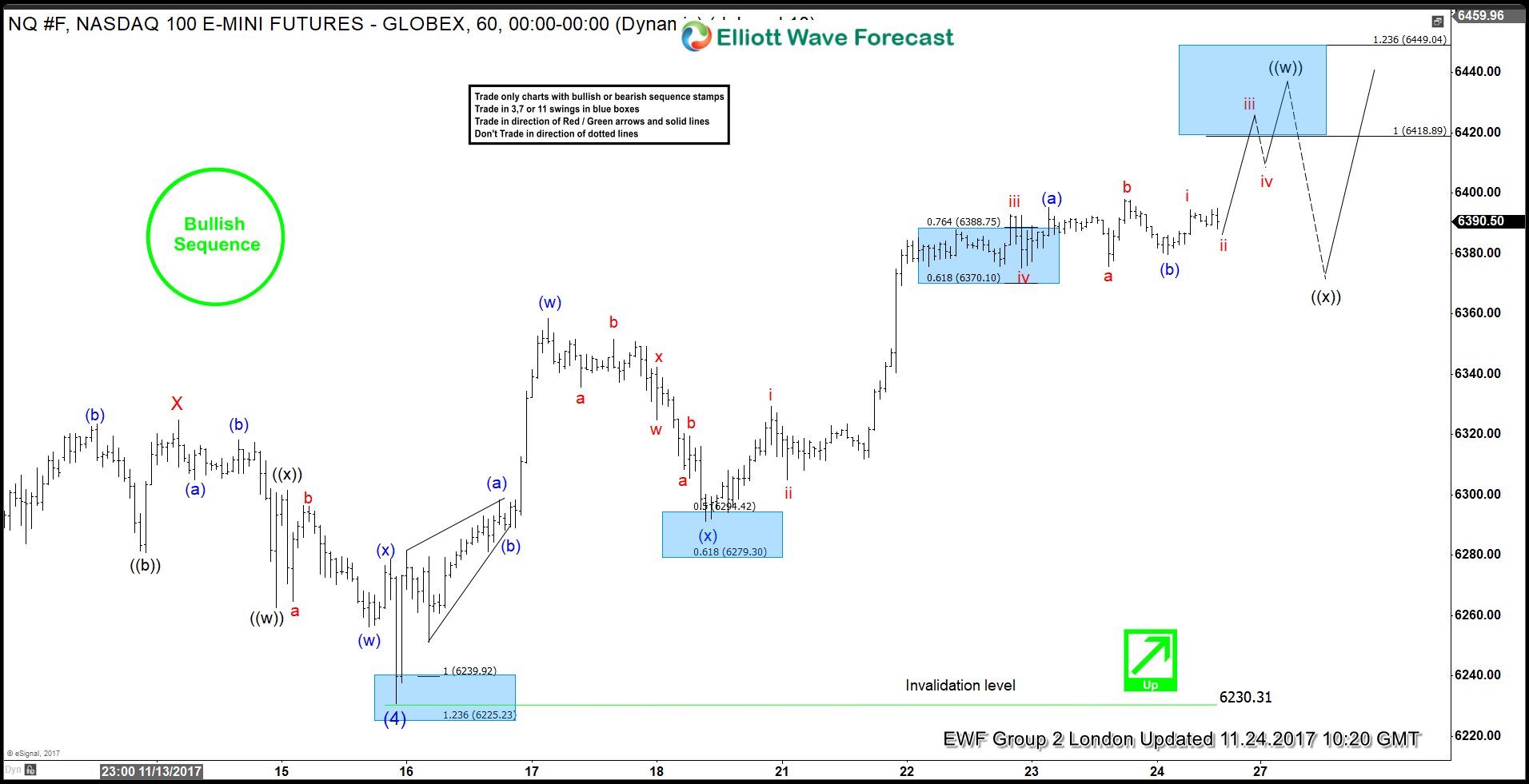

NASDAQ Elliott Wave view: 11.24.2017

Read MoreNASDAQ Short term Elliott Wave view suggests that the decline to 6230.31 on November 15 ended the intermediate wave (4) dip. A rally from there is unfolding as a double three Elliott wave structure and the index is already into new highs suggesting that next extension higher has started. As the structure of the 11/15 low 6230.31 low looks to be overlapping, […]

-

SPX Elliott Wave Analysis 11.17.2017

Read MoreSPX Short-Term Elliott Wave view suggests that the rally to 2597.02 ended Intermediate wave (3). Intermediate wave (4) pullback ended at 2557.45 as a double three Elliott Wave structure. Down from 2597.02, Minor wave W of (4) ended at 2566.33, Minor wave X of (4) ended at 2587.66, and Minor wave Y of (4) ended at […]

-

SPX Intra-Day Elliott Wave Analysis

Read MoreSPX Intra Day Elliott Wave view suggests that the rally to 2597.02 ended Intermediate wave (3). Intermediate wave (4) pullback is currently in progress as a double three Elliott Wave structure. Down from 2597.02, Minor wave W of (4) ended at 2566.33 and Minor wave X of (4) ended at 2587.66. While staying below 2597.02, expect […]

-

Chevron (CVX) Looking for New All Time Highs

Read MoreChevron Corporation (NYSE: CVX) is an American multinational energy corporation. It engages in integrated petroleum operations, chemicals operations, mining operations, power generation and energy services related to Oil and Natural Gas. Oil-company stocks tend to rise when oil prices goes higher, Chevron is no exception that’s why as Oil market is turning bullish after the recent break in price above […]