The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The Best Wheat Stocks to Buy in 2024

Read MoreWheat is not only a food staple but is also used in the production of biofuels and other derivatives for various industries. Therefore, the value of wheat is high and it also explains the high profits of the industry. The wheat Market is projected to register a CAGR of 4.5% over the forecast period (2022-2027), […]

-

Elliott Wave View: DAX Ending 5 Waves Rally

Read MoreDAX cycle from 9.28.2022 low is in progress as 5 waves and about to end soon. This article and video look at the Elliott wave path.

-

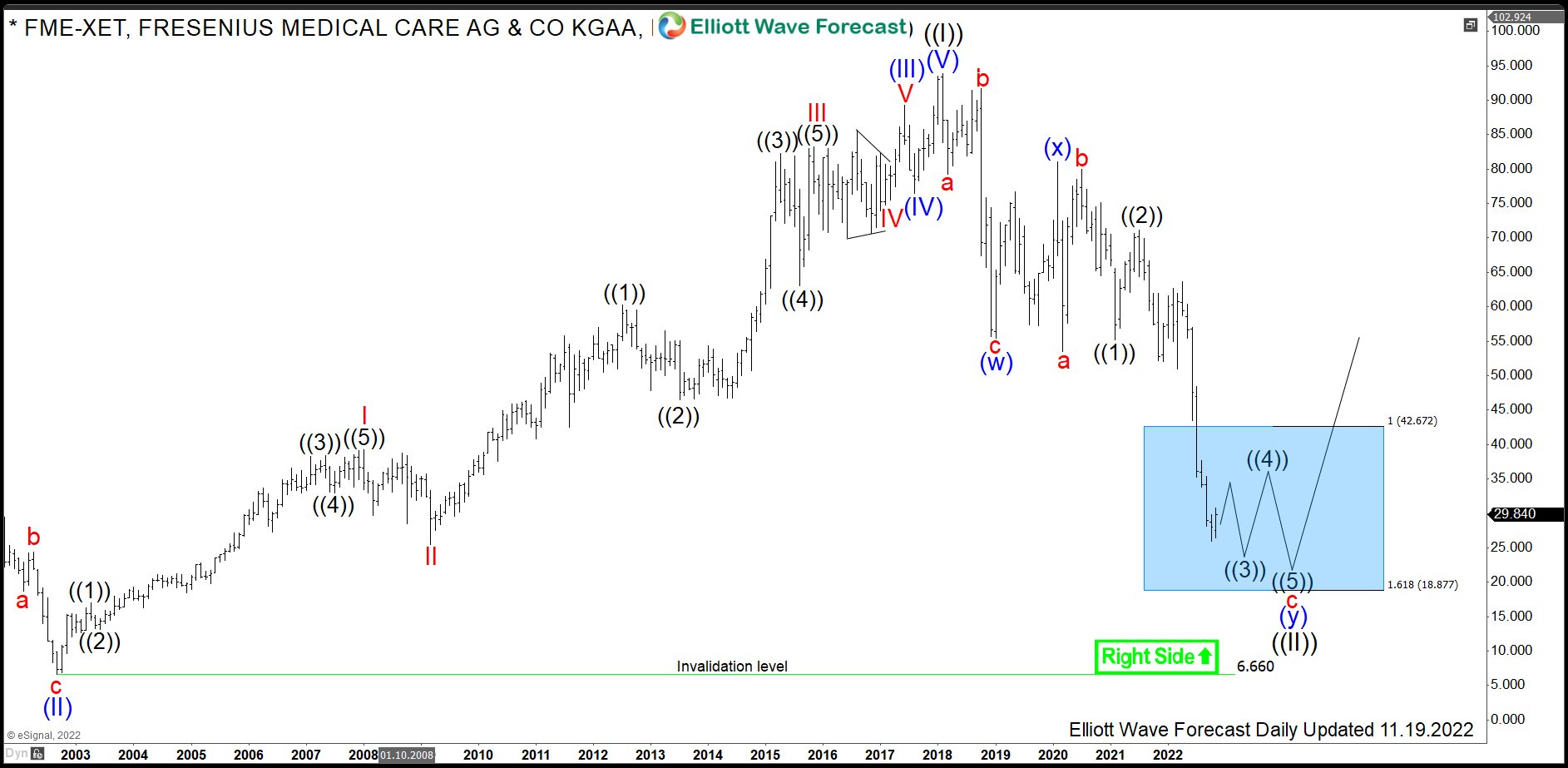

$FME : Fresenius Medical Care Enters Monthly Buying Area

Read MoreFresenius Medical Care is a German American healthcare company. It is one of the four devisions of Fresenius SE & Co. KGaA. The company provides kidney dialysis services and treats end-stage renal disease. Today, it has 38% share of the dialysis market in the US. Fresenius Medical Care operates 42 production sites, mainly in the […]

-

SPX ( S&P500) Elliott Wave View : Forecasting The Path

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of SPX ( S&P500) , published in members area of the website. As our members know SPX is showing higher high sequences in the short term cycle from the October 13th low. The index is looking for […]

-

RRR : Should It Be Ready For Next Rally ?

Read MoreRed Rock Resorts Inc., (RRR) develops & operates casino & entertainment properties in the US. It operates through two segments, Las Vegas Operations & Native American Management. It is based in Las Vegas, comes under Consumer Cyclical sector & trades as “RRR” ticker at Nasdaq. As discussed in previous blog, RRR finished wave I at […]

-

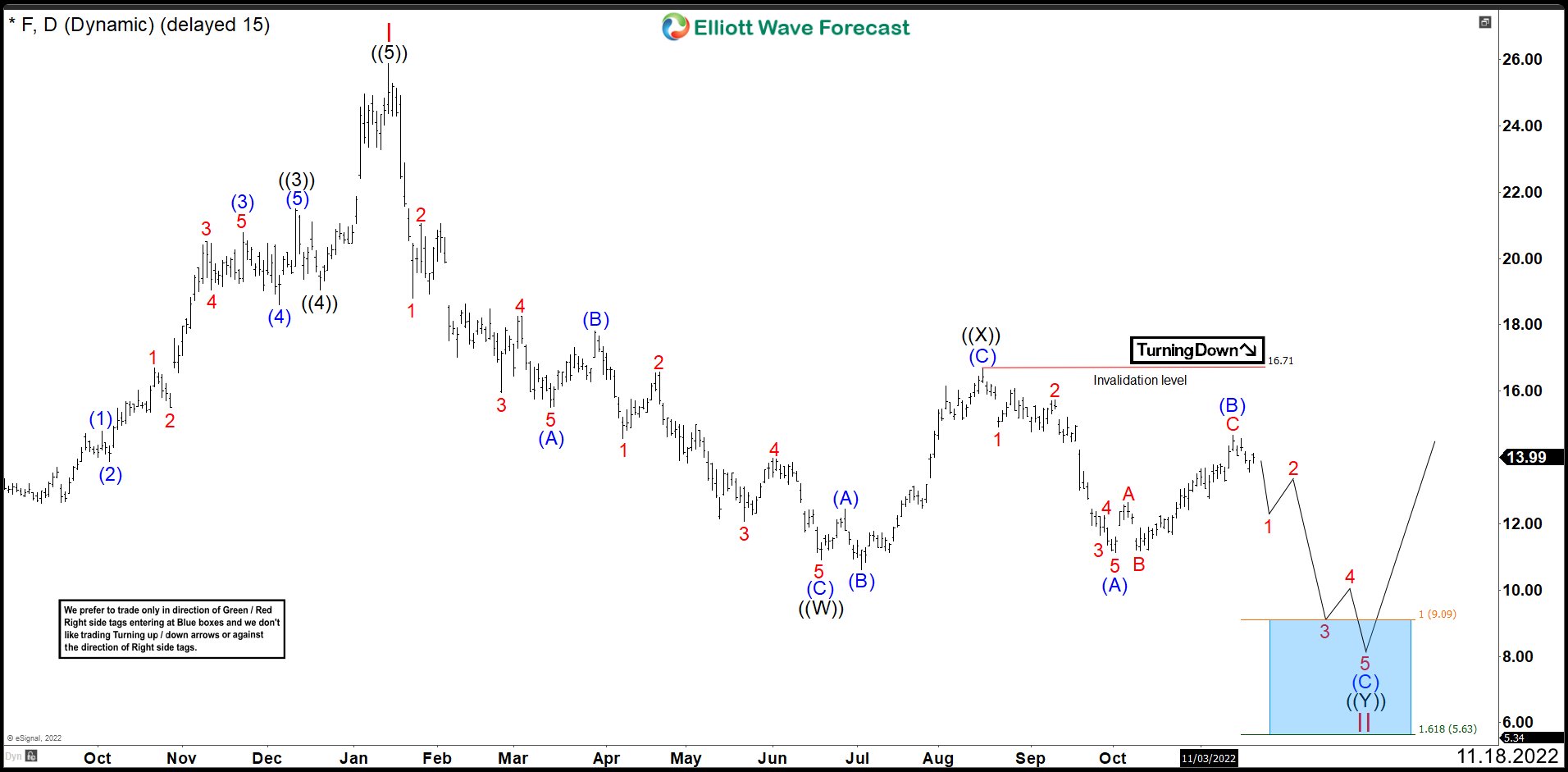

FORD (F) Is Entering in a Double Correction And Needs More Downside

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD July Daily Chart Last July, we showed that Ford (F) ended the bullish cycle from March 2020 at 25.86 […]