The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

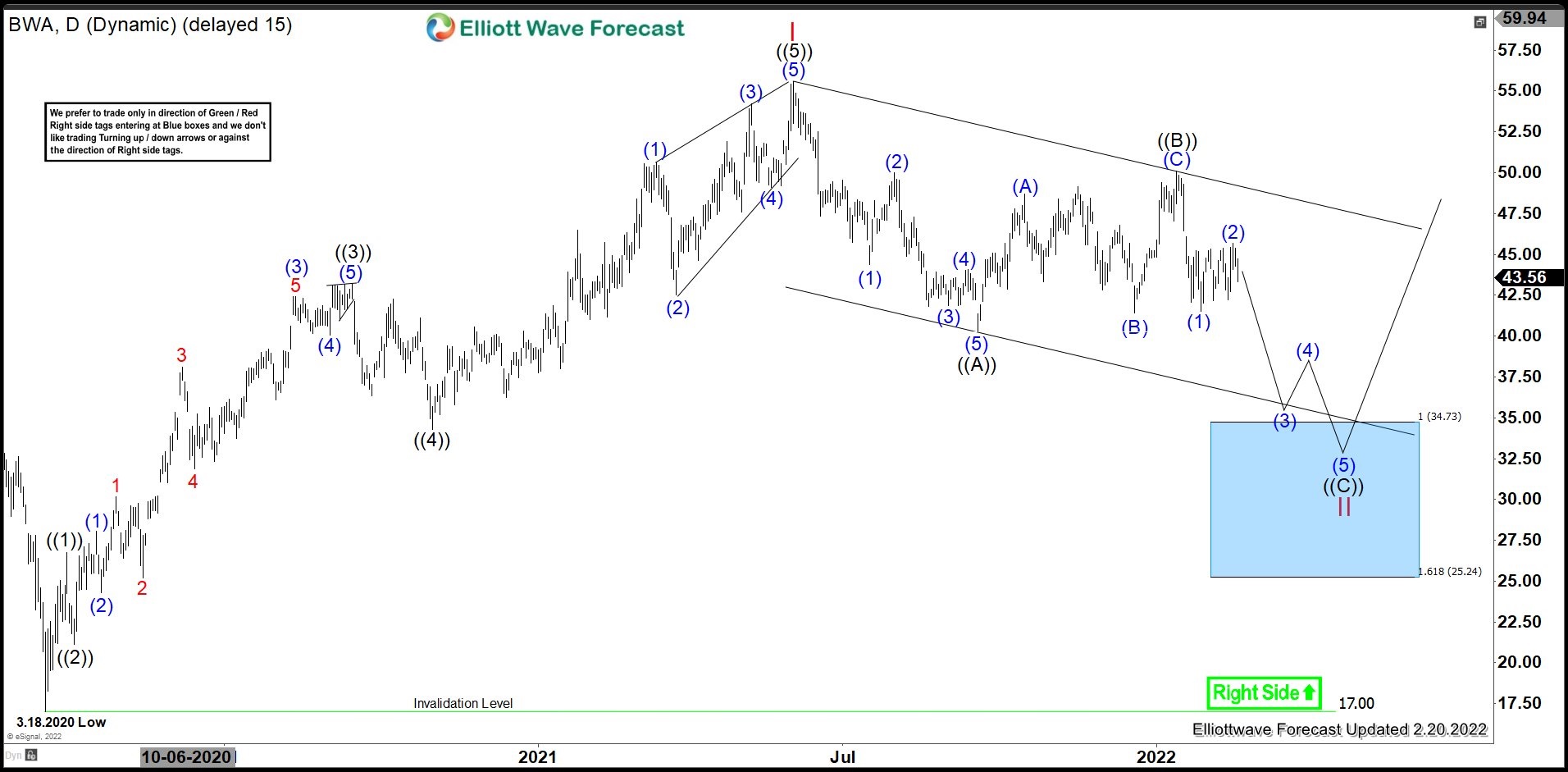

BWA : Expect Pulling Back in II Before Next Rally Resumes

Read MoreBorgWarner Inc (BWA) provides solutions for combustion, hybrid & electric vehicles worldwide. The company operates through four segments, Air management, E-propulsion & drivetrain, Fuel injection & Aftermarket. It is based in Auburn Hills, Michigan. It comes under Consumer cyclical sector & trades as “BWA” ticker at NYSE. BWA favored ended larger correction in weekly at […]

-

SIG : Expect To Pulling Back in II

Read MoreSignet Jewelers Limited (SIG) engages in the retail sale of diamond jewelry, watches & other products. It is based in Hamilton, Bermuda, comes under Consumer Cyclical sector & trades as “SIG” ticker at NYSE. SIG made intermediate low at $5.60 during Covid pandemic early last year. Thereafter it started higher high sequence as impulse up, […]

-

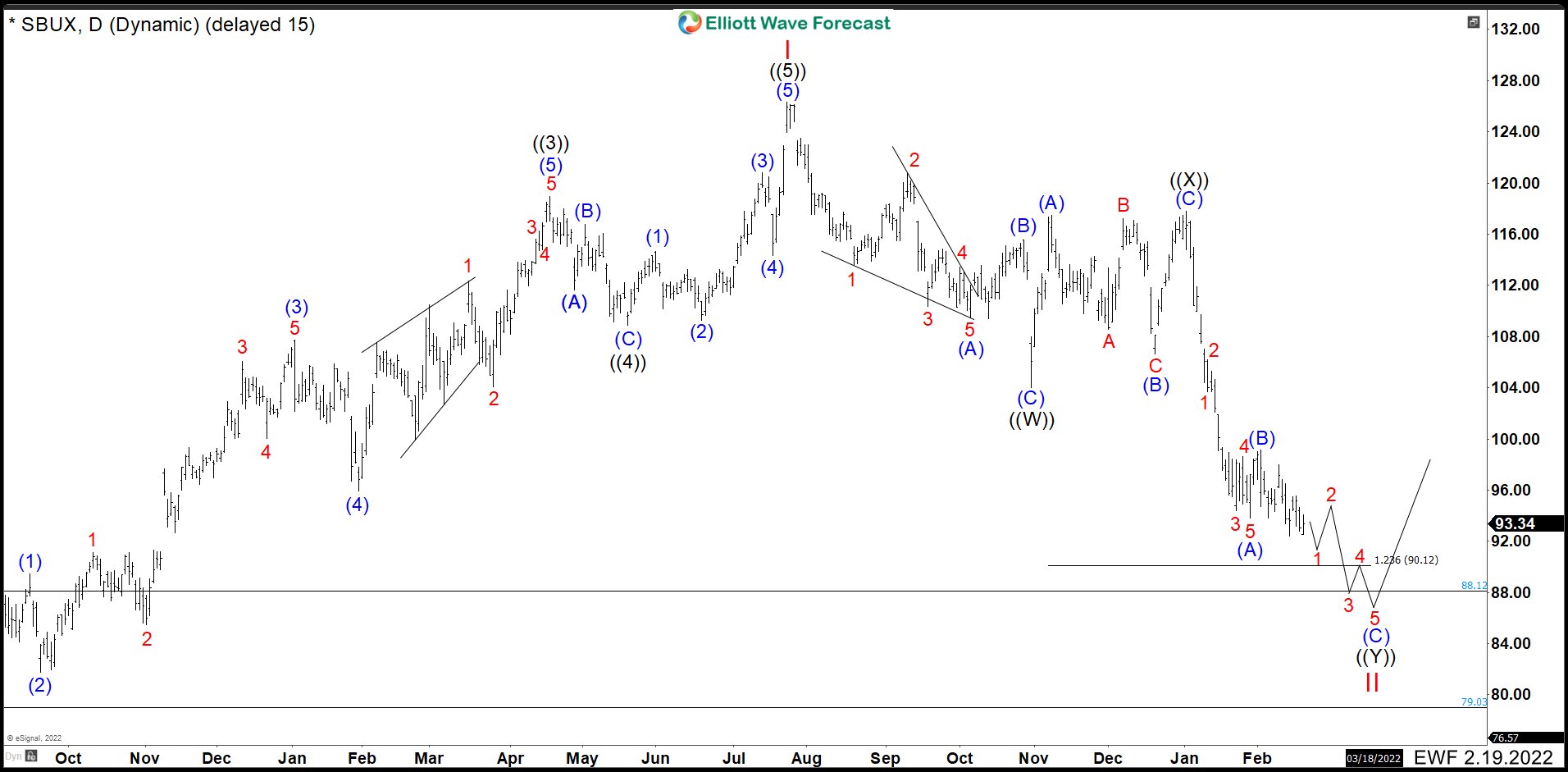

Starbucks (SBUX) Is Looking For Support And Buyers Will Appear

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks (SBUX) Daily Chart Starbucks (SBUX) […]

-

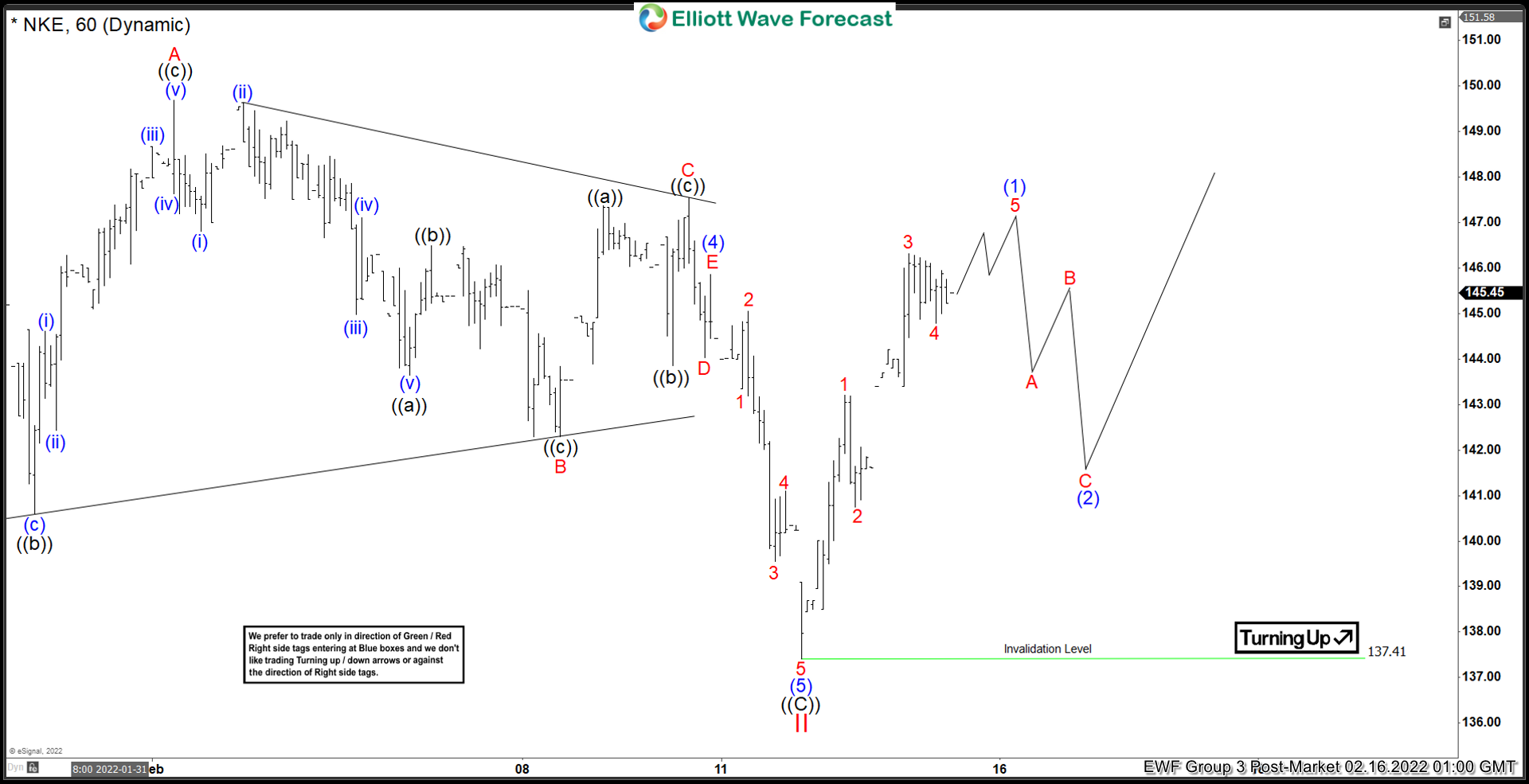

Elliott Wave View: Nike (NKE) At Potential Support Area

Read MoreNike (NKE) ended correction to the cycle from March 2020 low at 137.41. This article and video look at the Elliott Wave path.

-

Bit Digital ($BTBT) Is The Low Set?

Read MoreWith Bitcoin having rallied over 40K from the March 2020 low, Crypto and Blockchain markets continue to show potential. Bit Digital is a company that experienced a large vertical rally in late 2020. After that, it has been correcting the whole rally in a large wave II. Bit Digital touts itself as one of the […]

-

RTY_F Forecasting The Decline Into Blue Box And Reaction Higher

Read MoreRTY_F made a sharp decline during the month of January 2022. Clients of Elliottwave-Forecast were aware that decline was nothing more than another buying opportunity and our daily chart had the range defined where we expected 3 waves decline to end and buyers to appear to resume the rally or produce 3 waves reaction higher […]