The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

United States Steel Corporation $X Daily Elliott Wave View

Read MoreUnited States Steel Corporation (NYSE: X) is the second largest steel domestic producer behind Nucor Corporation (NYSE: NUE) and also the world’s 24th largest steel producer. Last year, Steel price surged higher reaching new all time high of 4772 in December gaining +60% before a correction took place. The price is expected keep rising in the coming years […]

-

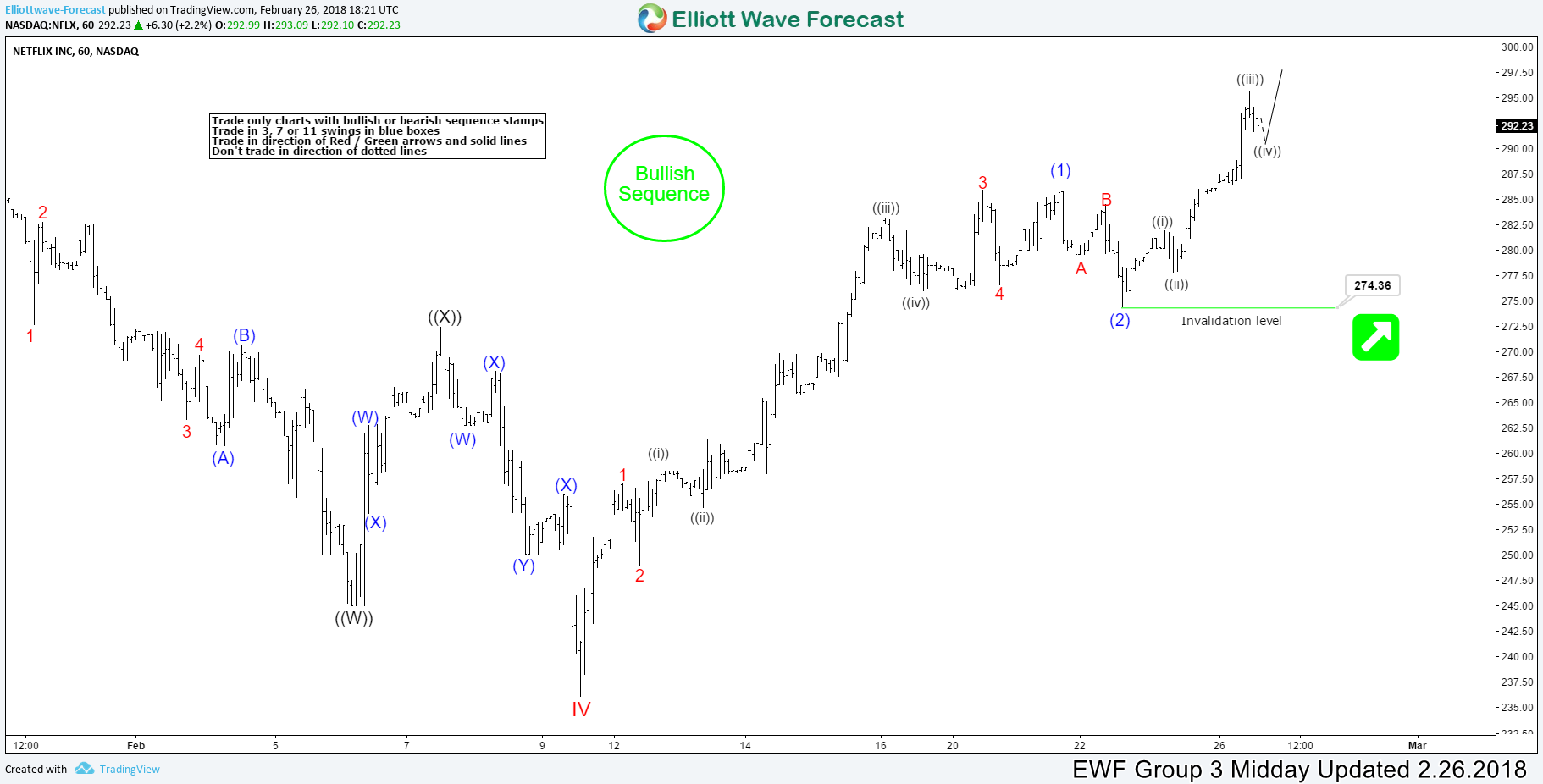

NFLX (Netflix) Elliott Wave: Showing incomplete Impulse sequence

Read MoreNetflix stock symbol: (NFLX ) Short Term Elliott Wave view suggests that the decline from January 29.2018 peak 286.70 to decline to 236.16 low on February 09.2018 low ended Cycle degree wave IV. Above from there, the rally has resumed higher by a break above 286.70 high in Cycle degree wave V looking for more upside extension. Also, it’s […]

-

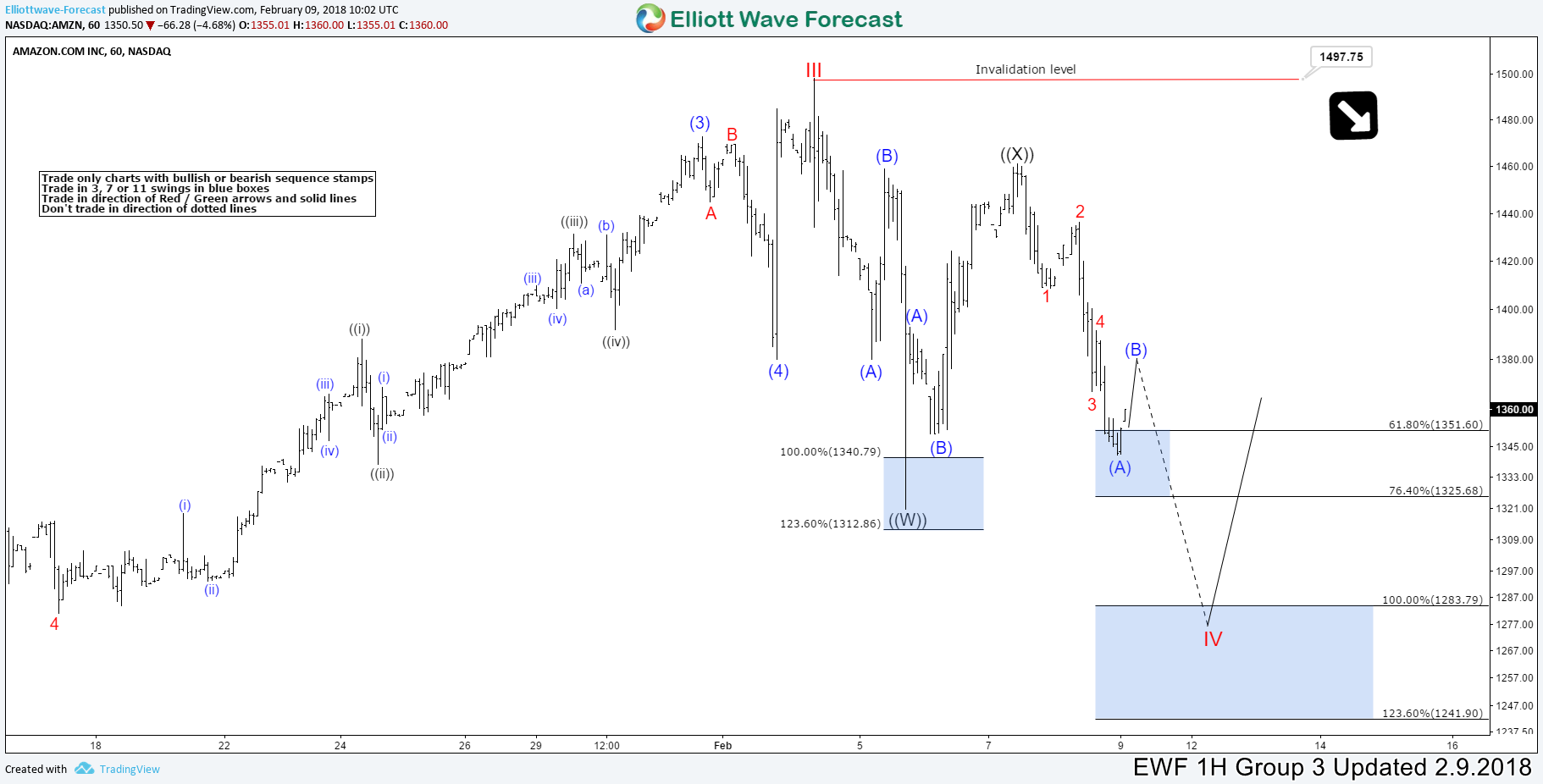

Trading The Amazon Stock The Right Way

Read MoreHello fellow traders, In this blog I want to share with you a trade in Amazon stock which we took in our Live Trading Room from Group 3. In Group 3 we cover stocks and ETFs. Now, let us have a look at some past charts of the stock Amazon and the respectable entry in […]

-

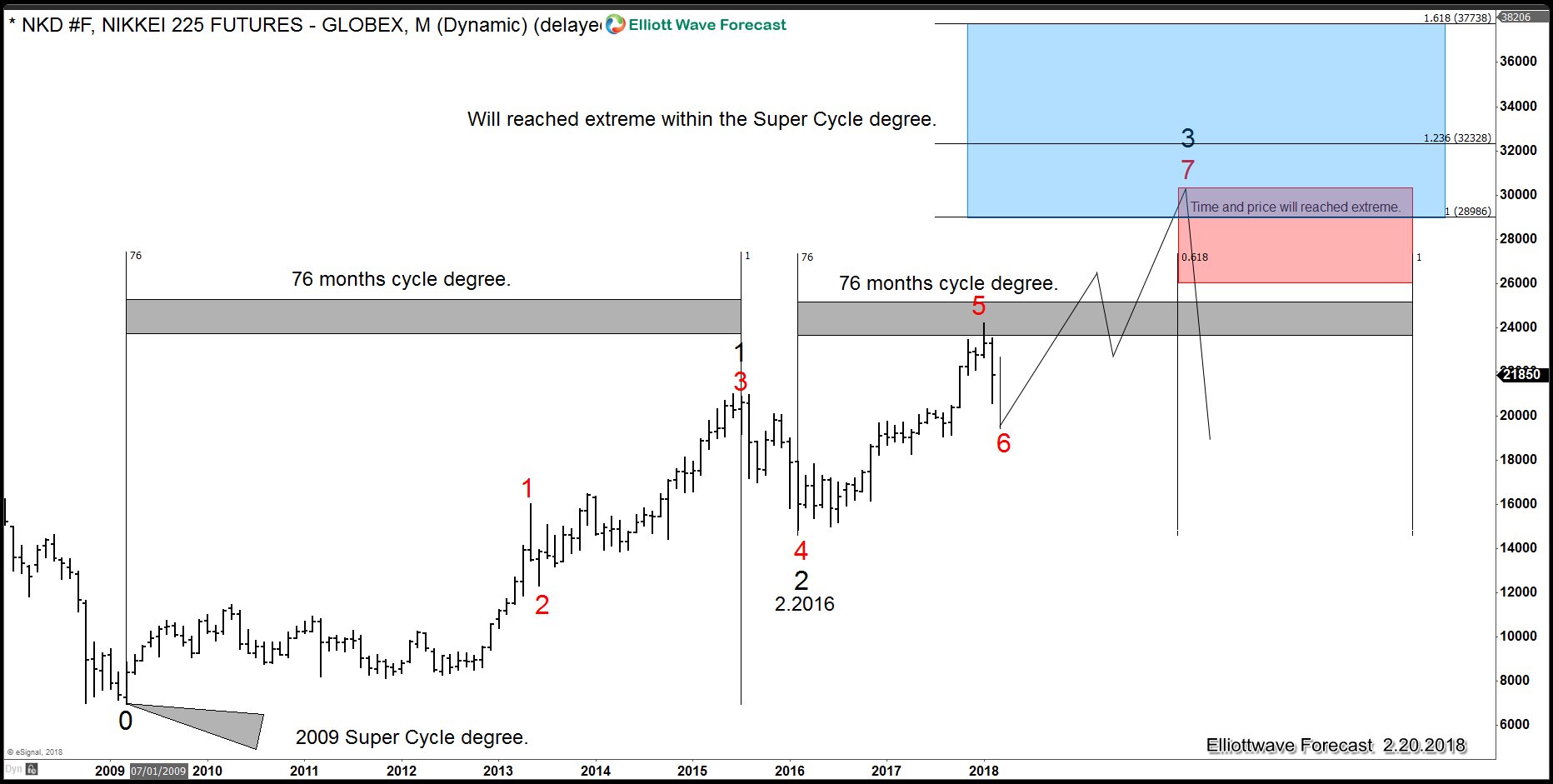

World Indices: What Will Happen in 2020 – 2022

Read More2020-2022 What will happen to the World Indices, A US Constitutional Crisis or Something Else? The market move by Technical sequences, levels, and areas. Every day we see how the price moves from one area to another and relates the time frames from Subminutte cycles to the Grand Super cycles. The Idea is relating the […]

-

Baidu (BIDU) Resuming the Bullish Cycle

Read MoreBaidu, Inc. (NASDAQ: BIDU) is one of the largest Chinese multinational technology companies specializing in Internet-related services & products and one of the premier AI leaders in the world. Last week, Baidu has reported excellent results in Q4 which helped its stock to bounce +15%. Solid margin expansion and good developments on several fronts were on the headlines behind the recent […]

-

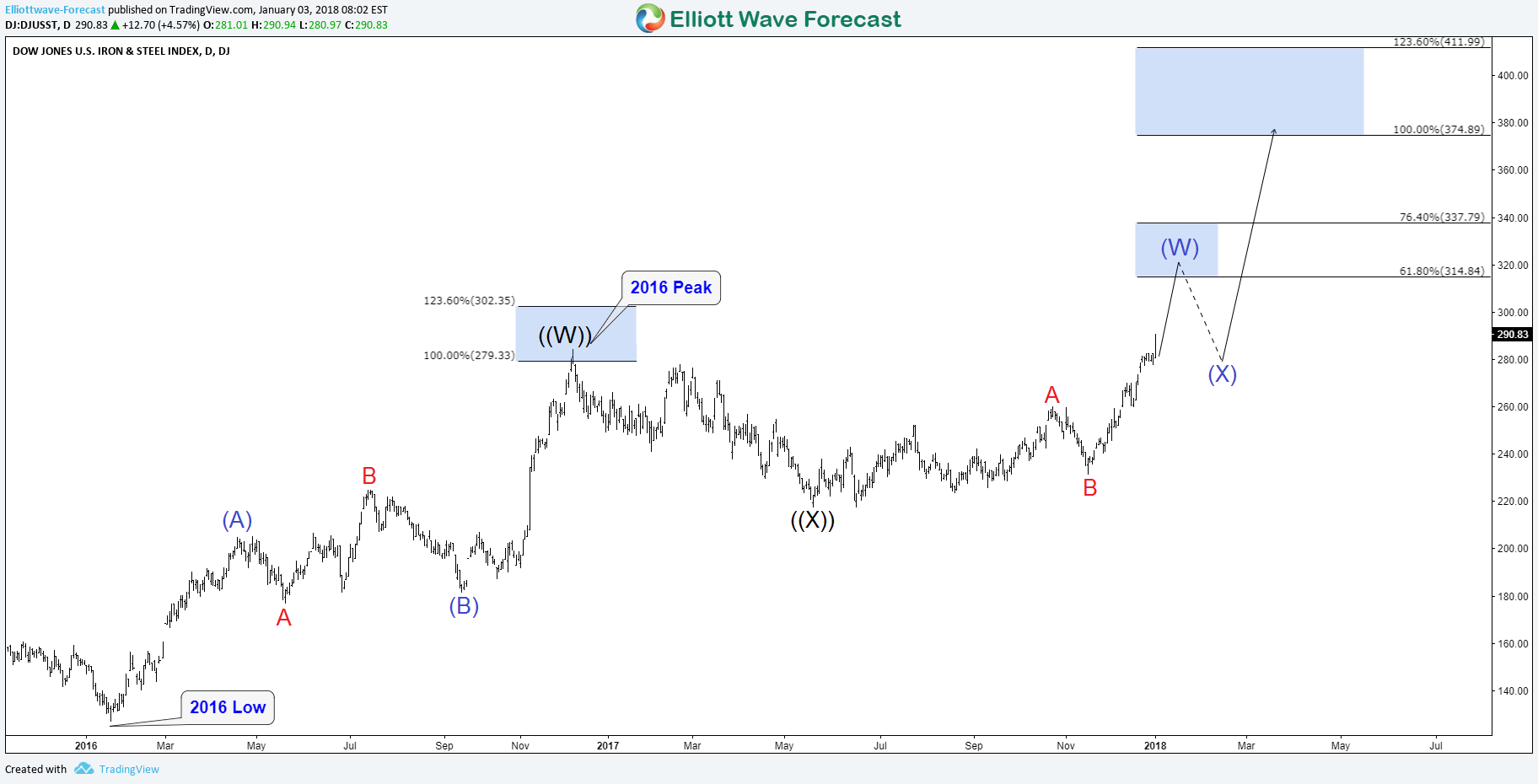

Dow Jones Iron & Steel Index DJUSST Bullish Sequence

Read MoreLast month, Dow Jones Iron & Steel Index DJUSST managed to break above December 2016 peak and created an incomplete bullish sequence from 2016 low calling for a move higher toward equal legs area $374 -$411. In the daily chart, we can see that the move higher was expected to pullback from the 61.8% – […]