The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Lithium ETF (LIT) is Under Pressure By Market Downtrend

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

ARK Invest ($ARKK) Near Term Favours More Downside.

Read MoreHello Everyone! In this technical blog, we are going to follow up on our initial article from July 2022 and take a look at the Elliott Wave path in ARK Invest ($ARKK). Summary of the Fund: ARK Invest (ARKK) is an actively managed Exchange Traded Fund (ETF). It seeks long-term growth of capital by investing in domestic […]

-

Mutual Funds Vs. Stocks: Which Should You Invest In?

Read MoreThe battle of Mutual Funds vs Stocks is the most common one in the investor world. Every investor has to make this decision at one point of time during his investment journey. Beginner investors usually have to make this decision early on when starting their investment journey. Mutual funds and stocks each offer specific types […]

-

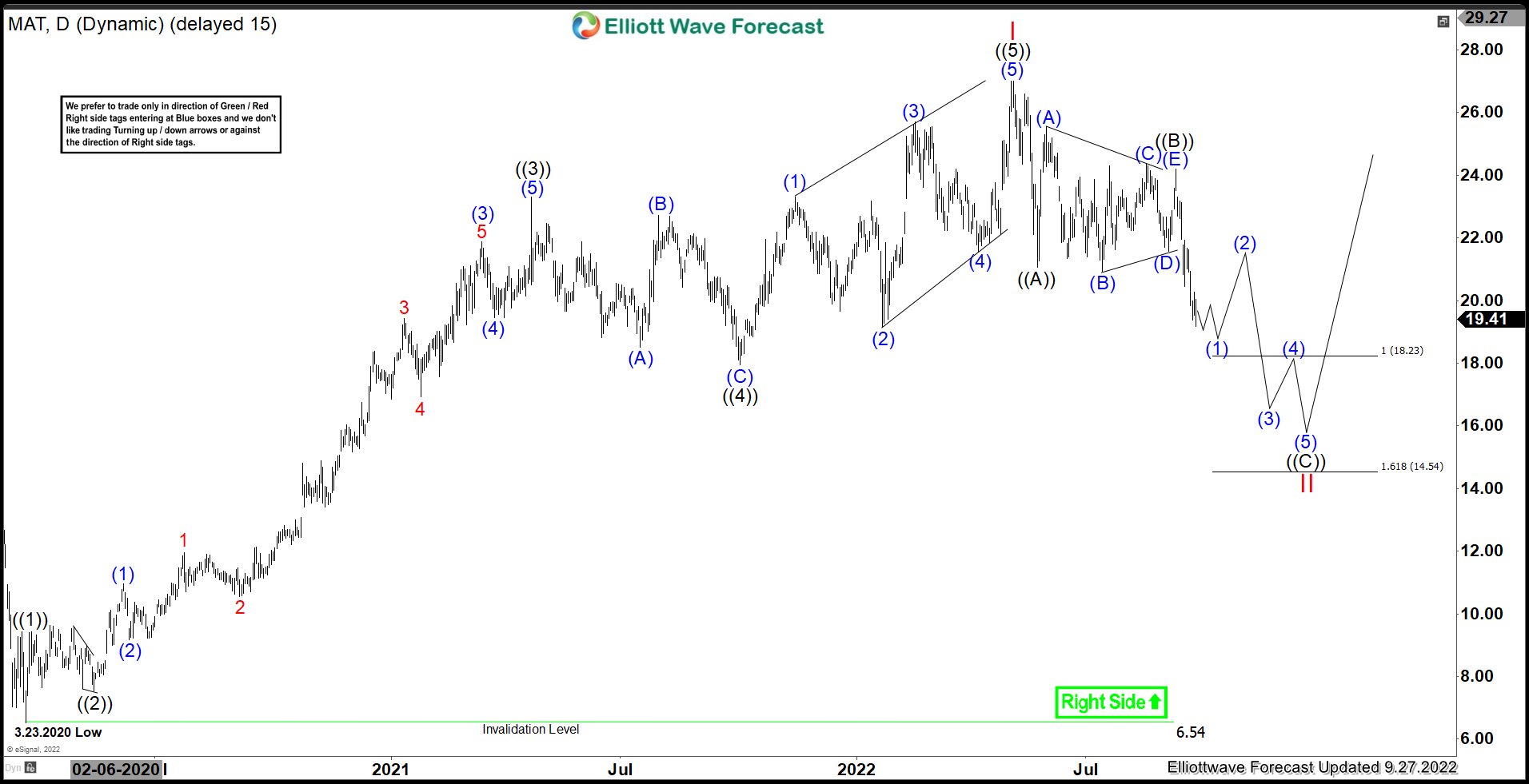

MAT : Expect Short Term Downside To Continue Before Rally Resumes

Read MoreMattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq. MAT made a low of $6.53 during March-2020 sell off […]

-

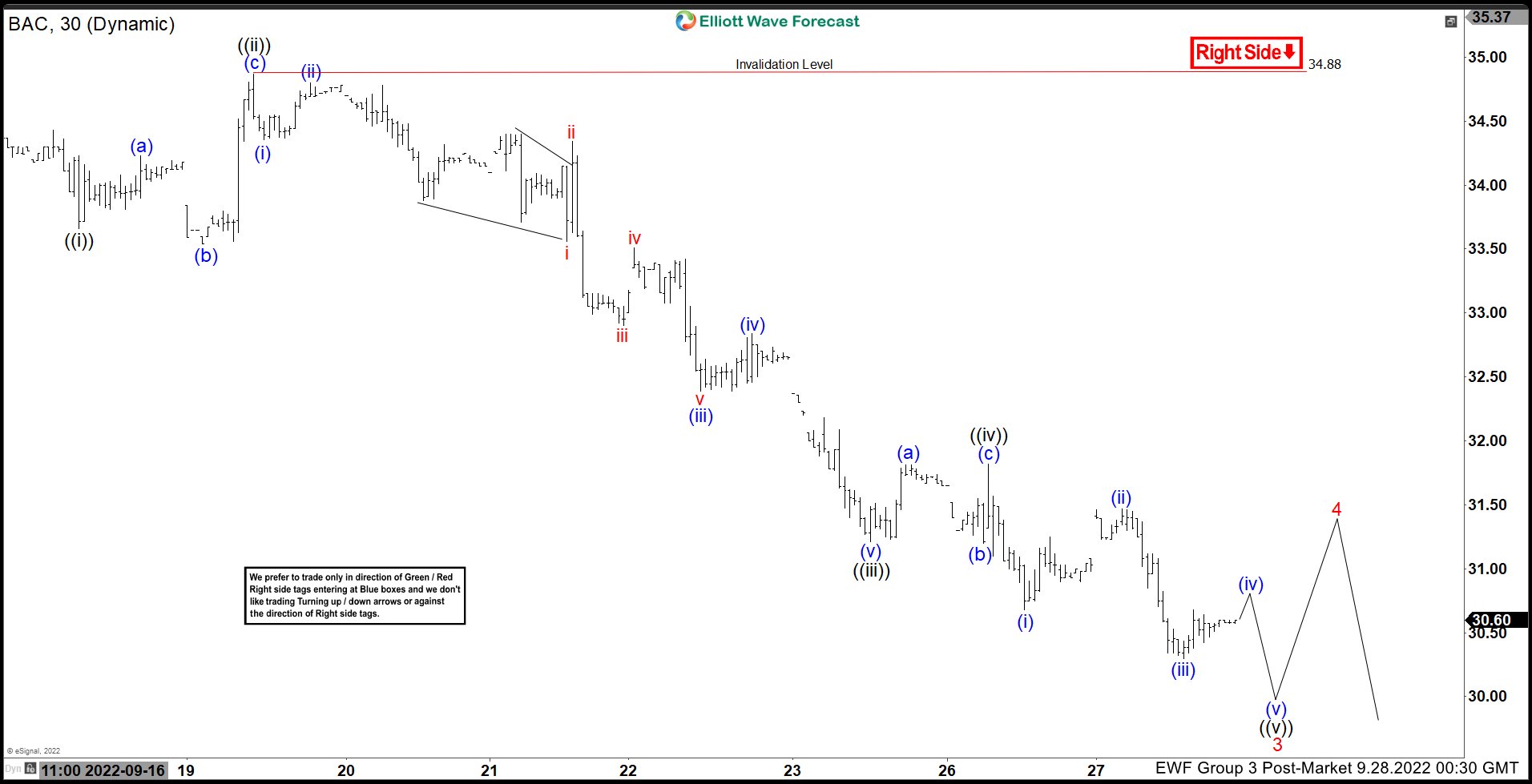

Elliott Wave View: Bank of America (BAC) Rally Should Fail for More Downside

Read MoreBank of America (BAC) shows an impulsive structure from 9.12.2022 high. Rally should fail in 3, 7, 11 swing for more downside.

-

Enphase Energy (ENPH) in wave (IV) Pullback

Read MoreEnphase Energy (NASDAQ: ENPH) is a technology company with headquarter in Fremont, California. Enphase designs and manufactures software-driven home energy solutions for the solar industry. It designs, develops, manufactures, and sells home energy solution that connect solar generation, energy storage, and management on one intelligent platform. The stock has resumed to all-time high and continues […]