The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

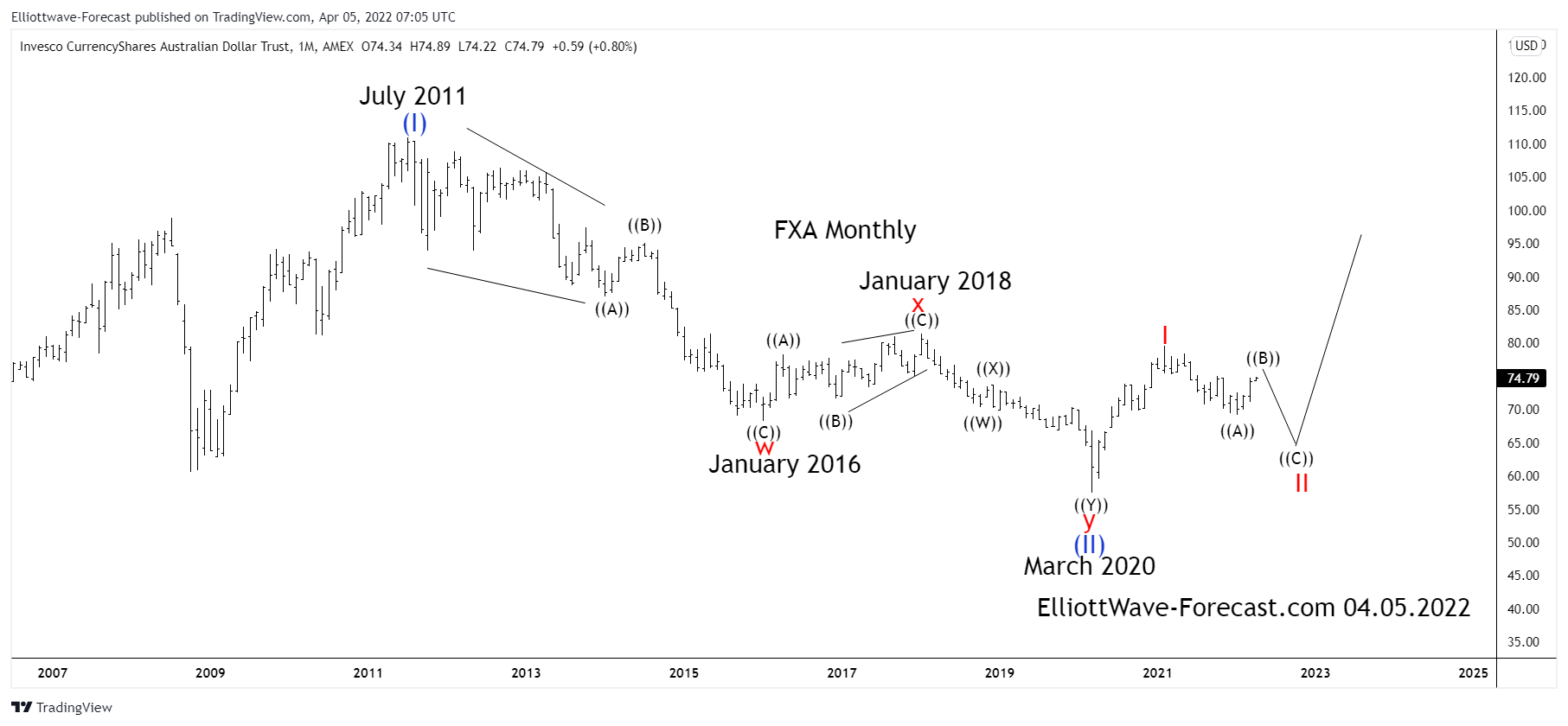

Elliott Wave Analysis and Long Term Cycles of $FXA

Read MoreElliott Wave Analysis and Long Term Cycles of $FXA The FXA ETF fund is the Australian dollar tracking fund that has an inception Date of 06/21/2006. With that said the fund mainly reflects the currency spot price of the AUDUSD pair. The data available from the Reserve Bank of Australia at their website suggests the spot price […]

-

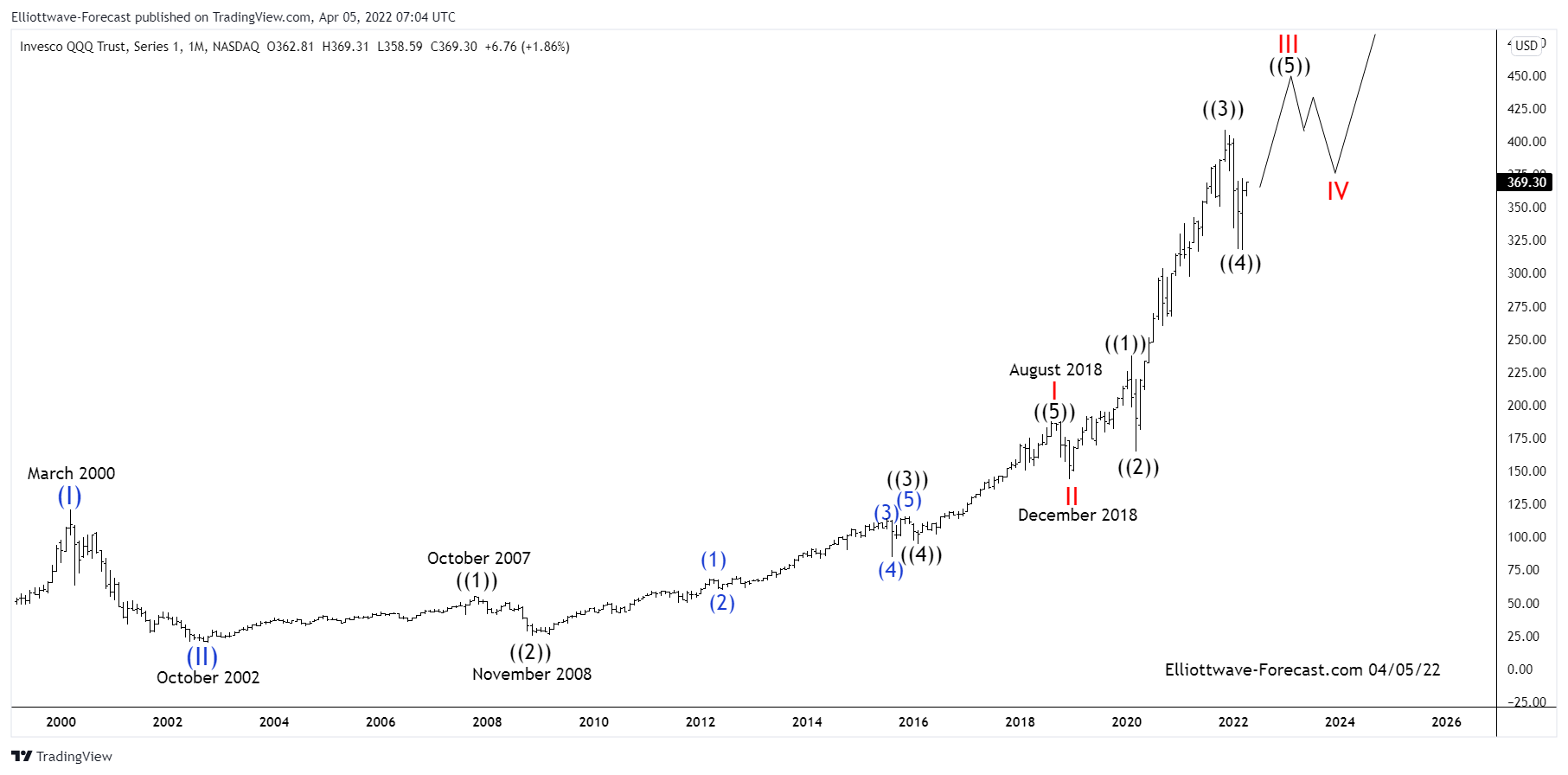

Long Term Cycles & Elliott Wave for $QQQ

Read MoreLong Term Cycles & Elliott Wave for $QQQ Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq index. As shown below from the March 2000 highs the instrument […]

-

XLF Bounce Allowed Longs To Get Into Risk-Free Position

Read MoreIn this technical blog, we will look at the past performance of the Daily Elliott Wave Charts of XLF. In which, the rally from the 23 March 2020 low unfolded as an impulse and showed a higher high sequence. Therefore, we knew that the structure in XLF is incomplete to the upside & should see […]

-

$UFI: Textile Stock Unifi to Accelerate Higher from Buying Area

Read MoreUnifi Inc. is a global textile solutions provider based in Greensboro, North Carolina, USA. The stock being a component of the Russel3000 index can be traded under ticker $UFI at NYSE. Unifi is one of the world’s leading innovators in manufacturing synthetic and recycled performance fibers. The company is in a possession of proprietary technologies and […]

-

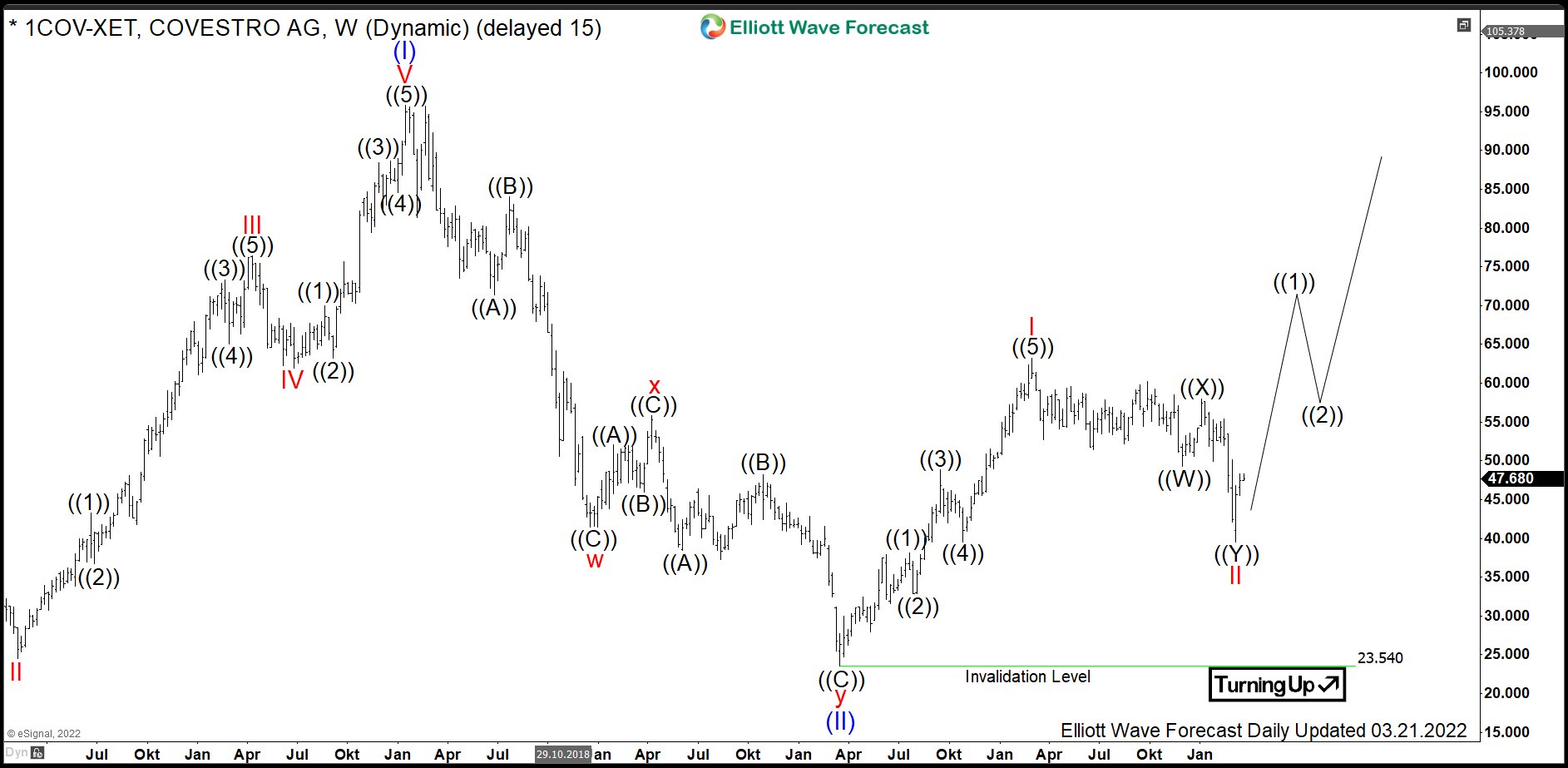

$1COV: Buying Material Science Stock Covestro in Pullback

Read MoreCovestro AG (formerly, Bayer MaterialScience) is a German company which produces a variety of polycarbonate and polyurethane based raw materials. The products include coatings and adhesives, polyurethanes for thermal insulation and electrical housings, polycarbonate based highly impact-resistant plastics (Makrolon) and more. Formed in 2015 as a spin off from Bayer, Covestro is headquartered in Leverkusen, […]

-

Best Performing Stocks in 2024

Read MoreThe stock market opened in 2024 amongst huge uncertainties and shaky ground. Rising inflation led to a record high inflation rate. Moreover, the political tension between Russia and Ukraine had an effect on the stock market. But amidst all this chaos, there are a handful of companies that have managed to grow ahead of the […]