The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: DAX Resumes Lower

Read MoreDAX has ended correction to cycle from 8.16.2022 high and resumes lower. This article and video look at the Elliott Wave path.

-

13 Best Recession Stocks to Buy in 2024

Read MoreWhat are Recession Stocks? Recession stocks are stocks of companies whose products and services consumers will continue to purchase, no matter what the economic conditions. Certain industries such as the defensive, healthcare, utilities, or consumer staples are often resistant to the negative effects of the recession. Investors chose to include recession-proof stocks in their portfolios […]

-

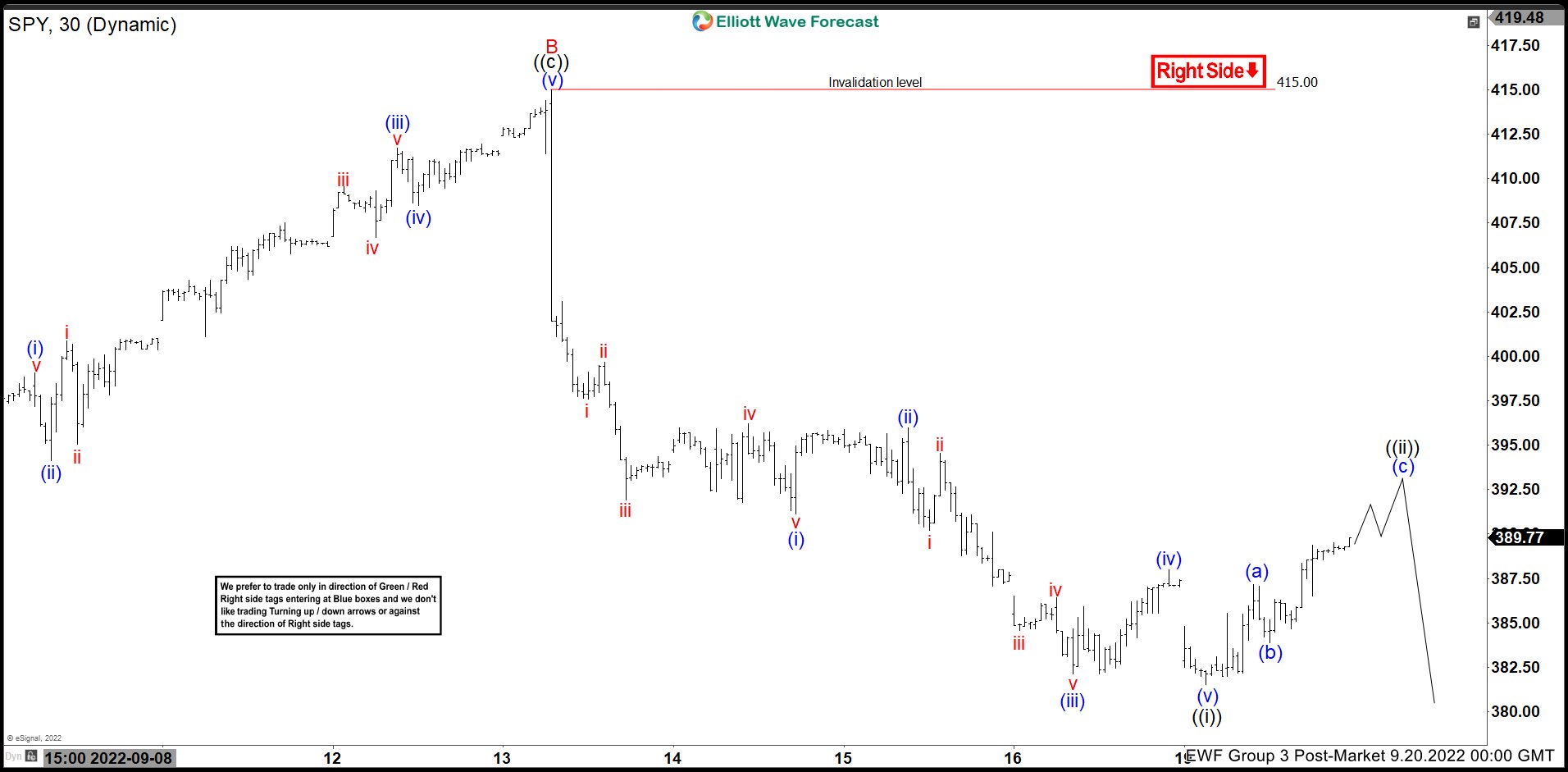

Elliott Wave View: SPY Rally Expected to Fail

Read MoreSPDR S&P 500 ETF (SPY) shows incomplete sequence from 8.17.2022 high favoring further downside. This article and video look at the Elliott Wave path.

-

EWBC : Expect Larger Correction To Continue Before Rally Resumes

Read MoreEast West Bancorp Inc, (EWBC) operates as the bank holding company for East West Bank that provides a range of personal & commercial banking services to individuals & businesses. It operates through three segments, Consumer & Business banking, Commercial banking & others. It is based in Pasadena, CA, comes under Financial services sector & trades […]

-

JPMorgan (JPM) Could Be Ready For A Rally In Next Quarter

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

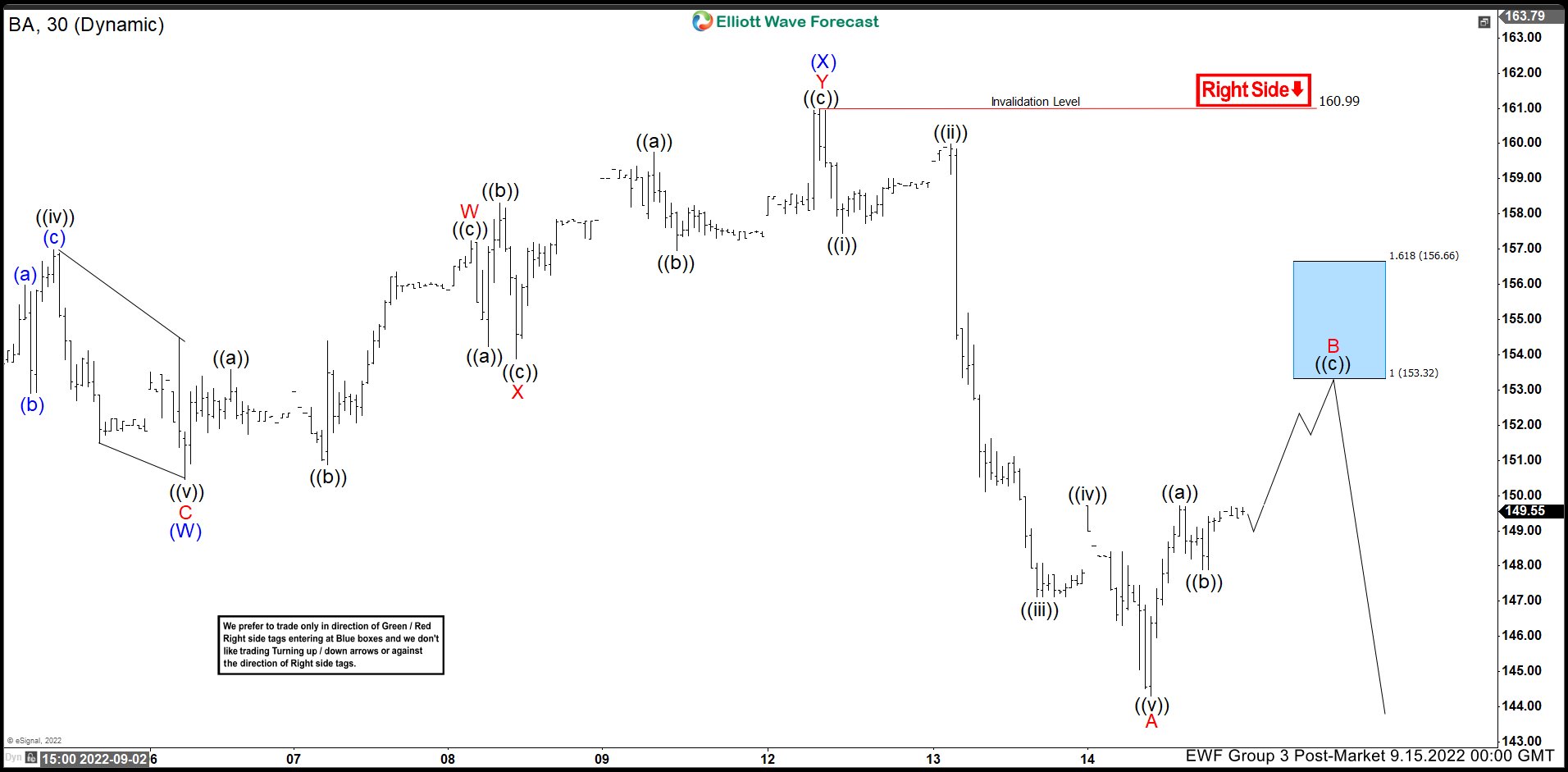

Boeing ($BA) Perfect Reaction Lower from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 1 Hour Elliottwave chart of Boeing ($BA). The decline from 08.16.2022 high is unfolding as a Double three (WXY) and made a lower low on 09.14.2022 which created a bearish sequence in the 1H timeframe. Therefore, we knew that the […]