The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

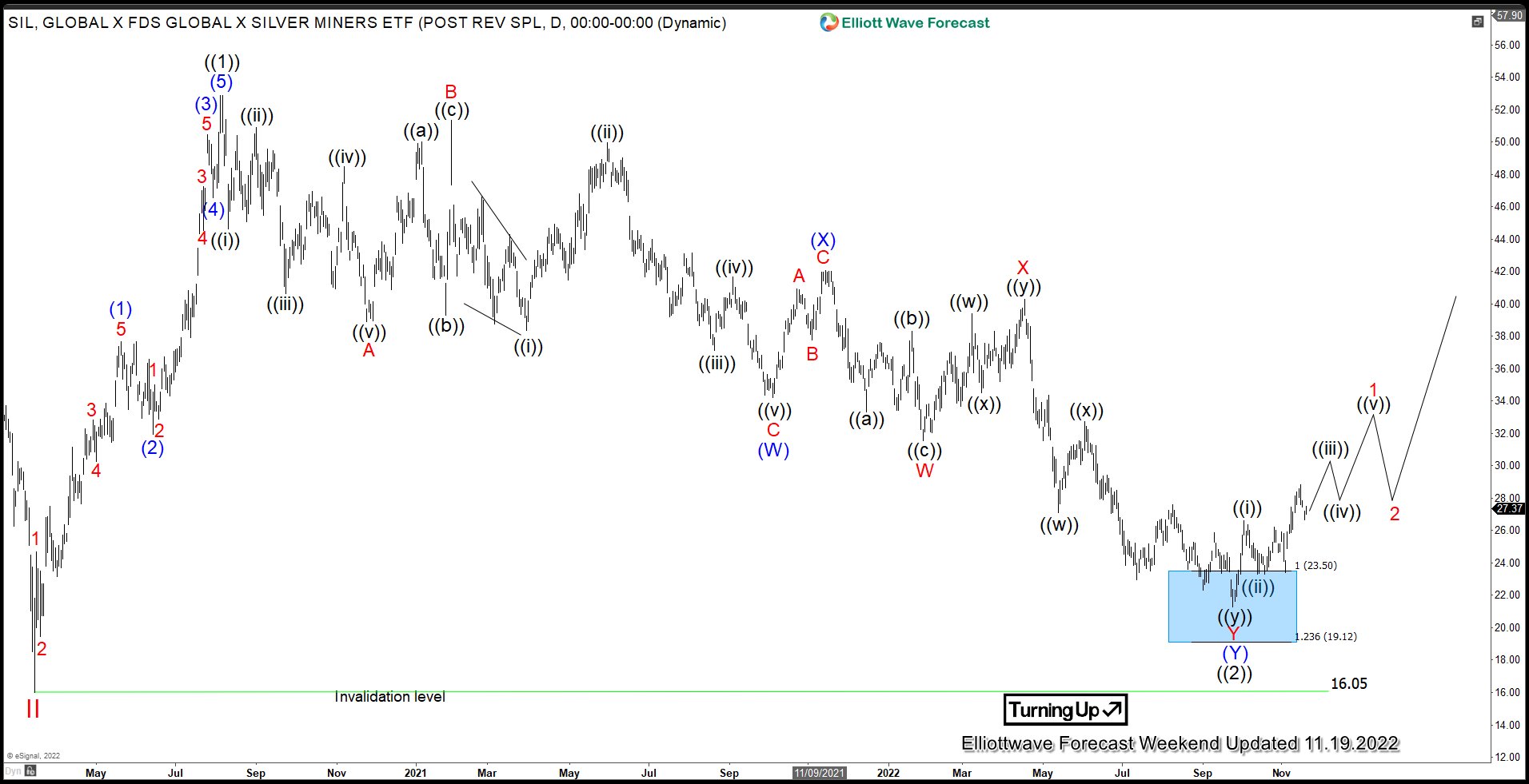

Elliott Wave View: SIL (Silver Miners) May Have Bottomed

Read MoreSilver Miners ETF (SIL) may have ended the correction to the cycle from March 2020 low. The correction took the form of a double as the chart below shows: A double three is labelled as WXY. The first leg wave W and the third leg Y both subdivide into 3 corrective waves. The subdivision of […]

-

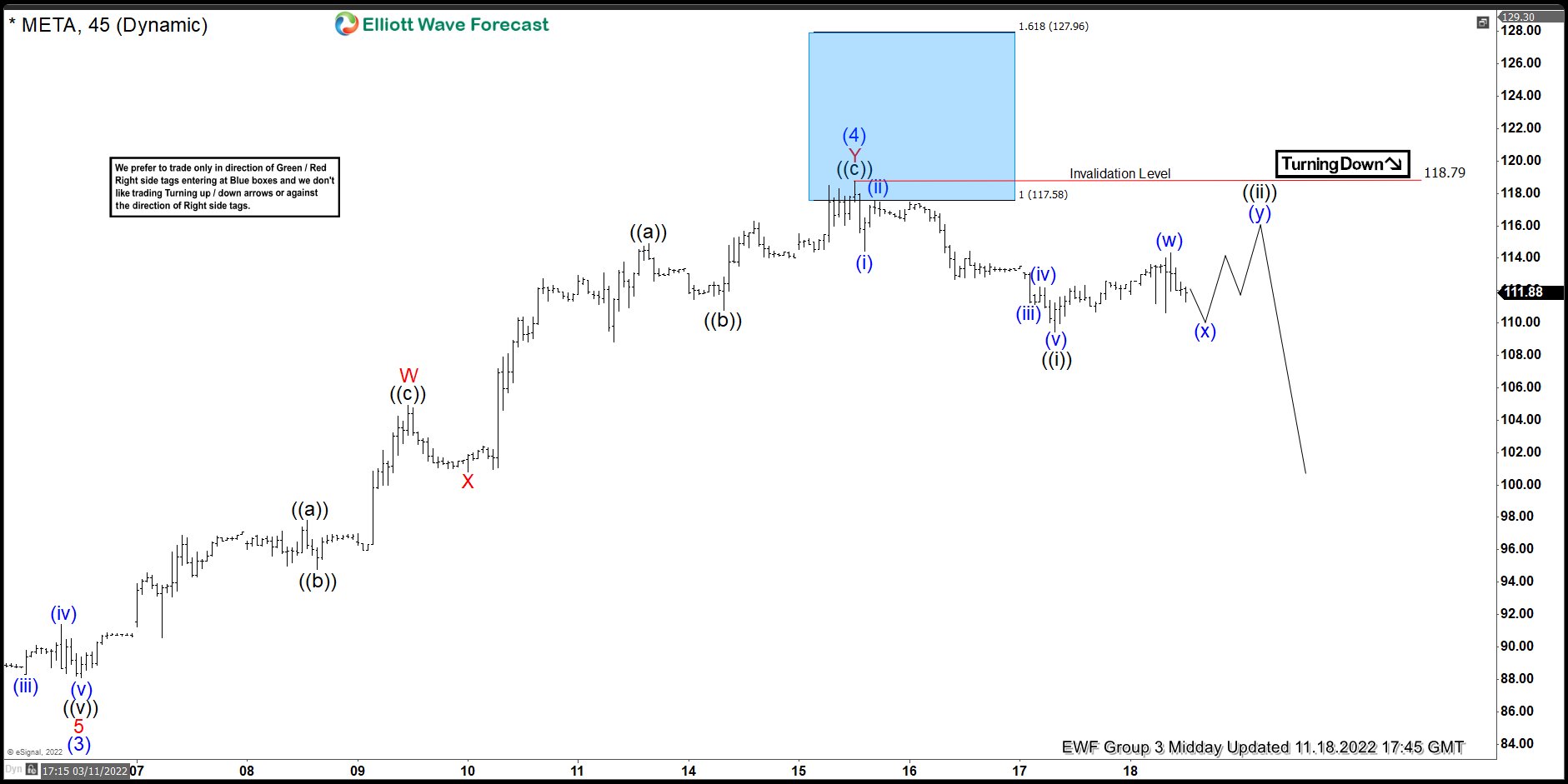

Meta Platforms, Inc. ($META) Provides Another Opportunity from Blue Box area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 1 Hour Elliottwave chart of Meta Platforms, Inc. ($META). The decline from 10.26.2022 high unfolded as 5 swings making a lower low within the 4H cycle from August 2022 peak which created a bearish sequence in the 1H timeframe. Therefore, we […]

-

10 Best Nuclear Energy Stocks to Buy Now

Read MoreThe energy crisis of 2021 left the whole economy shaken as market players saw a spike in oil prices. And with it followed an immediate rise in the value of energy stocks. Moreover, Russia’s invasion of Ukraine and the exclusion of energy from sanctions made all the European countries recognize the huge dependence on natural […]

-

Elliott Wave View: SPX Is Looking To Finish A Cycle Towards A Blue Box

Read MoreShort term Elliott Wave View in SP500 (SPX) shows an incomplete bearish sequence from 1.04.2022 high favoring further downside. Short term, rally from 10.13.2022 low is unfolding as a zigzag Elliott Wave structure. Up from 10.13.2022 low, wave A ended at 3905.64 and pullback in wave B ended at 3709.83. Wave C higher is in […]

-

Best Stocks to Buy for the Holiday Season

Read MoreThe holiday season will be starting soon. And with it will come increased consumer spending on a wide array of goods. Despite a slow economy, consumer spending is expected to be higher this year as compared to 2021. Holiday retail sales are likely to increase between 4 % and 6 % in 2022, according to […]

-

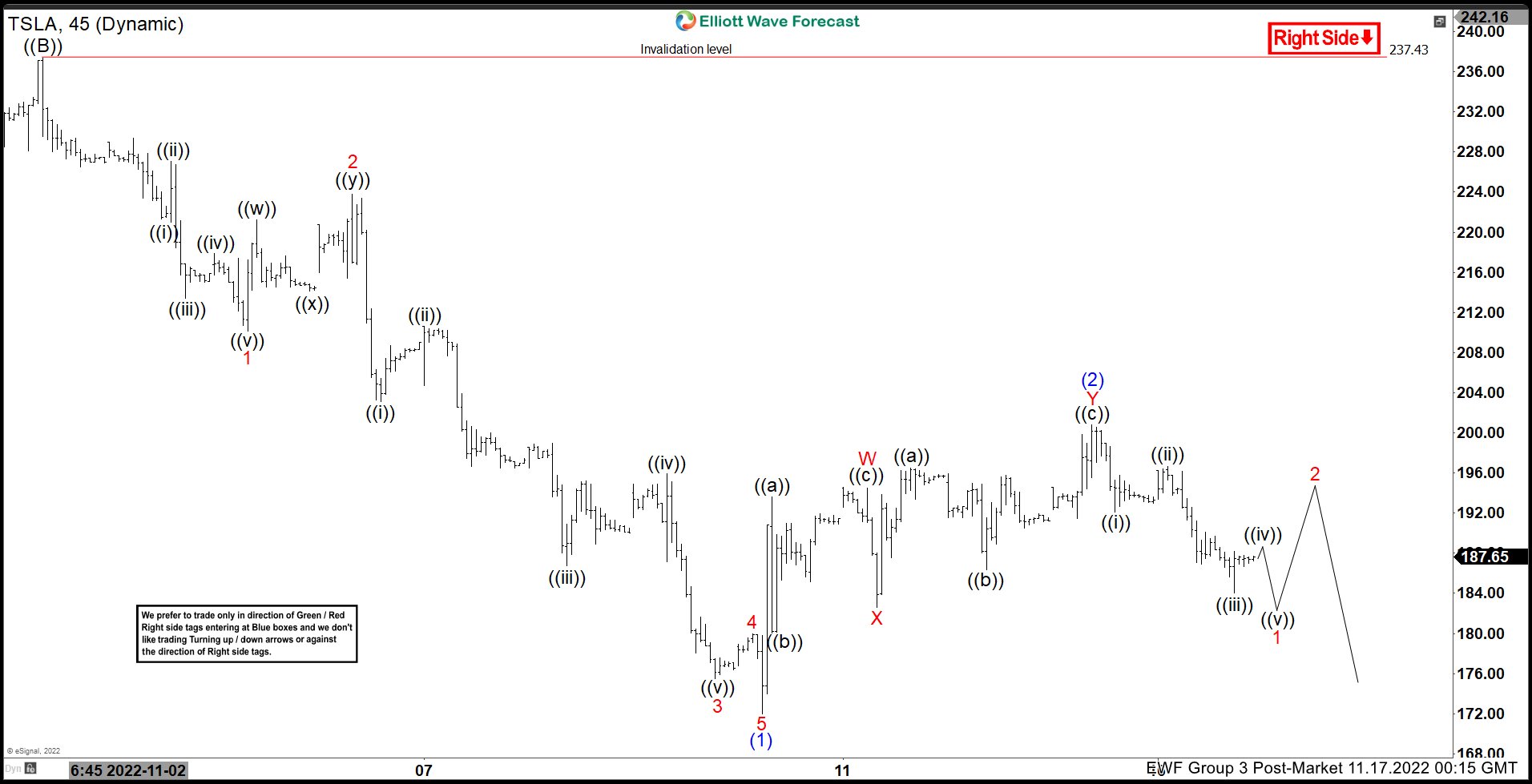

Elliott Wave View: Tesla (TSLA) Downtrend Should Start Again

Read MoreShort term Elliott Wave view in TESLA (ticker: TSLA) suggests the decline from 8.16.2022 high is unfolding as a zigzag Elliott Wave structure. Down from 8.17.2022 high, wave ((A)) ended at 198.33 and wave ((B)) rally ended at 237.43. The stock extends lower in wave ((C)) and the internal subdivision is in the form of […]